Table of Contents

Overview

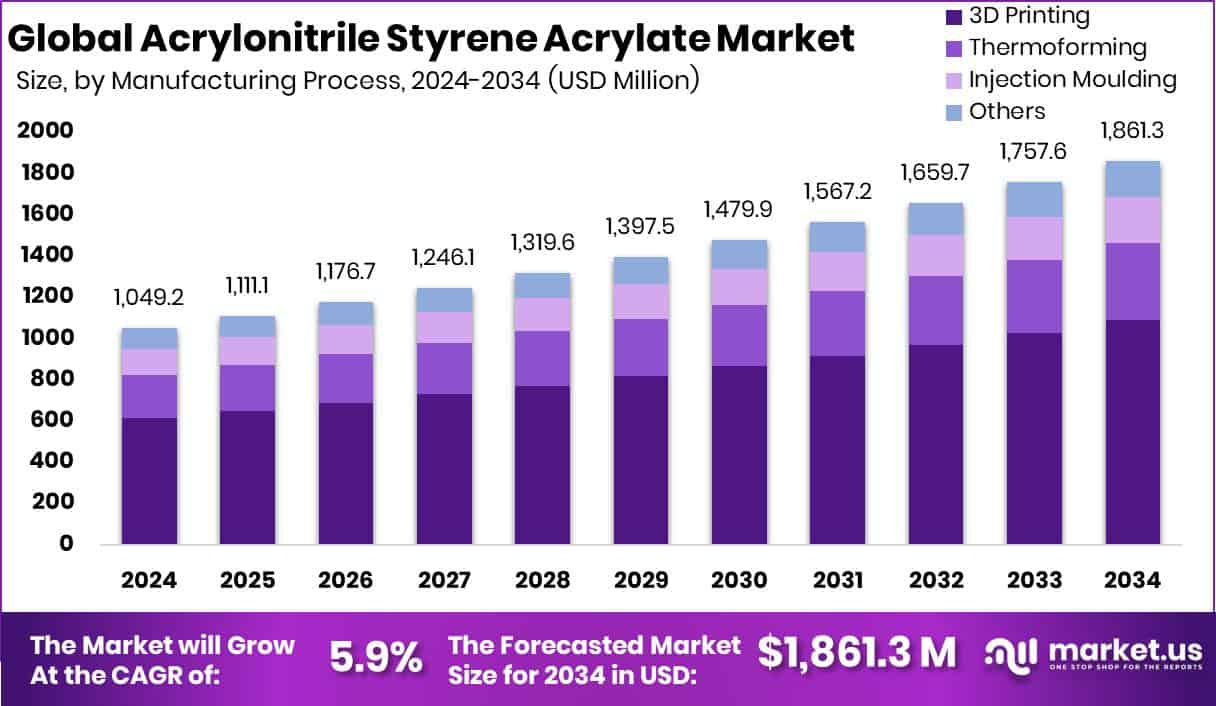

New York, NY – Dec 04, 2025 – The global Acrylonitrile Styrene Acrylate (ASA) market is projected to grow steadily, reaching around USD 1,861.3 million by 2034, rising from USD 1,049.2 million in 2024, at a 5.9% CAGR from 2025 to 2034. Asia-Pacific leads demand with a 45.90% share, supported by strong consumption across automotive and industrial manufacturing.

ASA is a high-performance thermoplastic valued for its superior resistance to weather, UV exposure, and long-term environmental stress. It maintains surface appearance and mechanical strength in outdoor conditions, making it well-suited for automotive exterior parts, consumer appliances, electrical enclosures, and industrial components. Its processing flexibility and durability position it as a reliable alternative to conventional plastics.

Market expansion is closely linked to the growing adoption of advanced 3D printing materials. ASA’s thermal stability and strength make it suitable for both prototyping and functional end-use parts. Investments such as Carbon’s $60M funding for DLS technology, Desktop Metal’s $115M round, and Caracol’s $40M raise are accelerating material innovation and industrial additive manufacturing adoption.

Further momentum comes from system-focused funding, including Mosaic ($28M), Novenda Technologies ($6.1M), and CustoMED ($6M), which supports high-performance material usage in automated and medical-grade manufacturing. As industries pursue lightweight, durable, and scalable production solutions, ASA remains well-positioned across mobility, construction, and advanced fabrication platforms.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-acrylonitrile-styrene-acrylate-market/request-sample/

Key Takeaways

- The Global Acrylonitrile Styrene Acrylate Market is expected to be worth around USD 1,861.3 million by 2034, up from USD 1049.2 million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- Injection moulding dominated the Acrylonitrile Styrene Acrylate Market with a 58.5% share.

- Car exterior panels dominated the acrylonitrile styrene acrylate market with a 27.8% share.

- Automotive dominated the Acrylonitrile Styrene Acrylate Market with a 41.9% share.

- The Asia-Pacific’sreached a market value of USD 481.5 Mn, driven by manufacturing growth.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=167133

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1049.2 Million |

| Forecast Revenue (2034) | USD 1,861.3 Million |

| CAGR (2025-2034) | 5.9% |

| Segments Covered | By Manufacturing Process (3D Printing, Thermoforming, Injection Moulding, Others), By Application (Car Exterior Panels, Side View Mirror Housing, Commercial Sliding, Electrical Housing, Furniture, Medical Devices, Garden Equipment, Others), By End-Use (Automotive, Electronics, Consumer Goods, Construction, Healthcare, Others) |

| Competitive Landscape | LG Chem, INEOS Styrolution, Chi Mei Corporation, Formosa Plastics Corporation, SABIC, Kumho Petrochemical, Techno-UMG Co., Ltd., Shenzhen Wote Advanced Materials Co., Ltd., Suzhou Sunway Polymer Co., Ltd. |

Key Market Segments

By Manufacturing Process Analysis

In 2024, injection moulding dominated the By Manufacturing Process segment of the Acrylonitrile Styrene Acrylate (ASA) market, accounting for a 58.5% share. Its leadership is driven by the ability to deliver uniform quality, excellent surface finish, and high mechanical strength, which are critical for automotive exterior parts, outdoor products, and long-lasting consumer goods.

The strong 58.5% market share also highlights manufacturers’ preference for injection moulding in large-scale production, as the process ensures precise dimensions and repeatable results. ASA performs efficiently under controlled moulding conditions, enabling complex component designs without losing structural stability or weather resistance.

As demand increased for UV-stable and weather-durable plastic parts, injection moulding continued to stand out as a cost-effective and dependable manufacturing solution. Its production efficiency, combined with consistent output quality, reinforced its dominant role in shaping ASA components across industrial and commercial applications.

By Application Analysis

In 2024, car exterior panels led the By Application segment of the Acrylonitrile Styrene Acrylate (ASA) market, capturing a 27.8% share. This leading position is supported by ASA’s strong resistance to UV exposure, heat fluctuations, and prolonged outdoor conditions, allowing panels to retain colour, gloss, and mechanical strength over time.

Automotive producers increasingly selected ASA for exterior components because it combines impact resistance with lightweight properties, supporting durability while contributing to better overall vehicle efficiency. The 27.8% market share also reflects the industry’s need for materials that deliver long-term surface stability without frequent maintenance.

As vehicle designs continue to incorporate advanced plastics for improved styling freedom and cost control, ASA has remained a preferred solution for exterior panel manufacturing. Its ability to balance appearance, performance, and environmental resistance has reinforced its importance across modern automotive applications.

By End-Use Analysis

In 2024, the automotive sector dominated the By End-Use segment of the Acrylonitrile Styrene Acrylate (ASA) market, holding a 41.9% share. This leadership underscores the industry’s dependence on ASA for parts that demand high durability, UV resistance, and long-term outdoor reliability.

Automakers consistently preferred ASA for exterior trims, body panels, and functional components because it resists colour fading and impact damage, even under prolonged environmental exposure. The strong 41.9% market share also reflects the ongoing shift toward lightweight polymers that enhance vehicle efficiency while allowing greater design freedom.

As vehicles increasingly require materials that maintain mechanical strength and appearance across diverse weather conditions, ASA has remained a trusted solution. Its balance of performance, stability, and adaptability continues to support widespread use in modern automotive manufacturing.

Regional Analysis

In 2024, Asia-Pacific led the Acrylonitrile Styrene Acrylate (ASA) market with a 45.90% share, valued at USD 481.5 Mn. This dominance reflects the region’s strong automotive production base, growing demand for outdoor consumer products, and expanding use of 3D printing technologies. Manufacturers across East and Southeast Asia increasingly adopted ASA for exterior panels, durable moulded parts, and weather-resistant components.

North America recorded stable growth, supported by advanced manufacturing systems and rising use of UV-stable materials in outdoor equipment and additive manufacturing. Europe maintained consistent demand, driven by automotive design innovation and preference for long-lasting engineering plastics in consumer applications.

Meanwhile, the Middle East & Africa experienced gradual expansion due to industrial diversification and increasing infrastructure activity, while Latin America showed moderate progress as ASA gained traction in impact-resistant and colour-stable applications. Overall, Asia-Pacific’s 45.90% market leadership highlights its scale, industrial strength, and broad integration of ASA across high-volume sectors.

Top Use Cases

- Automotive exterior parts: ASA is widely used for vehicle body components such as side-mirror housings, grilles, trims, and other exterior panels because it resists sunlight, UV radiation, rain and heat without losing colour or becoming brittle.

- Outdoor equipment & furniture: Thanks to its strong resistance to UV light, moisture, temperature changes, and chemicals — plus good mechanical strength — ASA is ideal for outdoor furniture, garden equipment, housings for outdoor tools, and other items exposed to weather.

- Electrical & appliance housings (indoors & outdoors): ASA’s chemical resistance, heat and UV stability make it a good choice for housings of electrical appliances (like washing machines, external electrical enclosures) and consumer electronics — especially when those items might see exposure to sunlight or heat.

- Construction and building materials / exterior elements: ASA finds use in building-related components — for example, exterior siding, window and door frames, cladding, or decorative panels — because of its excellent weather resistance, UV stability, and low shrinkage when moulded.

- Marine, outdoor-sports and recreational applications: Because ASA resists UV, heat, chemicals, salt water, and moisture, it is suitable for parts used in marine environments, outdoor sports gear, lawn/garden tools, and recreation equipment — wherever resilience and long-term exposure to weather or water matter.

Recent Developments

- In 2024, LG Chem obtained certification under ISCC PLUS in Korea for its entire lifecycle — from raw material purchase through production and sales—covering 61 eco-friendly products, including petrochemical plastics like ABS (and likely extending to its ASA portfolio).

- In June 2024, INEOS Styrolution signed an agreement to supply its “ultra-tough ASA/PC blend” exclusively to a company called Edge Solutions.

Conclusion

The Acrylonitrile Styrene Acrylate market continues to gain importance as industries seek durable plastic materials that perform reliably in outdoor and demanding environments. Its strong resistance to sunlight, weather, and impact makes it well suited for automotive parts, construction elements, consumer goods, and advanced manufacturing applications.

Increasing use of lightweight plastics, growing interest in additive manufacturing, and ongoing material innovation are supporting wider adoption. Companies are also placing more focus on sustainability, which is encouraging the development of improved and environmentally balanced ASA solutions.

As manufacturers prioritize long service life, design flexibility, and consistent surface quality, Acrylonitrile Styrene Acrylate is expected to remain a preferred engineering plastic across multiple end-use sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)