Table of Contents

Overview

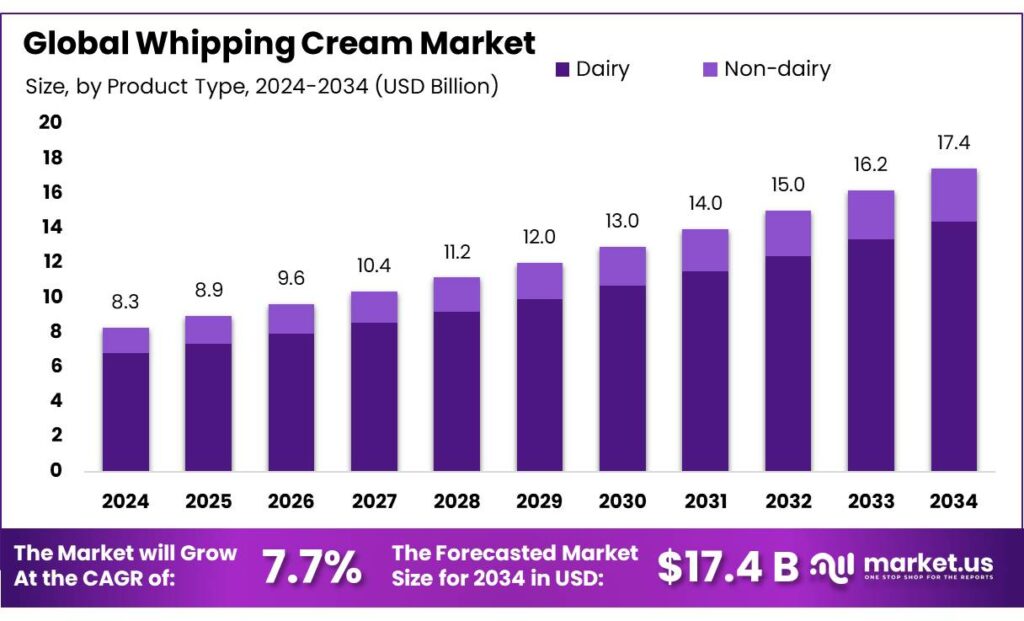

New York, NY – October 08, 2025 – The Global Whipping Cream Market is projected to reach USD 17.4 billion by 2034, rising from USD 8.3 billion in 2024, at a CAGR of 7.7% between 2025 and 2034. North America dominated in 2024, accounting for over 42.8% of total revenue, approximately USD 3.5 billion.

In India, the whipping cream market is expanding rapidly due to the nation’s strong dairy foundation and changing food preferences. As the world’s largest milk producer, India contributes more than 25% of global milk output, supporting a wide range of dairy-based industries. Whipping cream has become a key ingredient across desserts, bakery items, and beverages, driven by rising urban consumption and café culture.

The Indian dairy ecosystem consists of both organized and unorganized sectors. Around 64% of milk sales occur through traditional milkmen and local vendors, while the organized sector, including cooperatives and private dairies, processes the remaining 36%. Amul, India’s leading cooperative, exemplifies the organized strength of the sector, collecting about 35 million litres of milk daily and commanding nearly 75% of the national milk market.

Government initiatives are further accelerating the sector’s progress. India aims to double its milk processing capacity to 108 million metric tons (MMT) by 2025, signaling major infrastructure investment. Moreover, programs like the Ethanol Blended Petrol (EBP) initiative, which mandates 20% ethanol blending by 2025, have encouraged innovative uses of dairy byproducts.

Notably, Amul began producing bioethanol from whey, a byproduct of paneer and cheese production, to support sustainable fuel development. India’s milk output from cows and buffaloes is expected to reach 216.5 million metric tons, up from 211.7 million metric tons in 2024. This steady growth reflects improved herd management, quality feed, and favorable climate conditions, reinforcing India’s pivotal role in global dairy expansion.

Key Takeaways

- Whipping Cream Market size is expected to be worth around USD 17.4 billion by 2034, from USD 8.3 billion in 2024, growing at a CAGR of 7.7%.

- Dairy held a dominant market position in the Whipping Cream Market, capturing more than an 82.5% share.

- Fresh held a dominant market position in the Whipping Cream Market, capturing more than a 67.8% share.

- Bakery and Confectionery held a dominant market position in the Whipping Cream Market, capturing more than a 44.9% share.

- Hypermarkets and Supermarkets held a dominant market position in the Whipping Cream Market, capturing more than a 43.2% share.

- North America stands as the dominant region in the global whipping cream market, commanding a substantial share of 42.8% in 2024, equating to an estimated market size of approximately USD 3.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/whipping-cream-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 8.3 Billion |

| Forecast Revenue (2034) | USD 17.4 Billion |

| CAGR (2025-2034) | 7.7% |

| Segments Covered | By Source (Dairy, Non-dairy), By Type (Fresh, Premix), By End Use (Bakery and Confectionery, Desserts, Beverages, Others), By Distribution Channel (Hypermarkets/supermarkets, Specialty stores, Online, Others) |

| Competitive Landscape | Hanan Products Co., Inc., GCMMF, Conagra Brands, Gay Lea Foods Co-operative Ltd., Cabot Creamery, Borden Dairy, LACTALIS, Granarolo S.p.A., Arla Foods, Dairy Farmers of America |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157931

Key Market Segments

By Source Analysis

In 2024, dairy-based whipping cream commands an 82.5% share of the Whipping Cream Market, driven by its preferred texture, flavor, and stability. Widely used in home cooking and professional food services, particularly for desserts, cakes, and pastries, dairy whipping cream benefits from consumer trust in its natural ingredients and nutritional value. Despite the rise of plant-based alternatives, dairy maintains its dominance due to its culinary versatility and cultural significance, ensuring consistent performance in high-end confectionery applications.

By Type Analysis

Fresh whipping cream holds a 67.8% market share in 2024, favored for its rich texture, superior taste, and ability to maintain structure when whipped. Its popularity in home and professional kitchens, especially for premium toppings and fillings, is fueled by consumer demand for fresh, minimally processed ingredients. With a short shelf life and refrigeration needs, fresh whipping cream is a staple in artisanal and homemade products. In 2025, this segment is poised to retain its lead, driven by the foodservice industry’s demand for high-quality ingredients.

By End Use Analysis

The bakery and confectionery segment dominates with a 44.9% share in 2024, owing to whipping cream’s critical role in creating light, airy textures and rich flavors for cakes, pastries, and desserts. Consumer demand for premium baked goods, coupled with innovations in product formulations and the growing popularity of customized desserts, supports this segment’s growth. In 2025, bakery and confectionery will likely maintain its lead, propelled by the global foodservice industry’s expansion and increased spending on celebratory and premium confections.

By Distribution Channel Analysis

Hypermarkets and supermarkets lead with a 43.2% share in 2024, driven by their accessibility, variety of whipping cream options, and competitive pricing. These outlets cater to consumer preferences for convenient, one-stop shopping, offering both fresh and long-life whipping cream. The rise of online grocery shopping and expanding store networks further strengthens this segment. In 2025, hypermarkets and supermarkets are expected to sustain their dominance, supported by enhanced in-store experiences and growing consumer reliance on convenient purchasing channels.

Regional Analysis

In 2024, North America leads the global whipping cream market with a 42.8% share, valued at approximately USD 3.5 billion, with the United States contributing around USD 3 billion. This dominance is driven by strong demand for whipping cream in bakery, confectionery, desserts, and beverages. The U.S. dairy industry underpins this leadership, producing about 215,000 metric tons of whipping cream annually, supported by over 720 specialized dairy farms, ensuring a steady, high-quality supply to meet rising consumer needs.

Top Use Cases

- Bakery and Confectionery: Whipping cream is a key ingredient in cakes, pastries, and desserts, providing a light, creamy texture. Its ability to hold shape makes it ideal for decorative toppings and fillings, enhancing the appeal of baked goods in both home and professional settings, driving demand in the food industry.

- Beverage Toppings: Whipping cream adds richness to beverages like hot chocolate, coffee, and milkshakes. Its smooth texture and ability to float on drinks make it a popular choice for cafes and restaurants, elevating the customer experience with indulgent, visually appealing toppings that enhance flavor and presentation.

- Dessert Production: Whipping cream is essential for creating desserts like mousses, trifles, and ice cream. Its versatility allows chefs to craft creamy, airy textures that delight consumers, making it a staple in home kitchens and high-end restaurants, where premium desserts are in constant demand.

- Savory Dishes: Whipping cream is used in savory recipes like creamy soups, sauces, and pasta dishes. Its rich consistency enhances flavors and adds a smooth texture, making it a favorite in professional kitchens and households looking to elevate everyday meals with a touch of indulgence.

- Homemade Whipped Cream: Consumers use whipping cream to make fresh whipped cream at home for topping fruits, pies, or waffles. Its ease of use and fresh taste appeal to those seeking natural, high-quality ingredients, boosting its popularity for family gatherings and special occasions.

Recent Developments

1. Hanan Products Co., Inc.

Hanan Products has recently focused on expanding its private-label and foodservice offerings. The company has been emphasizing the reliability and consistent performance of its whipping cream products for bakeries and dessert manufacturers. While maintaining a strong presence in the industrial sector, they continue to invest in supply chain efficiency to ensure product availability. Their developments are often communicated directly through their sales channels.

2. GCMMF (Amul)

GCMMF, marketing its products under the Amul brand, recently launched “Amul Fresh Whipping Cream” in a new, more convenient packaging format. This launch is part of a strategic move to cater directly to the at-home baking enthusiast segment, which saw significant growth. Amul promotes this product as being easy to whip and perfect for creating stable desserts, highlighting its versatility for both professional and home use.

3. Conagra Brands

Under its Rich’s brand, Conagra has been heavily promoting the versatility and superior performance of its plant-based whipping toppings. A key recent development is the expansion of its “Bettercream” line, a non-dairy, gluten-free whipping cream alternative. This innovation targets the growing demand for vegan and allergen-friendly products in both retail and foodservice channels, emphasizing its stability and long shelf life.

4. Gay Lea Foods Co-operative Ltd.

Gay Lea has recently invested in sustainability, including the packaging for its Real Whipped Cream line. They have also been promoting the use of their whipping cream in trendy, at-home coffee creations. A key development is highlighting their product’s “Real Cream First” promise, ensuring it is made with simple, high-quality ingredients without hydrogenated oils, directly appealing to consumers seeking clean labels and natural products.

5. Cabot Creamery

Cabot Creamery, known for its award-winning cheeses, has been leveraging its reputation for quality to promote its Heavy Whipping Cream. A recent focus has been on marketing the product’s versatility beyond whipping, such as for creating rich, creamy sauces and soups. They emphasize its farm-fresh quality and use in savory applications, targeting home cooks looking to enhance their culinary creations with a premium, co-op-produced dairy product.

Conclusion

Whipping cream remains a versatile and highly valued ingredient across culinary applications, from sweet treats to savory dishes. Its ability to enhance texture, flavor, and presentation drives its popularity in both household and professional kitchens. As consumer demand for premium, indulgent foods grows, whipping cream continues to play a central role in the global food industry, supported by its adaptability and widespread appeal.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)