Table of Contents

Overview

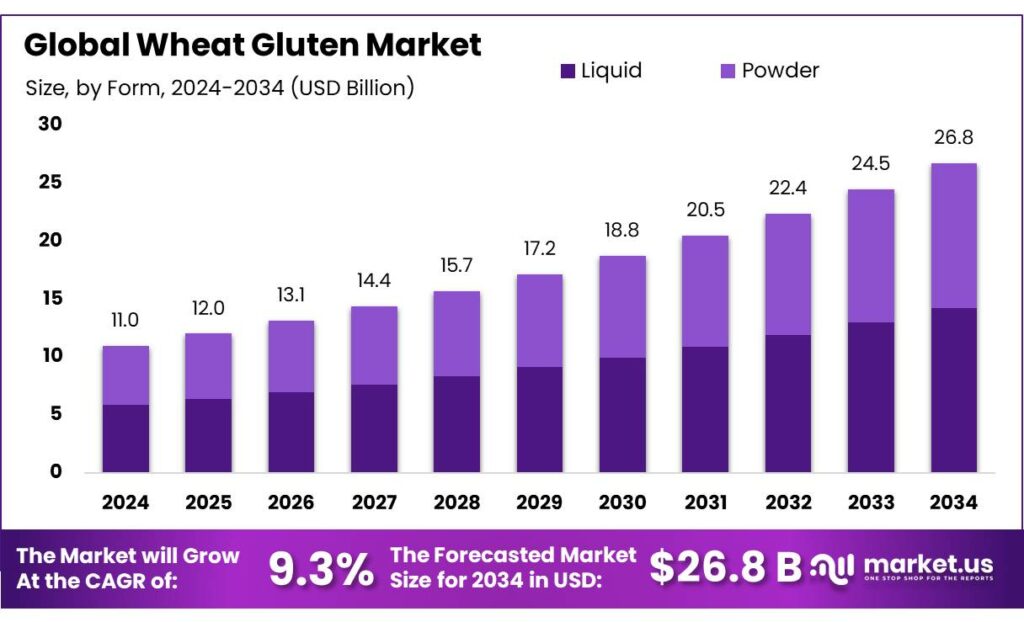

New York, NY – September 17, 2025 – The Global Wheat Gluten Market is projected to grow from USD 11.0 billion in 2024 to USD 26.8 billion by 2034, at a CAGR of 9.3% from 2025–2034. In 2024, North America led the market with a 42.8% share, generating USD 4.7 billion in revenue.

Wheat gluten, which makes up 8–15% of wheat flour, is produced through industrial washing that separates proteins from starch. Wheat is the third-largest U.S. field crop, with 1.97 billion bushels produced from 38.5 million harvested acres in 2024/25. Hard Red Winter wheat contributes around 40% of U.S. output, while Hard Red Spring wheat makes up 25%, both preferred for gluten due to higher protein levels.

Modern milling now produces vital wheat gluten with protein concentrations above 75%. Policy support also shapes the market: in October 2024, India increased its wheat minimum support price by 6.6% to ₹2,425 per 100 kg, while maintaining a 40% import duty to protect domestic growers. The Government of India launched the ₹24,000-crore annual Prime Minister Dhan-Dhaanya Krishi Yojana, aiming to enhance farm yields, infrastructure, and income in 100 underperforming districts, directly benefiting the wheat value chain and supporting long-term gluten supply stability.

Key Takeaways

- Wheat Gluten Market size is expected to be worth around USD 26.8 Billion by 2034, from USD 11.0 Billion in 2024, growing at a CAGR of 9.3%.

- 0–3 years held a dominant market position, capturing more than a 68.3% share in the Infant Formula DHA Algae Oil market.

- Liquid held a dominant market position, capturing more than a 53.2% share in the wheat gluten market.

- Bakery held a dominant market position, capturing more than a 38.5% share in the global wheat gluten market.

- North America held a dominant position in the wheat gluten market, capturing more than a 42.8% share, valued at approximately USD 4.7 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/wheat-gluten-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 11.0 Billion |

| Forecast Revenue (2034) | USD 26.8 Billion |

| CAGR (2025-2034) | 9.3% |

| Segments Covered | By Form (Liquid, Powder), By Application (Bakery, Meat Alternatives, Confectionery, Nutritional Supplements, Convenience Foods, Others), By Distribution Channel (Retail Stores, Supermarkets and Hypermarkets, E-commerce, Others) |

| Competitive Landscape | Crespel & Deiters GmbH, Pioneer Industries Limited, Anhui Ante Food, Ardent Mills LLC, MGP Ingredients, Z & F Sungold Corporation, Royal Ingredients Group, Tereos, Bryan W. Nash & Sons Limited, Kroener Staerke |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156516

Key Market Segments

By Age Group

0–3 Years Segment Leads with 68.3% Share in 2024

In 2024, the 0–3 years age group commanded a leading 68.3% share of the Infant Formula DHA Algae Oil market. This segment’s prominence stems from the critical role DHA plays in early childhood development, supporting brain growth, visual acuity, and cognitive function. Increasing parental awareness of DHA’s benefits has driven demand for algae oil-based formulas, valued for their sustainability and allergen-free properties compared to fish-derived DHA.

With pediatric guidelines emphasizing DHA’s importance for infants and toddlers, this segment is projected to retain its dominance into 2025. Infant nutrition brands are capitalizing on this trend by promoting the clinical benefits and natural sourcing of algae oil, bolstering consumer trust and market growth.

By Application

Liquid Wheat Gluten Commands 53.2% Share in 2024

In 2024, liquid wheat gluten held a dominant 53.2% share of the wheat gluten market, driven by its versatility in food processing. Its ease of integration into bakery products, beverages, and plant-based meat alternatives makes it a preferred choice for manufacturers seeking consistent texture and enhanced moisture retention.

Liquid wheat gluten’s ability to reduce processing time and eliminate rehydration needs further enhances its appeal, saving both energy and labor costs. As consumer demand for clean-label and high-protein products grows, liquid wheat gluten’s functional and nutritional benefits continue to fuel its market leadership, particularly in applications requiring superior binding and elasticity.

By Distribution Channel

Bakery Segment Holds 38.5% Share in 2024

The bakery segment captured a leading 38.5% share of the global wheat gluten market in 2024, propelled by the rising demand for high-protein and artisanal baked goods. Wheat gluten enhances texture, elasticity, and shelf life in products like breads, pastries, and rolls, delivering the soft, chewy qualities consumers prefer.

Its natural, plant-based protein profile aligns with the growing trend toward clean-label and high-protein bakery items. The segment’s strength is further supported by its critical role in both commercial and in-store bakeries, where consistent dough performance is essential for high-volume production. This trend underscores wheat gluten’s importance in meeting consumer expectations for quality and nutrition.

Regional Analysis

North America Leads with 42.8% Share in 2024

In 2024, North America dominated the wheat gluten market with a 42.8% share, valued at approximately USD 4.7 billion. This leadership is driven by strong demand in the food and beverage sector, particularly for bakery products, plant-based meat alternatives, and packaged snacks. The region’s preference for high-protein and functional foods has made wheat gluten a key ingredient, especially as plant-based diets gain traction in the U.S. and Canada.

Advanced food processing infrastructure and significant R&D investments in wheat gluten-based products further solidify North America’s position. Regulatory support and growing consumer awareness of wheat gluten’s nutritional benefits also contribute to its market growth, positioning the region as a leader in plant-based protein innovation.

Top Use Cases

- Bakery Enhancement: Wheat gluten boosts the strength and stretch in bread dough, making loaves taller and softer with better rise during baking. Bakers add a small amount to whole grain flours to mimic white flour’s performance, ensuring airy textures without extra effort. This simple tweak helps home cooks and pros alike create professional-quality baked goods that stay fresh longer, appealing to busy families seeking easy, nutritious meals.

- Vegan Meat Substitute: As seitan, wheat gluten forms chewy, protein-packed alternatives to beef or chicken, soaking up flavors from broths and spices. Vegans love it for high protein without animal products, turning simple mixes into stir-fries or sandwiches. Its meat-like bite satisfies cravings in plant-based diets, driving demand as more people shift to sustainable eating for health and eco reasons.

- Pet Food Nutrition: Wheat gluten adds affordable protein to kibble and treats, improving digestibility for dogs and cats while binding ingredients together. Pet owners choose premium feeds with it for shiny coats and strong muscles in their furry friends. As pet humanization grows, this use supports the booming industry, offering balanced nutrition that keeps tails wagging without breaking the bank.

- Confectionery Texture Aid: In candies and chocolates, wheat gluten stabilizes mixtures, preventing separation and creating smooth, chewy results. Candy makers rely on it for consistent quality in gummies or fillings, enhancing shelf life too. This behind-the-scenes role delights snack lovers with reliable treats, fueling the sweet tooth market where fun and flavor meet everyday indulgence.

- Animal Feed Binder: Farmers mix wheat gluten into livestock rations to clump feed particles, reducing waste and ensuring even nutrient spread for healthier cows and pigs. It cuts costs by replacing pricier options while boosting growth rates. In a world of rising feed prices, this practical application keeps meat production efficient, supporting global food chains with sustainable, low-impact solutions.

Recent Developments

1. Crespel & Deiters GmbH

Crespel & Deiters is heavily investing in expanding its production capacity for premium wheat-based proteins, including vital wheat gluten. A key recent development is the strategic focus on the wheat refining concept, transforming raw materials into high-value ingredients like textured wheat proteins for meat alternatives. This aligns with the growing demand for plant-based nutrition in Europe.

2. Pioneer Industries Limited

Pioneer Industries continues to be a major global exporter of wheat gluten. A recent key development is its enhanced focus on meeting stringent international quality and food safety standards to maintain its competitive position. The company is actively supplying the growing Asian market, where demand for plant protein and meat analogue applications is rising significantly, leveraging its established production scale.

3. Anhui Ante Food Co., Ltd.

Anhui Ante Food has been expanding its production capabilities for vital wheat gluten to capture a larger share of the global market. A recent development is its increased export volume to North America and Europe, competing on price and scale. The company focuses on providing a cost-effective ingredient source for the seitan and bakery industries, emphasizing supply chain reliability from a major wheat-producing region.

4. Ardent Mills LLC

Ardent Mills recently launched Sust Agrain Ultra High Fiber Wheat, which, while not pure gluten, impacts its wheat ingredient portfolio. A direct gluten development is the expansion of its technical service capabilities to help customers optimize vital wheat gluten usage in various applications, from baking to plant-based proteins, ensuring functionality and clean label solutions across North America.

5. MGP Ingredients

MGP Ingredients has made a significant recent development with the acquisition of a majority stake in Swiss-based plant protein company Particle. This move strategically expands MGP’s capabilities in textured wheat proteins and meat alternatives, complementing its existing wheat gluten and starch business. It signals a major push into the high-growth European plant-based market with innovative protein solutions.

Conclusion

Wheat gluten is a versatile ingredient with growing importance across several food sectors. It plays a critical role in improving texture, structure, moisture retention, and protein content, especially in baked goods, meat alternatives, pastas, and pet food. Market trends toward plant-based diets, demand for higher protein foods, and improving food yields suggest that wheat gluten will continue to see rising adoption. Manufacturers who optimise formulation and sourcing can gain a competitive advantage.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)