Table of Contents

Overview

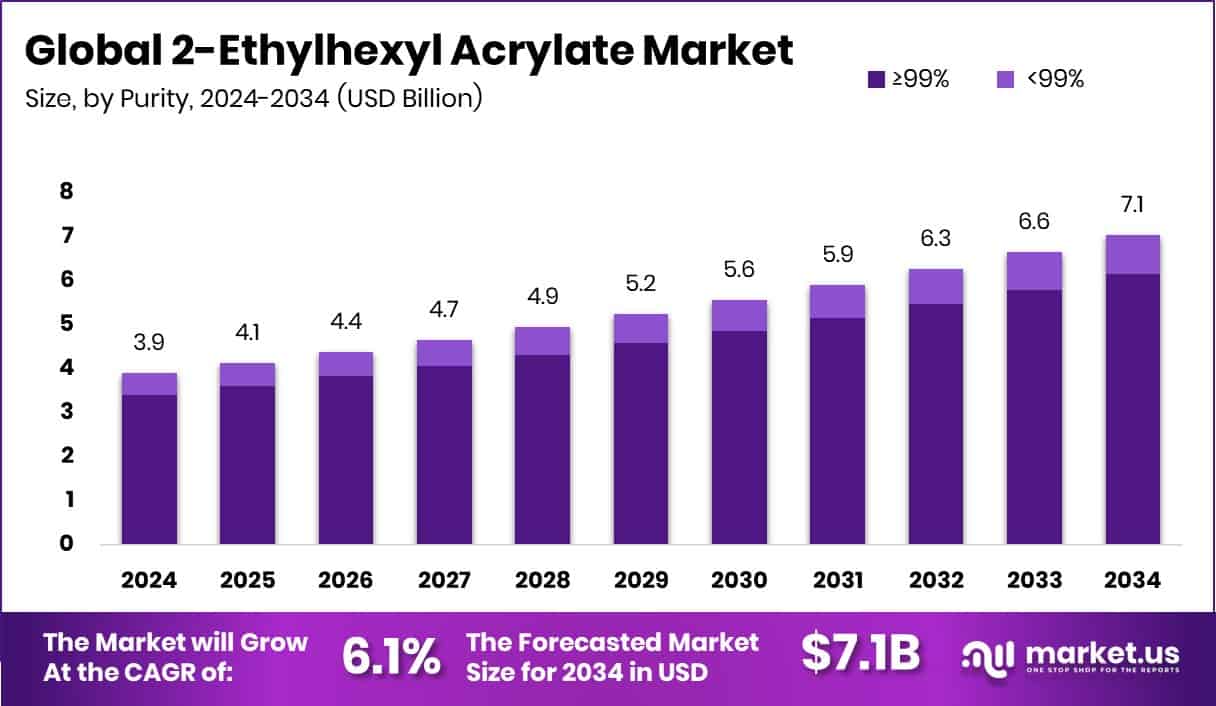

New York, NY – October 23, 2025 – The 2-Ethylhexyl Acrylate Market is projected to reach USD 7.1 billion by 2034, growing from USD 3.9 billion in 2024 at a 6.1% CAGR. The Asia Pacific region leads with a 47.8% share, valued at USD 1.8 billion, driven by strong demand in construction, coatings, and adhesives. This monomer’s flexibility, weather resistance, and compatibility with other monomers make it essential for paints, sealants, and pressure-sensitive adhesives.

Growth is propelled by infrastructure expansion, packaging needs, and regulatory emphasis on low-VOC, durable materials. Emerging economies are fueling consumption in architectural and industrial coatings. Sustainability-focused innovations also attract investor attention — Ecoat secured €21 million for eco-friendly paint solutions, while Nature Coatings raised $2.45 million, led by The 22 Fund and Regeneration VC. Similarly, Distil’s $7.7 million Series A highlights capital interest in next-gen chemical technologies.

Industrial movements include BASF’s $6.8 billion coatings business divestment, signaling strategic realignment. Regional momentum is further supported by mutual fund acquisitions worth ₹10,093 crore in firms like Asian Paints and Dixon Technologies, reflecting investor confidence. At the local level, Boldon Painting’s £50,000 grant showcases how grassroots funding is also stimulating employment and regional coatings growth.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-2-ethylhexyl-acrylate-market/request-sample/

Key Takeaways

- The Global 2-Ethylhexyl Acrylate Market is expected to be worth around USD 7.1 billion by 2034, up from USD 3.9 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- In 2024, ≥99% purity dominated the 2-Ethylhexyl Acrylate Market, capturing 87.3% share.

- Adhesives and sealants led the 2-ethylhexyl acrylate market, accounting for 39.7% share in 2024.

- Construction remained the key end-use in the 2-Ethylhexyl Acrylate Market, holding a 34.8% share.

- The 2-Ethylhexyl Acrylate Market in the Asia Pacific reached USD 1.8 billion in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161901

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.9 Billion |

| Forecast Revenue (2034) | USD 7.1 Billion |

| CAGR (2025-2034) | 6.1% |

| Segments Covered | By Purity (≥99%, <99%), By Application (Adhesives and Sealants, Paints and Coatings, Plastics, Textiles, Others), By End-Use (Construction, Automotive, Packaging, Electronics, Others) |

| Competitive Landscape | BASF SE, Arkema S.A., The Dow Chemical Company, Nippon Shokubai Co., Ltd., LG Chem Ltd., Evonik Industries AG, Shanghai Huayi Acrylic Acid Co., Ltd., Mitsubishi Chemical Corporation, KH Neochem Co., Ltd., SIBUR Holding |

Key Market Segments

By Purity Analysis

In 2024, the ≥99% purity segment dominated the By Purity category of the 2-Ethylhexyl Acrylate Market, holding a 87.3% share. This high-purity grade is the preferred choice for coatings, adhesives, and sealants, owing to its superior polymerization stability, transparency, and weather resistance. Manufacturers prioritize ≥99% purity to ensure consistency and performance in high-end formulations.

Its strong market position highlights the industry’s shift toward precision-grade monomers that enhance durability and aesthetic quality in paints and adhesives. The purity level minimizes impurities during polymer synthesis, improving product reliability and processing efficiency. Moreover, its compliance with environmental standards and contribution to low-emission, high-performance applications further solidify its dominance across global chemical and industrial manufacturing sectors.

By Application Analysis

In 2024, the Adhesives and Sealants segment dominated the By Application category of the 2-Ethylhexyl Acrylate Market, accounting for a 39.7% share. This leadership stems from the rising need for flexible, durable bonding materials in the construction, packaging, and automotive sectors. Owing to its excellent adhesion, elasticity, and weather resistance, 2-Ethylhexyl Acrylate is widely utilized in pressure-sensitive adhesives, caulks, and sealants.

Its capability to perform reliably under extreme environmental conditions enhances its value in structural and industrial applications. Additionally, the market’s focus on eco-friendly and low-VOC adhesive formulations is further accelerating its demand. Manufacturers are increasingly adopting 2-Ethylhexyl Acrylate to develop sustainable bonding solutions that deliver both high performance and environmental compliance, reinforcing its key role in the global adhesives and sealants industry.

By End-Use Analysis

In 2024, the Construction segment dominated the By End-Use category of the 2-Ethylhexyl Acrylate Market, securing a 34.8% share. This dominance was fueled by rising demand for high-performance coatings, sealants, and adhesives across residential, commercial, and infrastructure projects. Owing to its flexibility, strong adhesion, and weather durability, 2-ethylhexyl acrylate is extensively used in waterproofing, flooring, and architectural coatings.

The ongoing surge in construction and renovation activities, particularly in emerging economies, has significantly boosted its usage. Its ability to enhance bonding strength and maintain elasticity under diverse conditions positions it as a vital ingredient in modern construction chemicals. As the industry emphasizes durable, long-lasting materials, 2-Ethylhexyl Acrylate continues to play a central role in developing sustainable and performance-driven architectural applications.

Regional Analysis

The Asia Pacific region dominated the 2-Ethylhexyl Acrylate Market in 2024, holding a 47.8% share and generating USD 1.8 billion in revenue. Its growth is driven by rapid infrastructure expansion, thriving automotive and coatings industries, and strong demand from developing economies.

In North America, steady consumption stems from mature construction and manufacturing sectors, with emphasis on high-performance, eco-compliant coatings and adhesives. Europe remains a major hub for automotive and industrial coatings, where stringent low-VOC regulations continue to support the use of premium-grade acrylates.

Latin America is witnessing gradual adoption, supported by urbanization and rising access to modern paint and adhesive technologies. The Middle East & Africa show promising potential through construction and oil & gas development, though growth is tempered by economic variability and import reliance. Together, these regions shape a globally diversified yet sustainability-driven market landscape.

Top Use Cases

- Pressure-sensitive adhesives (PSAs): 2-EHA is widely used as a soft monomer in PSAs (such as tapes and labels). Its long, flexible side chain gives the adhesive both strong peel strength and good shear resistance.

- Architectural and industrial coatings: In coatings for buildings, industrial equipment, and outdoor surfaces, 2-EHA imparts flexibility, weather-resistance, and clarity, helping the paint or coating to endure sun, moisture, and movement.

- Sealants and caulks: As a comonomer in sealants, 2-EHA improves adhesion to substrates and allows the sealant to remain flexible under changing temperatures or structural shifts.

- Textile and fabric coatings/finishes: It is used in textile finishing (for awnings, upholstery, tarps, etc) to deliver water repellency, stain resistance, and durability to coated fabrics.

- Paper, label & printing ink coatings: In paper coatings and printing inks, 2-EHA contributes to smooth film formation, improved adhesion, and durability of the ink or coating over time.

- Feedstock for specialty polymers and plasticizers: 2-EHA serves as a building block for copolymers and can also act as a plasticizer in films, sheeting, or adhesives—lowering the glass transition temperature (Tg), thus making the polymer softer or more flexible.

Recent Developments

- In April 2025, Arkema announced the conversion of its European acrylic thickener product line (under brands Rheotech™, Thixol™, Viscoatex™) to bio-based content. These thickeners are made with the bio-sourced Ethyl Acrylate from Carling and deliver up to 30% bio-based content and up to a 25% reduction in carbon footprint.

- In May 2024, Nippon Shokubai’s Indonesian subsidiary (PT Nippon Shokubai Indonesia) started manufacturing and marketing ISCC PLUS-certified biomass-derived acrylic acid, acrylates (including 2-Ethylhexyl Acrylate), and superabsorbent polymers. This means they are offering acrylic esters made partly from renewable feedstocks.

- In April 2024, BASF signed a Letter of Intent (LoI) with Youyi Group to supply both butyl acrylate and 2-ethylhexyl acrylate from BASF’s future Zhanjiang Verbund site in Guangdong, China. This deal is designed to support Youyi’s expanding adhesive/tape business and aligns with BASF’s plan to produce 100,000 tons of 2-EHA annually at Zhanjiang from about 2025.

Conclusion

The 2-Ethylhexyl Acrylate market is witnessing steady expansion driven by its versatile use in coatings, adhesives, and sealants across construction, packaging, and automotive sectors. Its excellent weather resistance, flexibility, and strong adhesion make it an essential ingredient in high-performance formulations. Growing interest in sustainable and bio-based alternatives further enhances its relevance in eco-conscious industries.

Continuous innovation, investment in low-VOC solutions, and regional capacity expansions by major producers are strengthening the market’s long-term outlook. As industries prioritize durable and environmentally compliant materials, 2-Ethylhexyl Acrylate remains a vital component supporting advanced manufacturing and sustainable development worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)