Table of Contents

Overview

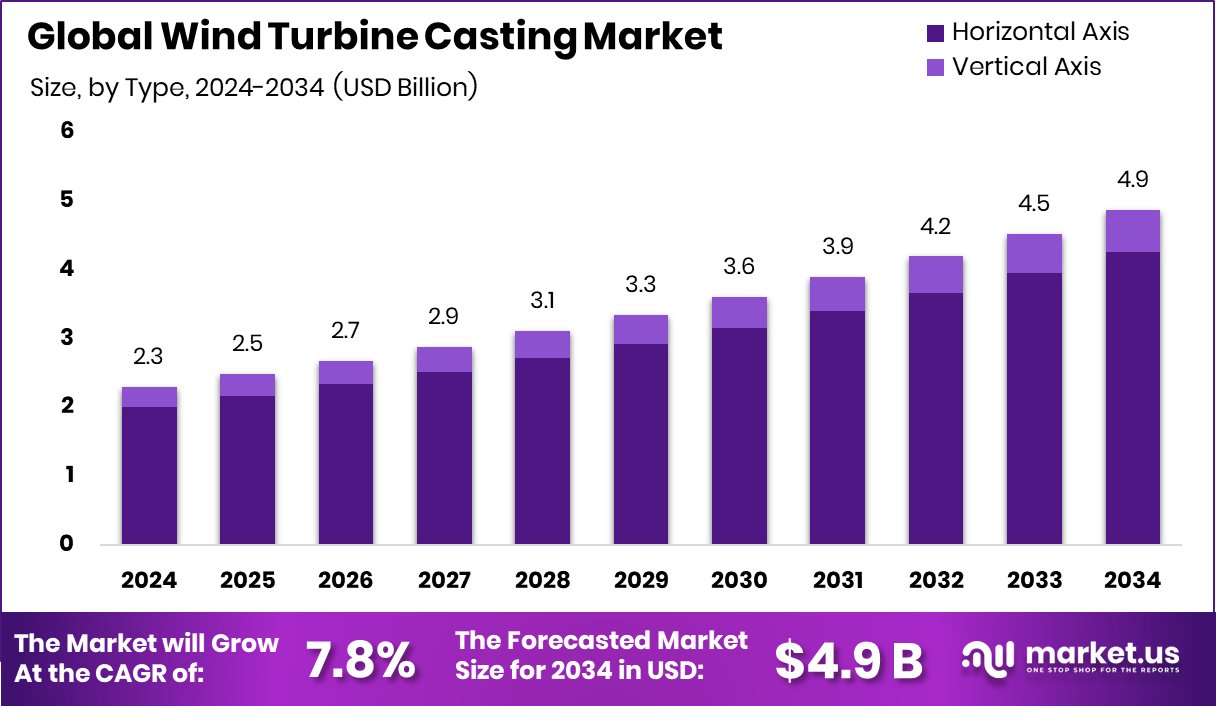

New York, NY – August 04, 2025 – The Global Wind Turbine Casting Market is projected to reach approximately USD 4.9 billion by 2034, rising from USD 2.3 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 7.8% from 2025 to 2034. The Asia-Pacific region led the market with a 38.7% share in 2024, supported by strong investments in wind energy infrastructure.

Wind turbine casting refers to the industrial process of producing large, high-strength metal components such as hubs, main shafts, gearbox housings, and bearing housings used in wind turbines. These parts are typically manufactured using advanced casting techniques involving iron or steel alloys and are engineered to endure mechanical stress, heavy loads, and harsh weather conditions. Precision casting remains essential, as these components operate continuously under rotational and environmental strain.

The wind turbine casting industry forms a critical link in the broader wind energy supply chain, enabling the production of both onshore and offshore turbines. Its growth is closely tied to the global transition to renewable energy sources. For instance, Bpifrance allocated €17 million to Wysenergy for a 9-MW wind project in Marne, demonstrating how government funding for renewable projects drives indirect demand for wind turbine castings.

One of the major factors fueling market expansion is the global shift toward sustainable energy. Countries worldwide are committing to renewable energy targets, increasing wind turbine installations. In the UK, Thrive Renewables received £10 million in funding, and over £2.5 million was allocated to clean energy initiatives in Yorkshire, both illustrating the rising financial support for wind-related infrastructure. Larger turbine designs, now increasingly common, necessitate more substantial and precise castings, further amplifying market demand.

Rapid growth in offshore wind installations, particularly in regions developing large-scale renewable energy projects, is expected to intensify demand for durable and corrosion-resistant cast components. Emerging economies are also expanding wind capacity, creating new avenues for casting manufacturers. Additionally, the European Union’s €1.25 billion in grants to enhance energy infrastructure is expected to bolster the wind energy supply chain, indirectly supporting the wind turbine casting market.

Key Takeaways

- The Global Wind Turbine Casting Market is expected to be worth around USD 4.9 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

- In the Wind Turbine Casting Market, horizontal axis turbines accounted for a dominant 87.3% share.

- Ductile iron held the largest material segment in the Wind Turbine Casting Market with 44.8% share.

- The sand casting process led the Wind Turbine Casting Market, contributing to 62.5% of total manufacturing methods.

- On-shore wind turbines dominated end-use in the Wind Turbine Casting Market, capturing around 72.9% market share.

- Medium-sized turbines (10–19 MW) represented 56.1% of the Wind Turbine Casting Market by turbine size.

- Wind turbine casting demand in the Asia-Pacific region reached USD 0.8 billion in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/wind-turbine-casting-market/request-sample/

Report Scope

| Market Value (2024) | USD 2.3 Billion |

| Forecast Revenue (2034) | USD 4.9 Billion |

| CAGR (2025-2034) | 7.8% |

| Segments Covered | By Type (Horizontal Axis, Vertical Axis), By Material (Ductile Iron, Gray Iron, Steel, Aluminum, Others), By Process (Sand Casting, Investment Casting, Die Casting), By End-Use (On-Shore Wind Turbines, Off-Shore Wind Turbines, Others), By Turbine Size (Small (less than 10 MW), Medium (10-19 MW), Large (20 MW or greater)) |

| Competitive Landscape | DHI DCW Group Co., Ltd., Dongfang Electric, Doosan Heavy Industries, Elyria Foundry Company, LLC, Enercon, GE Renewable Energy, Hyundai Heavy Industries, Riyue Heavy Industry Corporation Ltd., SAKANA Group, SEFORGE, Siemens Gamesa, Suzlon, Vestas |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153495

Key Market Segments

By Type Analysis

Horizontal axis turbines lead the Wind Turbine Casting Market, capturing an 87.3% share in 2024. Horizontal-axis wind turbines (HAWTs) dominate due to their superior efficiency and suitability for large-scale onshore and offshore projects.

Their aerodynamic design optimizes energy capture, driving demand for robust cast components like nacelle housings, hubs, and main shafts. Casting manufacturers prioritize HAWT components, leveraging advanced metallurgical techniques to meet the growing size and performance demands, solidifying their critical role in the renewable energy supply chain.

By Material Analysis

Ductile iron holds a leading 44.8% share in the By Material segment of the Wind Turbine Casting Market in 2024. Its high tensile strength, impact resistance, and cost-effective machinability make it ideal for critical components like hubs, bearing housings, and gearbox cases.

Ductile iron’s ability to withstand heavy mechanical loads and stress in wind turbine operations fuels its widespread use. As large-scale turbine deployments grow, manufacturers rely on ductile iron for its durability and structural integrity, reinforcing its dominance in the material segment.

By Process Analysis

Sand casting commands a 62.5% share in the By Process segment of the Wind Turbine Casting Market in 2024. Its versatility, cost-effectiveness, and ability to produce complex, large-scale components like hubs, bases, and main frames make it the preferred method.

Sand casting’s adaptability to various alloys and suitability for both low- and high-volume production ensure its continued dominance. This process delivers the structural integrity and flexibility required for wind turbine applications, maintaining its critical role in the casting industry.

By End-Use Analysis

Onshore wind turbines dominate the By End-Use segment, holding a 72.9% share in 2024. Lower installation costs, easier accessibility, and faster project timelines drive the widespread adoption of onshore wind farms.

This fuels demand for cast components like hubs, main shafts, and gear housings, designed to endure variable terrain and wind conditions. The casting industry aligns its capabilities to meet these needs, supporting the robust performance of onshore turbines and their pivotal role in global renewable energy expansion.

By Turbine Size Analysis

Medium turbines (10–19 MW) lead the By Turbine Size segment with a 56.1% share in 2024. These turbines balance power generation and cost efficiency, making them ideal for large onshore and early offshore projects.

Demand for cast components like hubs, main shafts, and nacelle frames has surged, requiring high-strength materials and precision casting. Manufacturers focus on meeting the structural demands of this segment, aligning with grid infrastructure and regulatory needs, cementing medium turbines as a key driver in the casting market.

Regional Analysis

In 2024, Asia-Pacific dominated the Wind Turbine Casting Market, holding a 38.7% share, valued at roughly USD 0.8 billion. This leadership stems from significant investments in wind energy infrastructure, particularly in expanding onshore wind farms and advancing offshore projects across key economies.

The region’s robust manufacturing capabilities and efficient supply chains drive large-scale production of critical cast components like hubs, nacelle housings, and main shafts. North America and Europe trail as significant markets, fueled by renewable energy goals and supportive policies, with Europe excelling in offshore wind growth and North America leveraging established projects and expertise.

Emerging regions like the Middle East & Africa and Latin America show growing demand for cast components as wind energy adoption rises, though their market shares remain smaller. Asia-Pacific’s dominance is set to continue, driven by ongoing capacity expansion and its pivotal role as a global hub for turbine component manufacturing.

Top Use Cases

- Onshore Wind Turbine Component Production: Wind turbine casting is widely used to create durable components like hubs, main shafts, and gearbox housings for onshore turbines. These parts ensure turbines withstand variable wind and terrain conditions, supporting the high demand for cost-effective, reliable onshore wind energy projects globally.

- Offshore Wind Turbine Durability: Casting produces robust components such as nacelle frames and rotor hubs for offshore turbines. These parts are designed to resist harsh marine environments, including saltwater corrosion and extreme weather, meeting the growing need for high-performance castings in expanding offshore wind farms.

- Large-Scale Turbine Manufacturing: Casting is essential for producing large components like bases and rotors for turbines sized 10–19 MW. These parts provide structural integrity for high-capacity turbines, catering to the rising preference for medium-sized turbines in both onshore and offshore installations.

- Eco-Friendly Energy Support: Wind turbine casting supports renewable energy goals by supplying components for eco-friendly power generation. Cast parts, made from materials like ductile iron, ensure long-lasting turbine performance, aligning with global policies to reduce carbon emissions and fossil fuel reliance.

- Cost-Effective Component Production: Sand casting, holding a market share, is a cost-effective method for producing large turbine components. Its versatility and ability to handle complex shapes make it ideal for manufacturers aiming to meet high demand while keeping production costs low.

Recent Developments

1. DHI DCW Group Co., Ltd.

DHI DCW Group has been expanding its wind turbine casting capabilities, focusing on large-scale components like hubs and bedplates. The company has invested in advanced casting technologies to improve material strength and reduce defects. They are supplying major wind turbine manufacturers in China and globally. Their R&D focuses on lightweight yet durable castings for offshore wind applications.

2. Dongfang Electric

Dongfang Electric has developed high-precision castings for next-gen wind turbines. They use simulation-driven design to optimize casting processes, reducing production time. The company collaborates with global wind energy firms to enhance component reliability. Their foundries now employ AI for quality control.

3. Doosan Heavy Industries

Doosan Heavy Industries is advancing wind turbine casting with high-strength ductile iron for large nacelles and rotor hubs. They recently secured contracts for offshore wind projects in Korea and Europe. Their casting facilities incorporate sustainable practices, reducing carbon emissions in production.

4. Elyria Foundry Company, LLC

Elyria Foundry specializes in ductile iron castings for wind energy, recently upgrading its facilities to handle larger components. They focus on improving fatigue resistance and corrosion protection for offshore wind turbines. The company is also exploring recycled materials for greener production.

5. Enercon

Enercon has been optimizing cast components for its direct-drive wind turbines, emphasizing weight reduction and durability. They use proprietary alloys to enhance performance in harsh environments. Recent innovations include modular casting designs for easier maintenance and installation.

Conclusion

The Wind Turbine Casting Market is thriving due to the global push for renewable energy and technological advancements. With Asia-Pacific leading market share, casting supports both onshore and offshore wind projects by delivering durable, cost-effective components. Innovations like 3D printing and ductile iron’s dominance ensure long-term growth, aligning with eco-friendly energy goals and rising turbine installations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)