Table of Contents

Overview

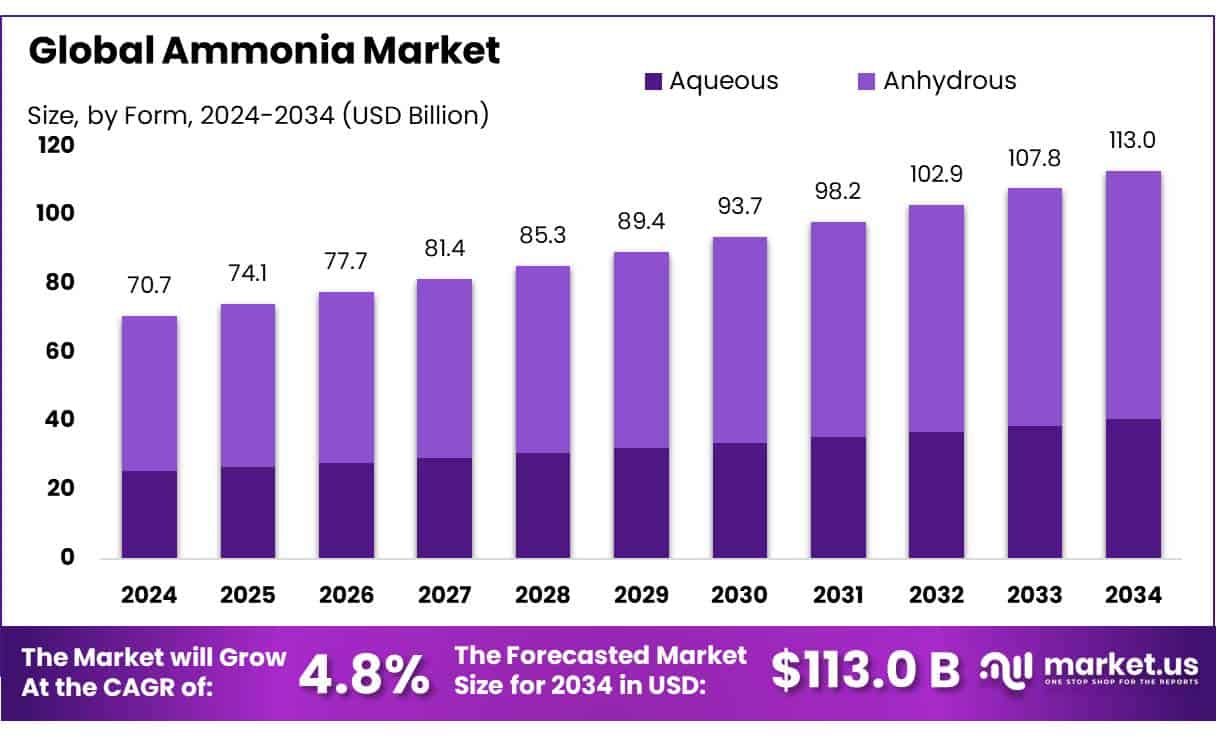

The global ammonia market is experiencing significant growth, driven by its essential role in agriculture, industrial applications, and emerging energy sectors. Valued at approximately USD 70.7 billion in 2024, the market is projected to reach around USD 113.0 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.8% during the forecast period from 2025 to 2034.

In 2024, anhydrous ammonia dominated the global market with a share of over 64.50%, driven by its high nitrogen content and significant use in fertilizer production. Grey/brown ammonia accounted for more than 72.20% of the market, primarily due to its industrial use, including in agriculture and manufacturing, produced via conventional fossil fuel methods.

Natural gas held a 65.50% share as the most common feedstock for ammonia production, offering efficiency and a lower carbon footprint. Fertilizers, a major ammonia application, made up over 53.40% of the market, driven by growing global agricultural needs. Regionally, the Asia Pacific (APAC) region led with a 54.20% share, valued at USD 38.3 billion, driven by high ammonia demand in countries like China, India, and Japan, which are key fertilizer producers and consumers.

Key growth factors include the increasing demand for fertilizers to support global food production, advancements in green ammonia technologies, and its potential as a clean energy source. The Asia-Pacific region is anticipated to lead market expansion, driven by rapid industrialization and agricultural development in countries like China and India.

However, the market faces challenges such as high energy consumption in traditional ammonia production processes, fluctuating raw material prices, and environmental concerns related to carbon emissions. Addressing these issues requires significant investment in sustainable production methods and infrastructure.

Recent developments highlight the industry’s shift towards sustainability. For instance, CF Industries has partnered with JERA and Mitsui to develop a $4 billion low-carbon ammonia facility in Louisiana, aiming to capture approximately 2.3 million metric tons of CO2 annually. Additionally, Woodside Energy’s acquisition of an ammonia plant in Texas for $2.35 billion underscores the growing emphasis on low-emission ammonia production.

Key Takeaways

- Ammonia Market size is expected to be worth around USD 113.0 Billion by 2034, from USD 70.7 Billion in 2024, growing at a CAGR of 4.8%.

- Anhydrous ammonia held a dominant market position, capturing more than a 64.50% share of the ammonia market.

- Grey/Brown ammonia held a dominant market position, capturing more than 72.20% of the overall market share.

- Natural Gas held a dominant market position, capturing more than a 65.50% share of the ammonia market.

- Fertilizers held a dominant market position, capturing more than a 53.40% share of the ammonia market.

- APAC held a commanding share of 54.20%, valued at approximately USD 38.3 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/ammonia-market/free-sample/

How Growth is Impacting the Economy

The ammonia market’s growth is positively impacting global agriculture and industrial sectors. The increasing demand for ammonia-based fertilizers plays a pivotal role in ensuring food security and supporting the agricultural industry, which is integral to the economy. Additionally, ammonia’s expanding use in clean energy solutions is driving investments in the green energy sector.

As industries shift towards low-carbon ammonia, businesses are poised to capitalize on sustainable practices that align with global environmental goals. The ammonia market’s robust growth is expected to support job creation, technological advancements, and the overall industrialization of emerging economies, particularly in Asia-Pacific. This trend is likely to boost economic development, increase agricultural output, and lower carbon footprints in the coming years.

Report Scope

| Market Value (2024) | USD 70.7 Billion |

| Forecast Revenue (2034) | USD 113.0 Billion |

| CAGR (2025-2034) | 4.8% |

| Segments Covered | By Form (Aqueous, Anhydrous), By Type (Grey/Brown, Blue, Green, Turquoise), By Feedstock (Natural Gas, Coal, Oil, Hydrogen, Others), By Application(Fertilizers, Refrigerants, Transportation, Textile, Power Generation, Others) |

| Competitive Landscape | Yara International ASA, CF Industries Holdings, Inc., BASF SE, Nutrien Ltd., QATAR FERTILISER COMPANY, Togliattiazot , SABIC, Sumitomo Chemical Co., Ltd., CSBP , EuroChem Group, Group DF, ThyssenKrupp AG, Nel Hydrogen, Sinopec, Rashtriya Chemicals and Fertilizers Limited, Siemens AG, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=18440

Key Market Segments

By Form

- Aqueous

- Anhydrous

By Type

- Grey/Brown

- Blue

- Green

- Turquoise

By Feedstock

- Natural Gas

- Coal

- Oil

- Hydrogen

- Others

By Application

- Fertilizers

- Refrigerants

- Transportation

- Textile

- Power Generation

- Others

Regional Analysis

The ammonia market is heavily shaped by regional factors, with the Asia Pacific (APAC) region leading the market. In 2024, APAC held a dominant market share of 54.20%, valued at approximately USD 38.3 billion. This strong position is driven by the region’s significant demand for ammonia, particularly in the agricultural sectors of countries like China, India, and Japan, which are major producers and consumers of fertilizers. Ammonia-based nitrogen fertilizers play a critical role in supporting the region’s agricultural output, helping meet the increasing food production demands.

While Europe also maintains a strong presence in the ammonia market, its share is comparatively smaller, accounting for about 20% of global consumption. The European market is primarily supported by stringent environmental regulations, which have led to the adoption of cleaner ammonia production methods, such as green ammonia. The EU’s Green Deal and emphasis on sustainability are expected to foster innovation and accelerate the adoption of low-carbon ammonia technologies in the near future.

Top Use Cases

- Agriculture: Ammonia is a key component in nitrogen-based fertilizers, essential for enhancing soil fertility and boosting crop yields. Its high nitrogen content supports the growth of staple crops like wheat, corn, and rice, addressing global food security needs.

- Industrial Manufacturing: Ammonia is utilized in producing chemicals such as plastics, explosives, and synthetic fibers. It serves as a precursor in manufacturing acrylonitrile, a vital raw material for synthetic fibers, plastics, and rubber.

- Refrigeration: Ammonia is employed as a refrigerant in industrial cooling systems due to its high energy efficiency and low environmental impact. It’s commonly used in large-scale applications like food processing and ice rinks.

- Water Treatment: Ammonia is used in water purification processes, particularly in producing chloramine, a disinfectant that helps maintain water quality in distribution systems. It’s also utilized in aquaculture for setting up new fish tanks.

- Energy Sector: Ammonia is being explored as a clean fuel alternative in power generation and maritime transport. It can be used directly in combustion engines or as a hydrogen carrier, offering a low-carbon energy source.

- Food Processing: Ammonia is used in food manufacturing as a leavening agent and acidity regulator. It’s involved in processes like cheese production and the preparation of baked goods, contributing to food texture and preservation.

- Cleaning Products: Ammonia solutions are common in household and industrial cleaning products due to their effectiveness in removing grease and stains. They are particularly useful for cleaning glass and stainless steel surfaces.

- Textile Industry: Ammonia is utilized in the textile industry for processes like mercerization, which enhances the strength and dye affinity of cotton fibers. It’s also used in the production of synthetic fibers such as nylon and rayon.

- Hydrogen Storage: Ammonia serves as a hydrogen carrier, facilitating the storage and transport of hydrogen fuel. It can be decomposed to release hydrogen, offering a practical solution for energy storage and distribution.

Recent Developments

Yara has initiated the production of renewable-based ammonia in Brazil, utilizing renewable biomethane as feedstock. This move aligns with Yara’s commitment to reducing carbon emissions and promoting sustainable agriculture. The company has already delivered the first batches of this lower-carbon product to customers, marking a significant step in its green ammonia strategy.

CF Industries has entered a joint venture with JERA Co., Inc. and Mitsui & Co., Ltd. to develop a $4 billion low-carbon ammonia production facility at its Blue Point Complex in Louisiana. The plant, expected to begin production in 2029, will have a capacity of approximately 1.4 million metric tons per year and aims to sequester about 2.3 million metric tons of CO₂ annually.

BASF has become the first producer of renewable ammonia in Central Europe, producing two new grades—renewable ammonia and renewable ammonia solution 24.5%—at its Ludwigshafen site. This development is part of BASF’s strategy to expand its sustainable product portfolio and reduce its carbon footprint in ammonia production.

Nutrien has partnered with thyssenkrupp Uhde to develop a clean ammonia plant at its Geismar facility in Louisiana. The project aims to produce low-carbon ammonia, contributing to Nutrien’s commitment to sustainable agriculture. The facility is expected to be one of the world’s largest clean ammonia production plants upon completion.

QAFCO has broken ground on a $1.2 billion blue ammonia project in Mesaieed Industrial City. The facility, expected to start production in Q2 2026, will have a capacity of 1.2 million metric tons per year and will produce low-carbon ammonia for use in marine, power, and industrial applications.

Togliattiazot has set a production record, producing 1.64 million tonnes of carbamide in 2023, a 1.8-fold increase from 2022, and 1.601 million tonnes of ammonia, up 13.4%. The company plans to increase ammonia production from 3.5 million tonnes to 4 million tonnes per year by 2035.

SABIC Agri-Nutrients has announced the development of a new low-carbon ammonia plant in Jubail Industrial City. The facility will have a production capacity of 1.2 million metric tons per year of low-carbon ammonia and 1.1 million metric tons per year of urea and specialized agri-nutrients. Feasibility and technical studies are currently underway.

Sumitomo Chemical has completed the construction of a pilot facility for acrylic resin production. While not directly related to ammonia, the facility’s operations are part of Sumitomo’s broader efforts in chemical manufacturing, which includes ammonia-based products.

CSBP, a subsidiary of Wesfarmers, is involved in the production of ammonia and other fertilizers in Australia. The company continues to operate its Kwinana facility, which produces ammonia for domestic use and export, supporting Australia’s agricultural sector.

Nel Hydrogen has been involved in hydrogen fueling infrastructure projects in California. However, the company is facing legal challenges related to the performance of its hydrogen fueling stations, which have impacted the state’s hydrogen car market. Nel denies the allegations and is addressing the issues through legal channels.

Siemens is involved in ammonia production through its automation and digitalization solutions for chemical plants. The company provides technologies that enhance the efficiency and sustainability of ammonia production processes.

Key Players Analysis

- Yara International ASA

- CF Industries Holdings, Inc.

- BASF SE

- Nutrien Ltd.

- QATAR FERTILISER COMPANY

- Togliattiazot

- SABIC

- Sumitomo Chemical Co., Ltd.

- CSBP

- EuroChem Group

- Group DF

- ThyssenKrupp AG

- Nel Hydrogen

- Sinopec

- Rashtriya Chemicals and Fertilizers Limited

- Siemens AG

- Other Key Players

Conclusion

The ammonia market is experiencing strong growth, driven by the increasing demand for fertilizers, agricultural development, and the shift towards sustainable practices. Businesses are well-positioned to capitalize on emerging opportunities. By investing in green technologies and focusing on regional expansions, particularly in Asia-Pacific and North America, the ammonia industry is expected to contribute positively to economic development and environmental goals in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)