Table of Contents

Overview

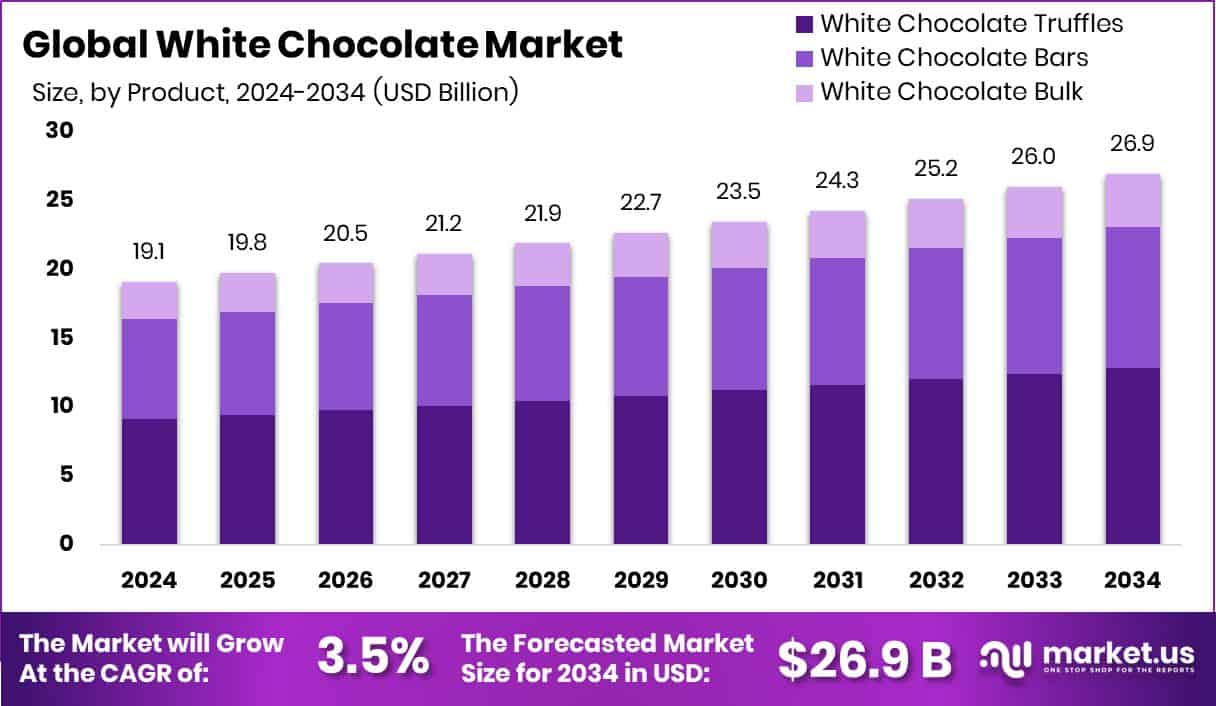

New York, NY – Aug 05, 2025 – The global white chocolate market is projected to reach approximately USD 26.9 billion by 2034, rising from USD 19.1 billion in 2024, with a compound annual growth rate (CAGR) of 3.5% between 2025 and 2034. North America, driven by strong retail distribution and increasing demand for premium offerings, accounted for a market value of USD 7.2 billion.

White chocolate, a confection made primarily from cocoa butter, sugar, and milk solids, differs from milk and dark chocolate as it lacks cocoa solids. This absence gives it a creamy white appearance and a milder, sweeter flavor. The cocoa butter component, derived from cocoa beans, contributes to its smooth texture and rich mouthfeel, making it a popular choice in baking, desserts, and premium confectionery products.

The global white chocolate market is witnessing steady growth, fueled by increasing demand for indulgent and gourmet sweets. Consumers, especially in urban regions, are gravitating toward premium and artisanal confections, expanding white chocolate’s appeal particularly among younger demographics and in innovative dessert formats. Companies like Awake Chocolate, which recently raised $8 million to expand its white chocolate energy bar line, are capitalizing on this evolving snacking trend.

A key market driver is the trend toward premiumization in the confectionery space. Consumers are seeking unique, high-quality chocolate experiences that stand out in both taste and aesthetics. This has led bakeries and manufacturers to introduce white chocolate in seasonal and limited-edition offerings.

For example, Choruba & the Chocolate Factory in Italy secured €3.4 million to grow its Foreverland range of cocoa-free treats, including white chocolate alternatives. Similarly, Planet A Foods raised $15.4 million in Series A funding to bring its sustainable, cocoa-free chocolate to the UK market, reflecting the rising importance of ingredient innovation and eco-conscious production.

The versatility of white chocolate is also driving its integration into modern baked goods, beverages, and frozen desserts. British brand McVitie’s saw profits climb to £131.3 million, partly due to high demand for its white chocolate digestives. Its pairing compatibility with nuts, fruits, and spices enhances its value in complex flavor formulations.

In addition, the shift toward health-conscious consumption is encouraging the development of reduced-sugar and plant-based white chocolate products. Functional snack brand MOSH recently closed a $3 million Series A funding round to expand its wellness-focused product line, which includes white chocolate-based items.

Highlighting investor confidence in sustainable innovation, Voyage Foods secured $52 million in a Series A+ round, backed by a strategic partnership with Cargill. This reflects the growing push toward ethical sourcing and climate-conscious alternatives that retain white chocolate’s sensory appeal.

Key Takeaways

- The global white chocolate market is projected to reach approximately USD 26.9 billion by 2034, rising from USD 19.1 billion in 2024, with a CAGR of 3.5% between 2025 and 2034.

- Truffles represented the largest share within the product segment, accounting for 47.8% of the total market.

- By form, bars led the market with a 53.1% share, driven by their widespread consumption and popularity.

- In terms of application, the confectionery segment dominated, contributing 44.9% to the overall market value.

- Supermarkets and hypermarkets were the primary distribution channels, capturing 48.5% of the market share.

- North America emerged as the leading regional market, holding a significant 37.8% share of global white chocolate sales.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-white-chocolate-market/free-sample/

Report Scope

| Market Value (2024) | USD 19.1 Billion |

| Forecast Revenue (2034) | USD 26.9 Billion |

| CAGR (2025-2034) | 3.5% |

| Segments Covered | By Product (White Chocolate Truffles, White Chocolate Bars, White Chocolate Bulk), By Form (Bars, Chips and Chunks, Spreads), By Application (Confectionery, Bakery, Dairy and Frozen Desserts, Beverages, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Non-Grocery Retailers, Others) |

| Competitive Landscape | Barry Callebaut AG, Blommer Chocolate Company, Cargill, Incorporated, CEMOI Group, Chocoladefabriken Lindt & Sprüngli AG, Ferrero, Fuji Oil Company Ltd., Ghirardelli Chocolate Co, Guittard Chocolate Company, Kerry Group, Kraft Heinz Company, Mars Incorporated, Mondelez International, Inc, Nestle S.A., The Hershey Company, Unilever |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153176

Key Market Segments

By Product Analysis

White chocolate truffles accounted for 47.8% of the product segment in 2024, maintaining a dominant position in the white chocolate market. Their popularity stems from rising consumer demand for premium, indulgent treats that deliver both exceptional taste and aesthetic appeal. Renowned for their smooth texture and rich fillings, white chocolate truffles are especially favored in urban markets and for gifting purposes.

These confections are frequently associated with celebrations and special occasions, enhancing their market visibility through festive promotions and seasonal campaigns. Their appeal is further amplified by the diversity of flavor infusions ranging from fruity centers to nut-based blends which cater to a wide spectrum of consumer palates.

The growing trend toward gourmet and artisanal sweets has also supported the steady rise in demand for white chocolate truffles. Their strong retail performance, combined with increasing sales through online specialty stores and luxury confectionery outlets, underlines their lasting popularity.

By Form Analysis

White chocolate bars led the market by form in 2024, capturing a 53.1% share globally. This dominance is largely driven by their broad consumer appeal as a convenient, portable indulgence. The bar format lends itself well to packaging flexibility, portion control, and continuous product innovation, making it a favored choice across various age demographics.

Often positioned as specialty or premium products, white chocolate bars attract attention through unique ingredient pairings, such as fruit inclusions, spices, or nut blends. Their format also supports effective branding and shelf visibility, influencing consumer purchase decisions at retail points.

The popularity of bars is reinforced by their widespread availability in supermarkets, convenience stores, and online marketplaces. Their adaptability in flavor, format, and packaging contributes to their continued leadership in the market.

By Application Analysis

The confectionery segment dominated by application in 2024, accounting for 44.9% of white chocolate utilization. This strong position is driven by increasing global demand for indulgent and visually appealing sweets where white chocolate plays a central role.

Its versatility enhances both the flavor and aesthetic of confections, allowing it to pair well with ingredients like fruits, nuts, and spices. This has led to a diverse range of white chocolate offerings tailored to shifting consumer tastes.

The ongoing interest in gourmet and handcrafted confections has further spurred innovation in this segment. Brands leverage the celebratory and emotional value of white chocolate products to strengthen their market appeal. With steady demand across retail and premium channels, confectionery remains a key application area within the market.

By Distribution Channel Analysis

Supermarkets and hypermarkets held a leading 48.5% share of the white chocolate market’s distribution in 2024. This dominance reflects consumer preference for shopping in large retail environments that provide variety, promotional offers, and product visibility.

These retail channels attract high foot traffic and facilitate both impulse and planned purchases. In-store experiences such as sampling, bundled deals, and seasonal displays boost consumer engagement and sales conversions.

The wide range of white chocolate products available from everyday bars to high-end truffles meets the needs of diverse customer segments under one roof. As urban retail infrastructure continues to expand, supermarkets and hypermarkets are expected to remain crucial to brand visibility and overall market performance.

Regional Analysis

In 2024, North America led the global white chocolate market, reaching a value of USD 7.2 billion and capturing a 37.8% market share. This dominance is fueled by strong consumer spending on premium confections, a well-developed retail ecosystem, and a growing appetite for indulgent desserts. Consumers in the region favor a variety of white chocolate products from classic truffles and bars to innovative baked goods boosting market penetration.

The presence of organized retail chains, specialty confectionery stores, and effective distribution channels further supports white chocolate’s visibility and accessibility across the region.

Europe also commands a substantial share, underpinned by its rich confectionery heritage and consistent demand for seasonal, artisanal chocolates. The market here is characterized by a mature consumer base that values quality, tradition, and flavor diversity.

In the Asia Pacific region, increasing disposable incomes and the westernization of food preferences are driving interest in white chocolate, particularly among younger consumers. Product innovation and expanding urban markets are helping to accelerate growth in this region.

Although Latin America and the Middle East & Africa currently represent smaller segments of the global market, both regions are experiencing steady expansion. Factors such as rising urbanization, evolving consumer tastes, and improvements in retail infrastructure are contributing to their gradual market development.

Top Use Cases

1. Product Innovation & Premium Positioning: White chocolate is used to create premium or limited-edition products like truffles, bars, and seasonal confectionery. Brands differentiate through flavor infusions such as fruit, caramel or nut combinations to meet consumer demand for gourmet experiences and justify higher pricing. A clear innovation strategy here can boost brand visibility and profit margins.

2. Expansion in Bakery & Foodservice Channels: White chocolate is increasingly adopted by bakeries, cafés, and dessert chains in items like cakes, cookies, pastries, drinks, and frozen desserts. Its creamy flavor and texture make it ideal for coatings, fillings, toppings, and décor, helping businesses attract dessert-focused customers and tap into foodservice growth.

3. Health-Conscious & Plant‑Based Product Development: Manufacturers are launching reduced-sugar or dairy-free white chocolate variants to appeal to health‑centric and vegan consumers. These formats position white chocolate as a “better‑for‑you” treat, aligned with growing interest in clean labels and plant‑based ingredients, helping widen market reach among wellness-minded buyers.

4. Retail & E‑Commerce Strategy Optimization: White chocolate products perform strongly through supermarkets, hypermarkets, specialty stores, and online platforms. Retail strategies focused on attractive packaging, impulse placement, bundled offers, and ecommerce listings enhance visibility. This omnichannel presence ensures broader reach and convenience, helping brands secure consistent sales across diverse markets.

5. Regional Market Expansion & Demographic Targeting: White chocolate gains traction in emerging markets in Asia Pacific, Latin America, and the Middle East & Africa, driven by rising incomes, urbanization, and exposure to Western confectionery trends. Younger demographics show particular interest, enabling brands to tailor marketing and product formats to regional tastes and unlocking new sales territories.

6. Flavor Fusion & Culinary Collaboration: Chefs and food innovators use white chocolate in creative sweet‑savory fusion dishes, such as caramelized or roasted white chocolate in desserts and even pairing it with savory ingredients. This culinary creativity expands its appeal beyond traditional markets and supports brand storytelling in premium and gourmet categories.

Recent Developments

Barry Callebaut AG: Barry Callebaut’s sustainability strategy “Forever Chocolate”, launched in 2016 and updated through 2023/24, continues to drive its industry leadership. With goals including 100% certified ingredients by 2030 and progress toward forest‑positive operations, the company is reinforcing ethical sourcing in its white chocolate supply chains. In fiscal year 2024/25, while volumes declined due to commodity volatility, revenue grew over 50% in local currency. Investments under the BC Next Level initiative support resilience in cocoa-derived segments, benefiting products such as white chocolate.

Cargill, Incorporated: Cargill launched its new Bright White chocolate line offering a visually pure white hue and balanced vanilla flavor designed specifically for bakery, confectionery, and frozen-dessert applications. This product meets demand for label-friendly, sustainably sourced ingredients, using Rainforest Alliance certified cocoa and no artificial additives. Bright White chocolate’s enhanced visual appeal and familiar formulation support consumer trends favoring clean-label, aesthetically striking products.

Blommer Chocolate Company: In March 2025, Blommer inaugurated a new 10,000 sq ft R&D center in Chicago’s Merchandise Mart, doubling its lab capacity to accelerate innovation in coating, processing, and ingredient applications including white chocolate formulations. This modernized facility aims to enhance prototyping, sensory evaluation, and specialty product development. Earlier in 2024, the company introduced the Elevate Cocoa Butter Equivalent line, offering white‑chocolate-like coatings with superior shelf‑life and bloom resistance ideal for confectioners seeking premium textures.

Conclusion

The rise of online retail channels and shifting consumer behavior toward convenience and customization are accelerating white chocolate sales globally. Moreover, the increasing availability of plant-based and reduced-sugar variants is attracting new consumer segments.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)