Table of Contents

Overview

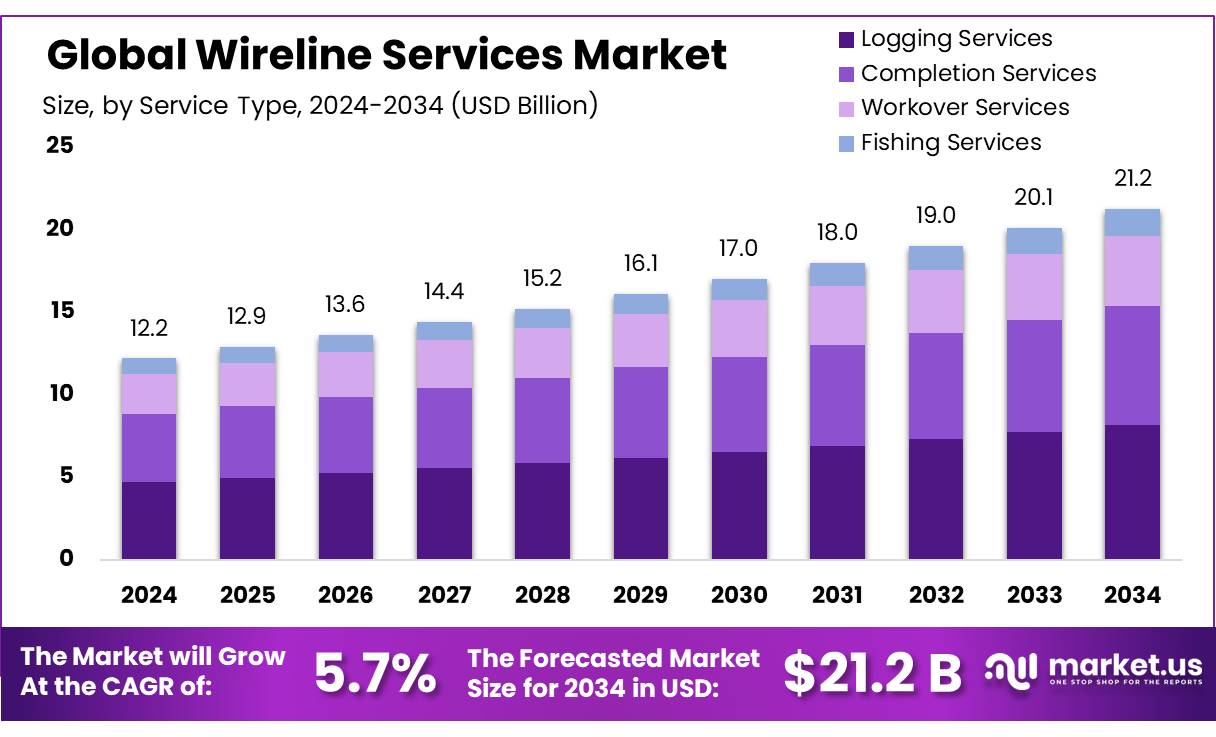

New York, NY – August 08, 2025 – The Global Wireline Services Market is projected to grow from USD 12.2 billion in 2024 to USD 21.2 billion by 2034, achieving a CAGR of 5.7% during the forecast period. In 2024, North America led the market, holding a 45.2% share with USD 5.5 billion in revenue.

The wireline services industry is vital to the oil and gas sector, supporting critical operations across the well lifecycle, including exploration, drilling, completion, and intervention. Services such as well logging, pipe recovery, and reservoir evaluation rely on specialized equipment like electric and slick lines for downhole tasks. Market growth is driven by rising global energy demand and the need for advanced oil recovery techniques.

In North America, particularly the U.S., the market thrives due to extensive shale oil and gas exploration, notably in the Permian Basin. According to the U.S. Energy Information Administration, U.S. crude oil production reached 11.6 million barrels per day in 2022, highlighting the scale of activity. In Europe, offshore exploration in the North Sea fuels demand for wireline services to maintain aging wells and optimize operations.

Government initiatives also bolster the market. For instance, the U.S. Broadband Equity, Access, and Deployment (BEAD) Program, with a USD 42.5 billion investment, enhances broadband infrastructure, indirectly supporting wireline services by improving communication networks critical for remote oil and gas operations.

Key Takeaways

- The Global Wireline Services Market size is expected to be worth around USD 21.2 billion by 2034, from USD 12.2 billion in 2024, growing at a CAGR of 5.7%.

- Logging Services held a dominant market position, capturing more than a 38.4% share of the wireline services market.

- Horizontal Wells held a dominant market position, capturing more than a 67.2% share of the wireline services market.

- Electric Line held a dominant market position, capturing more than a 68.3% share of the wireline services market.

- Cased Hole held a dominant market position, capturing more than a 73.8% share of the wireline services market.

- Onshore held a dominant market position, capturing more than a 68.7% share of the wireline services market.

- North America held a dominant position in the global wireline services market, capturing more than 45.2% of the market share, valued at approximately USD 5.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-wireline-services-market/request-sample/

Report Scope

| Market Value (2024) | USD 12.2 Billion |

| Forecast Revenue (2034) | USD 21.2 Billion |

| CAGR (2025-2034) | 5.7% |

| Segments Covered | By Service Type (Logging Services, Completion Services, Workover Services, Fishing Services), By Well Type (Vertical Wells, Horizontal Wells), By Type (Electric Line, Slick Line), By Hole Type (Open Hole, Cased Hole), By Location of Deployment (Onshore, Offshore) |

| Competitive Landscape | Schlumberger, Oceaneering International, Halliburton, Neptune Energy, Baker Hughes, National Oilwell Varco, Superior Energy Services, Cameron International, Weatherford International, Precision Drilling Corporation, TechnipFMC, Aker Solutions |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153732

Key Market Segments

By Service Type Analysis

In 2024, Logging Services commanded a 38.4% share of the wireline services market, driven by their critical role in evaluating well conditions, measuring formation properties, and delivering essential data for oil and gas exploration decisions. Techniques such as electrical, nuclear, and acoustic logging provide real-time insights into well integrity and reservoir potential. The growing complexity of modern wells, particularly in deepwater and unconventional projects, fuels demand for advanced logging technologies, which support efficient and sustainable extraction by enabling precise, real-time monitoring.

By Well Type Analysis

Horizontal Wells captured a 67.2% share of the wireline services market in 2024, reflecting the widespread adoption of horizontal drilling techniques. These wells enhance reservoir exposure, boost production rates, and enable access to challenging formations like shale and deepwater reserves. The surge in unconventional oil and gas extraction, especially shale production, drives demand for horizontal wells, which optimize resource recovery while minimizing surface land use.

By Type Analysis

In 2024, Electric Line services held a 68.3% market share, favored for their precision and efficiency in delivering well services via electrically powered cables. Essential for tasks like well logging, perforating, and intervention, electric lines excel in high-pressure and high-temperature wells, particularly in deepwater and unconventional plays. Their ability to provide real-time data and support diverse operations, from wellbore surveying to powering downhole tools, drives their dominance in modern oil and gas operations.

By Hole Type Analysis

Cased Hole services led the wireline services market in 2024 with a 73.8% share, critical for operations like logging, perforation, and wellbore maintenance in cased and cemented wells. These services ensure well integrity, enable reservoir analysis, and enhance production efficiency. As the industry emphasizes maximizing output from existing wells, cased hole services are vital for optimizing interventions, extending well life, and improving hydrocarbon recovery, particularly through techniques like acidizing and fracturing.

By Location of Deployment Analysis

Onshore operations accounted for a 68.7% share of the wireline services market in 2024, driven by the high volume of land-based wells and ongoing exploration and production activities. Well logging, perforation, and intervention services are in high demand to enhance production and maintain well integrity. The cost-efficiency of onshore operations, combined with established infrastructure, supports market dominance.

Regional Analysis

In 2024, North America commanded a 45.2% share of the global wireline services market, valued at USD 5.5 billion, driven by robust oil and gas activities in the United States and Canada. The region’s dominance stems from its extensive shale reserves, particularly in the Permian Basin and other unconventional plays, which rely heavily on wireline services for well logging, perforating, and interventions to optimize production and ensure well integrity in complex formations.

The U.S. has experienced steady growth in its oil and gas sector, fueled by advancements in horizontal drilling and hydraulic fracturing. These technologies have heightened demand for specialized wireline services to support extraction from shale and tight oil formations.

North America’s large-scale oilfields, coupled with a supportive regulatory environment, continue to attract investment in exploration and production, sustaining the need for wireline services. North America is poised to retain its market leadership, bolstered by ongoing technological innovations, the expansion of unconventional and offshore projects, and its robust energy infrastructure. These factors will ensure the region maintains its significant market share in the wireline services sector.

Top Use Cases

- Well Logging: Wireline services lower tools into wells to collect data on rock and fluid properties, such as porosity and resistivity. This helps operators understand reservoir potential and make informed drilling decisions. Real-time data from logging ensures accurate assessments, improving efficiency in exploration and production, especially in complex shale and deepwater wells.

- Perforation: Wireline tools create precise holes in well casings to connect reservoirs to the wellbore. This process enhances oil and gas flow, boosting production. Electric lines deliver accurate perforations in high-pressure environments, ensuring safety and efficiency. It’s vital for optimizing output in unconventional reservoirs like shale and tight oil formations.

- Well Intervention: Wireline services perform maintenance tasks like clearing blockages, adjusting valves, or replacing equipment to restore or boost well production. Slicklines and electric lines enable precise interventions in cased holes, extending well life. These operations reduce downtime and costs, ensuring wells remain productive in mature or challenging fields.

- Pipe Recovery: Wireline tools help retrieve stuck or damaged pipes from wells, preventing costly delays. Techniques like chemical cutting or mechanical freeing are used to remove obstructions. This ensures smooth operations and minimizes downtime, especially in deepwater or horizontal wells where equipment recovery is critical for project success.

- Reservoir Evaluation: Wireline services assess reservoir characteristics, such as pressure, temperature, and fluid content, using advanced tools. This data guides production strategies and optimizes resource recovery. Electric lines provide real-time insights, enabling operators to evaluate unconventional reservoirs effectively, ensuring sustainable and efficient extraction in complex geological formations.

Recent Developments

1. Schlumberger (SLB)

Schlumberger has introduced the Optiq Fiberline wireline solution, enhancing real-time data transmission and wellbore diagnostics. This technology improves efficiency in complex well environments. Additionally, SLB has integrated AI-driven analytics into wireline logging for better reservoir characterization. Their focus remains on reducing carbon footprint through advanced wireline interventions.

2. Oceaneering International

Oceaneering has expanded its e-coil hybrid wireline services, combining electric-line capabilities with fiber optics for improved well monitoring. They recently secured contracts in the North Sea for wireline logging and perforation services, emphasizing remote operations and automation. Their Subsea Robotics division also supports wireline deployments in deepwater fields.

3. Halliburton

Halliburton launched the ExpressKinetic wireline service, reducing rig time through faster tool conveyance. Their iCruise XMR logging-while-tripping technology enhances real-time decision-making. They also introduced AI-powered wireline data interpretation for unconventional reservoirs. Recent deployments include the Middle East and Latin America.

4. Neptune Energy

Neptune Energy has partnered with Weatherford for advanced wireline logging in its North Sea operations. They focus on low-carbon wireline interventions, using electric-line services for well abandonment and reservoir monitoring. Their recent campaign in Norway utilized fiber-optic wireline for real-time well integrity checks.

5. Baker Hughes

Baker Hughes introduced the TuffLINE Composite Wireline Cable, improving durability in high-temperature wells. Their Reservoir Performance services now include AI-driven wireline data analytics. A recent collaboration with C3 AI enhances predictive maintenance for wireline tools. They also deployed FiberStar distributed temperature sensing via wireline.

Conclusion

Wireline services are essential for the oil and gas industry, driving efficiency in exploration, production, and maintenance. From well logging to perforation and reservoir evaluation, these services provide critical data and solutions to optimize well performance. With growing demand for energy and advancements in technology, wireline services will continue to play a pivotal role in meeting global energy needs sustainably.