Table of Contents

Overview

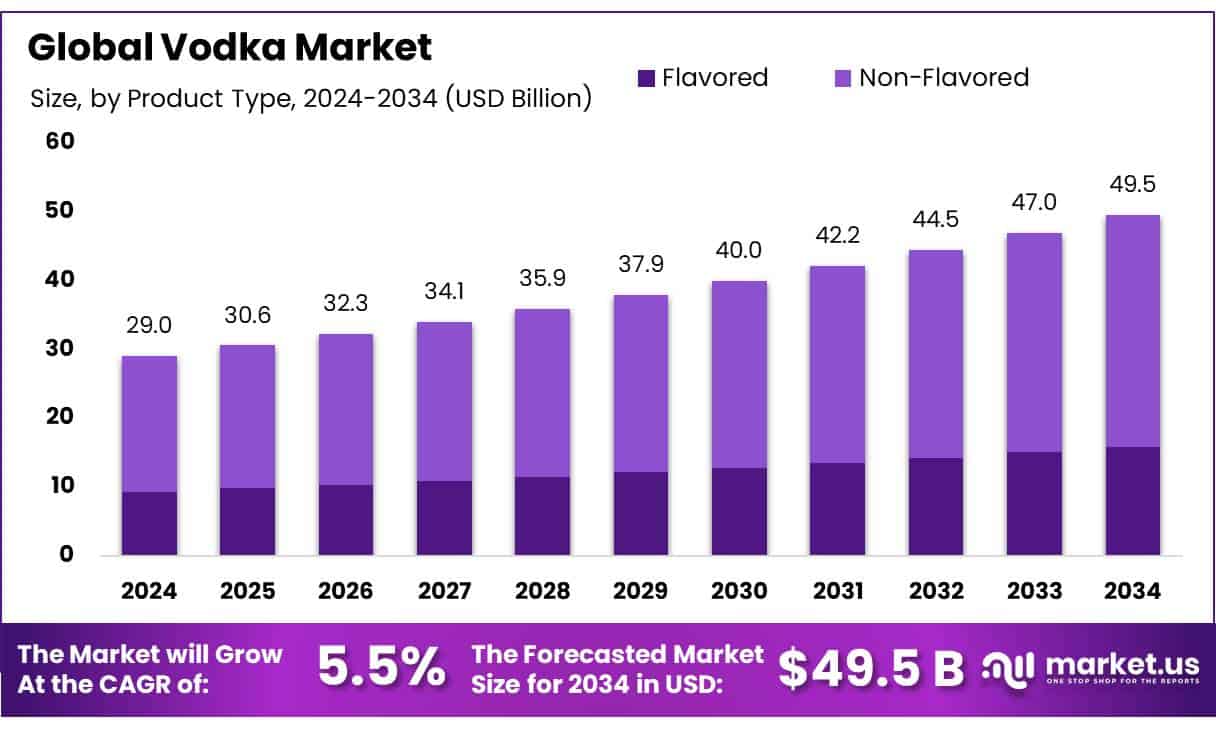

New York, NY – 06 Aug, 2025 – The Global Vodka market is projected to reach approximately USD 49.5 billion by 2034, up from USD 29.0 billion in 2024, growing at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2034. In 2024, North America led the market, accounting for over 38.9% of total revenue, with a valuation of around USD 11.2 billion.

The global vodka concentrates market has witnessed notable growth in recent years, driven by increasing consumer demand for convenient and customizable alcoholic beverage options. Vodka concentrates, which are high-strength formulations, allow consumers to tailor their drinks by blending with mixers and flavors to their preferred intensity.

This format has become especially popular amid the growing trend of at-home consumption and the rising interest in DIY cocktail experiences. The retail sector has seen increased demand for vodka-based cocktail products, further boosting this segment. According to the U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB), vodka consumption in the U.S. reached around 77 million cases in 2024, highlighting continued interest in a variety of vodka formats, including concentrates.

Key market drivers include shifting lifestyle choices and the popularity of home-crafted cocktails. TTB also reported a 4.5% increase in spirits sales in 2024, with vodka remaining one of the most widely consumed spirits. This reflects its ongoing appeal in both traditional and emerging formats.

Government support has also played a vital role in shaping market dynamics. For example, India’s “Make in India” initiative has encouraged local spirits production and attracted foreign investment, including Pernod Ricard’s €200 million investment in a new malt distillery India’s largest to date. In the U.S., regulatory efforts aimed at enhancing market competition and reducing corporate consolidation in the alcohol industry are contributing to a more dynamic and consumer-friendly environment, supporting innovation and broader product variety in the vodka segment.

Key Takeaways

- The global vodka market is forecast to grow from USD 29.0 billion in 2024 to around USD 49.5 billion by 2034, registering a compound annual growth rate (CAGR) of 5.5% during the period.

- Non-flavored vodka held the largest share within the product segment, contributing over 68% of total sales due to its versatility and broad consumer appeal.

- Within the pricing categories, the mass-market segment led with a share exceeding 57.2%, driven by affordability and widespread availability.

- From a consumer demographic perspective, men accounted for the majority of vodka consumption, representing over 67.9% of the market share.

- In terms of distribution, off-trade channels including supermarkets, liquor stores, and convenience outlets dominated the market, accounting for 78.3% of global sales.

- Regionally, North America maintained its leadership position in 2024, capturing roughly 38.9% of the total market and generating approximately USD 11.2 billion in revenue.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-vodka-market/free-sample/

Report Scope

| Market Value (2024) | USD 29.0 Billion |

| Forecast Revenue (2034) | USD 49.5 Billion |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Type (Flavored, Non-Flavored), By Category (Mass, Premium, Super Premium), By End User (Men, Women), By Distribution Channel (Off-Trade, On-Trade) |

| Competitive Landscape | Diageo plc, Pernod Ricard SA, Bacardi Ltd., LVMH (Moet Hennessy Louis Vuitton), Campari Group, William Grant and Sons, Canadian Iceberg Vodka Corp, Beluga Group, Stock Spirits Group, E.and J. Gallo, Heaven Hill Brands, Stoli Group, Proximo Spirits, Suntory Holdings Limited, Milestone Brands, Kirker Greer Holdings, B Radico Khaitan Ltd., Becle SAB de CV |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152946

Key Market Segments

1.By Type Analysis

- Non-Flavored Vodka Leads with 68% Market Share in 2024

In 2024, non-flavored vodka commanded over 68% of the global market, thanks to its clean profile, broad appeal, and versatility in cocktails. Its neutral taste makes it a popular choice for consumers who enjoy mixing drinks or prefer a more classic spirit. Demand remains strong across both developed and emerging markets. This category’s widespread availability in retail, horeca, and duty-free outlets further strengthens its position. As consumers increasingly prefer additive-free options, traditional vodka continues to gain popularity. The trend is expected to hold into 2025 as producers focus on premium offerings and expand in key regions such as the U.S., Eastern Europe, and Asia.

2. By Category Analysis

- Mass Segment Holds Over 57.2% Share in 2024

Mass-market vodka captured more than 57.2% of the market in 2024, led by its affordability and broad accessibility. These vodkas are priced for value and appeal to a wide consumer base across cities and rural areas. Heavily stocked in liquor stores, supermarkets, and bulk outlets, this segment thrives on volume. It’s especially popular at events and among price-conscious buyers. In 2025, this trend is likely to continue in regions such as Eastern Europe, South America, and Asia, where economic factors and local brand dominance play key roles in purchasing decisions.

3.By End User Analysis

- Men Account for 67.9% of Global Vodka Consumption in 2024

In 2024, male consumers made up more than 67.9% of total vodka consumption. This reflects entrenched cultural habits and social practices where vodka is traditionally consumed by men, especially in regions like Eastern Europe and parts of Asia. Brand marketing has historically focused on male audiences, reinforcing this trend. Men continue to favor vodka for its potency, affordability, and easy mixability. Although inclusivity in branding is growing, men are still expected to drive the majority of sales across both premium and mass-market categories into 2025.

4.By Distribution Channel Analysis

- Off-Trade Channels Dominate with 78.3% Share in 2024

Off-trade distribution comprising supermarkets, liquor stores, hypermarkets, and e-commerce led vodka sales in 2024, securing a 78.3% market share. These channels appeal to consumers due to their convenience, competitive pricing, and wide product selection. The shift to home consumption, amplified by the COVID-19 pandemic, has made off-trade channels even more prominent. Online retail and home delivery services further fuel this growth. As consumers continue seeking flexible and affordable purchasing options, off-trade is expected to maintain its dominance in 2025.

Regional Analysis

North America Leads the Vodka Market with 38.9% Share in 2024

- In 2024, North America remained the dominant player in the global vodka market, holding roughly 38.9% of the total market share and reaching an estimated value of USD 11.2 billion. The United States was the primary contributor, supported by a mature beverage industry, strong consumer demand, and evolving drinking habits.

- Vodka continues to be a staple in the U.S., thanks to its neutral flavor, adaptability in cocktails, and high volume of off-trade consumption. Data from the U.S. Distilled Spirits Council shows that vodka made up over one-third of all spirits volume in 2023, underscoring its importance in the regional market.

- The trend toward premiumization is gaining momentum, with millennial and Gen Z consumers showing growing interest in high-quality, craft, and sustainably produced vodka. Ready-to-drink (RTD) beverages are also driving growth, especially via retail and online platforms.

- Canada complements the region’s performance with a thriving local spirits market and increasing demand for both classic and flavored vodkas. Looking ahead, North America is projected to retain its lead, supported by robust distribution networks, product innovations, and effective branding strategies.

Top Use Cases

- RTD Cocktails (Ready‑to‑Drink): Vodka-based RTD cocktails are a growing force in the market, offering consumers convenient, pre-mixed drinks in cans or bottles. Their popularity is driven by the rising demand for cocktail-style beverages that require no mixing. Vodka RTDs now lead flavor-based cocktail categories in many regions thanks to their convenience and broad appeal.

- Craft & Premium Vodka: The trend toward premiumization has given craft vodka brands a strong foothold. Small-batch, artisanal vodkas emphasize quality ingredients, unique distillation methods, and sustainable production. These premium products appeal to younger consumers especially millennials and Gen Z who seek authenticity, bold flavor profiles, and boutique branding experiences.

- Flavored Vodka Innovations: Flavored vodka represents a fast-growing segment, with many consumers seeking novel tastes and unique experiences alongside their favorite spirits. Brands are experimenting with fruit, botanical, and spice infusions, boosting consumer engagement and category differentiation. This innovation is especially effective in drawing younger buyers interested in variety and novelty.

- Wellness & No‑Low‑Alcohol Vodka: Vodka’s low-calorie, clear profile positions it well for health-conscious drinkers. The rise of non-alcoholic or low-alcohol vodka variants often marketed as additive-free, organic, or gluten-free caters to consumers who want enjoyment with fewer health trade-offs. This segment is expanding as wellness trends continue to shape drinking habits.

- E‑commerce & Digital Engagement: Online sales and digital marketing are transforming vodka distribution. Brands are increasingly selling via e-commerce platforms and engaging consumers through social media storytelling, influencer partnerships, and direct-to-consumer campaigns. This approach allows vodka labels to reach younger consumers with personalized experiences and grow demand through broader digital discovery.

Recent Developments

- Diageo plc

- Diageo recently formed a strategic joint venture with Main Street Advisors to grow its Cîroc Ultra‑Premium Vodka in North America. This collaboration leverages Diageo’s global capabilities and Main Street Advisors’ cultural influence to accelerate brand growth in premium vodka and tequila markets. Additionally, Diageo launched an AI-powered Flavor Print “What’s Your Cocktail” platform, helping consumers discover personalized cocktails including vodka-based mixes based on their flavor preferences.

2. Pernod Ricard SA

- Pernod Ricard’s Absolut Vodka has unveiled a new global creative “Born to Mix” campaign, spotlighting the cultural connection between cocktail-making and dance. They are also collaborating with global pop act Sugababes as brand ambassadors for flavored Absolut products, aimed at boosting cocktail engagement in 2025.

3. Bacardi Ltd.

- Bacardi continues expanding the vodka RTD segment with new Eristoff Pink It Up! and Passion Star! ready-to-drink canned cocktails, designed for the retail and convenience channel. The company is also increasing investment in India, focusing on premium vodka and cocktails to capitalize on rising millennial demand and rapidly expanding urban markets.

Conclusion

The global vodka market is witnessing steady expansion, fueled by growing interest in both classic and modern vodka offerings. Consumers are increasingly drawn to options such as flavored vodkas and ready-to-drink formats, reflecting changing lifestyle preferences. Non-flavored vodka remains the most preferred type, thanks to its purity and mixability in cocktails. The mass-market segment leads due to its affordability and widespread consumer access across various regions. Off-trade distribution channels, including supermarkets and online retail, dominate sales as consumers prioritize convenience and home consumption.

Male consumers continue to represent the largest share of the market, influenced by long-standing cultural trends and social behaviors. Regionally, North America maintains a leading position, supported by well-established alcohol markets, premiumization trends, and strong retail infrastructure. With rising demand for craft, low-calorie, and sustainable spirits, along with evolving packaging formats, the vodka market is expected to maintain its momentum through continuous product innovation and targeted marketing strategies.