Table of Contents

Introduction

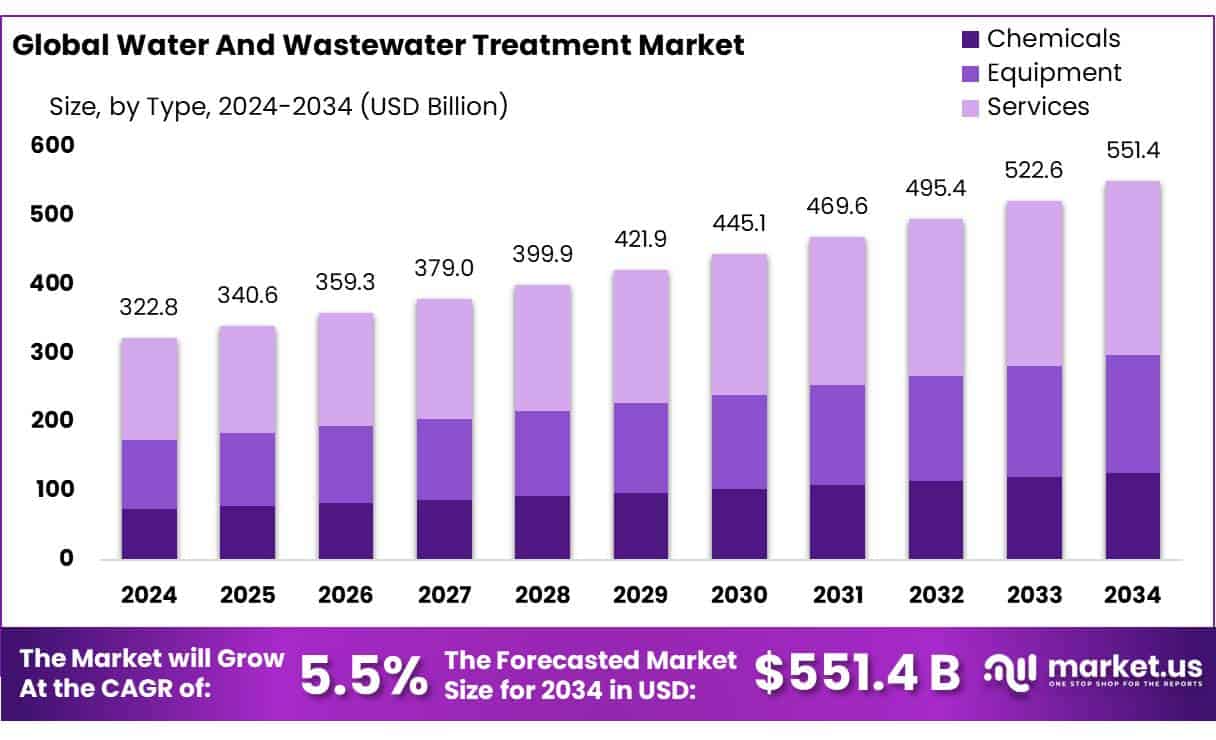

The global water and wastewater treatment market is projected to reach approximately USD 551.4 billion by 2034, up from USD 322.8 billion in 2024, growing at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2034. In 2024, North America led the market, accounting for a dominant 47.2% share, with revenue valued at USD 152.3 billion. This growth is largely driven by increasing environmental regulations, rapid urbanization, and the urgent need for improved sanitation infrastructure.

In developing regions, the treatment gap is substantial. India, for example, produces nearly 38,354 million litres per day (MLD) of municipal sewage but has the capacity to treat only 11,786 MLD, underscoring the need for significant investment in treatment systems. Government initiatives like the Jal Jeevan Mission, AMRUT, and the National Mission for Clean Ganga have prioritized the expansion of water infrastructure and the use of centralized and decentralized wastewater treatment technologies. Regulatory frameworks such as India’s National Water Policy, National Environment Policy, and National Sanitation Policy also play a crucial role in mandating wastewater reuse, quality compliance, and environmental conservation.

Globally, regulatory enforcement is accelerating. In the United States, the Environmental Protection Agency (EPA) enforces the Clean Water Act through Effluent Limitation Guidelines that cover approximately 40,000 direct-discharge industrial facilities and 129,000 point-source dischargers, all of which are required to use the best available treatment technologies. Elevated contamination levels—such as the widespread detection of PFAS in 95% of U.S. sewage sludge and downstream wastewater plants—have driven demand for more effective chemical dosing strategies. Draft EPA guidelines now propose limits for PFOA as low as 0.0009 parts per trillion, intensifying pressure on treatment facilities to adopt advanced chemical solutions.

Financial support mechanisms further enhance market expansion. In the U.S., the Clean Water State Revolving Fund and related federal infrastructure programs have allocated billions toward upgrading treatment facilities and chemical dosing systems. Similar initiatives exist in other regions, such as Brazil’s PRODES program, which reimburses up to 50% of the capital costs for new wastewater treatment plants that meet performance targets. These combined regulatory, technological, and financial factors are collectively driving sustained growth and innovation across the global water and wastewater treatment concentrates market.

Water and Wastewater Treatment Statistics

- A national mission allocated USD 51 billion to help Indian states increase household water connection coverage from 18.33% in 2019 to 100% by 2024.

- The U.S. Environmental Protection Agency (EPA) estimates that approximately 23,000 to 75,000 sanitary sewer overflows occur in the United States each year.

- Annually, between 3 billion to 10 billion gallons of untreated wastewater are discharged from sewage treatment facilities into the environment.

- Around 19% of households in the United States rely on septic systems, which can potentially contribute to groundwater contamination.

- There are approximately 14,748 publicly owned water treatment plants in the U.S., providing wastewater collection, treatment, and disposal services to nearly 238.2 million people.

- Toilets, showers, and faucets account for 62% of total indoor water usage, highlighting key areas for water efficiency improvements.

- A rising number of companies are seeking certification under ISO 14001, the international environmental management standard managed by the International Organization for Standardization (ISO).

- In 1993, over 46,000 companies were ISO 14001 certified worldwide. By 2010, this figure had grown to more than 400,000 companies across 171 countries.

- In 2010, California recycled approximately 650,000 acre-feet of water per year. The state set targets to increase water recycling to 1 million acre-feet by 2020 and 2 million acre-feet by 2030.

- After stabilization, more than 50% of qualified biosolids are applied for beneficial use in agriculture, forestry, land reclamation, and urban parks.

- A National Academy of Sciences report found that coastal cities in the U.S. could expand their water supply by 27% through the reuse of treated wastewater.

- Florida leads the nation in water reuse, with approximately 719 million gallons of reclaimed water utilized daily for various beneficial purposes.

Emerging Trends

Direct Potable Reuse (DPR) and Sewage Recycling: Direct potable reuse involves treating wastewater to drinking water standards without intermediate steps like river storage. This method is gaining traction in water-scarce regions due to its cost-effectiveness and efficiency. For instance, the Groundwater Replenishment System in California processes up to 130 million gallons daily, supplying 45% of central Orange County’s water.

Zero Liquid Discharge (ZLD) Systems: ZLD technologies aim to eliminate liquid waste by recovering all water from industrial effluents. These systems are particularly beneficial for industries like semiconductors, where stringent discharge regulations are in place. ZLD processes utilize advanced techniques such as reverse osmosis and evaporation to achieve near-total water recovery.

Artificial Intelligence (AI) and Smart Water Management: AI is revolutionizing wastewater treatment by enabling predictive maintenance, optimizing chemical dosing, and enhancing energy efficiency. Smart sensors and data analytics facilitate real-time monitoring, leading to proactive management of treatment processes and reduced operational costs.

Public Perception and Education: Overcoming public skepticism remains a challenge for initiatives like direct potable reuse. Educational campaigns and transparent communication are essential to build trust and acceptance among communities regarding recycled water initiatives.

Innovative Algal-Based Treatment Solutions: Algal-based treatment systems utilize microalgae to treat wastewater while producing biofuels. These systems offer a sustainable alternative to traditional methods, integrating wastewater treatment with renewable energy production.

Use Cases

Richmond Hill, Georgia (USA): A municipal water reclamation facility treats 3 million gallons per day (~11million liters/day) of wastewater, which is then used for landscape irrigation and wetland maintenance. The $25 million investment supports both regulatory compliance and sustainable resource management.

Tallahassee Southeast Farm, Florida (USA): Since 1984, the Thomas P. Smith Water Reclamation Facility has repurposed 17–18 million gallons/day of treated effluent to irrigate crops such as corn, soybeans, and hay, demonstrating long-term viability of large-scale water reuse.

Denver, Colorado (USA): Denver’s Direct Potable Reuse Project ran continuously for five years, showing reclaimed water met or exceeded drinking standards comparable to conventional supply, with rigorous chemical and microbiological safety validation. More than 50,000 residents participated in public outreach, reflecting cautious public acceptance under informed conditions.

Septic and Clustered Systems, USA: Decentralized wastewater systems treat over 4 billion gallons/day in the U.S., supporting over 20% of homes outside urban sewer networks. These systems help save on infrastructure—up to 60% less than centralized systems.

Water & Carbon Group Investment: The company received USD 14.5 million to commercialize container-sized PFAS treatment plants capable of the selective removal of PFAS in complex waste streams, with one plant handling 378,000 liters/day in Pennsylvania.

Major Challenges

Aging Infrastructure and Maintenance Deficits: Many water and wastewater treatment facilities worldwide are operating with outdated infrastructure. In the United States, for instance, the American Society of Civil Engineers (ASCE) has highlighted that a significant portion of wastewater treatment plants (WWTPs) are over 30 years old, leading to increased maintenance costs and reduced efficiency. The ASCE’s 2025 Infrastructure Report Card notes that approximately 55% of WWTPs do not meet effluent standards, with some lacking proper monitoring systems.

Untreated or Inadequately Treated Wastewater: Globally, a substantial amount of wastewater is either untreated or inadequately treated before being discharged into the environment. According to UN-Water, an estimated 90% of all wastewater in developing countries is discharged untreated directly into rivers, lakes, or oceans, leading to severe environmental and public health issues.

Emerging Contaminants and Chemical Pollutants: The presence of emerging contaminants, such as pharmaceuticals, personal care products, and industrial chemicals, poses significant challenges to wastewater treatment processes. These substances are often not effectively removed by conventional treatment methods, leading to their persistence in water bodies. For example, studies have detected high levels of PFAS (per- and polyfluoroalkyl substances), known as “forever chemicals,” in treated wastewater effluents, raising concerns about their long-term environmental and health impacts.

Energy Consumption and Greenhouse Gas Emissions: Wastewater treatment processes are energy-intensive, contributing to significant greenhouse gas emissions. In the United States, wastewater treatment facilities account for about 2% of the nation’s electricity use. In 2022, energy-related emissions from these facilities were estimated at 11.3 teragrams of CO2 equivalent, along with substantial amounts of sulfur dioxide and nitrogen oxides.

Sanitary Sewer Overflows (SSOs) and Raw Sewage Discharges: Sanitary sewer overflows occur when untreated sewage is discharged into the environment due to system malfunctions or overflows. The U.S. Environmental Protection Agency (EPA) estimates that at least 23,000 to 75,000 SSO events occur annually in the United States, leading to significant public health risks and environmental damage.

Market Growth Opportunities

Artificial Intelligence (AI) and Operational Intelligence: AI is being utilized to optimize wastewater treatment processes, enabling predictive maintenance and real-time monitoring. This leads to improved efficiency and reduced operational costs.

Smart Monitoring Systems: The adoption of Internet of Things (IoT) devices allows for continuous monitoring of water quality and infrastructure health, facilitating timely interventions and enhancing system reliability.

Membrane Filtration and UV Disinfection: These technologies are gaining traction for their effectiveness in removing contaminants and pathogens, ensuring safe and clean water supply.

Advanced Treatment Technologies: The development and implementation of technologies capable of removing pharmaceuticals, personal care products, and industrial chemicals from wastewater are critical to ensuring water safety.

Regulatory Compliance: Stricter regulations are prompting industries to adopt advanced treatment solutions to meet water quality standards.

Investment in Infrastructure: PPPs are enabling the construction and operation of advanced treatment facilities, addressing the growing demand for clean water and wastewater management.

Risk Sharing: These partnerships distribute financial and operational risks, encouraging private sector involvement in public utility projects.

Key Players Analysis

In 2023, SUEZ Environnement S.A. produced 29,715 megalitres of recycled water and supplied 83,565 tonnes of biosolids to farmers in South Australia. The company achieved a 12% reduction in its waste footprint compared to the previous year. Additionally, SUEZ initiated large-scale projects, such as the anaerobic digester at the Pau wastewater treatment plant in France, to produce energy from wastewater and waste .

In 2023, Xylem Inc. reported a revenue of $7.4 billion, a 33% increase from the previous year. The company expanded its portfolio by acquiring Evoqua Water Technologies in May 2023, enhancing its capabilities in water and wastewater treatment solutions . In 2024, Xylem’s revenue rose to $8.6 billion, driven by robust demand for its water infrastructure and treatment products .

In 2024, DuPont de Nemours, Inc. received the Global Sustainability Leadership Award from the International Desalination and Reuse Association (IDRA) for its efforts in implementing UN Sustainable Development Goal 6: Water for All. This recognition highlights DuPont’s commitment to sustainable water management practices. Additionally, DuPont announced plans to spin off its water technology business, valued at approximately $1.5 billion, as part of a broader strategy to separate into three independent publicly traded companies. The separation is expected to be completed by the spring of 2026 .

In 2023, 3M Company agreed to a settlement with U.S. public water suppliers to address contamination from per- and polyfluoroalkyl substances (PFAS) in drinking water. The settlement, which received final court approval in 2024, requires 3M to pay up to $10.3 billion over 13 years to assist water utilities with remediation and testing efforts . Additionally, 3M announced plans to exit all PFAS manufacturing by the end of 2025, reflecting its commitment to addressing environmental concerns associated with these substances .

In 2024, Pentair plc reported annual sales of $4.1 billion, with the Water Solutions segment contributing $255 million in operating income. The company launched an updated supplier sustainability assessment, focusing on greenhouse gas emissions and waste reduction. Despite a 4% decline in Water Solutions sales compared to 2023, Pentair achieved a 22.6% return on sales in this segment, up from 21.0% in the previous year. The company also reported free cash flow of $693 million for the year.

In the 2023/24 period, United Utilities Group PLC invested £1.479 million more in wholesale water projects compared to the previous year, reflecting ongoing infrastructure development. The company achieved a 79% success rate in meeting its performance commitments, including an 18th consecutive year of meeting its leakage target. Looking ahead, United Utilities plans to invest £256 million to improve smart meter coverage and £2.5 billion to reduce storm overflow spills by 33% over the 2025–2030 period.

Conclusion

In conclusion, the water and wastewater treatment industry is at a pivotal juncture, with substantial growth prospects driven by technological innovations, regulatory developments, and the need for sustainable water management practices. Stakeholders across the sector must focus on adopting advanced technologies, implementing resource recovery strategies, and investing in infrastructure to ensure a sustainable and resilient water future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)