Table of Contents

Introduction

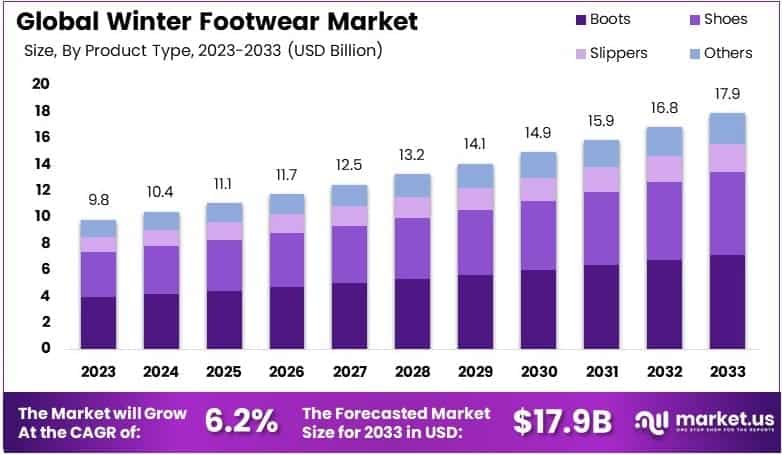

The Global Winter Footwear Market is projected to reach approximately USD 17.9 billion by 2033, rising from an estimated USD 9.8 billion in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 6.2% during the forecast period spanning from 2024 to 2033.

Winter footwear refers to a specialized category of shoes designed to provide insulation, protection, and enhanced grip during cold weather conditions. These include insulated boots, waterproof shoes, snow boots, and thermal-lined footwear, often equipped with non-slip soles and moisture-resistant materials to ensure functionality and comfort in snowy or icy environments. The winter footwear market comprises the global industry focused on the production, distribution, and sale of these seasonal products across diverse consumer segments, including men, women, and children. Market growth is being primarily driven by rising consumer awareness regarding weather-appropriate footwear, increased winter sports participation, and expanding demand in colder geographies.

Moreover, the effects of prolonged and severe winters due to climate variability have contributed to higher product usage across North America, Europe, and parts of Asia-Pacific. The growth in disposable income, especially in developing economies, has enabled a broader consumer base to purchase premium winter footwear offerings featuring innovative technologies such as thermal insoles, waterproof membranes, and sustainable materials. Heightened demand is also being observed in urban regions, where consumers prioritize both functionality and fashion in winter wear.

Furthermore, e-commerce platforms have expanded accessibility, allowing brands to reach wider audiences while offering seasonal discounts and customizable designs. A key opportunity lies in the integration of smart materials and sustainable manufacturing processes, as environmentally conscious consumers increasingly prefer products with low environmental footprints. In summary, the winter footwear market is experiencing sustained growth supported by climatic, technological, and lifestyle factors, presenting lucrative opportunities for innovation and regional expansion.

Key Takeaways

- The Winter Footwear Market was valued at USD 9.8 billion in 2023 and is projected to reach USD 17.9 billion by 2033, expanding at a CAGR of 6.2% during the forecast period. This growth is attributed to rising demand for seasonal and weather-appropriate footwear across key markets.

- Boots emerged as the leading product segment in 2023, owing to their widespread popularity for providing warmth, durability, and protection in harsh winter environments.

- The leather segment led the material category in 2023, supported by its strong consumer preference due to superior insulation properties, long-lasting quality, and premium appeal.

- In 2023, the men’s segment accounted for the largest share among end-users, driven by a consistent demand for functional and durable winter footwear suited for outdoor and work-related usage.

- The offline distribution channel held a dominant position in 2023, reflecting strong consumer preference for in-store experiences and product trials prior to purchase, especially for fit- and comfort-sensitive footwear.

- Europe captured 42.5% of the global market share in 2023, driven by prolonged winter seasons, colder climates, and the presence of established regional footwear brands that cater to seasonal demand.

Impact of U.S. Tariffs on the Winter Footwear Market

The U.S. winter footwear market is experiencing significant impacts due to recent tariff implementations, particularly affecting import dynamics, pricing structures, and consumer behavior.

Tariff Overview and Impact on Winter Footwear

As of early 2025, the U.S. government has imposed substantial tariffs on imported footwear, with rates reaching up to 54% on products from China, 46% from Vietnam, and 32% from Indonesia. These tariffs are in addition to existing duties, which for certain footwear categories, such as children’s shoes, already stand at 37.5% or higher .

Given that approximately 97% of footwear sold in the U.S. is imported, predominantly from Asian countries , these tariffs have led to increased costs for importers and, consequently, higher retail prices for consumers. For instance, Brooks Running has announced a $10 price increase on its popular Ghost shoe, raising it to $150 .

Market Response and Consumer Behavior

The increased costs have prompted major footwear companies, including Nike, Adidas, and Skechers, to petition the U.S. government for tariff exemptions, arguing that the tariffs could harm the industry by raising consumer prices and threatening jobs .Business Insider+1Reuters+1

In response to rising prices, consumers are increasingly turning to secondhand markets. The expiration of the “de minimis” loophole, which previously allowed imports under $800 to bypass duties, has further driven this shift. ThredUp projects the U.S. secondhand market to reach $73 billion by 2028, indicating a significant change in consumer purchasing habits .

Emerging Trends

- Sustainable Materials Adoption: Approximately 64% of consumers prefer eco-friendly winter footwear, with 35% willing to pay an additional $1–$5 for sustainable options. Materials such as recycled rubber, organic wool, and biodegradable insulation are increasingly utilized.

- Hybrid Footwear Designs: The emergence of “snoafers”—a blend of sneakers and loafers—reflects a consumer shift towards versatile footwear that combines style and functionality.

- Integration of Smart Technologies: Winter footwear is incorporating features like heated insoles, waterproof membranes, and slip-resistant soles to enhance performance and comfort.

- Customization and Personalization: Brands are offering customization options, allowing consumers to select materials, colors, and styles, catering to individual preferences.

- Athleisure Influence: The athleisure trend is influencing winter footwear designs, leading to products that blend performance features with casual fashion aesthetics.

Top Use Cases

- Outdoor Activities: Winter boots designed for hiking and snow sports are in demand, featuring waterproofing and insulation to withstand harsh conditions.

- Urban Commuting: Consumers seek winter footwear that offers both warmth and style for daily commuting in cold climates.

- Work Environments: Insulated and slip-resistant boots are essential for professionals working in cold and wet conditions.

- Casual Wear: Fashion-forward winter footwear, such as snoafers and sleek boots, cater to consumers looking for stylish yet functional options.

- Health and Wellness: Footwear with features like arch support and temperature regulation addresses health concerns, particularly for individuals with conditions like diabetes.

Major Challenges

- Seasonal Demand Fluctuations: The winter footwear market experiences significant seasonal variations, leading to inventory management challenges for manufacturers and retailers.

- Environmental Impact: The production and disposal of winter footwear contribute to environmental concerns, prompting scrutiny over materials and manufacturing processes.

- Intense Market Competition: Established and emerging brands vie for market share, necessitating continuous innovation and differentiation.

- Economic Sensitivity: Consumer spending on non-essential items like winter footwear is susceptible to economic downturns and uncertainties.

- Regulatory Compliance: Varying global regulations regarding materials and production processes add complexity to international market expansion strategies.

Top Opportunities

- E-commerce Expansion: The growth of online retail platforms enables brands to reach a broader customer base and adapt to changing consumer shopping behaviors.

- Product Innovation: Investing in research and development to introduce technologically advanced winter footwear can provide a competitive edge.

- Sustainable Practices: Embracing eco-friendly materials and ethical manufacturing processes can attract environmentally conscious consumers.

- Emerging Markets: Expanding into regions with growing middle-class populations and colder climates presents untapped potential for market growth.

- Health-Focused Footwear: Developing winter footwear that prioritizes foot health and comfort can cater to an aging population and health-conscious consumers.

Regional Analysis

Europe Leads the Winter Footwear Market with the Largest Share of 42.5% in 2024

Europe emerged as the dominant region in the global winter footwear market, accounting for the largest market share of 42.5% in 2024. This significant regional contribution is underpinned by a robust demand for high-quality winter boots, thermal shoes, and insulated outdoor footwear, especially across Northern and Central European nations where prolonged winter seasons and snowfall drive consumer need. The market value of winter footwear in Europe reached approximately USD 4.17 billion in 2024, supported by strong purchasing power, evolving fashion trends, and the presence of well-established footwear brands. Countries such as Germany, the United Kingdom, France, and the Nordic countries continue to play pivotal roles in driving the growth, owing to their mature retail infrastructure and high consumer awareness regarding functional winter apparel.

Furthermore, the European market benefits from a strong focus on sustainability and eco-conscious purchasing behaviors, which has accelerated the demand for winter footwear made from recyclable, biodegradable, and ethically sourced materials. The region’s inclination toward outdoor sports such as skiing and mountaineering also supports the growth of performance-oriented winter footwear segments. However, global trade dynamics have introduced new challenges.

Specifically, U.S. tariffs on imported footwear, including winter-specific categories, have created cost pressures for manufacturers with transatlantic supply chains. Although these tariffs primarily affect U.S. imports, they have indirectly impacted European exporters who ship to the American market, compelling firms to reassess pricing strategies and diversify distribution channels. Nevertheless, the European winter footwear market remains resilient, with consistent innovation and premiumization trends helping sustain its leading global position.

Recent Developments

- In 2024, Authentic Brands Group expanded its portfolio with the acquisition of Sperry, a classic American footwear brand. The company partnered with the ALDO Group to manage Sperry’s wholesale, online, and retail business in North America. ALDO will also take charge of Sperry’s global footwear design and distribution, strengthening its role as a key player in the global shoe market.

- In 2024, Shoe Carnival took a major step forward by acquiring Rogan’s Shoes for $45 million. This move brought 28 new store locations across Wisconsin, Minnesota, and Illinois under its control. The deal supports Shoe Carnival’s aim to lead the family footwear market in the U.S. while opening fresh expansion routes in the Midwest.

- In 2024, Sparx launched a fresh sneaker line for Autumn-Winter 2024 with a strong focus on youth appeal. The new collection combines everyday comfort with trendy styles, reflecting the brand’s focus on active and fashionable lifestyles. The launch aims to strengthen Sparx’s position as a go-to brand for modern Indian consumers

Conclusion

The global winter footwear market is experiencing steady growth, driven by factors such as climate variability, evolving fashion trends, and technological advancements. Consumers are increasingly seeking footwear that offers both functionality and style, leading to innovations like hybrid designs and the incorporation of smart technologies. Sustainability has become a significant focus, with a notable shift towards eco-friendly materials and ethical manufacturing practices. However, the market faces challenges, including seasonal demand fluctuations, high manufacturing costs, and regulatory complexities. Despite these hurdles, opportunities abound in expanding e-commerce channels, product innovation, and tapping into emerging markets with growing middle-class populations. Overall, the winter footwear market is poised for continued growth, supported by consumer demand for versatile, sustainable, and technologically advanced products.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)