Table of Contents

Overview

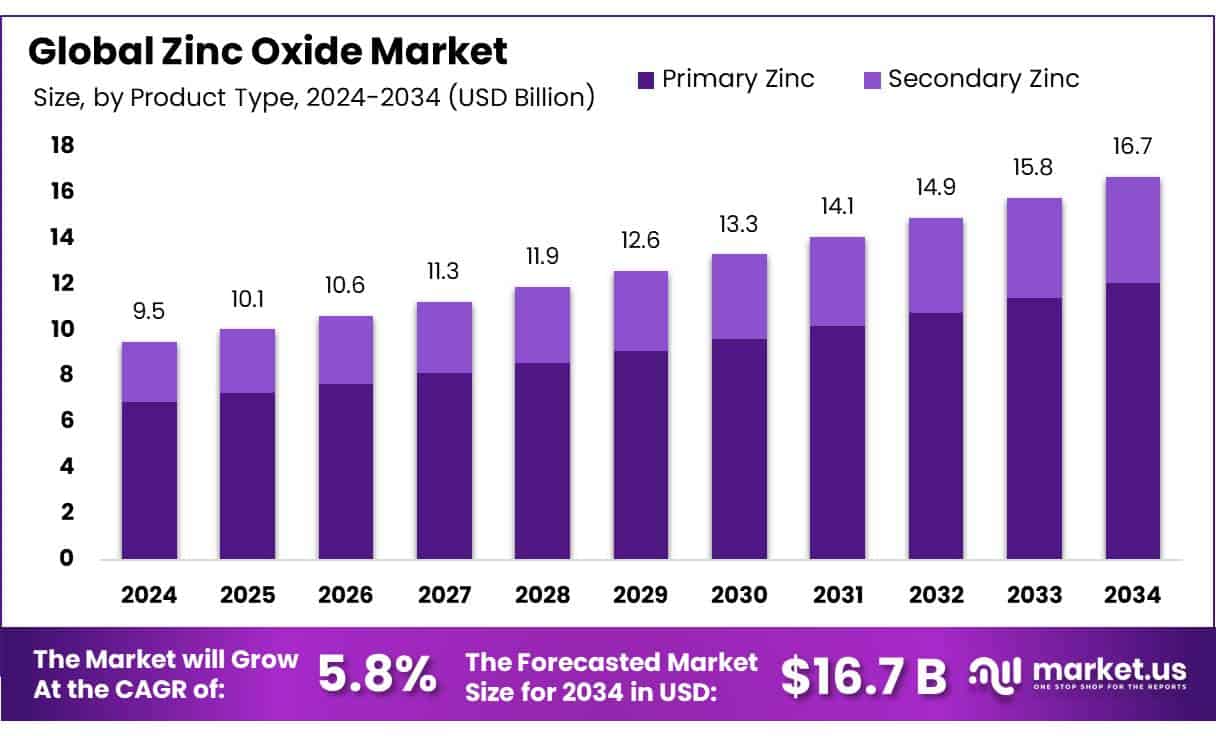

New York, NY – May 09, 2025 – The global Zinc Oxide Market is set for strong growth, with its size expected to jump from USD 9.5 billion in 2024 to around USD 16.7 billion by 2034, expanding at a steady CAGR of 5.8% from 2025 to 2034.

In 2024, primary zinc accounted for 72.3% of the global zinc oxide market, driven by its use in producing high-purity zinc oxide. Powder zinc oxide held a 68.6% market share in 2024, valued for its excellent dispersion, ease of handling, and integration into industrial processes. Standard grade zinc oxide captured a 47.2% share in 2024, widely used in rubber, ceramics, paints, and chemicals for its cost-effectiveness and reliable performance. The rubber sector accounted for 43.2% of the zinc oxide market in 2024, driven by its role in enhancing durability, elasticity, and heat resistance in tires and other products.

US Tariff Impact on Zinc Oxide Market

The world’s biggest zinc mine has become embroiled in escalating US-China trade tensions, threatening to disrupt global supply chains for this essential industrial metal. Located in remote Alaska, the Red Dog Mine produces approximately 5% of global zinc and 2.5% of lead supply annually, worth an estimated USD 2 billion. With China historically purchasing over 20% of the mine’s output, newly imposed tariffs have created unprecedented challenges for mine operator Teck Resources and its customers.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/zinc-oxide-market/request-sample/

The operating rate of zinc oxide this week was recorded at 60.79%, down 0.83% WoW. Recently, affected by tariffs, the orders for all-steel tires in the rubber-grade zinc oxide sector have been in the doldrums, with poor downstream demand. The overall demand for ceramic-grade zinc oxide remains relatively stable. The consumption of feed-grade zinc oxide is relatively average due to the current pork market demand, and companies are cautious about the future.

Key Takeaways

- Global zinc oxide market projected to grow from USD 9.5 billion in 2024 to USD 16.7 billion by 2034, at a CAGR of 5.8%.

- Primary zinc dominates with a 72.3% share, driven by its use in high-purity zinc oxide for rubber, ceramics, and paints.

- Powder form holds a 68.6% share, favored for its dispersion and integration in rubber, paints, and personal care industries.

- Standard grade captures a 47.2% share, valued for cost-effective performance in rubber, ceramics, and chemical applications.

- Direct process leads with a 56.1% share, preferred for cost-effective zinc oxide production for rubber, glass, and agriculture.

- The rubber industry commands a 43.2% share, relying on zinc oxide for enhanced durability and heat resistance in tires.

- Asia-Pacific region holds a 51.2% share (USD 4.8 billion), driven by industrial growth and demand in key sectors.

Analyst Viewpoint

Global demand for Zinc Oxide is rising, driven by consumer preference for natural, sustainable products. In cosmetics, zinc oxide’s UV-blocking ability makes it a key ingredient in eco-friendly sunscreens. Investment opportunities lie in expanding production, especially in Asia-Pacific, where China and India’s industrialization fuels growth.

Emerging uses, like zinc oxide nanoparticles in electronics and energy storage, offer further potential. However, risks persist. Technological advancements, such as low-carbon production and solar-powered innovations, cut costs and emissions, appealing to investors. Yet, these require significant upfront R&D investment, posing challenges for adoption.

Report Scope

| Market Value (2024) | USD 9.5 Billion |

| Forecast Revenue (2034) | USD 16.7 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Source (Primary Zinc, Secondary Zinc), By Form (Powder, Pellet, Liquid), By Grade (Standard, Treated, USP, FCC, Others), By Production Process (Direct, Indirect, Wet Chemical), By Application (Rubber, Ceramics and Glass, Cosmetics and Personal Care, Pharmaceuticals, Agriculture, Paints and Coatings, Chemicals, Others) |

| Competitive Landscape | Zochem LLC, EverZinc, Weifang Longda Zinc Industry Co. Ltd., Silox Holding, Akrochem Corporation, Ace Chemie Zynk Energy Limited, AG CHEMI GROUP s.r.o, PT CITRA CAKRALOGAM, Zinc Nacional, HAKUSUI TECH, Lanxess AG, IEQSA, Pan-Continental Chemical Co. Ltd., Rubamin, Tata Chemicals Ltd., ZM Silesia S.A., JG Chemicals Limited, Upper India, American Elements |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=15265

Key Market Segments

By Source

- In 2024, primary zinc accounted for 72.3% of the global zinc oxide market, driven by its use in producing high-purity zinc oxide. Industries like rubber, ceramics, and paints favor primary zinc for its consistent quality and performance, ensuring precise particle size and purity for advanced applications. In 2025, demand is projected to grow due to increased needs in automotive tires, pharmaceuticals, and cosmetics, as industries prioritize high-grade materials for efficiency.

By Form

- Powder zinc oxide held a 68.6% market share in 2024, valued for its excellent dispersion, ease of handling, and integration into industrial processes. Preferred by rubber manufacturing, paints, coatings, and personal care industries, its fine texture and high reactivity enhance product quality. With expanding automotive and electronics sectors, the powder segment is expected to sustain strong demand in 2025, maintaining its dominance due to versatility and performance.

By Grade

- Standard grade zinc oxide captured a 47.2% share in 2024, widely used in rubber, ceramics, paints, and chemicals for its cost-effectiveness and reliable performance. Ideal for general-purpose applications, it appeals to manufacturers seeking consistent quality without ultra-high purity. Demand is expected to remain robust in 2025, driven by growth in the construction and automotive sectors, ensuring the standard grade’s strong market position.

By Production Process

- The Direct (American) process dominated with a 56.1% share in 2024, valued for producing zinc oxide with controlled particle size and adequate purity for rubber, glass, and agricultural applications. Its balance of cost and performance supports large-scale manufacturing. In 2025, demand from tire and ceramic production is expected to sustain the Direct process’s lead, bolstered by its cost efficiency and reliable output.

By Application

- The rubber sector accounted for 43.2% of the zinc oxide market in 2024, driven by its role in enhancing durability, elasticity, and heat resistance in tires and other products. The tire industry’s reliance on zinc oxide fuels demand, supported by rising global vehicle production and replacement needs. In 2025, growth in the automotive, industrial, and consumer goods sectors is expected to maintain the rubber segment’s dominance.

Regional Analysis

The Asia-Pacific (APAC) region leads the global zinc oxide market, holding a 51.2% share, equivalent to roughly USD 4.8 billion in revenue. This dominance stems from the region’s strong industrial foundation, rapid urbanization, and growing demand across multiple sectors. The automotive sector, particularly in China, India, Japan, and South Korea, drives significant demand. Zinc oxide is critical in tire manufacturing, enhancing durability and performance through its role in vulcanization. As the world’s top tire producer, China significantly boosts regional consumption.

In construction, rapid infrastructure growth and urbanization increase the need for zinc oxide in paints, coatings, and ceramics, valued for its UV protection and anti-corrosion properties, making it essential for durable building materials. The cosmetics and personal care sector in APAC is thriving, fueled by demand for sun protection and skin-whitening products. Zinc oxide’s effectiveness as a UV filter and its anti-inflammatory benefits have made it a key ingredient in sunscreens and skincare products.

Top Use Cases

- Rubber Industry: Zinc oxide is vital in rubber production, especially for tires, enhancing durability and elasticity. It acts as an activator in vulcanization, improving heat resistance and performance. The growing automotive sector, particularly in Asia-Pacific, drives demand, with tire manufacturing relying heavily on its unique properties for high-quality output.

- Cosmetics and Skincare: Zinc oxide is a key ingredient in sunscreens and skincare products due to its UV-blocking and anti-inflammatory properties. It’s a natural, safe profile that aligns with consumer demand for eco-friendly cosmetics. The rising focus on skin health and sun protection fuels its use in creams, lotions, and makeup.

- Paints and Coatings: Zinc oxide is used in paints and coatings for its anti-corrosion and UV-resistant properties. It enhances durability and protects surfaces, making it ideal for construction and industrial applications. Growing infrastructure projects, especially in developing regions, boost demand for zinc oxide-based protective coatings.

- Ceramics and Glass: In ceramics, zinc oxide reduces melting temperatures, saving energy and improving product quality. It’s used in tiles and glass for added strength and clarity. The expanding construction and electronics industries, particularly in Asia-Pacific, increase their demand for high-performance ceramic and glass products.

- Pharmaceuticals: Zinc oxide is widely used in ointments, creams, and antiseptic products for its antibacterial and soothing properties. It treats skin irritations like burns and diaper rash. The growing pharmaceutical sector, especially in India, drives demand as consumers prioritize skin health and effective topical treatments.

Recent Developments

- Zochem LLC, a leading North American zinc oxide producer, has expanded its manufacturing capabilities to meet growing demand in rubber and ceramics. The company focuses on high-purity zinc oxide for industrial and personal care applications. Recent investments in sustainable production methods align with stricter environmental regulations. Zochem also emphasizes customer-centric solutions, offering tailored zinc oxide grades for diverse industries.

- EverZinc, a global zinc oxide supplier, has introduced new Zano 20 and Zano 30 ultra-fine zinc oxide grades for sunscreens and cosmetics. The company is enhancing its European production facilities to support the rising demand for high-performance zinc oxide. EverZinc also emphasizes sustainability, reducing energy consumption in manufacturing. Their focus on pharmaceutical-grade zinc oxide strengthens their position in medical applications.

- Weifang Longda, a major Chinese zinc oxide manufacturer, has increased production capacity to serve the booming Asian rubber and ceramics markets. The company is investing in advanced processing technologies to improve product quality. Recent expansions target exports to Europe and North America, capitalizing on competitive pricing and high-volume supply capabilities.

- Silox Holding, known for specialty chemicals, has developed nano zinc oxide for advanced coatings and UV protection applications. The company is collaborating with research institutions to enhance zinc oxide efficiency in sunscreens and antimicrobial products. Silox is also exploring eco-friendly production techniques to reduce its carbon footprint.

- Akrochem Corporation has introduced new zinc oxide additives for rubber compounding, improving durability in automotive and industrial products. The company is expanding its distribution network to serve North American and Latin American markets better. Akrochem’s R&D focuses on optimizing zinc oxide dispersion for enhanced performance in elastomers.

Conclusion

The Zinc Oxide Market is on a strong growth path. Demand is rising due to its key role in rubber manufacturing, sunscreens, ceramics, and pharmaceuticals. The Asia-Pacific region leads the market, driven by industrial growth and increasing consumer demand, while North America and Europe remain key players in high-quality zinc oxide applications. Innovations in nano zinc oxide and sustainable production methods are creating new opportunities. With expanding industries and technological advancements, the zinc oxide market is set for steady expansion in the coming decade.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)