Table of Contents

Overview

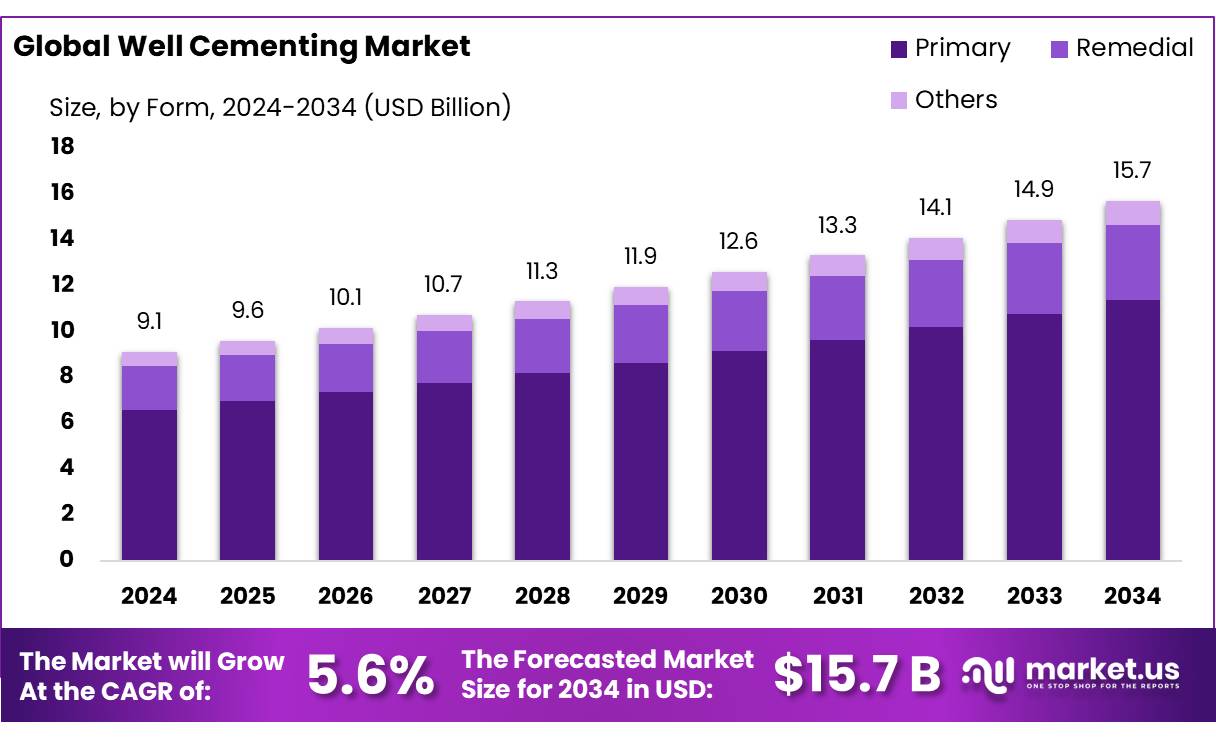

New York, NY – August 07, 2025 – The Global Well Cementing Market is projected to reach USD 15.7 billion by 2034, up from USD 9.1 billion in 2024, with a CAGR of 5.6% from 2025 to 2034. In 2024, North America led the market, holding a 44.7% share, equivalent to USD 4.0 billion in revenue.

Well cementing concentrates are vital in the oil and gas industry, used during drilling and well completion to seal the annular space between the casing and borehole, preventing fluid migration and ensuring well integrity. The U.S. Department of Energy notes that cementing is critical for long-term well safety, with approximately 50% of well failures linked to poor cementing practices.

The market is driven by technological advancements in oil and gas extraction and rising global energy demand, which the U.S. Energy Information Administration (EIA) projects will increase by 28%. This growth fuels exploration in offshore and deepwater fields, increasing the need for high-quality cementing solutions. Stringent regulations, such as the U.S. Environmental Protection Agency’s guidelines under the Safe Drinking Water Act, further emphasize proper cementing to protect drinking water sources.

The U.S. Department of Energy reported a 12% rise in oil and gas wells, amplifying demand for effective cementing techniques. Key growth drivers include expanded drilling in offshore and unconventional fields, particularly in North America and the Middle East. The International Energy Agency (IEA) forecasts that U.S. shale gas production will account for 75% of the nation’s natural gas output, significantly boosting the need for robust cementing solutions to support the growing number of wells.

Key Takeaways

- Well Cementing Market size is expected to be worth around USD 15.7 Billion by 2034, from USD 9.1 Billion in 2024, growing at a CAGR of 5.6%.

- Primary held a dominant market position, capturing more than a 72.4% share in the Well Cementing Market.

- Oil held a dominant market position, capturing more than a 67.9% share in the Well Cementing Market.

- Onshore held a dominant market position, capturing more than a 69.2% share in the Well Cementing Market.

- North America held a dominant position in the global Well Cementing Market, capturing approximately 44.7% of the total market share. The region accounted for a market value of nearly USD 4.0 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/well-cementing-market/request-sample/

Report Scope

| Market Value (2024) | USD 9.1 Billion |

| Forecast Revenue (2034) | USD 15.7 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Type (Primary, Remedial, Others), By Well Type (Oil, Gas, Shale Gas), By Application (Onshore, Offshore) |

| Competitive Landscape | Halliburton, Schlumberger, COSL-China Oilfield Services Limited, Baker Hughes, C&J Energy Services, Trican Well Service Ltd., Superior Energy Services, Weatherford, Calfrac Well Services Ltd., Sanjel Energy Services, Gulf Energy SAOC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153620

Key Market Segments

By Type Analysis

Primary Cementing Commands 72.4% Market Share in 2024, Driven by Its Role in Well Integrity

In 2024, primary cementing led the Well Cementing Market by type, holding a 72.4% share. This dominance stems from its critical function in ensuring structural integrity and zonal isolation during well construction. Primary cementing seals the annulus between the casing and borehole, protecting freshwater zones and supporting long-term casing stability.

Its widespread use in onshore and offshore drilling, particularly in deepwater and unconventional wells facing high-pressure and high-temperature conditions, drives demand. Stringent regulations emphasizing well integrity and environmental safety further prioritize high-quality primary cementing practices.

By Well Type Analysis

Oil Wells Lead with 67.9% Share in 2024, Fueled by Global Drilling Surge

In 2024, oil wells dominated the Well Cementing Market by well type, capturing a 67.9% share. This reflects the global reliance on crude oil and sustained exploration and production activities to meet energy demand. Cementing in oil wells ensures wellbore stability, protects water zones, and maintains casing integrity during drilling and production.

Increased drilling in offshore and onshore fields, especially in the Middle East, North America, and Asia-Pacific, boosts demand for cementing services. Oil-producing nations are expanding budgets to access new and existing reserves, reinforcing the need for reliable cementing processes.

By Application Analysis

Onshore Cementing Holds 69.2% Share in 2024, Supported by Growing Land-Based Drilling

In 2024, onshore cementing led the Well Cementing Market by application, with a 69.2% share. This is driven by the high volume of land-based oil and gas wells in regions like North America, the Middle East, and Asia.

Onshore projects, being more cost-effective and logistically simpler than offshore operations, attract sustained investment for faster project execution. The redevelopment of mature onshore fields and new exploration in untapped reserves further increase demand for cementing services, which are essential for securing casings, preventing fluid migration, and ensuring long-term well performance.

Regional Analysis

North America Dominates with 44.7% Share in 2024, Valued at USD 4.0 Billion

In 2024, North America led the global Well Cementing Market, holding a 44.7% share valued at USD 4.0 billion. The region’s dominance is driven by robust upstream activities in the United States and Canada. The U.S., supported by a strong oilfield service infrastructure and favorable regulations, saw crude oil production average 12.9 million barrels per day in 2024, per the U.S. Energy Information Administration, boosting cementing demand for new wells and maintenance.

In Canada, oil sands and unconventional resource development further drive demand, particularly for primary cementing in onshore wells. Advanced cementing additives are increasingly adopted to ensure zonal isolation, minimize environmental risks, and meet stringent well integrity standards.

Top Use Cases

- Zonal Isolation: Well cementing seals the space between the casing and borehole, preventing fluid movement between geological layers. This ensures oil and gas stay separated from water zones, reducing contamination risks. It’s critical for safe and efficient hydrocarbon extraction, especially in complex reservoirs.

- Casing Protection: Cementing secures the steel casing in the wellbore, protecting it from corrosion caused by harsh underground fluids. This strengthens the well’s structure, extending its lifespan and ensuring operational safety in high-pressure or high-temperature environments.

- Well Stability: Cementing fills voids in the wellbore, providing structural support to the casing. This prevents collapse under pressure, ensuring the well remains stable during drilling and production. It’s essential for both onshore and offshore wells.

- Environmental Protection: By sealing the wellbore, cementing prevents leaks that could contaminate groundwater or surface ecosystems. This is vital for meeting strict environmental regulations and reducing the risk of spills in sensitive areas like offshore fields.

- Enhanced Oil Recovery (EOR): Cementing supports EOR techniques by ensuring proper sealing in wells using water or gas injection. This maintains pressure and prevents fluid leaks, improving oil extraction efficiency from mature reservoirs.

Recent Developments

1. Halliburton

- Halliburton has introduced Cementium, a digital well cementing platform that optimizes slurry design and real-time monitoring. The solution enhances zonal isolation and reduces environmental impact. Additionally, Halliburton’s iCement service integrates AI for predictive cementing performance. The company also expanded its LifeCem CO₂-resistant cement for carbon capture and storage (CCS) wells.

2. Schlumberger (Now SLB)

- SLB launched Cementis, an AI-driven cementing optimization system that improves well integrity. Their EcoShield geopolymer cement reduces CO₂ emissions. SLB also partnered with Aker BP to deploy automated cementing solutions in the North Sea, enhancing efficiency.

3. COSL (China Oilfield Services Limited)

- COSL developed high-temperature-resistant cement for deepwater wells in the South China Sea. They also introduced nanotechnology-enhanced cement for better durability in shale formations. COSL is expanding digital cementing monitoring with IoT sensors.

4. Baker Hughes

- Baker Hughes introduced TerraCem Synergy, an eco-friendly cement system that cuts emissions. Their RemoteCem digital platform enables real-time cementing diagnostics. The company also deployed self-healing cement for long-term well integrity in harsh environments.

5. C&J Energy Services (Now NexTier)

- NexTier (formerly C&J) has enhanced its OptiCem software for optimized slurry designs. They also introduced low-density foam cement for weak formations. Their SmartCem system uses real-time data analytics to improve cement job accuracy.

Conclusion

The Well Cementing Market is growing steadily due to rising global demand for oil and gas, increased exploration in unconventional reserves, and stricter environmental regulations. Innovations like eco-friendly cement and real-time monitoring are driving efficiency and sustainability. With expanding offshore and shale gas activities, the market is poised for strong growth, offering opportunities for advanced solutions and cost-effective practices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)