Table of Contents

Overview

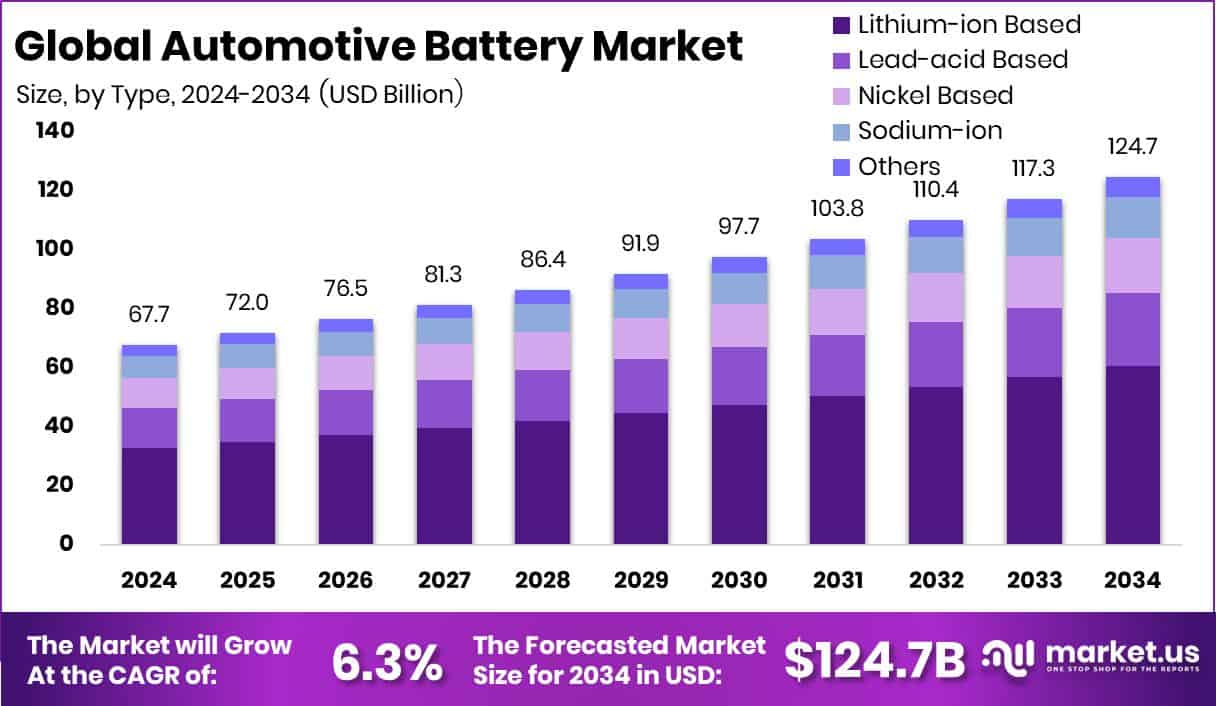

New York, NY – December 08, 2025 – The global automotive battery market is on a strong growth path, projected to reach USD 124.7 billion by 2034, rising from USD 67.7 billion in 2024, with a steady 6.3% CAGR between 2025 and 2034. Asia–Pacific leads this expansion, supported by its deep manufacturing base, holding a 45.80% market share and contributing about USD 31.2 billion in value.

Automotive batteries are rechargeable power units that support key vehicle functions such as ignition, lighting, onboard electronics, and electric propulsion. They are designed to provide reliable and stable energy performance across varying weather conditions and driving demands. The market includes batteries for passenger cars and commercial vehicles across conventional, hybrid, and fully electric platforms, along with recycling and technology upgrades aimed at safety, durability, and sustainability.

Rapid electric vehicle uptake and stricter emission norms are major growth drivers. Investment activity reflects this momentum. Green Li-ion secured USD 20.5 million, while SGL Carbon raised EUR 42.9 million to improve lithium-ion battery materials and manufacturing capacity. At the same time, recycling is gaining importance. Ascend Elements attracted USD 542 million in funding, followed by an additional USD 162 million to build advanced lithium-ion material facilities in the United States.

Future opportunities focus on alternative battery chemistries and circular supply chains. In India, Offgrid raised USD 15 million to reduce lithium reliance, while BatX Energies secured USD 5 million to expand lithium battery recycling, strengthening long-term sustainability.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-automotive-battery-market/request-sample/

Key Takeaways

- The Global Automotive Battery Market is expected to be worth around USD 124.7 billion by 2034, up from USD 67.7 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- Automotive Battery Market shows strong dominance of lead-acid based batteries, holding 48.6% share due to reliability.

- Automotive Battery Market remains largely driven by ICE vehicles, which account for 73.4% demand globally.

- Automotive Battery Market demand is led by Starting-Lighting-Ignition applications, capturing 49.9% share across vehicles.

- Automotive Battery Market sales are mainly supported by OEM channels, contributing 61.2% share through vehicle production.

- The Asia-Pacific region’s Automotive Battery Market holds 45.80%, reaching USD 31.2 Bn in total value.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=167986

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 67.7 Billion |

| Forecast Revenue (2034) | USD 124.7 Billion |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Type (Lithium-ion Based, Lead-acid Based, Nickel Based, Sodium-ion, Others), By Drive (ICE, Electric Vehicle (BEV, PHEV)), By Application (Starting-Lighting-Ignition (SLI), Propulsion, Start-Stop, Auxiliary/12 V Systems, Battery-as-a-Service / Swap, Others), By Sales Channel (OEM, Aftermarket) |

| Competitive Landscape | Exide Technologies, GS Yuasa International Ltd., Panasonic Corporation, LG Energy Solution, A123 Systems Corp, East Penn Manufacturing Company, Robert Bosch GmbH, ENERSYS., Samsung SDI, Hitachi, Ltd. |

Key Market Segments

By Type Analysis

In 2024, lead-acid–based batteries held a dominant position in the By Type segment of the automotive battery market, capturing a 48.6% share. Their leadership is rooted in long-standing reliability, widespread availability, and a deeply established manufacturing and recycling ecosystem that supports both passenger and commercial vehicles.

These batteries are widely used in starting, lighting, and ignition (SLI) functions, where dependable performance is critical across different climates and road conditions. Their relatively low cost compared with newer chemistries makes them especially attractive in price-sensitive markets, where affordability and ease of replacement play a major role in buying decisions.

Another key advantage is the mature recycling infrastructure that allows lead-acid batteries to be reused efficiently at the end of their life cycle. This reduces waste and improves overall sustainability. In addition, service technicians and vehicle maintenance networks are highly familiar with this technology, ensuring easy servicing and strong customer trust. Together, these factors allow lead-acid batteries to maintain a stable and widely accepted role in the automotive battery market.

By Drive Analysis

In 2024, vehicles powered by internal combustion engines (ICE) dominated the By Drive segment of the automotive battery market, accounting for a substantial 73.4% share. This leadership reflects the vast global fleet of ICE vehicles that continue to depend on reliable batteries for starting functions and day-to-day electrical needs.

ICE models remain widely favored due to their mature fueling infrastructure, proven vehicle technologies, and extensive repair and service networks. Within this segment, batteries are essential for smooth ignition, dependable lighting, and uninterrupted operation of onboard electronics, making them a critical component of overall vehicle performance.

Long replacement cycles and extended vehicle lifespans in many countries further support consistent battery demand from ICE vehicles. Many owners retain vehicles for years, creating a steady need for battery replacements and maintenance. As a result, despite the growth of alternative powertrains, the ICE segment continues to play a central role in shaping overall demand within the automotive battery market.

By Application Analysis

In 2024, Starting-Lighting-Ignition (SLI) applications led the By Application segment of the automotive battery market, capturing a solid 49.9% share. This leading position reflects how essential SLI batteries are to everyday vehicle operation, as nearly all vehicles require dependable power for engine starting and basic electrical functions.

SLI batteries are designed to deliver quick, high-power bursts needed to start engines and to support lighting and core electrical systems during regular use. Their proven reliability across different vehicle types, along with simple installation and wide compatibility with existing vehicle designs, helps maintain strong and consistent demand.

Another factor supporting their dominance is the regular maintenance and replacement cycle. SLI batteries typically require periodic replacement, creating repeat demand across both passenger and commercial vehicles. This ongoing need, combined with broad vehicle coverage and trusted performance, allows SLI batteries to remain a dominant and stable application segment within the automotive battery market.

By Sales Channel Analysis

In 2024, the OEM channel led the By Sales Channel segment of the automotive battery market, securing a strong 61.2% share. This dominance highlights the importance of batteries being integrated directly during vehicle production, where they are installed as part of the original manufacturing process.

OEM-supplied batteries are selected to match precise vehicle specifications, ensuring full compatibility, consistent quality, and reliable performance from day one. Automakers often rely on long-term supply agreements with battery manufacturers, allowing stable sourcing that aligns closely with planned vehicle production volumes. This structured approach supports efficiency and reduces quality variation.

Another advantage of the OEM channel is streamlined warranty coverage, which strengthens customer confidence and vehicle reliability. As global vehicle production continues and new cars are increasingly delivered with factory-installed battery systems, the OEM sales channel continues to anchor demand and plays a central role in maintaining stability across the automotive battery value chain.

Regional Analysis

The Asia-Pacific region leads the global automotive battery market with a dominant 45.80% share, reaching a market value of USD 31.2 billion. This strong position is driven by large-scale vehicle manufacturing, robust battery production capacity, and high battery usage across both passenger and commercial vehicles. Well-established supply chains and frequent battery replacement needs further sustain demand across cities and rural areas.

North America remains a mature market, supported by high vehicle ownership and routine battery replacement cycles. Emphasis on safety, durability, and reliable performance maintains steady demand.

In Europe, strict emission regulations and a focus on vehicle efficiency encourage consistent use of dependable battery systems, supported by ongoing vehicle upgrades.

The Middle East & Africa region shows gradual growth, aided by rising vehicle imports and expanding transport infrastructure.

Meanwhile, Latin America experiences stable demand as vehicle fleets increase and maintenance-driven battery replacements continue to support market activity.

Top Use Cases

- Starting the Engine: When you turn the ignition key (or press “start”), the battery delivers a strong burst of electricity to the starter motor and ignition system — enough to crank the engine and get the vehicle running. Without this, the engine would not start.

- Powering Lights, Wipers, and Accessories (when engine is off): Even when the engine isn’t running, the battery powers essential electrical parts like headlights, interior lights, windshield wipers, horn, and basic electronics.

- Supporting Electronics and On-board Systems (even while driving): While the car is running, the battery works with the alternator to power dashboard electronics, infotainment, air-conditioning, sensors, and other systems. If the electrical load increases (for example, using many accessories at once), the battery supplements power to keep everything working smoothly.

- Stabilizing Voltage and Protecting Electronics: The battery acts like a buffer against spikes or drops in electrical voltage. That keeps sensitive electronics safe and ensures that lights, control units, and wiring aren’t damaged by sudden power fluctuations.

- Auxiliary Power in Electric and Hybrid Vehicles: In hybrid or electric vehicles (which have a main traction battery), a smaller auxiliary battery (often 12-volt) provides power to essential systems — lights, safety controls, infotainment, sensors — especially before the main battery engages, or when the main high-voltage system is off.

- Emergency or Backup Power When Alternator or Main Power Fails: If a car’s alternator fails or electrical load spikes too much, the battery alone can temporarily keep critical systems running (lights, indicators, control modules), giving the driver time to reach a service location.

Recent Developments

- In April 2025, Hitachi ZeroCarbon partnered with JBM Electric Vehicles to deploy its BatteryManager system in JBM’s electric buses. The goal is to monitor charging patterns, optimize bus routes, and manage battery usage under varied Indian climate conditions — helping make EV public transport more dependable and cost-effective.

- In March 2024, Exide Technologies acquired German firm BE-Power GmbH, a specialist in high-power and high-voltage lithium-ion battery solutions. This gave Exide access to BE-Power’s advanced battery modules and battery-management technology, boosting Exide’s capabilities in lithium-ion and energy-storage offerings.

Conclusion

The automotive battery market continues to play a vital role in the global vehicle ecosystem, supporting dependable mobility across conventional, hybrid, and electric vehicles. Ongoing advancements in battery design, durability, and energy management are improving vehicle performance and reliability.

Automakers and battery manufacturers are steadily focusing on safer systems, longer service life, and improved recycling practices. Growing emphasis on clean mobility, electrification of transport, and sustainable manufacturing is shaping future development paths. At the same time, strong demand from existing vehicle fleets ensures steady replacement needs, balancing innovation with stability.

As transportation systems evolve, automotive batteries will remain a foundational component, supporting both current mobility needs and the transition toward more efficient and environmentally responsible vehicle technologies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)