Table of Contents

Overview

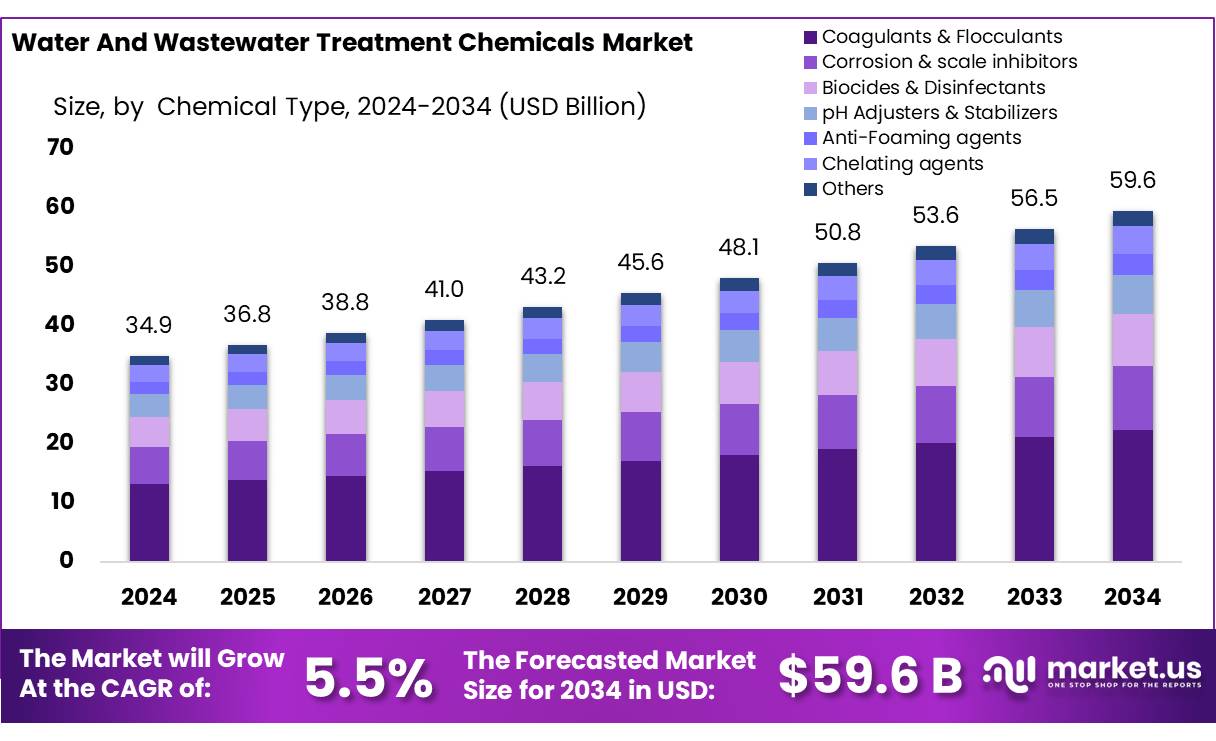

New York, NY – August 06, 2025 – The Global Water and Wastewater Treatment Chemicals Market is projected to grow from USD 34.9 billion in 2024 to USD 59.6 billion by 2034, with a CAGR of 5.5% during the forecast period (2025–2034). In 2024, North America led the market, accounting for a 34.8% share and generating USD 12.1 billion in revenue.

This industry encompasses specialized chemicals, coagulants, flocculants, biocides, scale inhibitors, corrosion inhibitors, and pH adjusters used to treat industrial and municipal wastewater by removing contaminants, pathogens, and emerging pollutants. These chemicals facilitate primary, secondary, and tertiary treatment processes to meet discharge regulations and promote water reuse.

Market growth is driven by government investments in water infrastructure. In India, the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) 2.0 allocated ₹800 crore to Delhi for sewage infrastructure upgrades, including 2.5 lakh new sewer connections and recycling 50 million liters of water daily. The Jal Jeevan Mission, with a ₹3.60 lakh crore investment (₹2.08 lakh crore from the central government), aims to provide tap water to all rural households by 2024.

Globally, regulatory frameworks bolster demand. In the U.S., the Clean Water State Revolving Fund (CWSRF) has provided over USD 153.6 billion in low-interest loans since 1988 for wastewater facility upgrades. The United Nations’ Sustainable Development Goal 6 targets halving untreated wastewater and increasing recycling, supported by USD 9 billion in water sector ODA in 2018.

UN-Water data from 2022 indicates 76% of wastewater received some treatment, but only 60% achieved safe secondary treatment, with industrial wastewater treatment at 38% and safe treatment at 27% across 22 countries. In the EU, the Urban Waste Water Treatment Directive (91/271/EEC) mandates treatment for populations over 2,000–10,000, with upcoming revisions targeting energy neutrality and stricter limits on nitrogen, phosphorus, and micropollutants. The wastewater sector currently consumes 0.8–1% of global energy, potentially increasing by 60% without efficiency gains.

Key Takeaways

- The Global Water and Wastewater Treatment Chemicals Market is projected to reach USD 59.6 billion by 2034, up from USD 34.9 billion in 2024, reflecting a CAGR of 5.5% during the forecast period.

- In 2024, Coagulants & Flocculants emerged as the leading chemical type, accounting for over 37.6% of the total market share.

- Liquid form chemicals held the dominant position by form, contributing to more than 68.9% of the market share in 2024, driven by their ease of use and dosing efficiency.

- Synthetic chemicals captured a substantial 85.1% share in 2024, making them the most widely used type due to their consistent performance and industrial compatibility.

- Based on end-user analysis, Municipal Water and Water Treatment led the market with over 48.2% share in 2024, supported by increasing urban sanitation needs and public water infrastructure.

- Regionally, North America commanded a significant 34.8% share, which is valued at approximately USD 12.1 billion in 2024, underpinned by strong regulatory enforcement and industrial demand.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/water-and-wastewater-treatment-chemicals-market/request-sample/

Report Scope

| Market Value (2024) | USD 34.9 Billion |

| Forecast Revenue (2034) | USD 59.6 Billion |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Chemical Type (Coagulants And Flocculants, Corrosion And scale inhibitors, Biocides And Disinfectants, pH Adjusters And Stabilizers, Anti-Foaming agents, Chelating agents, Others), By Form (Liquid, Powder, Granules), By Type (Synthetic Chemicals, Natural Chemicals), By End-user (Municipal Water and Water Treatment, Chemical And Petrochemical, Food And Beverages, Oil And Gas, Healthcare, Others) |

| Competitive Landscape | Baker Hughes, BASF SE, BioMicrobics, Inc., Cortec Corporation, DuPont, Ecolab, Xylem, Gradiant Corporation, Green Water Treatment Solutions, Johnson Matthey, Kemira Oyj, Kurita Europe GmbH, Nouryon, Pentair, Solvay S.A. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153439

Key Market Segments

By Chemical Type Analysis

Coagulants & Flocculants led the global water and wastewater treatment chemicals market in 2024, holding a 37.6% share. These chemicals are critical in primary treatment, aggregating suspended particles for removal via sedimentation or filtration. Their dominance stems from strong demand in municipal wastewater treatment and industries like food processing, pulp and paper, textiles, and oil refining.

Stricter environmental regulations in 2024 drove increased use to improve effluent quality. In developing regions with growing urban populations and aging infrastructure, coagulants and flocculants are vital for managing high organic loads and turbidity, offering cost-effective solutions for water reclamation and recycling in water-stressed areas.

By Form Analysis

Liquid chemicals dominated in 2024, capturing a 68.9% market share. Their preference is driven by ease of storage, flexible dosing, and rapid reaction times in large-scale treatment systems, particularly in municipal wastewater facilities.

Liquid formulations are compatible with automated dosing systems, simplifying operations amid rising wastewater volumes from aging urban infrastructure and increasing water demand. Liquid coagulants, flocculants, disinfectants, and pH adjusters are favored for their scalability and efficiency in handling fluctuating influent volumes and pollutant loads.

By Type Analysis

Synthetic Chemicals held an 85.1% share in 2024, driven by their consistent quality, customizable compositions, and reliable performance across diverse treatment conditions. Widely used in municipal and industrial applications, synthetic coagulants, flocculants, biocides, and anti-scalants are tailored to remove heavy metals, organic waste, and pathogens, meeting stringent water quality regulations. Their scalability, long shelf life, and availability make them the preferred choice for large, continuously operating treatment plants.

By End-user Analysis

Municipal Water and Wastewater Treatment led with a 48.2% share in 2024, fueled by rising urban populations, increased household water use, and heightened focus on safe drinking water and sanitation. Municipalities, especially in developing nations, are expanding treatment capacities to comply with environmental regulations and protect public health. These facilities rely heavily on chemicals like coagulants, disinfectants, and corrosion inhibitors to treat complex wastewater loads and ensure safe water distribution or discharge, driven by significant government investments in public water infrastructure.

Regional Analysis

In 2024, North America dominated the global water and wastewater treatment chemicals market, capturing a 34.8% share, equivalent to USD 12.1 billion. This leadership is driven by stringent regulations, robust industrial infrastructure, and substantial investments in public utilities. The U.S. Clean Water Act (1972) and its ongoing updates enforce strict discharge standards, compelling municipal and industrial sectors to use advanced chemicals like coagulants, biocides, corrosion inhibitors, and pH adjusters.

Federal funding for infrastructure upgrades and private sector compliance efforts has sustained high chemical demand, with the U.S. market alone valued at approximately. High industrial activity in power generation, petrochemicals, food processing, and pharmaceuticals fuels demand, with nearly 50% of regional chemical sales supporting industrial applications. These sectors rely on chemicals for cooling water systems, boiler treatment, and membrane processes to ensure equipment efficiency and prevent scaling and corrosion.

Top Use Cases

- Municipal Water Treatment: These chemicals purify drinking water for cities by removing contaminants and pathogens. Coagulants and flocculants help clear sediments, while disinfectants eliminate harmful bacteria, ensuring safe water for homes. This supports public health and meets strict water quality regulations, especially in urban areas with growing populations.

- Industrial Wastewater Management: Factories use treatment chemicals to clean wastewater from processes like manufacturing and oil refining. Chemicals like biocides and scale inhibitors prevent equipment damage and ensure compliance with environmental rules, reducing pollution and enabling water reuse in industries such as power generation and chemicals.

- Desalination Processes: In regions with scarce freshwater, desalination plants use chemicals to treat seawater for drinking or industrial use. Antiscalants prevent equipment scaling, while coagulants remove impurities. This supports water supply in arid areas like the Middle East, meeting rising demands from urbanization and industrial growth.

- Cooling and Boiler Systems: Power plants and industries rely on chemicals to maintain cooling towers and boilers. Corrosion inhibitors protect equipment, while biocides control microbial growth. These chemicals ensure efficient operations, reduce maintenance costs, and extend system lifespans, especially in energy and manufacturing sectors with high water usage.

- Agricultural Water Treatment: Farms use treatment chemicals to purify water for irrigation and livestock. Coagulants and disinfectants remove pollutants, ensuring safe water for crops and animals. This supports food safety and boosts agricultural productivity, especially in regions facing water scarcity and stricter environmental standards.

Recent Developments

1. Baker Hughes

Baker Hughes has introduced METHANOL GUARD, a new solution to prevent methanol loss in wastewater treatment. This technology reduces operational costs and environmental impact in oil & gas wastewater systems. The company is also advancing digital solutions for real-time water treatment monitoring.

2. BASF SE

BASF launched Zetag ULTRA, a new high-performance flocculant for sludge dewatering, improving efficiency in municipal and industrial wastewater treatment. They also expanded their Sokalan product line for scale and corrosion inhibition in harsh water conditions.

3. BioMicrobics, Inc

BioMicrobics enhanced its Integrated Fixed-Film Activated Sludge (IFAS) systems with bioaugmentation to improve nutrient removal in wastewater. Their solutions now integrate smart sensors for better process control in decentralized treatment.

4. Cortec Corporation

Cortec introduced EcoShield, a biodegradable water treatment chemical for corrosion and scale prevention in industrial systems. They also expanded VpCI technology for municipal water treatment, reducing heavy metal discharge.

5. DuPont

DuPont’s FilmTec Fortlife series now includes advanced antifouling reverse osmosis membranes for industrial wastewater reuse. They also launched AmberSep, a new ion exchange resin for heavy metal removal.

Conclusion

The Water and Wastewater Treatment Chemicals Market is growing due to rising urbanization, stricter environmental regulations, and increasing industrial activities. These chemicals are vital for ensuring safe water supply, regulatory compliance, and sustainable practices across municipal, industrial, and agricultural sectors. With ongoing innovations like eco-friendly formulations, the market is poised for steady expansion to meet global water challenges.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)