Table of Contents

Introduction

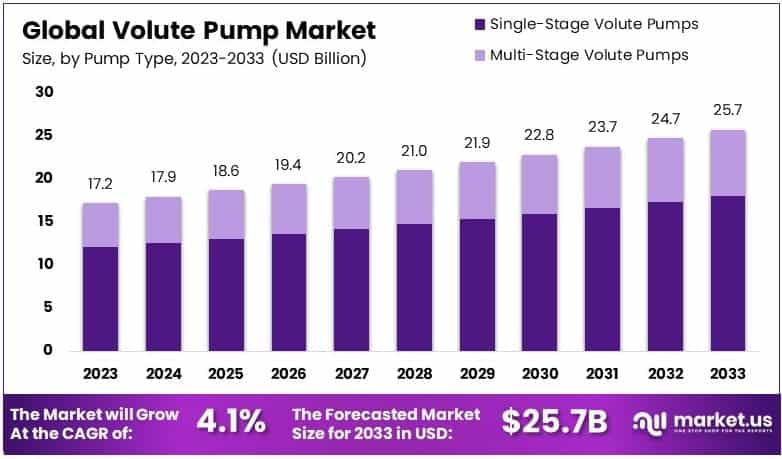

The Global Volute Pump Market is projected to reach a value of approximately USD 25.7 billion by 2033, up from USD 17.2 billion in 2023, reflecting a compound annual growth rate (CAGR) of 4.1% over the forecast period from 2024 to 2033.

The volute pump is a type of centrifugal pump characterized by a spiral-shaped casing that efficiently converts the kinetic energy of fluid into pressure energy. It is widely used in various industries, including water treatment, chemical processing, and agriculture, due to its ability to handle large flow rates and provide a consistent and reliable discharge. The volute pump market refers to the global industry that manufactures and distributes these pumps, which are essential in systems requiring fluid transportation, circulation, or drainage.

The market is driven by several factors, including increasing industrialization, urbanization, and the growing need for efficient water management systems. As industries worldwide expand, the demand for volute pumps is rising due to their ability to handle both low and high-pressure applications effectively. The water and wastewater treatment sector, in particular, is experiencing significant growth, fueling demand for volute pumps to manage and transport water efficiently.

Furthermore, the push toward sustainability and eco-friendly technologies presents a significant opportunity for the market, as industries seek energy-efficient and environmentally friendly pumping solutions. Technological advancements, such as the development of smart and automated pumps, also provide new growth avenues, enabling more efficient operations and reducing maintenance costs. Additionally, the expanding use of volute pumps in industries such as oil and gas, chemicals, and manufacturing, combined with a growing focus on infrastructure development, ensures that the volute pump market is poised for continued growth, driven by both demand and technological innovation.

Key Takeaways

- The Volute Pump Market was valued at USD 17.2 billion in 2023 and is projected to reach USD 25.7 billion by 2033, reflecting a CAGR of 4.1%.

- Single-Stage Volute Pumps led the pump type segment in 2023, driven by their extensive use in water and wastewater treatment applications.

- Horizontal Volute Pumps dominated the discharge direction segment in 2023, owing to their stability and efficiency in various industrial applications.

- Water and Wastewater Treatment emerged as the leading application in 2023, spurred by significant infrastructure development and rising demand for efficient water management solutions.

- North America held a dominant position in the market in 2023, supported by robust demand in industrial and municipal water treatment sectors.

Impact of US Tariffs on Volute Pump Market

The imposition of U.S. tariffs on imported goods has significantly impacted the volute pump industry, particularly affecting the centrifugal pump segment. The following points outline the key effects:

- Increased Manufacturing Costs: Tariffs on imported components, such as steel, aluminum, and electronic parts, have raised production costs for U.S. manufacturers of volute pumps. These materials are essential for pump construction and assembly.

- Supply Chain Disruptions: The tariffs have led to delays and uncertainties in the supply chain, especially for components sourced from countries like China and Mexico. This has affected the timely delivery of finished pumps and spare parts.

- Price Inflation: Manufacturers have been compelled to increase the prices of volute pumps to offset the higher costs incurred due to tariffs. This price inflation has been passed on to consumers, potentially reducing demand.

- Shift in Sourcing Strategies: To mitigate tariff impacts, some companies are exploring alternative sourcing strategies, including domestic procurement and diversification of supply sources to countries with lower or no tariffs.

- Competitive Disadvantages: U.S. manufacturers face challenges in competing with international suppliers who may not be subject to similar tariffs, potentially leading to a loss of market share in the global pump market.

- Investment in Automation and Innovation: To maintain competitiveness, some manufacturers are investing in automation and innovative technologies to reduce reliance on imported components and improve production efficiency.

Emerging Trends

- Integration of Smart Technologies: The adoption of IoT-enabled systems for real-time monitoring and predictive maintenance is enhancing the functionality and longevity of volute pumps.

- Focus on Energy Efficiency: Manufacturers are developing energy-efficient pumps that reduce energy consumption while maintaining high performance, aligning with global efforts to mitigate climate change.

- Advancements in Pump Design: Innovations in pump design, materials, and manufacturing processes have led to the development of more efficient and reliable volute pumps.

- Use of High-Performance Materials: The use of specialized materials, such as stainless steel and high-performance alloys, ensures the durability and resistance of volute pumps to chemical attacks.

- Adoption in Renewable Energy Projects: Volute pumps are increasingly utilized in renewable energy projects, such as hydropower and geothermal energy, due to their efficiency in handling large volumes of fluids.

Top Use Cases

- Water and Wastewater Treatment: Volute pumps are essential in processes such as water supply, sewage treatment, and desalination, playing a crucial role in providing clean and potable water.

- Oil and Gas Industry: The growing exploration and production activities in the oil and gas sector require efficient pumping solutions for fluid transportation, with volute pumps widely used in oil refineries, offshore platforms, and pipelines.

- Infrastructure Development: Rapid urbanization and infrastructure development in emerging economies fuel the demand for volute pumps in construction projects, including dewatering, irrigation, HVAC systems, and firefighting applications.

- Chemical Processing: In the chemical industry, volute pumps are used for handling corrosive and abrasive fluids, ensuring safe and efficient processing.

- Renewable Energy Systems: Volute pumps are employed in renewable energy systems, such as hydropower and geothermal energy, for fluid circulation and heat exchange processes.

Major Challenges

- High Initial Investment: The initial investment cost of volute pumps can be substantial, especially for large-scale projects or applications requiring multiple pumps, posing a barrier for small and medium-sized enterprises.

- Maintenance Complexities: Regular maintenance is required to ensure efficiency, which can be challenging for operators with limited technical expertise, leading to increased operational costs.

- Fluctuating Raw Material Prices: Volatility in the prices of materials like steel and cast iron affects production costs and pricing, limiting affordability and impacting market growth.

- Regulatory Compliance: Volute pumps must meet strict environmental and safety standards, increasing compliance costs and complicating market entry, particularly in regulated industries.

- Intense Market Competition: Numerous manufacturers offer similar products, leading to pricing pressures and reducing profit margins, making it difficult for smaller players to establish a foothold.

Top Opportunities

- Expansion into Emerging Economies: Rapid industrialization and infrastructure development in regions like Asia-Pacific and Latin America present significant growth opportunities for volute pump manufacturers.

- Retrofitting and Upgrading Infrastructure: Modernizing aging pumping systems with energy-efficient and technologically advanced volute pumps can improve performance and reduce operational costs.

- Integration with Smart Technologies: The adoption of IoT-enabled pumps equipped with sensors and monitoring systems allows for real-time data collection, predictive maintenance, and enhanced operational efficiency.

- Focus on Sustainability: Developing eco-friendly pump designs and materials aligns with global sustainability goals, supporting green initiatives across industries.

- Growth in Renewable Energy Sector: The increasing demand for renewable energy sources, such as hydropower and solar-powered irrigation, presents opportunities for volute pumps in sustainable water management practices.

Key Player Analysis

In 2024, the global Volute Pump Market remains competitive, with several key players leading the sector. Grundfos, known for its energy-efficient and sustainable solutions, maintains a strong presence with innovative designs and global reach. Wilo SE continues to expand its market share through advanced product development and strategic acquisitions. KSB SE & Co. KGaA has carved a niche with its high-quality and technologically advanced pumps, catering to industrial, municipal, and building services markets.

Xylem Inc. remains a prominent player due to its diverse pump offerings that integrate smart technologies for water management. Pentair plc has demonstrated steady growth, driven by its focus on water treatment and fluid handling systems. Flowserve Corporation, Sulzer Ltd., and Ebara Corporation emphasize operational efficiency, providing reliable pumps for a range of applications, while Weir Group plc and ITT Inc. leverage engineering expertise and global supply chains to maintain competitiveness in diverse sectors, contributing to ongoing market expansion.

Top Key Players in the Market

- Grundfos

- Wilo SE

- KSB SE & Co. KGaA

- Xylem Inc.

- Pentair plc

- Flowserve Corporation

- Sulzer Ltd

- Ebara Corporation

- Weir Group plc

- ITT Inc.

Recent Developments

- In March 2025, Honeywell revealed that it has finalized an agreement to acquire Sundyne, a company known for its specialized pumps and gas compressors used in various industrial applications. The transaction, valued at $2.16 billion, is an all-cash deal, reflecting about 14.5 times the expected EBITDA for 2024, adjusted for tax. This acquisition strengthens Honeywell’s Energy and Sustainability Solutions segment, expanding its capabilities to offer more efficient and innovative solutions in energy security across the globe.

- In February 2024, PLEUGER, a leading company in the flow control and submersible motor industry, announced its acquisition of AVI International, a Connecticut-based expert in the repair and upgrade of rotating equipment. This move will allow PLEUGER to significantly grow its presence in the North American market, enhancing its technological capabilities and further solidifying its reputation as a leader in engineering and innovation.

- In August 2024, IDEX Corporation declared the pricing of its public offering for $500 million in Senior Notes, with an interest rate of 4.950% and a maturity date set for 2029. These unsecured notes, which will rank equally with IDEX’s existing senior debt, are expected to close by August 21, 2024, contingent on the fulfillment of typical closing conditions. This offering will help support IDEX’s ongoing strategic initiatives.

- In 2025, Weir Group further integrated artificial intelligence (AI) into its operations after acquiring SentianAI in the previous year. This move marks a significant step in optimizing mineral processing through AI, automation, and digitalization, which is helping mining companies enhance efficiency and productivity. With growing adoption of such technologies, Weir aims to lead in offering innovative solutions to the mining sector.

Conclusion

The global volute pump market is experiencing steady growth, driven by increasing industrialization, urbanization, and the rising demand for efficient water and wastewater management systems. Technological advancements, such as the integration of smart technologies and energy-efficient designs, are enhancing the performance and sustainability of volute pumps. Key industries, including water treatment, agriculture, oil and gas, and chemical processing, continue to be significant contributors to market expansion. While challenges like high initial costs, maintenance complexities, and fluctuating raw material prices persist, they are being addressed through innovation and strategic investments. The market’s outlook remains positive, with emerging economies presenting substantial opportunities for growth and development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)