Table of Contents

Introduction

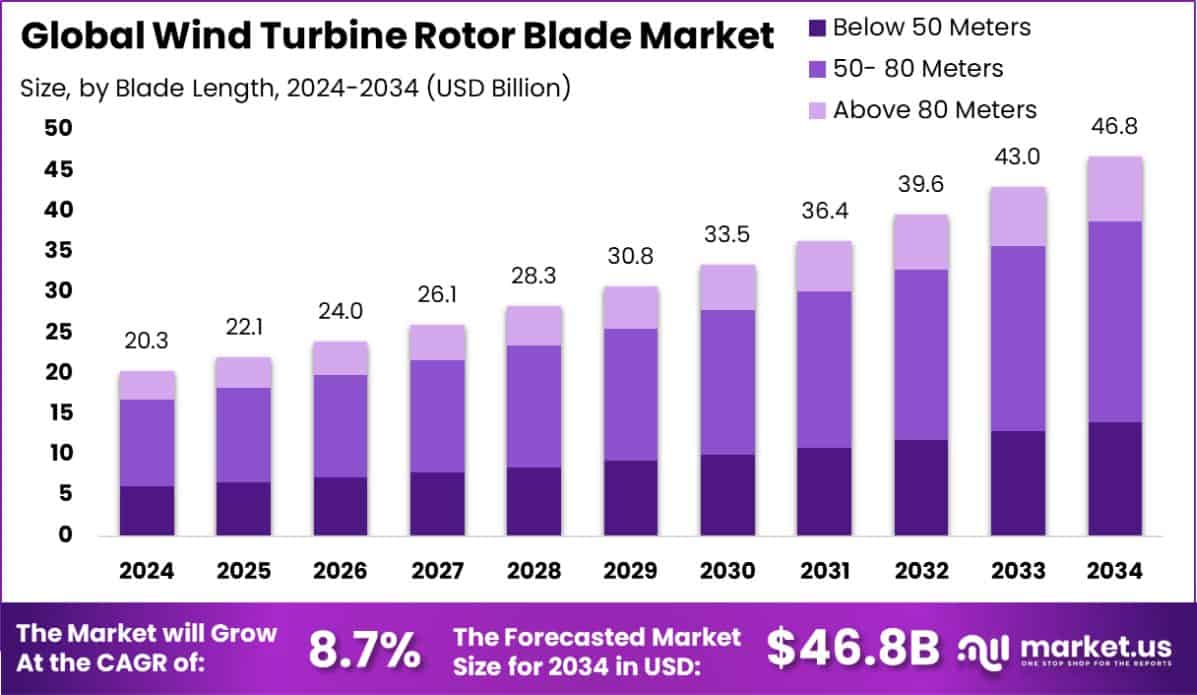

New York, NY – April 03, 2025 – The global Wind Turbine Rotor Blade Market is poised for significant growth, with projections indicating an increase from USD 20.3 billion in 2024 to approximately USD 46.8 billion by 2034, reflecting a compound annual growth rate (CAGR) of 8.7% during the forecast period from 2025 to 2034.

This expansion is primarily driven by the escalating global demand for renewable energy sources as countries aim to reduce carbon emissions and combat climate change. Government policies and incentives promoting wind energy projects further bolster market demand. Advancements in blade technology, including the development of longer and more efficient blades, enhance energy capture and contribute to market popularity.

The increasing adoption of offshore wind projects presents substantial market opportunities, necessitating larger and more durable rotor blades to withstand harsh marine environments. Additionally, innovations in manufacturing processes, such as the use of lightweight materials and automated production techniques, are facilitating market expansion by reducing costs and improving scalability.

Key Takeaways

- Global Wind Turbine Rotor Blade Market is expected to be worth around USD 46.8 billion by 2034, up from USD 20.3 billion in 2024, and grow at a CAGR of 8.7% from 2025 to 2034.

- The wind turbine rotor blade market sees 52.30% adoption for 50-80 meter blades, optimizing wind capture efficiency globally.

- Blades supporting 5–8 MW turbines hold a 37.90% share, driven by rising demand for high-capacity wind projects.

- Carbon fiber-reinforced polymer (CFRP) dominates with 48.30% market share, enhancing durability, strength, and aerodynamic performance.

- Variable-speed, variable-pitch blade designs account for a 42.20% share, improving wind adaptability and maximizing power generation efficiency.

- Onshore wind installations lead with 72.40% market share, benefiting from lower costs, simpler logistics, and infrastructure readiness.

- The Asia-Pacific wind turbine rotor blade market reached USD 9.7 billion, driven by increasing renewable energy investments.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-wind-turbine-rotor-blade-market/request-sample/

Report Scope

| Market Value (2024) | USD 20.3 Billion |

| Forecast Revenue (2034) | USD 46.8 Billion |

| CAGR (2025-2034) | 8.7% |

| Segments Covered | By Blade Length (Below 50 Meters, 50- 80 Meters, Above 80 Meters), By Capacity (Upto 5 MW, 5 – 8 MW, Above 8 MW), By Material (Glass Fiber Reinforced Polymer (GFRP), Carbon Fiber Reinforced Polymer (CFRP), Natural Fiber Reinforced Polymer (NFRP), Others), By Design (Fixed-speed Fixed-pitch, Fixed-speed Variable-pitch, Variable-speed Fixed-pitch, Variable-speed Variable-pitch), By Location (Onshore, Offshore) |

| Competitive Landscape | Acciona S.A., Aeris Energy, Aerodyne Energies, CRRC Wind Power, EnBW, Enercon GmbH, Envision Renewables, Gamesa Corporation Technology, General Electric, Goldwind, Hitachi Power Solutions, Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd, LM Wind Power, Nordex SE, Senvion, Sinoma wind power blade Co. Ltd, Suzlon Energy Limited, TPI Composites Inc., Vestas Wind Systems AS |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=143634

Emerging Trends

- Longer Blades for Higher Efficiency: Manufacturers are designing longer rotor blades to capture more wind energy, especially for offshore turbines. Longer blades increase energy output but require advanced materials to reduce weight and maintain structural integrity. This trend supports larger turbines (10MW+), boosting renewable energy capacity while lowering costs per kWh.

- Advanced Composite Materials: New materials like carbon fiber and hybrid composites are replacing traditional fiberglass, offering higher strength-to-weight ratios. These materials enhance blade durability, reduce fatigue, and allow for longer designs. Innovations in recyclable composites are also emerging, addressing sustainability concerns in blade disposal.

- Modular Blade Designs: Modular blades, assembled on-site, ease transportation and installation challenges, especially for massive offshore turbines. This approach cuts logistics costs and enables quicker deployment. Companies are testing segmented blades that can be replaced individually, reducing maintenance downtime and improving life cycle management.

- Smart Blades with Sensors & AI: IoT-enabled blades with embedded sensors monitor stress, temperature, and damage in real time. AI analyzes data to optimize performance, predict failures, and automate adjustments (like pitch control). This improves efficiency, extends blade lifespan, and lowers operational costs through predictive maintenance.

- Aerodynamic Enhancements: Innovations like winglets, serrated trailing edges, and adaptive surfaces improve airflow, reducing drag and noise. These tweaks boost energy capture while minimizing wear. Biomimicry (inspired by nature, like whale fins) is also being explored to refine blade shapes for better efficiency in varying wind conditions.

Use Cases

- Onshore Wind Farms: Onshore turbines use rotor blades ranging from 50-80 meters to harness land-based wind energy. These blades are optimized for cost efficiency and ease of maintenance, supporting large-scale renewable energy projects. Advances in lightweight materials and modular designs help reduce installation costs, making onshore wind a dominant choice for clean energy generation.

- Offshore Wind Energy Projects: Offshore wind turbines require longer (80-120m+) and more durable blades to withstand harsh marine conditions. These blades capture stronger, steadier winds, significantly boosting energy output. Innovations like corrosion-resistant coatings and smart sensors enhance reliability, making offshore wind a key player in global renewable energy expansion.

- Hybrid Wind-Solar Systems: Rotor blades are integrated with solar panels in hybrid systems to maximize energy production. Wind turbines generate power during low sunlight hours, ensuring a consistent energy supply. This approach improves grid stability and land-use efficiency, particularly in regions with variable weather patterns.

- Distributed & Small-Scale Wind Power: Smaller rotor blades (5-20m) are used in community wind projects, farms, and remote off-grid locations. These turbines provide localized energy solutions, reducing transmission losses. Lightweight, cost-effective designs make them viable for residential and commercial use, supporting decentralized renewable energy adoption.

- Repowering Old Wind Farms: Aging turbines are being upgraded with advanced rotor blades to improve efficiency and lifespan. Longer, smarter blades replace older models, increasing energy output without requiring new infrastructure. Repowering extends project viability and aligns with sustainability goals by minimizing waste.

Major Challenges

- Material Costs & Supply Chain Issues: High costs of advanced materials like carbon fiber and supply chain disruptions impact blade production. Dependence on specialized resins and composites creates vulnerability to price fluctuations. Manufacturers seek cheaper alternatives but struggle to balance cost with performance, affecting overall wind energy project economics.

- Blade Fatigue & Structural Failures: Constant stress from wind loads causes cracks, delamination, and erosion over time. Harsh weather accelerates wear, leading to costly repairs. Ensuring long-term durability while keeping blades lightweight remains a key engineering challenge, especially for offshore turbines facing extreme conditions.

- Transportation & Logistics Constraints: Longer blades (80m+) face difficulties in road transport due to size restrictions. Offshore projects require specialized vessels, increasing costs. Modular designs help but add complexity. Infrastructure limitations in remote areas further complicate turbine installation and maintenance.

- Recycling & Waste Management: Most blades end up in landfills due to non-recyclable thermoset composites. Disposal regulations are tightening, forcing manufacturers to adopt recyclable materials. However, bio-resins and thermoplastic solutions are still costly and lack scalability, creating sustainability hurdles.

- Noise & Environmental Concerns: Blade noise affects community acceptance, especially near residential areas. Wildlife impacts, particularly bird and bat collisions, raise ecological concerns. Balancing efficiency with minimal environmental disruption requires continuous design refinements and stricter regulatory compliance.

Market Growth Opportunities

- Structural Integrity: Blades endure high centripetal loads and environmental stresses, leading to potential structural issues like cracks and material fatigue, which can reduce their lifespan and performance.

- Material Durability: Exposure to elements like UV radiation, moisture, and lightning can degrade blade materials, necessitating regular maintenance and potentially shortening operational life.

- Manufacturing Complexity: Designing blades with optimal aerodynamic properties involves complex manufacturing processes, requiring precise engineering to balance weight, strength, and flexibility.

- Ice Formation: In cold climates, ice accumulation on blades alters aerodynamics, reducing efficiency and posing operational challenges, requiring effective de-icing solutions.

- End-of-Life Disposal: Disposing of blades is challenging due to their size and material composition, leading to environmental concerns and the need for sustainable recycling methods.

Recent Developments

1. Acciona S.A.

- Acciona has been focusing on sustainable rotor blade innovation, including recyclable materials and modular designs. The company is testing thermoplastic resins to replace traditional epoxy, improving end-of-life recyclability. Acciona also invests in digital twin technology for real-time blade monitoring, enhancing predictive maintenance. Their latest onshore and offshore projects feature longer, lighter blades to boost energy output.

2. Aeris Energy

- Aeris Energy, a Brazilian manufacturer, is expanding its rotor blade production for both local and global markets. The company recently introduced optimized blade designs for low-to-medium wind speeds, improving efficiency in emerging markets. Aeris also focuses on cost-effective manufacturing techniques to compete with global players while maintaining durability standards.

3. Aerodyne Energies

- Aerodyne Energies specializes in small and medium-sized wind turbine blades, targeting decentralized energy solutions. Their recent developments include hybrid composite materials for enhanced strength and reduced weight. The company is also exploring AI-driven aerodynamic optimizations to maximize performance in urban and remote installations.

4. CRRC Wind Power

- CRRC, a Chinese leader in wind energy, has introduced longer offshore wind blades exceeding 100 meters. The company is integrating smart sensors for real-time structural health monitoring. CRRC also emphasizes cost-efficient production to support large-scale wind farm deployments across Asia and Europe.

5. EnBW

- EnBW, a German energy giant, is advancing offshore wind projects with next-gen rotor blades. Their latest investments include recyclable blade materials and partnerships for sustainable disposal solutions. EnBW also tests adaptive blade designs that adjust pitch dynamically for optimal energy capture in varying wind conditions.

Conclusion

The Wind Turbine Rotor Blade Market is experiencing significant growth, propelled by the global shift towards renewable energy sources. Technological advancements in blade materials and design are enhancing efficiency and performance. However, challenges such as high manufacturing costs, logistical complexities, and competition from alternative energy sources persist. Addressing these issues requires ongoing innovation, strategic investments, and supportive policies to ensure the sustainable expansion of wind energy infrastructure worldwide.