Table of Contents

Overview

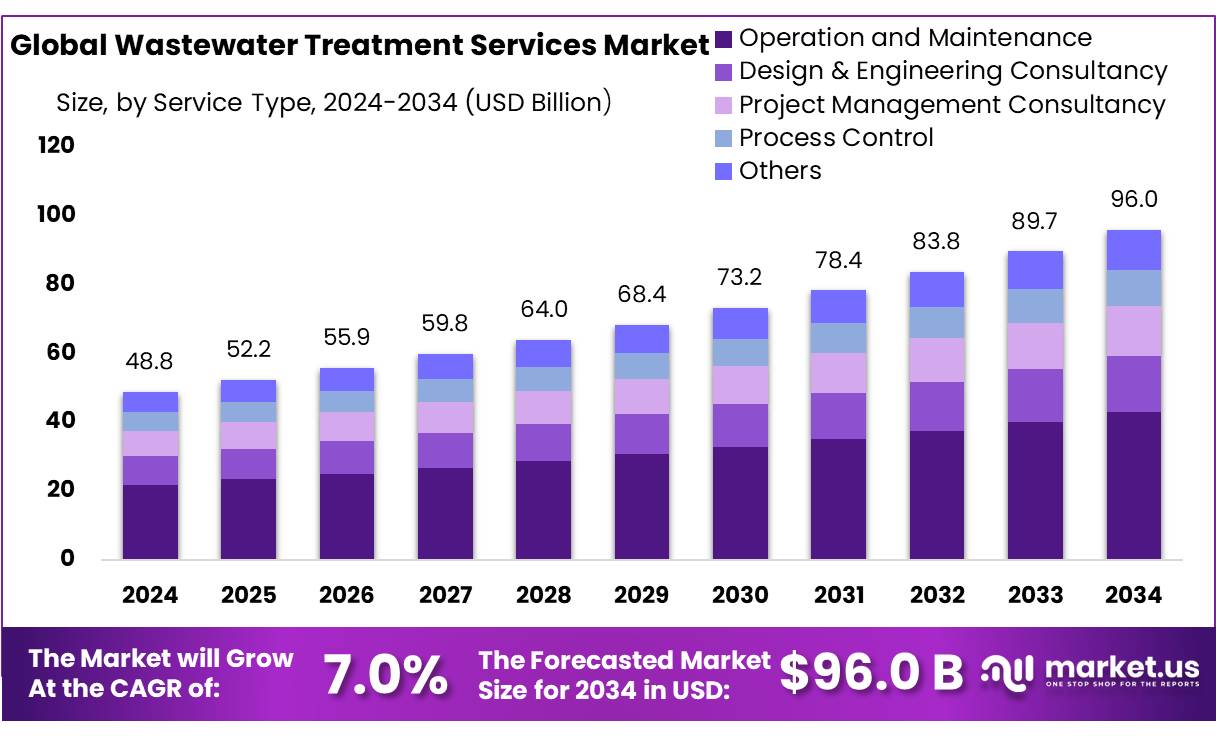

New York, NY – August 06, 2025 – The Global Wastewater Treatment Services Market is projected to reach USD 96.0 billion by 2034, up from USD 48.8 billion in 2024, with a CAGR of 7.0% during the 2025–2034 forecast period. In 2024, the Asia-Pacific (APAC) region led the market, accounting for a 41.8% share and generating USD 20.3 billion in revenue.

The wastewater treatment industry is driven by strong demand, significant public-sector involvement, and promising growth prospects. Key services, including design, engineering consulting, process control, maintenance, and operations, are essential for water infrastructure in urban and industrial areas, supporting environmental compliance and public health. Government initiatives have a significant impact on the wastewater treatment landscape. India’s Atal Mission for Rejuvenation and Urban Transformation (AMRUT) 2.0 requires cities with over 100,000 residents to recycle at least 20% of their wastewater.

The Namami Gange Programme has approved 161 sewage management projects, costing ₹24,581 crore, to develop and rehabilitate 5,501 million liters per day (MLD) of sewage treatment capacity and establish 5,134 km of sewerage networks. Additionally, the Swachh Bharat Mission and Jal Jeevan Mission bolster sanitation infrastructure and access to safe drinking water, indirectly enhancing wastewater management.

The National Mission for Clean Ganga (NMCG), part of the Namami Gange Programme, is a key driver with a budget of ₹20,000–22,500 crore (approximately USD 2.5–3 billion) from 2014 to 2026. It focuses on building and upgrading sewage treatment plants, wastewater interception and diversion, and riverfront development.

State-level efforts further support these initiatives. Maharashtra’s urban development department approved a ₹332 crore sewage pipeline project for 16 villages under the Pune Municipal Corporation, including 472 km of new collection lines, 90.5 km of main sewage lines, and eight new treatment plants. Similarly, Delhi has been allocated ₹800 crore under AMRUT 2.0 to expand its sewage infrastructure, adding approximately 250,000 new sewer connections to serve around 3.5 million residents.

Key Takeaways

- Wastewater Treatment Services Market size is expected to be worth around USD 96.0 Billion by 2034, from USD 48.8 Billion in 2024, growing at a CAGR of 7.0%.

- Operation and Maintenance held a dominant market position, capturing more than a 44.8% share of the global wastewater treatment services market.

- Industrial Wastewater held a dominant market position, capturing more than a 52.7% share of the global wastewater treatment services market.

- Asia-Pacific (APAC) region dominated the global wastewater treatment services market, accounting for a substantial 41.8% share, with a market value reaching approximately USD 20.3 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-wastewater-treatment-services-market/request-sample/

Report Scope

| Market Value (2024) | USD 48.8 Billion |

| Forecast Revenue (2034) | USD 96.0 Billion |

| CAGR (2025-2034) | 7.0% |

| Segments Covered | By Service Type (Operation and Maintenance, Design and Engineering Consultancy, Project Management Consultancy, Process Control, Others), By Application (Industrial Wastewater, Residential Wastewater, Commercial Wastewater) |

| Competitive Landscape | 3M, Acciona, American Water, Aquatech International LLC, ASIO, BioMicrobics Inc., DuPont, Ecolab Inc., Evoqua Water Technologies LLC, Hydro International, Italmatch Chemicals S.p.A., Kemira, Kurita Water Industries Ltd., Pentair PLC, SUEZ Worldwide |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153380

Key Market Segments

By Service Type Analysis

In 2024, O&M commanded a 44.8% share of the global wastewater treatment services market, propelled by the need for consistent plant operations, efficiency enhancements, and compliance with stringent environmental regulations. Public utilities and industrial sectors increasingly depend on long-term O&M contracts to ensure seamless facility performance, minimize downtime, and meet discharge standards.

These services encompass equipment maintenance, system monitoring, chemical dosing, troubleshooting, and staff training. Rising water pollution in both developed and developing regions has heightened the focus on efficient plant operations. As a result, O&M service providers offering comprehensive solutions are securing steady contract renewals and long-term partnerships, reinforcing the segment’s dominance.

By Application Analysis

In 2024, Industrial Wastewater accounted for a 52.7% share of the global wastewater treatment services market, fueled by demand for efficient effluent treatment in industries such as chemicals, textiles, pharmaceuticals, food processing, and manufacturing. Stricter environmental regulations and growing water scarcity concerns are pushing industries to prioritize wastewater recycling and safe disposal to mitigate environmental and operational risks.

Factories are increasingly adopting advanced biological and chemical treatment services to comply with discharge standards and reduce water use through recycling. This demand for specialized industrial wastewater treatment is expected to remain robust into 2025, particularly in emerging markets where industrial expansion and modernization continue.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region led the global wastewater treatment services market with a 41.8% share, valued at approximately USD 20.3 billion. This dominance is driven by rapid urbanization, industrial growth, and increasing environmental concerns over water pollution and resource scarcity. Economic development in countries like China, India, Japan, and Southeast Asian nations has boosted municipal wastewater and industrial effluent volumes, spurring demand for advanced, large-scale treatment services.

China is the region’s largest contributor, supported by its 14th Five-Year Plan, which funds water infrastructure upgrades and modern wastewater treatment plants, alongside mandates for zero-liquid discharge and reuse in sectors like textiles, electronics, and petrochemicals. India’s growth is fueled by initiatives like the Namami Gange Mission and AMRUT, which focus on river rejuvenation, urban sanitation, and sewage infrastructure development.

Japan and South Korea lead in advanced treatment technologies, including membrane filtration, biological treatment, and sludge recovery systems. The region’s emphasis on public-private partnerships and stricter compliance regulations further accelerates investments in centralized and decentralized wastewater treatment. APAC’s leadership is underpinned by regulatory momentum, infrastructure growth, and a growing focus on sustainable water management.

Top Use Cases

- Municipal Wastewater Management: Cities use wastewater treatment services to clean sewage from homes and businesses, ensuring safe disposal or reuse. These services remove harmful pollutants, protect public health, and meet strict regulations. Advanced technologies like membrane filtration help recycle water for non-drinking purposes, supporting sustainable urban water systems.

- Industrial Effluent Treatment: Factories in industries like chemicals, textiles, and food processing rely on treatment services to manage wastewater. These services remove toxins, enabling safe discharge or reuse. They help industries comply with environmental laws, reduce water use, and lower operational risks, especially in water-scarce regions.

- Agricultural Wastewater Reuse: Farms use wastewater treatment to recycle water for irrigation. Treated water from livestock or crop processing reduces freshwater demand. Services ensure water meets safety standards, preventing soil and crop contamination. This supports sustainable farming and helps address water scarcity in agricultural regions.

- Public Health Protection: Wastewater treatment services remove pathogens and pollutants from sewage, preventing waterborne diseases. They ensure clean water bodies and safe drinking water sources. By meeting health and environmental standards, these services safeguard communities, especially in densely populated urban areas with high sewage volumes.

- Environmental Compliance: Industries and municipalities use treatment services to meet strict environmental regulations. Services like chemical treatment and sludge management ensure wastewater meets discharge standards. This prevents fines, protects ecosystems, and supports corporate sustainability goals, particularly in regions with tough environmental laws.

Recent Developments

1. 3M

3M has introduced advanced filtration technologies for wastewater treatment, focusing on PFAS removal. Their innovative solutions include membrane filtration and adsorbent media to tackle emerging contaminants. 3M is also collaborating with municipalities to implement sustainable water treatment systems.

2. Acciona

Acciona has expanded its wastewater treatment projects using smart digital solutions like AI-driven monitoring. They recently completed a large-scale plant in Spain, enhancing energy efficiency and sludge management. Acciona also emphasizes circular economy approaches in water reuse.

3. American Water

American Water is investing in next-gen wastewater treatment, including nutrient recovery and biogas production. Their recent initiatives focus on green infrastructure and decentralized treatment systems to improve resilience against climate change.

4. Aquatech International LLC

Aquatech has launched advanced zero-liquid discharge (ZLD) systems, reducing wastewater disposal costs. They are also integrating IoT for real-time monitoring in industrial wastewater treatment, ensuring compliance with stricter environmental regulations.

5. ASIO

ASIO has developed compact, energy-efficient wastewater treatment units, including membrane bioreactors (MBRs). Their recent projects emphasize modular systems for urban and industrial applications, supporting water recycling and reduced carbon footprints.

Conclusion

The Wastewater Treatment Services Market is thriving due to rising urbanization, industrial growth, and stricter environmental regulations. With increasing water scarcity and public health concerns, demand for efficient treatment solutions is strong. Technologies like membrane filtration and resource recovery are driving innovation, while government initiatives and public-private partnerships fuel market growth. The industry’s future looks promising as sustainability and compliance remain key priorities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)