Table of Contents

Overview

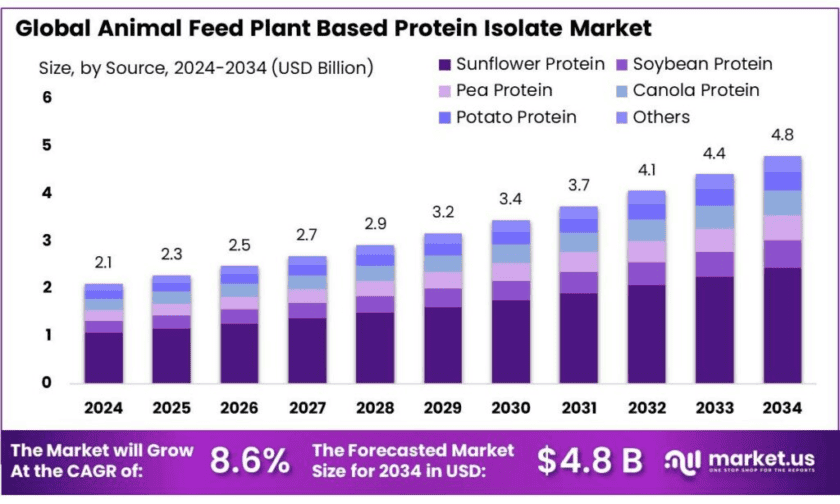

New York, NY – Oct 29, 2025 – The Global Animal Feed Plant-Based Protein Isolate Market is projected to reach USD 4.8 billion by 2034, up from USD 2.1 billion in 2024, expanding at a CAGR of 8.6% (2025–2034). In 2024, Asia Pacific dominated the market with 43.8% share, representing around USD 0.9 billion in revenue.

Animal-feed plant-based protein isolates are high-purity protein ingredients derived from plant sources and processed to remove non-protein matter. They are increasingly used in livestock, poultry, and aquaculture feeds, offering better purity, digestibility, and nutritional consistency than traditional proteins such as fishmeal or animal by-products. These isolates also reduce anti-nutritional factors and have lower environmental footprints, making them ideal in markets with protein shortages or high animal protein costs.

- According to the Food and Agriculture Organization (FAO), global fishmeal production remains under heavy pressure while demand for aquaculture feed continues to rise. For example, in Asia, fishmeal consumption for Nile tilapia grew from 0.8 million tonnes to 1.7 million tonnes, as fish feed output increased from 40% to 60% between 2000 and 2008. This trend supports the shift toward plant-based protein isolates as viable alternatives.

Government programs further stimulate this transition. In India, the Animal Husbandry Infrastructure Development Fund (AHIDF)—established in 2020 with a corpus of ₹15,000 crore—supports private investment in feed manufacturing infrastructure. Similarly, the European Union’s plant protein strategy emphasized local protein production; in 2023–24, EU farms produced 64 million tonnes of crude plant protein, while imports added another 19 million tonnes, underlining Europe’s reliance on external protein supplies.

- In India’s feed balance model, total dry matter availability is around 510.6 million tonnes, including 47.2 million tonnes from concentrates, 319.6 million tonnes from crop residues, and 143.8 million tonnes from green fodder—demonstrating the substantial potential for plant-based protein isolates to enhance the country’s feed protein mix and reduce dependence on imported sources.

Key Takeaways

- Animal Feed Plant Based Protein Isolate Market size is expected to be worth around USD 4.8 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.6%.

- Sunflower Protein Plant Based Protein Isolate Extract held a dominant market position, capturing more than a 51.2% share.

- Powder held a dominant market position in the Animal Feed Plant Based Protein Isolate market, capturing more than an 88.1% share.

- Poultry Feed held a dominant market position in the Animal Feed Plant Based Protein Isolate market, capturing more than a 48.9% share.

- Asia Pacific region dominated the animal feed plant-based protein isolate market, holding a 43.8% share, equivalent to approximately USD 0.9 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/animal-feed-plant-based-protein-isolate-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.1 Bn |

| Forecast Revenue (2034) | USD 4.8 Bn |

| CAGR (2025-2034) | 8.6% |

| Segments Covered | By Source (Sunflower Protein, Soybean Protein, Pea Protein, Canola Protein, Potato Protein, Others), By Form (Powder, Liquid), By Application (Poultry Feed, Aquaculture Feed, Livestock Feed, Pet Food, Others) |

| Competitive Landscape | The Scoular Company, Cargill, Incorporated, Hamlet Protein, Glanbia PLC, Ingredion, A&B Ingredients Inc., HL Agro Products Pvt. Ltd., Roquette Freres, ADM, Emsland Group |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158935

Key Market Segments

By Source Analysis – Sunflower Protein Dominates with 51.2% Share

In 2024, Sunflower Protein Plant-Based Protein Isolate Extract held a dominant market position, accounting for 51.2% share of the global animal feed protein isolate segment. Its leadership is attributed to its balanced amino acid profile, high digestibility, and non-GMO characteristics, which make it a preferred protein source among feed manufacturers. Sunflower protein offers a sustainable and cost-effective alternative to traditional proteins and is widely used in poultry, swine, and aquaculture feed formulations.

Government-backed programs promoting sustainable agriculture and feed efficiency have accelerated its adoption. The sector also benefits from advancements in protein extraction technologies, increased processing capacity, and growing awareness among livestock producers regarding the nutritional and economic advantages of sunflower protein in animal nutrition.

By Form Analysis – Powder Form Leads with 88.1% Share

In 2024, the Powder form dominated the Animal Feed Plant-Based Protein Isolate Market, capturing a substantial 88.1% share. This dominance is mainly due to the ease of handling, longer shelf life, and superior storage stability that powdered isolates offer compared to liquid or paste forms. Powdered proteins ensure uniform nutrient content and better blending capabilities, making them ideal for formulating precise feed mixes in poultry, swine, and aquaculture sectors.

The rising focus on feed efficiency and sustainability under various government initiatives further encourages the use of powder-form isolates. Additionally, technological improvements in spray drying and micronization processes have enhanced the solubility, texture, and bioavailability of these powders, reinforcing their dominant presence in the market.

By Application Analysis – Poultry Feed Dominates with 48.9% Share

In 2024, Poultry Feed emerged as the largest application segment in the Animal Feed Plant-Based Protein Isolate Market, capturing 48.9% share. The strong growth is primarily driven by the rapid expansion of the global poultry industry, coupled with the increasing requirement for high-protein and easily digestible feed components. Plant-based protein isolates have become essential for supporting efficient growth, egg production, and overall poultry health, while also addressing sustainability concerns by reducing reliance on animal-derived proteins.

Government support for feed fortification and sustainable livestock production continues to promote the integration of plant-based protein isolates in poultry diets. Furthermore, advancements in protein extraction and formulation technologies are improving nutrient retention and absorption rates, ensuring poultry feed remains the leading application segment driving market growth.

List of Segments

By Source

- Sunflower Protein

- Soybean Protein

- Pea Protein

- Canola Protein

- Potato Protein

- Others

By Form

- Powder

- Liquid

By Application

- Poultry Feed

- Broilers

- Layers

- Turkey

- Aquaculture Feed

- Fish

- Crustaceans

- Mollusks

- Livestock Feed

- Swine

- Cattle (Beef & Dairy)

- Sheep & Goats

- Pet Food

- Dogs

- Cats

- Others

Regional Analysis

Asia Pacific – 43.8% Share (2024) | Valued at USD 215.2 Million

In 2024, the Asia Pacific region led the Animal Feed Plant-Based Protein Isolate Market, capturing a 43.8% share, valued at approximately USD 0.9 billion. This dominance is supported by the region’s strong agricultural base, rising livestock population, and a growing preference for sustainable, plant-derived protein sources in animal nutrition. Countries such as China, India, Japan, and South Korea are playing a major role, driven by both domestic consumption and export-focused feed industries.

In China, the government’s “Green Agriculture” policy promotes eco-friendly farming and encourages the integration of plant-based feed ingredients, reducing reliance on conventional animal proteins. Meanwhile, India’s National Livestock Mission focuses on enhancing productivity through nutritionally balanced feeding practices, indirectly supporting the demand for plant-based protein isolates.

Technological innovation is also accelerating regional market growth. Advanced enzyme-assisted extraction and fermentation techniques are improving the yield, purity, and cost efficiency of protein isolate production. These developments, combined with strong government initiatives and industry investment, continue to position Asia Pacific as the leading region in the global market for animal feed plant-based protein isolates.

Top Use Cases

Aquaculture: Replace fishmeal to meet fast-rising output: Global fisheries + aquaculture hit 223.2 Mt in 2022; aquaculture supplied 51% of aquatic animal output (about 94.4 Mt), marking the first time farmed production surpassed wild catch. Asia accounts for ~90% of aquaculture—so feed makers urgently need scalable, consistent proteins. High-purity plant isolates (e.g., soy/sunflower/pea) help reduce reliance on volatile fishmeal while maintaining amino-acid targets for tilapia, carp, shrimp, and seabass diets.

Supply-risk hedge: Smooth shocks from fishmeal shortfalls: Peru canceled its main anchovy season in June 2023, sharply tightening global fishmeal; the following year, output was only beginning to recover, with Peru fishmeal 2024/25 forecast around 1.1 MMT (+39% YoY). Isolates offer a tactical hedge—stabilizing crude-protein inclusion rates when marine inputs swing due to El Niño/La Niña or quota changes.

EU protein autonomy: Substitute imports in poultry & swine feeds: The EU arable sector produced 64 Mt crude plant protein in 2023/24, but still imports ~19 Mt of plant-protein products, exposing feed mills to trade and price risk. Incorporating EU-grown isolates (sunflower/rapeseed/pea) can cut import dependency, comply with CAP priorities for legumes, and standardize digestible amino acid specs in broiler/finisher and grower-pig rations.

India capex pipeline: Build/upgrade feed & isolate capacity: India’s Animal Husbandry Infrastructure Development Fund (AHIDF) earmarks ₹15,000 crore to finance projects including animal feed plants—a clear avenue to add isolate extraction, spray-drying, and blending lines. Processors can use concessional credit to localize protein inputs, supporting poultry, dairy, and aquaculture clusters while meeting quality and sustainability goals.

Performance & digestibility: Enzyme-aided isolate programs: Formulators increasingly pair isolates with enzyme tech to unlock amino-acid availability and reduce anti-nutritional factors. A 2024 turkey study using 15% sunflower meal with an enzyme cocktail reported improved growth metrics versus controls—evidence that plant proteins, when processed and enzyme-supplemented, can sustain performance in monogastrics. Similar strategies (phytase, xylanase, protease) support high-inclusion isolate diets in broilers and weaners.

Sustainability & compliance: Align with “green” and non-GMO policies: Policy pushes (e.g., EU protein strategy; national “green agriculture” programs) reward lower-footprint, traceable inputs. Isolates—especially from non-GMO sunflower/rapeseed—help feed brands meet retailer specs, life-cycle targets, and eco-labels, while preserving nutrient consistency lot-to-lot. (Policy data on EU protein focus above.)

Recent Developments

The Scoular Company: In 2023 the company recorded about US $7.3 billion in total sales and generated US $1.6 billion from its feed ingredients & protein business, highlighting its presence in supplying plant-based protein isolates into the animal feed chain. Its product offering includes soy protein isolate and vegetable proteins for animal feed, aquafeed and pet food markets.

Cargill, Incorporated: In fiscal year 2024, Cargill reported revenues of about US $160 billion, underlining the scale of its animal-nutrition and feed-ingredient operations. It offers plant-based proteins and ingredients for animal feed—including grain-derived proteins and concentrates—through its animal nutrition solutions and feed-ingredients divisions. Its global network spans 40 countries and produces more than 16 million tons of feed annually.

Hamlet Protein A/S: In 2023 Hamlet Protein undertook significant R&D in “protein kinetics,” finding their plant-based isolates hydrolyse at rates comparable to blood plasma, a benchmark for high digestibility in young animal feeds. The firm also signalled expansion into poultry and aquaculture feed markets alongside its traditional calf milk replacer niche.

Ingredion Incorporated: In 2023, Ingredion emphasised its plant-based protein isolate business—its VITESSENCE® pea protein isolates deliver 80-85% protein dry basis, are non-GMO, and sourced in North America. While much of its communication is on food & beverage applications, its animal-nutrition arm lists “pulse ingredients” in animal-nutrition portfolios, supporting feed formulators seeking high-purity plant proteins.

A&B Ingredients Inc.: By 2023, A&B Ingredients offered its Pisane™ pea protein isolates described as “98% digestible, allergen-free, high solubility” and positioned for textured applications including meat-poultry-fish analogues. Although their focus is largely human food, these clean-label, non-GMO protein isolates are relevant to feed firms seeking plant-based isolates in animal nutrition.

H.L. Agro Products Pvt. Ltd.: In FY 2024 (ending March), this Indian company reported operating revenues in the range of ₹100–500 crore, with EBITDA down ~15.2 % YoY while net worth rose ~27.5 % year-on-year. The firm manufactures corn/maize derivatives (including maize gluten) and exports animal-nutrition products globally, positioning itself as a plant-derived ingredient contributor into feed chains.

Archer Daniels Midland Company (ADM): In 2023, ADM released its “Global Trends” report identifying major drivers in the alternative-protein ecosystem, signifying its strategic emphasis on plant-based protein solutions for human and animal nutrition. Its Animal Nutrition platform supports all major species (poultry, swine, ruminant, aquaculture) via high-purity protein ingredients sourced from oilseeds and grains. Though specific isolate volumes for feed are not public, the repositioning underlines ADM’s intent to grow in plant-based feed proteins.

Emsland Group: For fiscal year 2022/23, Emsland reported revenue of approximately €900 million, processing around 180,000 tonnes of peas annually, with 70% of pea protein delivered into non-food applications including animal and feed sectors. Under its Empro® brand (2023 release), the company offers high-purity pea protein isolates (≥84% protein content) and explicitly positions its non-GMO pea/potato protein ingredients for animal-nutrition uses, including feed-mixer-ready formats.

Conclusion

In conclusion, the market for animal feed plant-based protein isolates is poised for sustained expansion, driven by strong underlying demand and favourable supply-chain dynamics. Key demand drivers include the increasing preference for sustainable and cost-effective protein sources in animal nutrition, coupled with rising regulatory and industry pressures to reduce reliance on conventional animal-based proteins such as fishmeal.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)