Table of Contents

Overview

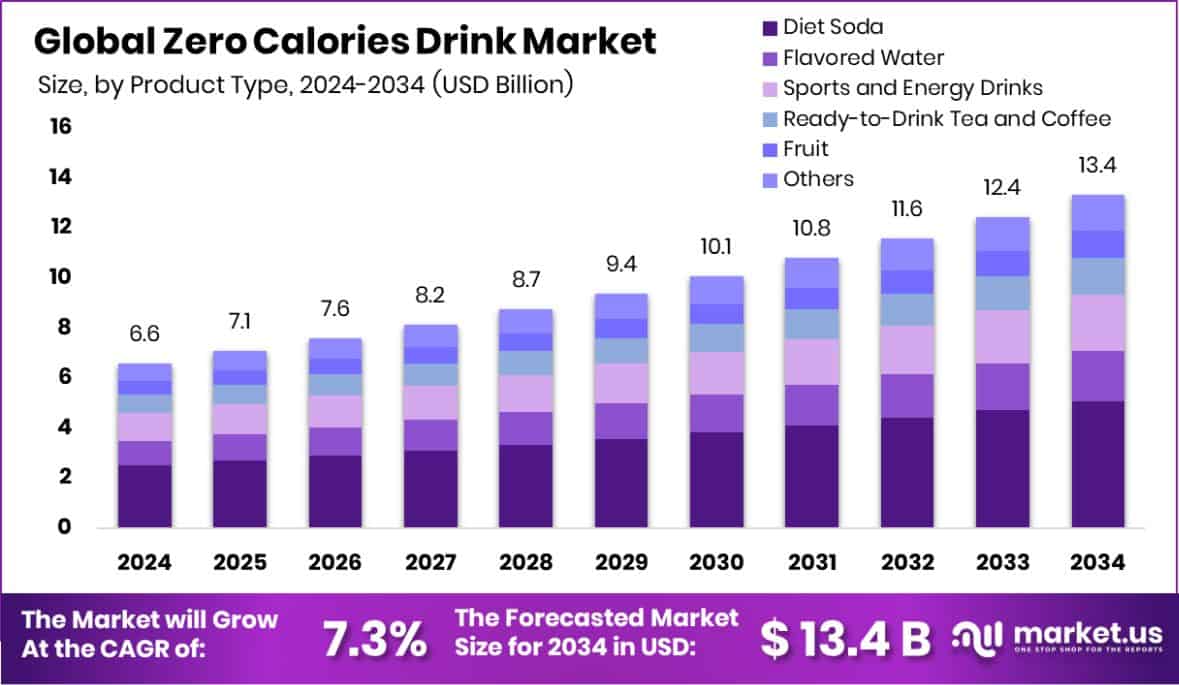

New York, NY – Aug 6, 2025 – The global zero-calorie drink market is projected to reach approximately USD 13.4 billion by 2034, rising from USD 6.6 billion in 2024. This reflects a steady compound annual growth rate (CAGR) of 7.3% between 2025 and 2034. Asia-Pacific leads the market with a dominant 47.20% share, representing a value of around USD 3.1 billion.

A zero-calorie drink is a beverage that contains little to no calories per serving, typically sweetened with artificial or natural low-calorie alternatives. These drinks offer the sweetness of traditional beverages without the added calories, making them popular among individuals aiming to manage weight or reduce sugar intake. Common types include sodas, teas, and flavored waters.

The zero-calorie drink market involves the production and distribution of beverages that provide enjoyment without contributing to daily caloric intake. This market primarily serves health-conscious consumers and those managing conditions like diabetes. A recent example is Lucky Energy, which secured $14 million in Series A1 funding in March 2025, highlighting investor confidence in this growing segment.

Market expansion is being driven by rising health awareness globally. With increasing concerns about obesity and diabetes, consumers are shifting toward healthier beverage options. Technological advancements have also improved flavor profiles, enhancing appeal.

Younger consumers, especially millennials and Gen Z, are key drivers of demand. They are gravitating toward nutritious, convenient, and trendy alternatives to sugary drinks. This demographic shift aligns with broader wellness and lifestyle trends.

The market presents strong opportunities for innovation and regional growth. New flavor launches, functional ingredients like vitamins or antioxidants, and market penetration in emerging economies are expected to further stimulate consumer interest and boost sales.

Key Takeaways

- The global zero-calorie drink market is projected to grow from USD 6.6 billion in 2024 to approximately USD 13.4 billion by 2034, reflecting a CAGR of 7.3% between 2025 and 2034.

- Diet sodas lead the market by product type, holding a notable 38.20% share due to their widespread popularity.

- Artificial sweeteners dominate the ingredient segment, making up 42.20% of the market’s composition as a preferred sugar substitute.

- Supermarkets and hypermarkets are the leading distribution channels, accounting for 45.30% of total sales, driven by strong consumer reach and product visibility.

- Individual consumers represent the largest end-user group, contributing 82.20% of market demand, highlighting personal health and lifestyle choices as key drivers.

- Asia-Pacific stands as the leading regional market, capturing a 47.20% share and demonstrating strong consumer interest in healthier beverage alternatives.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/zero-calories-drink-market/free-sample/

Report Scope

| Market Value (2024) | USD 6.6 Billion |

| Forecast Revenue (2034) | USD 13.4 Billion |

| CAGR (2025-2034) | 7.3% |

| Segments Covered | By Product Type (Diet Soda, Flavored Water, Sports and Energy Drinks, Ready-to-Drink Tea and Coffee, Fruit, Others), By Ingredients (Artificial Sweeteners, Natural Sweeteners, Electrolytes and Minerals, Vitamins and Antioxidants, Herbal and Botanical Ingredients, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others), By End-User (Individuals, Commercial Use) |

| Competitive Landscape | Coca-Cola Company, PepsiCo, Inc., Dr Pepper Snapple Group, Nestlé S.A., Monster Beverage Corporation, Red Bull GmbH, Keurig Dr Pepper, Diageo plc, Unilever plc, Hormel Foods Corporation, Pure Leaf, Bai Brands, Zevia LLC, AHA Sparkling Water |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144778

Key Market Segments

- By Product Type Analysis

In 2024, diet soda emerged as the leading product type in the zero-calorie drink market, accounting for 38.20% of the segment. This dominance is fueled by consumers seeking a sweet, satisfying beverage without added calories, aligning with rising health-conscious lifestyles. Widespread availability across retail platforms enhances accessibility, while innovations in flavors and packaging continue to attract a broad demographic. Marketing strategies highlighting lifestyle and wellness benefits further reinforce diet soda’s strong market position.

- By Ingredients Analysis

Artificial sweeteners led the ingredient segment of the zero-calorie drink market in 2024, securing a 42.20% share. Their ability to mimic sugar’s sweetness without the calories makes them a core component in low-calorie beverage formulations. Consumer demand for healthier, sugar-free drinks especially among those managing conditions like obesity or diabetes drives this trend. Their versatility across beverage categories and stability in production processes support continued growth and innovation in the sector.

- By Distribution Channel Analysis

Supermarkets and hypermarkets dominated the distribution landscape for zero-calorie drinks in 2024, with a 45.30% market share. These outlets offer convenience, variety, and competitive pricing, making them a preferred choice for consumers. Prominent product placement, promotional campaigns, and immediate product access all contribute to their strong performance. As health-focused shopping habits rise, these retail formats are expected to remain key distribution hubs for zero-calorie beverages.

- By End-User Analysis

Individual consumers made up the largest share of the zero-calorie drink market in 2024, comprising 82.20% of total consumption. The increasing emphasis on personal health, weight management, and reduced sugar intake is driving individual demand. A wide range of flavors, convenient access through multiple channels, and targeted marketing emphasizing wellness benefits contribute to the segment’s dominance. This group is expected to remain the primary consumer base as health and lifestyle trends continue to evolve.

Regional Analysis

Asia-Pacific leads the global zero-calorie drink market, holding a dominant 47.20% share, valued at USD 3.1 billion. This strong regional performance is fueled by rising health awareness in countries such as China and India, combined with growing disposable incomes that support the purchase of premium, health-focused beverages.

North America and Europe also contribute significantly to the market, supported by well-established health and wellness trends. High consumer awareness regarding nutrition and the presence of major beverage brands actively developing innovative zero-calorie products further strengthen market growth in these regions.

Emerging markets in the Middle East & Africa and Latin America are showing increasing potential. Urbanization, changing consumer lifestyles, and greater awareness of the health impacts of sugar consumption are gradually driving demand for zero-calorie drinks. While their current market size is smaller, these regions offer promising opportunities for future growth as interest in healthier beverage alternatives continues to rise.

Top Use Cases

- Convenient Weight-Management Beverages:

- Busy, health-focused individuals often choose zero‑calorie sodas or flavored waters to satisfy cravings without added calories. These drinks provide an easy way to manage daily energy intake, especially important for consumers monitoring weight or sugar intake amid rising diabetes and obesity concerns.

2. Functional Hydration with Added Benefits:

- Many brands now offer zero‑calorie beverages enriched with vitamins, electrolytes, or antioxidants. These functional drinks appeal to fitness enthusiasts, professionals, and older consumers seeking added health perks delivering both hydration and perceived wellness in one convenient bottle.

3. On-the-Go Single-Serve Format:

- Single-serve cans or bottles of zero‑calorie drinks are ideal for retail channels like convenience stores and e‑commerce platforms. Their portability aligns with modern lifestyles, making them a top choice for midday consumption, travel, or quick refreshment without guilt.

4. Retail Displays and Impulse Marketing:

- Supermarkets and hypermarkets allocate prominent shelf space and eye-catching displays to zero‑calorie beverages. Paired with promotions, these placements drive impulse buying, especially among health-conscious shoppers and millennials seeking flavorful, low‑calorie alternatives.

5. Regulation-Driven Product Innovation:

- With sugar taxes and labeling mandates in many regions, beverage companies are innovating zero‑calorie alternatives to traditional sodas. Reformulated diet drinks and new sweetener blends (e.g. stevia, monk fruit) help brands avoid taxation and appeal to consumers demanding taste and health simultaneously.

Recent Developments

1. The Coca‑Cola Company

- Coca‑Cola Zero Sugar volumes rose 14% in Q2 2025, driven by strong global demand, helping the company outperform revenue and profit expectations. Low‑ and no‑calorie beverages now account for around 30% of its overall volume, supported by innovations such as Coca‑Cola Orange Cream Zero Sugar, which generated USD 50 million in retail sales shortly after launching. The company is also planning to introduce a cane‑sugar sweetened variant in the U.S. later in 2025, appealing to consumers interested in perceived “natural” ingredients.

2. Zevia LLC

- In Q1 2025, Zevia reported net sales of USD 38 million, slightly above expectations, with an improved gross margin of 50.1% and reduced net loss per share of USD 0.08. The company highlighted that its new variety pack is now the best‑selling product at Walmart. Zevia’s mission remains centered on delivering zero‑sugar, naturally sweetened beverages across soda, energy drinks, teas, mixers, and more available through expanding distribution, all backed by a clean‑ingredient promise.

Conclusion

The global zero-calorie drink market is witnessing strong momentum, driven by shifting consumer preferences toward healthier, low-sugar alternatives. The increasing awareness about lifestyle-related health issues such as obesity and diabetes has propelled the demand for beverages that offer flavor without added calories. Among product types, diet sodas continue to lead, while artificial sweeteners dominate the ingredient segment due to their ability to replicate sweetness without contributing to caloric intake.

Supermarkets and hypermarkets remain the most popular distribution channels, offering consumers access to a wide variety of zero-calorie drink options. Individuals represent the primary end-user segment, reflecting a trend toward personal health management. Regionally, Asia-Pacific holds a dominant share of the market, backed by rising disposable incomes and growing health awareness. North America and Europe also present strong markets due to established health-conscious consumer bases. Overall, the market is expected to expand steadily, supported by innovation, marketing efforts, and increasing availability across global regions.