Table of Contents

Overview

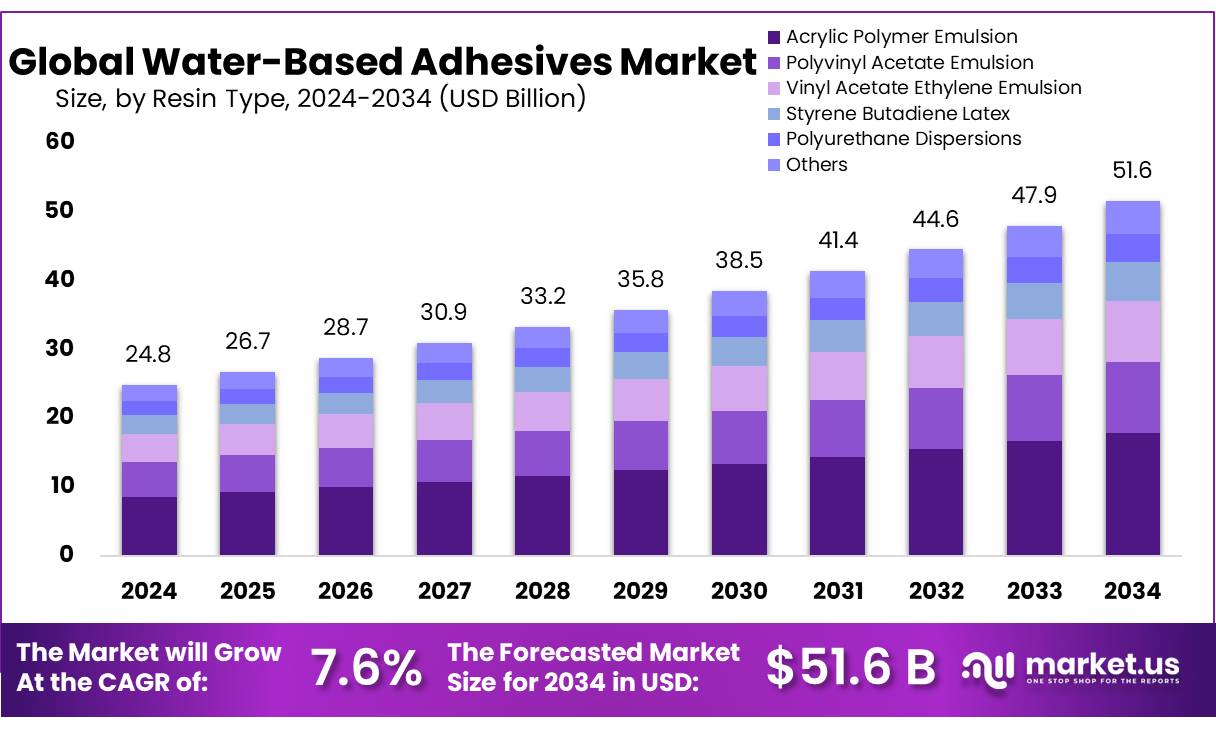

New York, NY – September 15, 2025 – The Global Water-Based Adhesives Market is projected to reach USD 51.6 billion by 2034, up from USD 24.8 billion in 2024, with a CAGR of 7.6% during the 2025–2034 forecast period. In 2024, North America led the market, holding a 48.9% share and generating USD 12.1 billion in revenue.

Water-based adhesive concentrates, such as acrylic, VAE, and PVA polymer dispersions, are critical binders in industries like packaging, paper converting, woodworking, hygiene, and select assembly lines. These formulations offer fast setting, clean application, and low residual monomer/VOC emissions compared to solvent-based systems. In Europe, polymer-dispersion/emulsion chemistries represent over 45% of adhesive volume demand, highlighting the dominance of water-based technologies in industrial applications.

Regulatory focus on packaging circularity is a key demand driver. The EU produced 83.4 million tonnes of packaging waste (186.5 kg per capita). The EU’s Packaging & Packaging Waste Regulation (PPWR), effective from 11 February 2025 and applicable 18 months later, enforces stricter rules on recyclability, recycled content, and waste reduction. This pushes brand owners and converters toward water-based adhesives, which support fiber and film recycling due to their low solvent content and repulpability-friendly properties.

Key Takeaways

- Water-Based Adhesives Market size is expected to be worth around USD 51.6 Billion by 2034, from USD 24.8 Billion in 2024, growing at a CAGR of 7.6%.

- Acrylic Polymer Emulsion held a dominant market position, capturing more than a 34.7% share in the water-based adhesives market.

- Paper & Packaging held a dominant market position, capturing more than a 36.9% share in the water-based adhesives market.

- North America held the leading position in water-based adhesives, capturing 48.9% of global demand, valued at USD 12.1 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/water-based-adhesives-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 24.8 Billion |

| Forecast Revenue (2034) | USD 51.6 Billion |

| CAGR (2025-2034) | 7.6% |

| Segments Covered | By Resin Type (Acrylic Polymer Emulsion, Polyvinyl Acetate Emulsion, Vinyl Acetate Ethylene Emulsion, Styrene Butadiene Latex, Polyurethane Dispersions, Others), By Application (Paper and Packaging, Woodworking, Building and Construction, Automotive and Transportation, Others) |

| Competitive Landscape | Henkel AG & Co. KgaA, H.B. Fuller, Arkema, Dow, Ashland, Bayer AG, PPG Industries, Sika AG, Akzo Nobel N.V., 3M, DuPont |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155396

Key Market Segments

Resin Type Analysis

In 2024, Acrylic Polymer Emulsion led the water-based adhesives market with a 34.7% share, favored across industries like packaging, woodworking, textiles, and construction. Its robust bonding strength, resistance to yellowing, and compatibility with diverse substrates make it a top choice.

With low volatile organic compound (VOC) emissions, it meets stringent regulations like the U.S. EPA’s adhesive emission standards and the EU’s REACH framework, appealing to manufacturers prioritizing compliance and performance. The surge in e-commerce and policies curbing single-use plastics has further boosted demand for acrylic emulsions in paper and board packaging.

Application Analysis

In 2024, the Paper & Packaging segment dominated the water-based adhesives market with a 36.9% share, driven by the global shift toward sustainable packaging and e-commerce growth. These adhesives, often acrylic or starch-based, provide strong bonding for cartons, corrugated boxes, and paper wraps while offering low VOC emissions and recyclability. This aligns with initiatives like the European Green Deal’s packaging waste targets and U.S. state-level bans on single-use plastics, which encourage the adoption of eco-friendly, paper-based packaging solutions.

Regional Analysis

In 2024, North America led the global water-based adhesives market, holding a 48.9% share worth USD 12.1 billion. The region’s dominance is supported by a robust adhesives ecosystem, with the Adhesive & Sealant Council estimating the North American adhesives and sealants industry at USD 22 billion and over 28,000 jobs.

The U.S. drives this growth, propelled by strict regulations from the U.S. Environmental Protection Agency (EPA) limiting VOC emissions, encouraging industries to adopt low-toxicity water-based adhesives. These adhesives are widely used in packaging, construction, automotive, and woodworking, aligning with the region’s push for sustainable manufacturing practices.

Top Use Cases

- Packaging Industry: Water-based adhesives are key for sealing cartons, boxes, and paper wraps in the fast-growing e-commerce world. They offer strong, quick bonds on porous materials like cardboard, while keeping emissions low to meet green rules. This helps cut plastic use and boosts recycling, making packaging faster and friendlier for brands shipping billions of items yearly.

- Woodworking and Furniture: In making cabinets, chairs, and floors, these glues join wood pieces tightly without harming the environment. They dry clear, resist moisture, and work well on uneven surfaces, saving time in factories. With home building booming, they support eco-friendly designs that last, reducing waste in a sector hungry for sustainable options.

- Textile and Apparel: For bonding fabrics, foams, and linings in clothes, shoes, and car seats, water-based adhesives provide flexible holds that flex with movement. They’re safe for skin, easy to clean up, and low-odor, fitting fashion’s push for green production. This versatility cuts costs in high-volume sewing lines worldwide.

- Bookbinding and Labeling: These adhesives stick pages, covers, and labels on books, bottles, and jars with durable, water-resistant bonds. Ideal for porous paper, they speed up printing presses and allow easy bottle recycling in drinks. As reading and branding grow, they help publishers and bottlers stay compliant and efficient.

- Construction Applications: Used for tiling floors, laminating panels, and gluing drywall, water-based adhesives ensure safe, strong fixes in homes and offices. Low toxicity means better worker health, and it aligns with green building codes. With urban growth, they enable faster installs while lowering energy use in massive projects.

Recent Developments

1. Henkel AG & Co. KgaA

Henkel is advancing its water-based adhesive portfolio with a strong focus on sustainability and digital printing compatibility. Their recent innovations include developing solutions for recyclable packaging that meet stringent regulatory demands. They are also creating high-performance products for the construction sector, emphasizing low VOC content and enhanced durability to replace solvent-based systems in various applications.

2. H.B. Fuller

H.B. Fuller is pioneering next-generation water-based adhesives designed for circular economy principles. Their recent work includes developing adhesives that enable full packaging recyclability by creating repulpable and recyclable bonds. They also introduced new products with improved initial tack and heat resistance for the woodworking and flexible packaging industries, aiming to provide sustainable alternatives without compromising on performance.

3. Arkema

Through its Bostik brand, Arkerya is innovating in high-performance water-based adhesives for construction and packaging. A key development is their new generation of acrylics offering superior adhesion to difficult substrates. They are also focusing on bio-based raw materials to reduce the carbon footprint of their products, aligning with their sustainability goals and responding to the demand for greener adhesive solutions.

4. Dow

Dow is leveraging its materials science expertise to create innovative water-based adhesive technologies. Recent developments include acrylic and vinyl acetate-ethylene (VAE) emulsions that enhance performance in demanding applications like textiles and wood assembly. A major focus is on improving the end-of-life profile of products, creating adhesives that support recycling and the use of recycled content in packaging.

5. Ashland

Ashland is focusing on innovative, sustainable thickeners and additives that enhance the performance of water-based adhesive formulations. Their recent developments include bio-based and synthetic associative thickeners that provide superior application properties and stability. They are also creating new polymer emulsions designed to improve wet tack and final bond strength on non-porous surfaces, expanding the use of water-based systems.

Conclusion

Water-Based Options surging is driven by tough eco-rules, e-commerce boom, and green building trends; these glues shine for their low emissions, strong performance, and cost savings in packaging, auto, and construction. Innovations like bio-based formulas will tackle drying times, opening doors in emerging Asia markets. Overall, they’re set to dominate as industries chase sustainability without sacrificing quality— a smart bet for future-proof growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)