Table of Contents

Overview

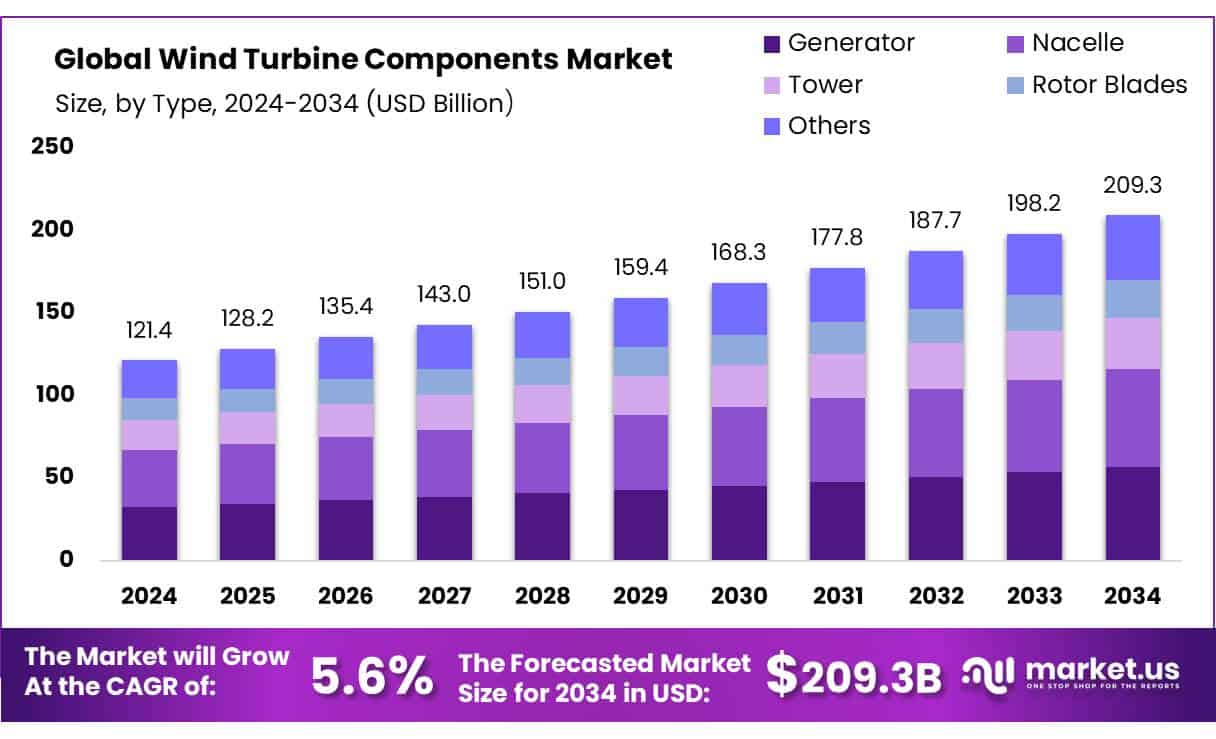

New York, NY – February 26, 2025 – The global Wind Turbine Components Market is projected to grow from USD 121.4 billion in 2024 to USD 209.3 billion by 2034, expanding at a CAGR of 5.6%.

This growth is fueled by increasing investments in renewable energy and the demand for sustainable power solutions. Wind energy requires key components such as blades, nacelles, generators, and control systems to operate effectively. Technological advancements and cost reductions have propelled the market forward, with major players like Siemens Gamesa and GE Renewable Energy dominating.

Government incentives and policy frameworks in regions like the United States, China, and the EU further boost market potential by promoting clean energy projects. Opportunities are also arising from emerging markets in Asia-Pacific and Latin America, where countries are significantly investing in wind energy.

Key Takeaways

- The market size for wind turbine components is expected to reach USD 209.3 billion by 2034, growing from USD 121.4 billion in 2024, at a compound annual growth rate (CAGR) of 5.6% from 2025 to 2034.

- In 2024, the generator segment captured more than 27.4% of the market and is projected to increase to around 28.1% in 2025.

- The utility application held over 63.3% of the market share in 2024.

- Grid-connected turbines had an 82.2% market share in 2024.

- Onshore wind energy accounted for more than 69.5% of the market share in 2024.

- The Asia-Pacific region holds a dominant market share of 45.8%, valued at approximately USD 55.8 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/wind-turbine-components-market/request-sample/

Report Scope

| Market Value (2024) | USD 121.4 Billion |

| Forecast Revenue (2034) | USD 209.3 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Type (Generator, Nacelle, Tower, Rotor Blades, Others), By Application (Utility, Industrial, Commercial, Residential), By Wind Turbine Type (Grid Connected, Standalone), By Location (Offshore Wind Energy, Onshore Wind Energy) |

| Competitive Landscape | Aerodyn Energies, Doosan Heavy Industries Construction, Enercon GmbH, Gamesa, General Electric, Goldwind Technology, Guodian United Power Technology Company, LM Wind Power, Ming Yang Smart Energy Group, Mitsubishi Heavy Industries, Nordex SE, Senvion, Siemens Gamesa Renewable Energy, Sinovel Wind Groups Co. Ltd., Suzlon Group, TPI Composites, Vestas Wind System A/S, Windey |

Experts Review

- Government incentives play a crucial role in the expansion of the wind turbine components market. Subsidies, tax credits, and renewable energy certificates have been instrumental in supporting wind energy projects. These incentives lower the financial barriers for companies and promote the adoption of wind technology globally.

- Technological innovations are revolutionizing the industry, with advancements in turbine design, materials, and manufacturing processes. These developments are boosting energy efficiency, reducing costs, and enhancing reliability, making wind energy increasingly competitive compared to traditional energy sources.

- Investment opportunities are abundant, particularly in emerging markets within Asia and Latin America. However, risks remain, primarily due to the high initial investment costs and the potential for policy changes. Investors must navigate these uncertainties, alongside issues such as supply chain disruptions and fluctuating material costs.

- Consumer awareness regarding climate change and the benefits of renewable energy is growing. This shift in perception is driving demand for sustainable energy solutions, creating further market opportunities.

- The technological impact is profound, as improved turbine technology directly contributes to achieving greater energy outputs and operational efficiencies. In terms of the regulatory environment, there is a growing global emphasis on reducing carbon emissions and increasing renewable energy infrastructure, creating a supportive backdrop for market growth. However, companies must remain adaptable to evolving regulations.

➤ Directly Purchase a copy of the report – https://market.us/purchase-report/?report_id=140974

Key Market Segments

By Type

- In 2024, generators took the lead in the wind turbine components market, grabbing over 27.4% of the global share. Their starring role comes from being the heart of wind turbines, turning mechanical energy into electricity. As the industry shifts toward bigger, more efficient turbines, the need for top-notch generators has shot up. Looking ahead, this segment is set to keep growing steadily, thanks to tech upgrades that boost energy conversion and reliability.

By Application

- Last year, the utility sector ruled the wind turbine components market, claiming over 63.3% of the global share. This hefty slice reflects the huge appetite for wind energy in large-scale power generation. Utilities, tasked with powering entire regions, are the main buyers of big wind turbines, leaning on the wind as a renewable fix for energy transition goals. Government policies and incentives are giving this segment a big lift, with many countries chasing bold renewable targets through onshore and offshore wind farms.

By Wind Turbine Type

- In 2024, grid-connected turbines dominated the scene, snagging over 82.2% of the global wind turbine components market. Their popularity stems from the rising need for turbines tied into power grids, delivering steady electricity to national networks. These setups make it easy to spread wind power across regions, making them a go-to for utilities and large energy producers.

By Location

- Onshore wind energy held strong in 2024, locking down over 69.5% of the global wind turbine components market. This chunk comes from the widespread rollout of onshore wind farms, which are cheaper and simpler to build than their offshore counterparts. Onshore remains the backbone of wind power, especially in windy hotspots with friendly regulations, like the U.S., China, and parts of Europe. New turbine designs and construction tricks are pushing onshore performance higher, cutting costs and making it a tougher competitor in the energy game.

Regional Analysis

- The Wind Turbine Components Market in the Asia-Pacific (APAC) region is booming, thanks to swift progress in renewable energy infrastructure and a surge in wind power investments. APAC holds a commanding 45.8% share of the global market, making it a key player in wind energy development, with an estimated value of around USD 55.8 billion.

- This region hosts several fast-growing economies with big renewable energy goals, like China, India, and Japan, which are boosting both the demand for and production of wind turbine components. China leads the pack, with its government pouring funds into wind energy projects and aiming high for renewable energy growth. India’s wind energy sector is also on the rise, supported by pro-renewable policies and efforts to cut reliance on fossil fuels.

- APAC’s top spot comes from its edge in manufacturing, cost-effective production, and hefty investments in wind energy setups. Plus, a stronger push to lower carbon emissions and gain energy independence has sharpened the region’s focus on wind power.

- The market’s upward climb is also powered by cutting-edge tech and innovations in turbine parts—like more efficient blades, gearboxes, and generators. With solid government backing, tech breakthroughs, and rising environmental awareness, APAC’s wind turbine components market looks set to keep leading the global charge.

Top Use Cases

- Blade Design and Material Innovation: Wind turbine blades are crucial for capturing wind energy. New materials like carbon fiber and advanced composites are being used to make blades lighter and more durable. These innovations enhance the blades’ performance, leading to increased efficiency and a longer operational life for turbines, reducing maintenance costs over time.

- Gearbox Efficiency and Reliability: The gearbox is responsible for converting the low-speed rotation of the blades into high-speed rotation for the generator. Advances in gearbox design, such as the use of hybrid systems or direct-drive technology, aim to reduce mechanical stress and increase the lifespan of the component, leading to lower maintenance and operational costs.

- Control Systems Optimization: Wind turbines use sophisticated control systems to adjust the blade angle and speed based on wind conditions. These systems ensure optimal energy capture while protecting the turbine from potential damage during extreme weather. Innovations in control algorithms enhance the system’s efficiency, providing higher energy output and improving reliability.

- Power Converter Advancements: Power converters are essential for converting the variable AC power generated by the turbine into stable, grid-compatible DC power. Improved converter designs and semiconductors contribute to more efficient energy transfer, reducing losses and improving the overall energy efficiency of the turbine.

- Structural Health Monitoring: Monitoring the health of wind turbine components, like blades, towers, and gearboxes, is critical to predict failures and reduce unplanned downtime. New sensors and IoT technologies provide real-time data on the performance of these parts, helping operators plan maintenance activities and enhance turbine reliability and operational lifespan.

Recent Developments

1. Aerodyn Energies

- Recent Developments:

- Innovation: Aerodyn has been focusing on the development of next-generation floating offshore wind turbines. Their SCDnezzy dual-rotor turbine design has gained attention for its efficiency in deep-water installations.

- Partnerships: Collaborated with Chinese and European offshore wind developers to test and deploy floating wind turbine prototypes.

- Contribution: Their innovations are aimed at reducing the Levelized Cost of Energy (LCOE) for offshore wind projects, making floating wind turbines more commercially viable.

2. Doosan Heavy Industries & Construction

- Recent Developments:

- Acquisition: Acquired a minority stake in a European wind turbine blade manufacturer in 2022 to strengthen its supply chain.

- Partnership: Partnered with the South Korean government to develop offshore wind farms as part of the country’s Green New Deal initiative.

- Contribution: Their investments and partnerships are helping to localize wind turbine production in Asia, reducing dependency on European suppliers.

3. Enercon GmbH

- Recent Developments:

- Innovation: Enercon introduced a new modular nacelle design in 2023, which simplifies maintenance and reduces downtime for onshore wind turbines.

- Partnership: Partnered with a German research institute to develop recyclable wind turbine blades, addressing sustainability concerns in the industry.

- Contribution: Their modular nacelle design and focus on recyclable materials are setting new standards for sustainability and efficiency in the wind energy sector.

4. Gamesa (Siemens Gamesa Renewable Energy)

- Recent Developments:

- Innovation: Launched the SG 14-236 DD offshore wind turbine in 2023, one of the largest and most powerful turbines in the world, with a capacity of 14 MW.

- Acquisition: Siemens Energy increased its stake in Siemens Gamesa to 100% in 2023, aiming to streamline operations and focus on wind energy solutions.

- Contribution: Their large-capacity turbines are helping to reduce the cost of offshore wind energy and increase energy output per turbine.

5. General Electric (GE Renewable Energy)

- Recent Developments:

- Innovation: GE unveiled the Haliade-X 12 MW offshore wind turbine in 2023, which features advanced digital monitoring systems for predictive maintenance.

- Partnership: Partnered with the US Department of Energy to develop next-generation wind turbine technologies under the Advanced Research Projects Agency-Energy (ARPA-E) program.

- Contribution: Their Haliade-X turbines and digital solutions are enhancing the efficiency and reliability of offshore wind farms globally.

Conclusion

The Wind Turbine Components Market, it’s clear this industry is on a roll and not slowing down anytime soon. The Asia-Pacific region, led by powerhouses like China and India, is driving the charge with massive investments and a focus on green energy. Generators, utility applications, grid-connected systems, and onshore projects are the big winners, holding the largest shares thanks to their critical roles and cost advantages.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)