Table of Contents

Overview

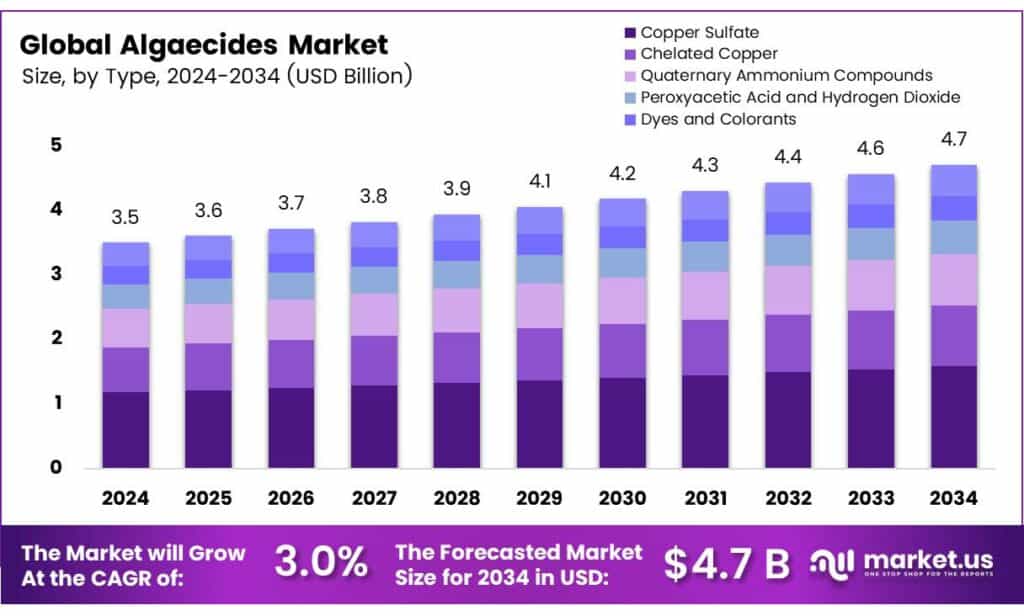

New York, NY – October 03, 2025 – The Global Algaecides Market is projected to grow from USD 3.5 billion in 2024 to about USD 4.7 billion by 2034, registering a CAGR of 3.0% between 2025 and 2034. Algaecides are widely used across water treatment, agriculture, aquaculture, and industrial sectors to control algae growth, which is essential for maintaining water quality, ecosystem balance, and operational efficiency.

They are particularly important in municipal water treatment plants, irrigation systems, aquaculture ponds, and industrial reservoirs, where algae proliferation can disrupt filtration, reduce irrigation efficiency, and harm aquatic environments. Alongside this, fungal plant diseases remain a major cause of global crop losses, with thousands of fungal pathogens posing risks to agriculture. To manage this, chemical and biological fungicides are extensively used worldwide, with the United States alone applying more than 50,000 tons annually, particularly for crops like grapes and tomatoes.

Fruit production in regions such as eastern apple orchards, southern peach farms, and California vineyards relies heavily on fungicides, making them integral to modern farming. With agriculture accounting for nearly 70% of global freshwater use, the demand for algae control solutions continues to rise to safeguard irrigation systems and crop yields. Furthermore, aquaculture, which contributes over 50% of the world’s fish consumption, requires constant water quality management, further driving the adoption of algaecides.

Fungicides are generally categorized by their mode of application: foliar fungicides protect plant leaves and stems by forming a barrier against pathogens, soil fungicides act within the soil either as fumigants or by absorption through plant roots, and dressing fungicides are applied directly to seeds or harvested crops to prevent fungal attacks during storage or germination. Together, these treatments highlight the critical role of both fungicides and algaecides in sustaining agricultural productivity, food supply, and water quality management worldwide.

Key Takeaways

- The Global Algaecides Market is projected to grow from USD 3.5 billion in 2024 to USD 4.7 billion by 2034 at a CAGR of 3.0%.

- Copper Sulfate led the market in 2024 with a 33.7% share due to its effectiveness in controlling algae across various applications.

- Liquid algaecides dominated the market in 2024, with a 56.8% share, due to their ease of application and fast results.

- Non-selective algaecides held a 67.9% share in 2024, valued for their ability to effectively target a diverse range of algae species.

- Surface water treatment accounted for a 33.5% share in 2024, driven by the need to manage algal blooms in natural water bodies.

- North America led the global market in 2024 with a 43.7% share, valued at USD 1.5 billion, due to advanced agriculture and water management practices.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-algaecides-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.5 Billion |

| Forecast Revenue (2034) | USD 4.7 Billion |

| CAGR (2025-2034) | 3.0% |

| Segments Covered | By Type (Copper Sulfate, Chelated Copper, Quaternary Ammonium Compounds, Peroxyacetic Acid and Hydrogen Dioxide, Dyes and Colorants, Others), By Mode of Action (Non-Selective, Selective), By Form (Liquid, Granular Crystal, Pellet), By Application (Surface Water Treatment, Aquaculture, Sports and Recreational Centers, Agriculture, Others) |

| Competitive Landscape | Airmax Inc., BASF SE, UPL Limited, Oreq Corporation, BioSafe Systems LLC, Waterco Limited, Nufarm Limited, SePRO Corporation, Phoenix Products Co., Kemira |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157706

Key Market Segments

By Type

Copper Sulfate Commands 33.7% Market Share

Copper Sulfate led the global algaecides market in 2024, holding a 33.7% share. Its widespread use stems from its proven effectiveness in controlling algae across agricultural irrigation, aquaculture, and natural water bodies. Valued for its rapid action against various algae types, it remains a cost-effective choice for farmers and water management authorities. With increasing focus on water safety and aquatic ecosystem protection, copper-based products are expected to maintain their dominance, supported by regulatory approvals for controlled use.

By Mode of Action

Non-Selective Algaecides Hold 67.9% Share

Non-selective algaecides dominated the market in 2024 with a 67.9% share, favored for their ability to eliminate a broad spectrum of algae species. Widely used in water treatment facilities, aquaculture, and irrigation systems, these products deliver quick, cost-effective results for large-scale applications. As water safety regulations tighten and harmful algal blooms rise, demand for non-selective algaecides is projected to grow, driven by their efficacy in maintaining clean water sources.

By Form

Liquid Algaecides Lead with 56.8% Share

In 2024, liquid algaecides captured a 56.8% market share, preferred for their ease of application, uniform mixing, and rapid results. Used extensively in ponds, lakes, reservoirs, and irrigation systems, liquid formulations are ideal for large-scale algae control. Their compatibility with modern spraying and pumping equipment enhances their appeal for agricultural and municipal water management. As concerns over algal blooms impacting water quality and aquatic life grow, liquid algaecides are expected to retain their market lead.

By Application

Surface Water Treatment Accounts for 33.5% Share

Surface water treatment led algaecide applications in 2024, holding a 33.5% share. Driven by the need to combat harmful algal blooms in lakes, rivers, and reservoirs, algaecides are critical for ensuring safe drinking water and supporting irrigation and recreational water quality. With climate change and nutrient pollution fueling algae growth, demand for algaecides in surface water treatment is set to rise, reinforcing their role in sustainable water management.

Regional Analysis

North America led the global algaecides market in 2024, capturing a 43.7% share valued at USD 1.5 billion. The U.S. drives this dominance, fueled by advanced agriculture, robust aquaculture, and proactive water quality management. Increased algal bloom concerns, supported by EPA monitoring and government initiatives, boost algaecide use in surface water treatment and fish farming. With rising investments in water resource management and climate-driven algal challenges, North America is poised to maintain its market leadership.

Top Use Cases

- Surface Water Treatment: Algaecides help keep lakes, rivers, and reservoirs free from unwanted algae growth. This ensures clean drinking water and safe spots for swimming or boating. By stopping harmful blooms, they protect fish and plants in these natural areas. Water managers apply them carefully to maintain balance without harming the environment. Overall, they make public water sources healthier and more usable for everyone.

- Aquaculture Ponds: In fish farming, algaecides control algae that cloud the water and steal oxygen from fish. Clear water means healthier fish that grow faster and stay disease-free. Farmers add these treatments to ponds regularly to boost yields. This keeps operations running smoothly and cuts losses from poor water quality. It’s a simple way to support sustainable seafood production.

- Agricultural Irrigation Systems: Farmers use algaecides in canals and ditches to prevent algae from clogging pipes and slowing water flow. This helps deliver water evenly to crops, improving growth and saving resources. Without clogs, irrigation works better, leading to stronger harvests. It’s an easy fix for busy farms facing dry spells or nutrient buildup.

- Swimming Pools and Recreational Centers: Algaecides keep pool water sparkling and safe by killing algae that turn it green or slimy. This stops slips and skin issues for swimmers. Pool staff apply them during routine checks to maintain clear, inviting spaces. Happy visitors mean more use of pools, spas, and water parks year-round.

- Industrial Cooling Towers: Factories rely on algaecides to stop algae in cooling systems, which prevents machinery from overheating. Clean towers run efficiently, saving energy and cutting repair costs. Workers add treatments to water loops to avoid buildup. This keeps plants productive and safe, especially in hot climates where algae spreads fast.

Recent Developments

1. Airmax Inc.

Airmax has integrated its algaecides, like PondMaster, with robust pond aeration systems. Their recent focus is on a holistic “ecosystem” approach, promoting beneficial bacteria to work alongside algaecides for long-term control. They emphasize proactive management through their integrated water quality solutions, combining chemical and mechanical methods for superior results in lakes and large ponds, reducing future chemical dependency.

2. BASF SE

BASF is advancing algaecide technology through its R&D pipeline, focusing on new active ingredients and formulations for agricultural and industrial water treatment. A key development is creating more sustainable and targeted solutions that minimize environmental impact. Their research includes combination products that offer dual-action control against a broader spectrum of algal species, enhancing efficacy and application efficiency for professional users.

3. UPL Limited

UPL is expanding its algaecide portfolio under the “BION” and “SHINE” brands, targeting the agricultural sector. Recent developments include formulations that combine algaecidal action with other beneficial properties, such as nutrient management. Their strategy leverages open agriculture networks to provide solutions that not only control algae in irrigation ponds but also contribute to overall crop health and water efficiency for farmers.

4. Oreq Corporation

Oreq Corporation focuses on developing high-efficacy, EPA-registered algaecides for the professional vegetation management market. Their recent developments involve creating more potent and selective copper-based and peroxide-based formulations. They emphasize products that are effective yet have favorable environmental profiles, catering to applicators managing algae in lakes, reservoirs, and golf course water hazards who require reliable, fast-acting control.

5. BioSafe Systems LLC

BioSafe Systems champions peroxide-based algaecides like GreenClean and OxyFusion. A key recent development is the promotion of these as a sustainable alternative to copper, as they degrade into water and oxygen, leaving no long-term residue. They highlight the use in sensitive environments, including potable water reservoirs and aquaculture, aligning with the growing demand for effective, environmentally responsible solutions with minimal re-entry intervals.

Conclusion

The Algaecides sector is thriving amid growing worries about water health and climate shifts. Demand surges in farming, fish raising, and city water care as people seek simple ways to fight algae overgrowth. Makers are shifting to greener options that fit strict rules, sparking fresh ideas like smart dosing tools. Partnerships between firms and nature groups promise wider reach, especially in sunny spots prone to blooms. In the end, algaecides stand as key helpers for clean water, backing strong growth in eco-smart industries worldwide.