Table of Contents

Overview

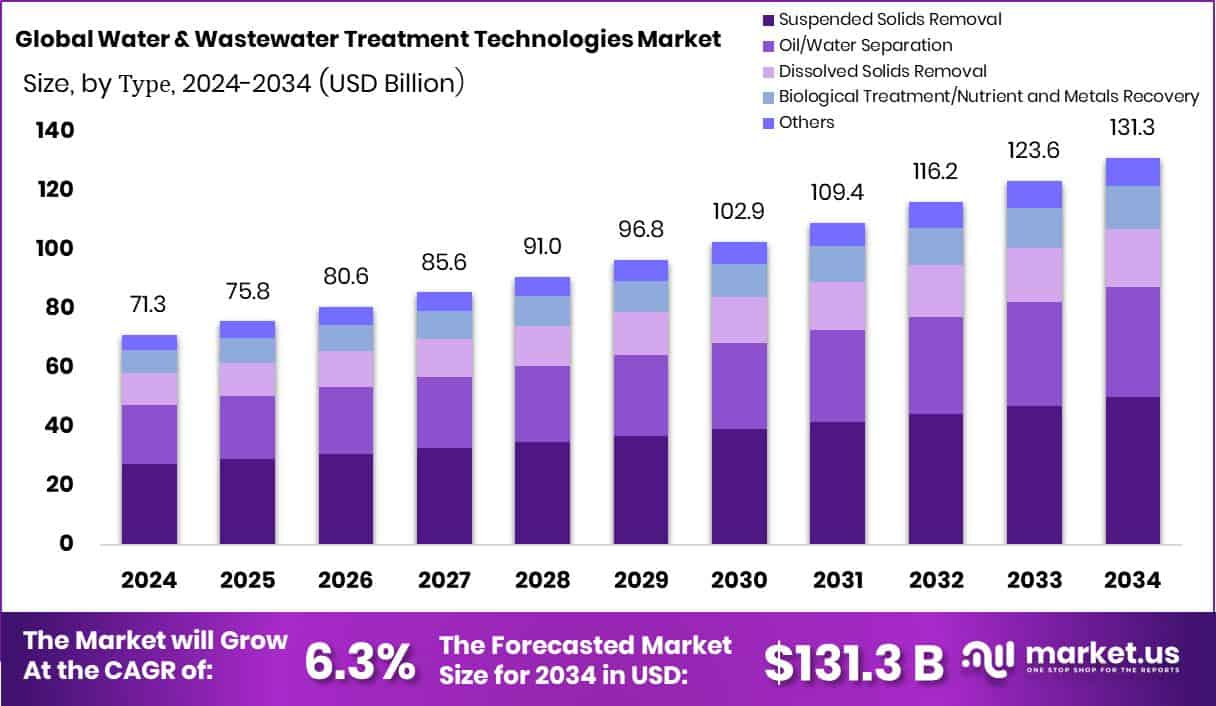

New York, NY – August 07, 2025 – The global Water and Wastewater Treatment Technologies Market is projected to reach approximately USD 131.3 billion by 2034, rising from USD 71.3 billion in 2024. This growth is expected at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2034. The Asia-Pacific region, backed by strong infrastructure investments, led the market with a valuation of USD 29.8 billion. The market includes a wide range of technologies designed to clean and treat water and wastewater, ensuring safety for consumption, industrial use, or safe environmental discharge.

These treatment technologies encompass physical, chemical, and biological methods such as filtration, sedimentation, ultraviolet disinfection, reverse osmosis, and biological digestion. The market serves a broad spectrum of applications, including drinking water purification, sewage treatment, industrial wastewater management, and water reuse systems. It supports municipal, residential, and industrial sectors, with demand increasing due to stricter environmental regulations, growing urbanization, and outdated water infrastructure.

One of the major forces behind market growth is the growing global concern over water scarcity. With only a small portion around 0.5% of Earth’s water being accessible and usable, treatment systems are vital for sustainable water management. Industrial expansion and rising urban populations continue to strain water resources, making water treatment investments critical. Governments are responding by allocating significant funding, such as a €73 million package for wastewater infrastructure upgrades and a £42 million regulatory funding round to support new treatment initiatives.

Key Takeaways

- The global Water and Wastewater Treatment Technologies Market is projected to reach USD 131.3 billion by 2034, increasing from USD 71.3 billion in 2024, with a CAGR of 6.3% during 2025–2034.

- The removal of suspended solids makes up 38.2% of the overall market share, highlighting its significance in water treatment solutions.

- Secondary treatment methods, which focus on biological and chemical processes, account for 39.4% of the market.

- The municipal sector leads among end-users with a 67.9% share, largely due to growing populations and infrastructure modernization.

- The Asia-Pacific region’s market value hit USD 29.8 billion, backed by major investments in water treatment systems.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/water-and-waste-water-treatment-technologies-market/free-sample/

Report Scope

| Market Value (2024) | USD 71.3 Billion |

| Forecast Revenue (2034) | USD 131.3 Billion |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Туре (Suspended Solids Removal, Oil/Water Separation, Dissolved Solids Removal, Biological Treatment/Nutrient and Metals Recovery, Others), By Process (Secondary, Primary, Tertiary, Advance), By End-user (Municipal, Industrial (Food and Beverage, Pulp and Paper, Oil and Gas, Healthcare, Chemical and Petrochemical, Others) ) |

| Competitive Landscape | AECOM, Aquatech International LLC, Black and Veatch Holding Company, Doosan Heavy Industries and Construction, DuPont, Ecolab, Evoqua Water Technologies LLC, Hindustan Dorr-Oliver Ltd, Hitachi, Ltd., ITT INC., Kurita Water Industries Ltd, Mott MacDonald, REMONDIS SE and Co. KG, Siemens, SLB, SUEZ, Thermax Limited, VA Tech Wabag Ltd., Veolia |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153416

Key Market Segments

1. By Type Analysis

- In 2024, suspended solids removal held the dominant position in the Water and Wastewater Treatment Technologies Market by type, accounting for 38.2% of the total market share. This segment’s strong performance can be attributed to its critical role in the initial stages of water treatment, where the removal of particulate matter such as silt, organic debris, and other impurities is necessary to maintain overall treatment efficiency. These contaminants, if left untreated, can impair the performance of downstream processes. Technologies like sedimentation, filtration, and flotation are widely adopted for their effectiveness in addressing these challenges, making solids removal a foundational element in both municipal and industrial treatment systems.

By Process Analysis

- Secondary treatment processes led the market by process in 2024, capturing 39.4% of the market share. This segment’s dominance reflects the increasing emphasis on biological treatment techniques used to break down organic pollutants in wastewater. Methods such as activated sludge systems, bio-towers, and trickling filters are commonly implemented in municipal and industrial facilities due to their efficiency in meeting discharge standards. As regulatory bodies continue to tighten environmental norms, particularly around effluent quality, secondary processes have become essential components in ensuring wastewater is treated to acceptable levels. Additionally, ongoing advancements in microbial treatment technologies and process automation have further enhanced the reliability and appeal of secondary treatment systems.

By End-user Analysis

- The municipal sector maintained a strong lead in the market by end-user in 2024, holding a substantial 67.9% market share. This dominant position is largely due to the rising demand for clean and safe water in rapidly urbanizing areas, along with the pressing need to upgrade aging public water infrastructure. Municipal authorities across the globe are increasingly focused on large scale water and wastewater treatment solutions that can handle both water supply and sewage management for growing populations. Strict environmental regulations and public health standards have further pushed municipalities to invest in advanced treatment technologies. Moreover, government-backed initiatives and funding, along with public-private partnerships, have played a key role in driving the expansion and modernization of municipal treatment facilities.

Regional Analysis

- In 2024, the Asia-Pacific region led the global Water and Wastewater Treatment Technologies Market with a dominant 41.8% market share, valued at USD 29.8 billion. This strong regional performance is largely driven by rapid urbanization, expanding industrial activity, and significant government investments in water infrastructure in key countries such as China, India, and those in Southeast Asia. The increasing need for clean water and efficient wastewater treatment solutions in these densely populated areas has resulted in the widespread adoption of advanced treatment technologies.

- North America followed closely behind, propelled by strict environmental regulations focused on water reuse, pollution control, and sustainable resource management. In countries like the United States and Canada, regulatory bodies have enforced stringent standards that have encouraged municipalities and industries to upgrade their water treatment systems. Europe also demonstrated notable growth, supported by the European Union’s Water Framework Directive, which promotes sustainable water use and reinforces environmental compliance across member nations.

- Elsewhere, the Middle East and Africa are gradually advancing in the market, particularly in water-scarce regions where wastewater reuse is gaining traction as a key strategy to combat water shortages. Latin America is also experiencing steady progress, with countries like Brazil and Mexico making consistent investments in modernizing their municipal water treatment infrastructure. Across all these regions, rising public health concerns and growing awareness of environmental sustainability are playing a crucial role in accelerating the adoption of water and wastewater treatment technologies.

Top Use Cases

- Wastewater Recycling for Potable Supply: Municipal utilities are using advanced treatment such as microfiltration, reverse osmosis, and UV to recycle sewage into safe drinking water. A notable example supplies nearly half of a region’s needs. This approach reduces reliance on external sources and supports long‑term water resilience in drought‑prone areas.

- Industrial Water Reuse Systems: Manufacturing plants like food processing, pharmaceuticals, textiles, oil & gas install closed‑loop systems that treat and reuse their process water. These systems reduce freshwater intake, lower operating costs, and ensure compliance with strict effluent regulations. Technologies like membrane filtration and biological digestion are tailored to meet specific pollutant loads efficiently.

- Agricultural Irrigation with Treated Water: Farmers in water-scarce regions irrigate with treated wastewater or brackish water. Technologies remove contaminants and pathogens, making water safe for crops. This reduces pressure on freshwater supplies while supporting sustainable farming practices. Such use aids food security and conserves resources in drought affected areas.

- Decentralized & Mobile Treatment Units: Remote communities, disaster relief sites and rural areas deploy solar‑powered or containerized treatment units. These modular systems operate autonomously, treating local water or wastewater without centralized infrastructure. Solutions often include filtration, disinfection and AI‑enabled monitoring providing rapid access to potable water in off‑grid or emergency contexts.

- Micropollutant Removal in Healthcare & Industrial Streams: Facilities such as hospitals and chemical plants use advanced oxidation processes or moving‑bed biofilm reactors to remove pharmaceuticals, pesticides or heavy metals from wastewater. This ensures hazardous micro pollutants are degraded or captured, protecting downstream ecosystems and meeting stringent environmental discharge norms.

- Smart Monitoring & Predictive Control: Treatment plants integrate IoT, sensors and AI analytics to continuously monitor water quality and equipment performance. Predictive analytics optimize chemical dosing, reduce energy usage, detect faults before downtime, and support regulatory compliance. Smart systems improve efficiency and reduce operating costs across municipal and industrial facilities.

Recent Developments

1. Black & Veatch:

- In mid‑2024, Black & Veatch was selected to engineer major upgrades at three Miami Dade wastewater treatment plants as part of an $8.6 billion capital improvement initiative. The scope includes enhancements to biological treatment, filtration, disinfection, energy recovery systems, and deep‑well injection infrastructure. A core objective is to enable the reuse of 60% of treated wastewater in line with Florida’s Ocean Outfall Legislation, boosting sustainability and operational resilience.

2. Veolia:

- In Q1 2025, Veolia secured over $750 million in new water‑technology contracts across energy and semiconductor sectors in the U.S., Brazil, and UAE. It also finalized a $1.75 billion deal to acquire the remaining 30% of its WT&S unit from CDPQ, aiming to unlock ~€90 million in cost synergies by 2027. With this, Veolia targets a 50% turnover increase in the U.S. by 2027 and plans to double its business in the U.S. by 2030.

3. Thermax Limited:

- In April 2024, Thermax inaugurated its first water and wastewater treatment manufacturing facility in Pune, India, powered entirely by solar energy and rainwater harvesting. Its water and waste solutions division has tripled in size over four years and is projected to hit an order book of ₹1,000 crore in FY‑25, growing at 20–30% annually. The company focuses on industrial and commercial deployments of RO, ZLD, effluent recycling systems, and desalination technologies.

4. Kurita Water Industries Ltd:

- Kurita has launched Kurita Kitakantou in Japan, a new local subsidiary providing integrated water treatment chemicals, equipment, and IoT‑enabled maintenance services. It also promotes cost‑saving modular wastewater solutions using FRP tower tanks that reduce civil work and cut installation costs. Kurita emphasizes digital systems to optimize chemical usage and minimize operating costs. This supports its strategy of local partnership networks, recurring solution‑based revenue, and sustainability‑driven innovation.

Conclusion

The Water and Wastewater Treatment Technologies Market is evolving rapidly, driven by global challenges such as water scarcity, pollution, and the rising demand for sustainable water use. Companies across the globe are investing in advanced technologies like membrane filtration, zero-liquid discharge, and smart monitoring systems to meet strict environmental standards.

Regions like Asia-Pacific and the Middle East are focusing on large scale infrastructure upgrades, while industrial players seek energy efficient, cost effective solutions for water reuse. Public and private sector initiatives are increasingly aligned to tackle both urban and industrial water challenges. With innovation, digital integration, and environmental responsibility at the core, this market is set for continuous growth and transformation in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)