Table of Contents

Overview

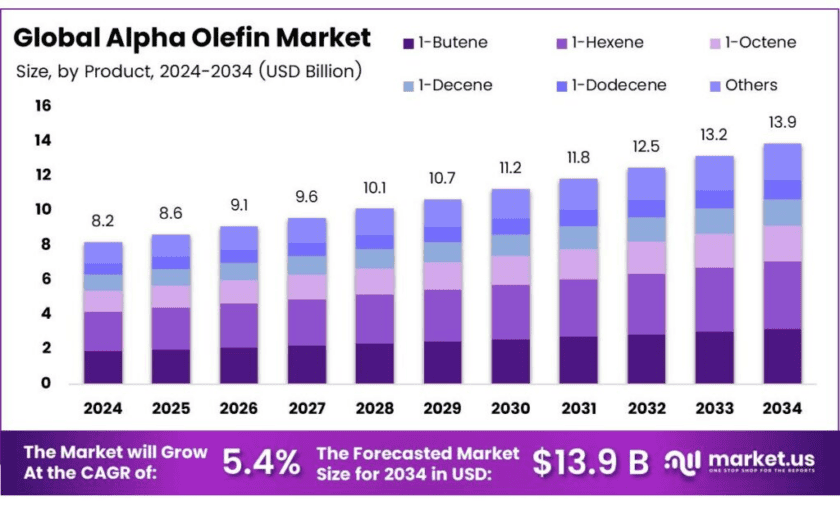

New York, NY – Dec 03, 2025 – The global Alpha Olefin market is projected to reach USD 13.9 billion by 2034, up from USD 8.2 billion in 2024, reflecting a CAGR of 5.4% between 2025 and 2034. Alpha Olefin (AOS), a formaldehyde-free surfactant derived from sodium C14–C16 olefins and preserved with MCI/MI, provides excellent viscosity, hard water stability, detergency, foam, and pH stability (pH 4–10). It is milder than lauryl sulfate and is widely used in sulfate-free shampoos, shower gels, hand sanitizers, pet care products, as well as in oilfield applications for unloading poor fluids and particles, remaining thermally stable up to 400°F, and being readily biodegradable.

AOS is synthesized from α-olefins via sulfonation in continuous membrane reactors, producing a mixture of olefin sulfonic acid and sulfolactone, which is then neutralized with aqueous sodium hydroxide and hydrolyzed to form alkene sulfonate and hydroxysulfonate, yielding an aqueous Alpha Olefin sulfonate solution. Solid anhydrous products can be produced using isopropanol instead of water during neutralization and hydrolysis.

LINEALENE 4 (1-butene) exhibits >99.5% purity, with minimal by-products such as n-butane (<0.2%) and isobutene (<0.3%). Higher-chain α-olefins, LINEALENE 6–12 (1-hexene to 1-dodecene), maintain 95–97.5% α-olefin purity, densities ranging from 0.673 to 0.758 g/cm³, low melting points (−140 °C to −35 °C), and controlled boiling ranges (62–216 °C), supporting uses in polyethylene comonomers and lubricant intermediates.

LINEALENE 14–18 (1-tetradecene to 1-octadecene) offer >88.5% purity, densities of 0.771–0.788 g/cm³, flash points of 113–159 °C, and melting points between −13 °C and 18 °C, making them suitable for detergent alcohols, synthetic base oils, and plasticizers. Blended grades such as LINEALENE 124, 148, and 168 provide tailored C12–C18 distributions with flash points of 91–141 °C and densities of 0.764–0.784 g/cm³, while LINEALENE 2024 (40–60% C20, 25–50% C22) is ideal for high-viscosity oils, waxes, and lubricants, offering superior oxidative resistance.

Key Takeaways

- The Global Alpha Olefin Market is projected to grow from USD 8.2 billion in 2024 to USD 13.9 billion by 2034, at a CAGR of 5.4%.

- 1-Hexene held a 27.9% market share in 2024, vital for high-performance polyethylene (LLDPE, HDPE) production.

- Polyethylene dominated with a 64.2% market share in 2024, driven by its use in films, packaging, pipes, and containers.

- North America led with a 41.2% market share in 2024, valued at USD 3.3 billion, fueled by strong petrochemical infrastructure.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-alpha-olefin-market/free-sample/

Report Scope

| Market Value (2024) | USD 8.2 Bn |

| Forecast Revenue (2034) | USD 13.9 Bn |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Product (1-Hexene, 1-Butene, 1-Octene, 1-Decene, 1-Dodecene, Others), By Application (Polyethylene, Detergent Alcohol, Synthetic Lubricant, Others) |

| Competitive Landscape | Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, Idemitsu Kosan Co., Ltd., INEOS Oligomers, Mitsubishi Chemical Corporation, SABIC, Sasol, Shell plc, Jam Petrochemical, and Dow. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161309

Key Market Segments

By Product – 1-Hexene Dominates with 27.9% Share

In 2024, 1-Hexene emerged as the leading product in the global alpha olefin market, accounting for over 27.9% of the total share. It serves as a critical co-monomer in producing high-performance polyethylene (PE), especially linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). Its consistent molecular structure and superior reactivity make it suitable for applications in packaging films, pipes, and automotive components. The rising adoption of 1-Hexene in flexible packaging and extrusion processes in 2024 was driven by the demand for durable yet lightweight materials, supported by advancements in production technologies and catalyst developments that enhanced yield efficiency and supply stability.

By Application – Polyethylene Leads with 64.2% Share

In 2024, Polyethylene held a dominant position in the alpha olefin application segment, capturing over 64.2% of the market. This reflects its extensive use in manufacturing HDPE and LLDPE, which are widely applied in films, packaging, pipes, and containers. Growth in flexible packaging, especially for food and e-commerce sectors, fueled consumption, with alpha-olefin-based polyethylene preferred for its mechanical strength, durability, and environmental resistance. Expansion of global infrastructure and new polymerization units further increased utilization. Polyethylene is expected to remain the primary growth driver in the alpha olefin market, supported by applications in lightweight automotive parts, durable geomembranes, and recyclable packaging materials, highlighting its essential role in modern manufacturing.

List of Segments

By Product

- 1-Hexene

- 1-Butene

- 1-Octene

- 1-Decene

- 1-Dodecene

- Others

By Application

- Polyethylene

- Detergent Alcohol

- Synthetic Lubricant

- Others

Regional Analysis

North America Leads Alpha Olefin Market with 41.2% Share, Valued at USD 3.3 Billion

In 2024, North America dominated the global alpha olefin market, holding over 41.2% of the total share, equivalent to approximately USD 3.3 billion. The region’s growth is driven by a robust petrochemical manufacturing infrastructure, advanced refining technologies, and high consumption of polyethylene, synthetic lubricants, and surfactants. The United States serves as the primary hub, supported by abundant shale gas reserves providing cost-effective ethylene feedstock, with states like Texas and Louisiana hosting major integrated production complexes.

These facilities ensure stable supply and competitive pricing for derivatives such as LLDPE and polyalphaolefins (PAO). North American producers are increasingly investing in sustainable olefin technologies, aligned with EPA and Department of Energy (DOE) initiatives, promoting low-emission production, renewable feedstock integration, and circular chemical recycling, thereby modernizing the region’s alpha olefin manufacturing capabilities.

Top Use Cases

As Comonomers in Polyethylene Production: Alpha olefins—particularly lower‑chain variants such as 1‑hexene and 1‑octene—are widely used as comonomers to produce high‑performance polyethylene (HDPE, LLDPE). These polymers are essential for manufacturing items such as packaging films, pipes, containers, and consumer goods due to their strength, flexibility, and environmental resistance. Overall, polyethylene production remains the largest application segment for alpha olefins—accounting for roughly 56% of the global alpha olefin demand.

Surfactants and Detergents: Alpha olefins serve as feedstock for the production of α‑olefin sulfonates (AOS), which are used in detergents, cleaning agents, and personal‑care products such as shampoos, soaps, hand sanitizers, and liquid cleansers. AOS is valued for its good foaming, wetting, emulsifying properties, biodegradability and relatively low skin irritation potential — making it favorable for household and personal‑care formulations. In 2025, the surfactant/cleaning‑agent segment is projected to account for more than 40% of the AOS-derived product market, reflecting rising consumption of home‑care and hygiene products globally.

Synthetic Lubricants and Polyalphaolefins (PAO): Alpha olefins serve as feedstock for the synthesis of synthetic lubricants, especially polyalphaolefins (PAO), which have superior thermal stability, low volatility, and good performance across a wide temperature range. Because of their stability and favorable viscosity characteristics, PAOs derived from alpha olefins are used in automotive engine oils, industrial lubricants, and high-performance machinery where conventional mineral oils may underperform.

Plasticizers, Specialty Plastics & Chemical Intermediates: Some alpha olefins (especially medium to high carbon‑chain variants) are used in the production of plasticizers and specialty polymers/plastomers. These are used to improve flexibility, durability, and workability of plastic materials, supporting applications in packaging, construction, and industrial components.

Oilfield Chemicals & Industrial Applications: Alpha olefins are used in oil‑field chemicals, such as drilling fluids, emulsifiers, and additives that support exploration and extraction processes. Their chemical versatility also supports other industrial applications including emulsion polymerization, paper sizing, textile‑auxiliary chemicals, and specialty chemical intermediates.

Recent Developments

Chevron Phillips Chemical Company LLC (CPChem) — In 2024–2025, Chevron Phillips Chemical fortified its position in the alpha‑olefin (AO) sector by operating multiple facilities producing normal alpha olefins (NAO), including an on-purpose 1‑hexene unit with capacity reaching ~646 kt per annum after the commissioning of a second U.S. plant at Old Ocean, Texas. Its alpha‑olefin output supports a broad range of end uses — polyethylene comonomers, synthetic lubricants, surfactants, and specialty chemical intermediates — enabling CPChem to meet rising global demand for flexible packaging, high‑performance polymers, and industrial oils.

Exxon Mobil Corporation — In 2024–2025, ExxonMobil entered the alpha‑olefin market with its new linear alpha olefins (LAO) unit at the Baytown, Texas complex, delivering an annual capacity of ~350,000 tons under its “Elevexx™” brand. These LAOs feed into applications such as plastic packaging, industrial and engine lubricants, surfactants, and drag‑reducing agents — supporting broad demand among plastics, automotive, and chemical industries.

Idemitsu Kosan Co., Ltd. — As of 2024, Idemitsu continues to operate substantial petrochemical and olefin value‑chain infrastructure, supplying basic chemicals and olefin feedstocks used in polyolefin production. The company’s ongoing structural review — including a planned consolidation of its Chiba ethylene complex together with Mitsui Chemicals, Inc. — demonstrates a strategic shift toward optimizing production amid shifting demand for polyolefins in Japan. While Idemitsu itself focuses on petrochemicals, these developments could influence alpha‑olefin supply chains linked to polyethylene and related derivatives.

INEOS Oligomers — In 2024, INEOS Oligomers reported annual production of approximately 1.6 million tonnes of linear alpha olefins, polyalphaolefins, and specialty oligomers globally. The company operates six manufacturing sites across North America and Europe, positioning itself as one of the world’s largest merchant producers of linear alpha olefins (LAO). Its product slate — including LAO for polyethylene comonomers, surfactant intermediates, synthetic lubricants, and drilling-fluid agents — supports broad industrial demand across plastics, personal‑care, lubricant, and oilfield‑chemical sectors.

Mitsubishi Chemical Corporation — As of 2025, Mitsubishi Chemical continues to operate a broad petrochemical portfolio, including production of olefins and related intermediates under its Olefins & Aromatics division. While publicly available data do not confirm a large‑scale linear alpha olefin (LAO) production restart, the company remains a recognized player among global LAO suppliers. Its strategic focus under the “KAITEKI Vision” emphasizes sustainable chemical production and diversification, enabling downstream supply‑chains for plastics, surfactants, and performance materials.

SABIC — In 2024, SABIC maintained a strong footprint in linear alpha olefins (LAO), offering a full range of LAO products (e.g., Hexene‑1, Octene‑1, Decene‑1, C14–C18 and C20+ grades) used as polyethylene comonomers, plasticizer alcohols, synthetic lubricants, surfactants, and other specialty chemicals. Despite global petrochemical headwinds, SABIC reported improved profitability in 2024 with a net profit of SAR 1.5 billion, reflecting resilience across its chemicals segment including olefins. Through continued investment in manufacturing efficiency and asset optimization, SABIC remains well‑positioned to supply LAO derivatives for plastics, lubricants, and detergent markets worldwide.

Sasol — As of 2025, Sasol remains a major global supplier of alpha olefins, offering C5‑C8 products such as pentene, hexene, and octene. These olefins serve as important co‑monomers for polyethylene (HDPE/LLDPE), as well as feedstocks for polyalphaolefins (PAOs), elastomers and plastomers, supporting applications in packaging, plastics, and specialty materials. Sasol’s diversified chemicals business maintains global reach, supplying to over 4,000 customers across 80 countries, reinforcing its role in global alpha olefin supply chains.

Shell plc — In 2024–2025, Shell, through its chemicals arm, continued supplying linear alpha olefins (LAO) under brand NEODENE, offering high‑purity alpha‑ and internal‑olefins (C4–C26+) for use in polyethylene, synthetic lubricants, detergents, surfactants, drilling fluids, and other functional fluids. Its joint venture facility in China (CSPC) announced in 2025 a petrochemical complex expansion including LAO production units, strengthening integration and supporting regional demand for olefin-derived products. Shell’s established technology base (SHOP process) and global feedstock access continue to make it a key player in the alpha olefin market globally.

Jam Petrochemical Company — In 2024, Jam Petrochemical reported revenues of approximately USD 550 million, reinforcing its status as a major olefin‑ and polymer‑producer in the Middle East. Its complex in Asaluyeh includes olefin and Butene‑1 units, and downstream lines for HDPE, LLDPE and other polymers — positioning Jam as a full‑spectrum supplier of alpha‑olefins, polyethylene feedstock and related derivatives for both domestic and export markets.

Conclusion

In conclusion, Alpha olefins (AOs) continue to serve as a cornerstone chemical building block across multiple industries — from plastics to detergents to lubricants. Their predominant role as comonomers in Polyethylene production (especially LLDPE and HDPE) supports the global surge in packaging, consumer‑goods, and pipe applications. Meanwhile, AOs converted into surfactants (e.g., α‑olefin sulfonates) or synthetic lubricants deliver value in personal care, cleaning, automotive, and industrial sectors due to their stability, performance, and biodegradability.