Table of Contents

Overview

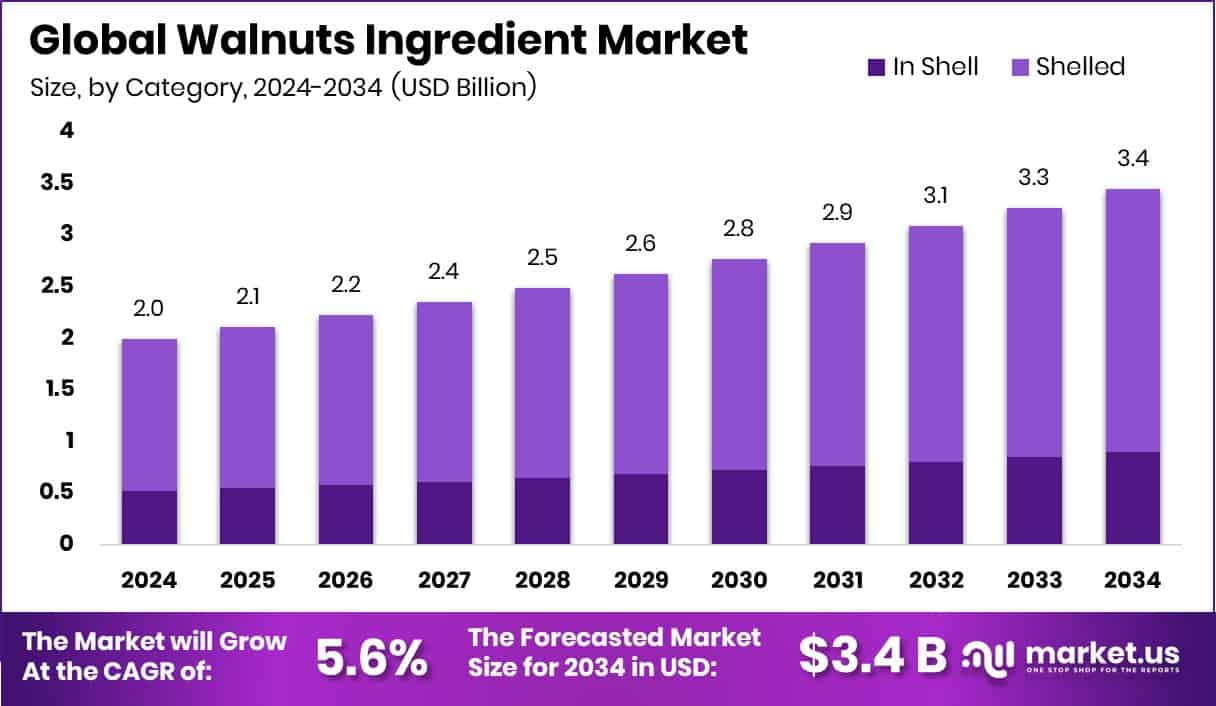

New York, NY – Aug 5, 2025 – The global walnut ingredient market is projected to reach approximately USD 3.4 billion by 2034, rising from USD 2.0 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 5.6% between 2025 and 2034. North America accounts for 37.2% of the market share, driven by robust demand for walnut-based products across the food and wellness industries.

Walnut ingredients refer to processed forms of walnuts used across various industries, including food, beverages, cosmetics, and nutraceuticals. These ingredients such as walnut kernels, oil, meal, butter, and extract offer unique nutritional and functional properties. In a recent move to strengthen global outreach, the USDA allocated $7 million to promote walnut exports from California, supporting broader availability of these ingredients worldwide.

Walnuts are naturally rich in omega-3 fatty acids, antioxidants, fiber, and protein, making them an ideal choice for health-conscious consumers. Their mild flavor and adaptable texture make them suitable for a wide range of applications, including baked goods, dairy alternatives, confectionery, sauces, and dietary supplements.

The walnut ingredient market is experiencing consistent growth, driven by increasing awareness of plant-based and heart-healthy diets. Consumers are actively seeking clean-label and natural products, pushing manufacturers to incorporate walnut-derived components into new formulations. The USDA’s export support initiative further enhances global market reach and encourages broader use of walnut ingredients.

Emerging opportunities lie in diversification and product development. The use of walnut protein and oil in plant-based dairy and meat substitutes is gaining momentum. Additionally, walnut oil and exfoliating products are becoming increasingly popular in the cosmetics sector, opening new, non-food-related applications.

While not directly tied to ingredients, the broader walnut industry is also attracting investor interest. For example, Walnut, a healthcare-focused company, has raised $110 million in Series A funding and an additional $4.6 million from the National Bank to expand its buy-now-pay-later (BNPL) and embedded insurance services, reflecting growing confidence in wellness-oriented business models.

Key Takeaways

- The global walnut ingredient market is projected to reach USD 3.4 billion by 2034, rising from USD 2.0 billion in 2024, with a CAGR of 5.6% between 2025 and 2034.

- Shelled walnuts are the leading segment in 2024, accounting for 74.2% of the total market share.

- Processed walnut forms dominate the market with a 69.5% share, driven by consumer preference for convenience.

- Conventional walnut ingredients continue to lead the market, capturing 87.4% share due to their affordability and wide availability.

- Walnut kernels remain the most popular product type, making up 58.3% of the market.

- The food industry is the primary application segment, representing 69.1% of total demand for walnut ingredients.

- In North America, the market reached a value of USD 0.7 billion in 2024, fueled by growing health awareness among consumers.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-walnuts-ingredient-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.0 Billion |

| Forecast Revenue (2034) | USD 3.4 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Category (In Shell, Shelled), By Form (Raw, Processed), By Nature (Organic, Conventional), By Product (Walnut Kernels, Walnut Oil, Walnut flour/meal, Others), By Application (Food Industry, Cosmetics and Personal Care, Pharmaceuticals, Animal Feed, Others) |

| Competitive Landscape | ADM, Barry Callebaut, Blue Diamond Growers, California Walnut, Callebaut, Carriere Family Farms, Diamond of California, Hammons, Jabsons Foods, Kanegrade Limited, Kerry Group, Mondelez Inteational, Morada Nut Company, Olam International, Poindexter Nut Company |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153111

Key Market Segments

By Category Analysis

Shelled Walnuts Lead with 74.2% Market Share

In 2024, shelled walnuts represented a commanding 74.2% of the walnut ingredient market under the category segment. Their widespread usage across culinary, food processing, and nutritional applications has made them a preferred choice.

Offering convenience, extended shelf life, and easy incorporation into various recipes, shelled walnuts appeal to both industrial processors and home cooks. Their versatility in texture and flavor compatibility makes them ideal for bakery items, cereals, snacks, and plant-based dishes.

Rich in protein, fiber, essential fatty acids, and antioxidants, shelled walnuts also align with growing consumer preferences for whole, nutrient-dense, and minimally processed foods. As demand for clean-label and health-oriented ingredients continues to rise, shelled walnuts are expected to retain their dominant market position.

By Form Analysis

Processed Forms Dominate with 69.5% Share

Processed walnut ingredients captured a 69.5% market share in 2024, making them the leading segment by form. Their strong presence is attributed to their adaptability across a range of food, beverage, and personal care applications.

Forms like walnut oil, butter, powder, and extracts offer ease of use, shelf stability, and consistent quality key attributes for large-scale manufacturing. These forms are increasingly used in baked goods, sauces, nutritional products, and skincare formulations.

The appeal of processed walnuts lies in their nutritional retention, flavor concentration, and compatibility with health-centric product lines. As manufacturers prioritize functional, plant-based, and clean-label innovations, processed walnut ingredients remain an integral component in modern product development.

By Nature Analysis

Conventional Products Hold a 87.4% Market Share

Conventional walnut ingredients led the market in 2024 with an 87.4% share in the nature segment. This dominance stems from their wide availability, cost-effectiveness, and established supply chains.

Used extensively in food manufacturing, cosmetics, and nutraceuticals, conventional walnuts offer consistent quality and scalability factors critical for industrial buyers focused on cost and volume.

Despite being conventionally farmed, these products still provide core nutritional benefits such as healthy fats, protein, and antioxidants. Their inclusion in everyday consumer products reinforces their stronghold in the market. With rising global demand, conventional walnut production remains essential for ensuring affordability and supply continuity.

By Product Analysis

Walnut Kernels Account for 58.3% of the Market

In 2024, walnut kernels led the product segment with a 58.3% market share. Their popularity is driven by their rich nutritional content, versatility, and broad application across consumer and industrial markets.

Widely used in bakery items, cereals, confectionery, and savory dishes, walnut kernels are favored for their texture, mild flavor, and ease of use. As demand rises for clean-label and nutrient-rich foods, their unprocessed, whole form resonates strongly with health-conscious consumers.

Walnut kernels offer a reliable source of omega-3s, protein, and fiber, positioning them as a core ingredient in wellness-oriented formulations. Their adaptability and appeal across sectors ensure their continued dominance in the walnut ingredient market.

By Application Analysis

Food Industry Drives 69.1% of Market Demand

The food industry led the application segment in 2024, generating 69.1% of total demand for walnut ingredients. This strong position is supported by extensive usage in bakery products, snacks, cereals, dairy alternatives, sauces, and ready-to-eat meals.

Manufacturers favor walnut ingredients for their nutritional benefits especially essential fats, protein, and antioxidants which align with evolving consumer preferences for healthier foods.

The segment’s dominance reflects the growing popularity of functional and plant-based food products. Walnut-based ingredients not only elevate nutritional value but also enhance flavor and texture, making them highly attractive for innovation within the food sector. As wellness trends continue to drive food choices, the food industry will remain the largest consumer of walnut ingredients.

Regional Analysis

In 2024, North America led the global walnut ingredient market, capturing 37.2% of the overall share. This regional dominance is fueled by heightened consumer focus on nutrition and strong demand for plant-based, functional ingredients across food and wellness sectors. The well-developed food processing industry in the region continues to integrate walnut-based components into a variety of applications, including snacks, supplements, and bakery items, reflecting the popularity of natural and nutrient-rich products.

Europe stands as a prominent market, driven by growing interest in health-forward, clean-label, and fortified food products featuring walnut ingredients.

The Asia Pacific region is quickly emerging as a high-growth area, with increasing urbanization and rising demand for functional foods influenced by western dietary habits.

In contrast, Latin America and the Middle East & Africa are evolving markets where interest in walnut-based formulations is gradually growing. These regions are experiencing steady progress as health awareness spreads and demand for nutrient-dense foods gains momentum.

Top Use Cases

1. Food & Bakery Products: Walnut kernels, flour or chopped pieces are used in baked goods like breads, muffins, and cookies. These ingredients add a crunchy texture, subtle nutty taste, and nutritional value, helping brands market products as healthy and premium while meeting consumer demand for plant-based and clean-label snacks.

2. Dairy Alternatives & Nut Butters: Walnut oil and walnut butter are incorporated into plant-based milk, yogurt, and butter alternatives. These ingredients deliver healthy fats, creamy mouthfeel, and added protein. Brands benefit from positioning these items as nutritious, allergen-friendly, and sustainable options aligned with evolving consumer lifestyles.

3. Nutraceuticals & Dietary Supplements: Walnut extracts, peptides, and powders are formulated into capsules, protein bars, smoothies, and health drinks. Their antioxidant and omega-3 rich profile supports claims for brain health, heart protection, and anti‑inflammatory benefits. Nutra brands leverage these ingredients to tap into the growing wellness and preventive nutrition segment.

4. Cosmetics & Personal Care: Cold‑pressed walnut oil, shell powder, and leaf extracts are used in skincare and haircare products. These natural ingredients serve as exfoliants, moisturizers, and antioxidants. Brands emphasize their botanical origin, gentle skin benefits, and eco-friendly credentials to attract clean‑beauty consumers seeking plant-derived formulations.

5. Functional Beverages & Superfood Blends: Walnut flour, oil, or powder are featured in antioxidant-rich smoothies, plant-based protein blends, and wellness shots. Their mild flavor and nutrition profile make them a good fit for functional food launches. Marketing highlights include omega‑3, fiber, and plant protein benefits for active and health-conscious consumers.

6. Animal Feed & Agro-Byproducts: Walnut meal and shell residues serve as value‑added by-products in pet food, feed pellets, or natural abrasive cleaners. These applications support sustainable practices and waste utilization. Companies position such uses as eco-friendly, cost-effective, and aligned with circular economy principles in agriculture and manufacturing.

Recent Developments

- ADM

- ADM continues to invest in nut-based ingredients, including walnuts, as part of its expanding nut ingredients strategy. The company is increasing R&D collaboration to create clean‑label, plant‑based walnut oils, powders, and extracts. In the U.S. walnut‑ingredient market, ADM remains a major player focusing on product innovation and strategic partnerships to boost its share. Recent activities include pilot launches of walnut‑based functional ingredients and customer co‑development projects. ADM’s strategy involves leveraging its large processing infrastructure for scalability and global distribution.

2. Olam International

- ofi (formerly Olam Food Ingredients) has unveiled a USD 500 million equity investment plan to strengthen its food‑ingredients division, including nuts like walnuts, and divest non-core assets. This underscores its ambition to focus on value‑added ingredients. ofi also recently rolled out TRACT, a sustainability tool developed with Olam Agri to estimate farmer income and support supply chain resilience. Further, ofi exhibited its edible nuts, cocoa, and spices portfolios together at Food Ingredients Europe, signaling greater integrated positioning in nut‑based ingredient solutions.

3. Blue Diamond Growers

- While primarily focused on almonds, Blue Diamond has bolstered its Global Ingredients Division, which serves as a model for nut ingredients innovation and scaling. In 2025, the cooperative shipped 186.7 million pounds of ingredients. Their state‑of‑the‑art Turlock, CA, processing facility supports large‑scale nut ingredient production. Blue Diamond’s infrastructure and R&D model highlight strategies Woolnut‑based ingredient firms (like those in walnuts) could replicate. The cooperative continues investing in growth, sustainability, and innovation to meet global demand and support growers.

4. Carriere Family Farms

- According to industry reports, these U.S. walnut growers and ingredient processors remain recognized key players in the walnut ingredient market. Recent trends show these firms expanding their product portfolios with walnut protein powders, oil derivatives, and kernel blends tailored to food, nutraceutical, and cosmetic clients. They focus on clean‑label, minimally processed ingredient formats to align with rising consumer demand. Though direct press releases are limited, market studies consistently list them as top contributors in U.S. supply and innovation.

Conclusion

The global walnut ingredient market is witnessing consistent growth, driven by increasing consumer awareness around health, wellness, and plant-based nutrition. Walnut-based ingredients such as kernels, oils, powders, and extracts are being widely adopted across diverse industries including food and beverage, nutraceuticals, and cosmetics. Their rich nutritional profile, which includes healthy fats, protein, and antioxidants, makes them highly suitable for functional food and clean-label formulations.

The market is further supported by innovation in product development and growing interest in sustainable, minimally processed ingredients. Manufacturers are responding to consumer demand by introducing walnut-derived products in dairy alternatives, bakery items, snacks, and supplements. Additionally, government-backed initiatives promoting walnut exports are helping companies expand their international reach. Traditional segments like shelled and conventional walnuts continue to lead, while processed forms are gaining popularity for their versatility and ease of use. Overall, the walnut ingredient market is expected to maintain strong momentum across key application areas.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)