Table of Contents

Overview

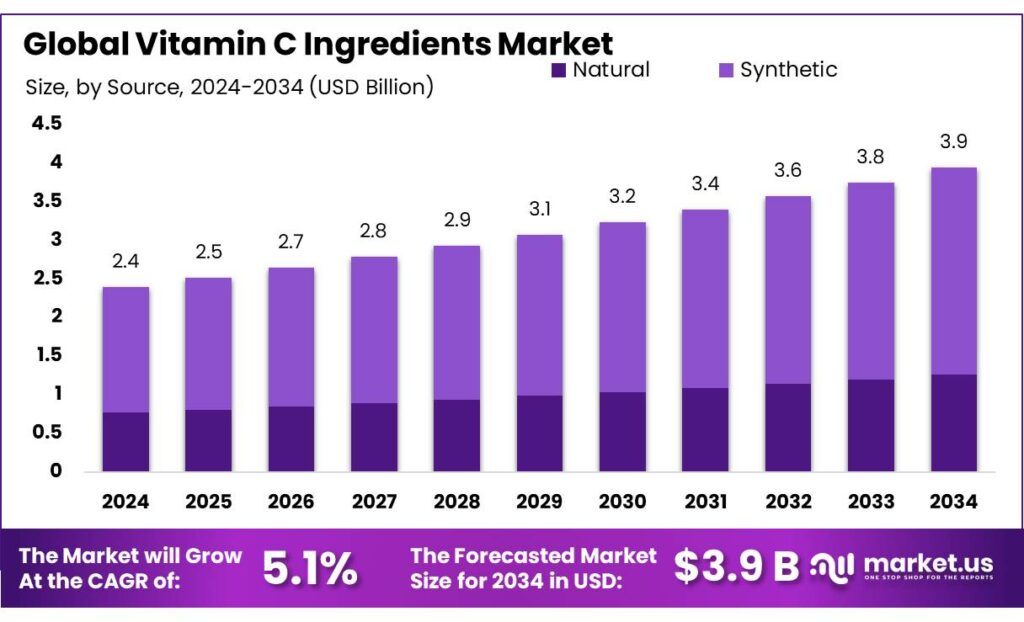

New York, NY – September 18, 2025 – The Global Vitamin C Ingredients Market is projected to reach USD 3.9 billion by 2034, up from USD 2.4 billion in 2024, registering a CAGR of 5.1% between 2025 and 2034. In 2024, North America led the market with a dominant 42.7% share, generating approximately USD 1 billion in revenue.

The industry is marked by large-scale production, growing consumer demand, and technological innovation. China remains the hub of global vitamin C manufacturing, producing nearly 70–80% of the total supply. In 2022, the country’s raw material output exceeded 300,000 tons, with exports valued at around USD 950 million. Chinese manufacturers mainly use the two-step fermentation process, converting glucose into sorbitol, then into sorbose, before producing vitamin C, a method with high efficiency and consistency.

Government regulations and nutritional guidelines are also shaping demand. For example, in July 2023, India’s FSSAI doubled the RDA for men (40 mg to 80 mg) and raised the recommendation for women (40 mg to 65 mg), further boosting consumption. Vitamin C (L-ascorbic acid) continues to be essential in dietary supplements, food preservation, pharmaceuticals, and cosmetics.

It is primarily manufactured through the Reichstein process or modern fermentation techniques, achieving conversion yields of around 60%. By 2021, global production reached 95,000 metric tons, with China alone contributing about 76,000 metric tons. Pricing varies regionally, influenced by logistics and regulations. In 2024, average prices per metric ton were about USD 2,220 in Shanghai, USD 2,850 in Hamburg, and USD 3,490 in the U.S., underlining cost differences across supply chains.

Key Takeaways

- Vitamin C Ingredients Market size is expected to be worth around USD 3.9 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 5.1%

- Synthetic held a dominant market position, capturing more than a 67.9% share in the global vitamin C ingredients market.

- Ascorbic Acid Powder held a dominant market position, capturing more than a 31.3% share in the global vitamin C ingredients market.

- Dietary Supplements held a dominant market position, capturing more than a 35.5% share in the global vitamin C ingredients market.

- Industrial held a dominant market position, capturing more than a 74.2% share in the global vitamin C ingredients market.

- Offline held a dominant market position, capturing more than a 69.7% share in the global vitamin C ingredients market.

- North America emerged as a pivotal region in the vitamin C ingredients market, commanding a 42.7% share, which translates to a robust USD 1 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-vitamin-c-ingredients-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.4 Billion |

| Forecast Revenue (2034) | USD 3.9 Billion |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Source (Natural, Synthetic), By Form (Crystalline, Ascorbic Acid Powder, Sodium Ascorbate, Calcium Ascorbate, Ester-C), By Application (Food and Beverages, Dietary Supplements, Cosmetics and Personal Care, Pharmaceuticals, Animal Feed, Others), By End User (Industrial, Household), By Distribution Channel (Online, Offline) |

| Competitive Landscape | DSM, Mason Vitamins, Sabinsa, Now Foods, Roquette, Nature’s Way, Lonza, Jarrow Formulas, BulkSupplements, Ashland |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156634

Key Market Segments

Source Analysis

Synthetic Vitamin C Commands 67.9% Market Share in 2024

In 2024, synthetic vitamin C (ascorbic acid) held a commanding 67.9% share of the global vitamin C ingredients market. Its dominance stems from cost-effective production, consistent availability, and scalability, making it the preferred choice for industries like food, beverage, pharmaceuticals, and cosmetics.

Unlike natural vitamin C, synthetic variants offer uniform potency, formulation compatibility, and longer shelf life, ideal for large-scale manufacturing. Synthetic vitamin C is a staple in multivitamins, energy drinks, fortified snacks, and immune-support supplements, particularly in regions with extensive nutritional programs or pharmaceutical production, where bulk supply and quality consistency are critical.

Form Analysis

Ascorbic Acid Powder Secures 31.3% Share in 2024

Ascorbic acid powder led the global vitamin C ingredients market in 2024 with a 31.3% share, driven by its adaptability, ease of blending, and extended shelf life. This form is favored for its suitability in tablets, capsules, drink mixes, and food fortification, offering cost-efficiency and flexibility for both small and large-scale production.

Its high purity and water solubility make ascorbic acid powder a top choice for dietary supplements and processed foods. In 2024, demand spiked in health-conscious markets, where consumers increasingly incorporate vitamin C into daily routines for immunity and energy support.

Application Analysis

Dietary Supplements Capture 35.5% Share in 2024

Dietary supplements dominated the vitamin C ingredients market in 2024, holding a 35.5% share. The surge reflects vitamin C’s role as a daily essential for immunity, energy, and overall wellness, delivered through forms like chewables, capsules, and effervescent tablets. High consumer demand, particularly in North America and Asia-Pacific, was driven by growing awareness of preventive healthcare. Innovations in supplement formats, such as gummies and flavored powders, further boosted appeal across diverse age groups.

End User Analysis

Industrial Sector Leads with 74.2% Share in 2024

In 2024, the industrial sector accounted for a dominant 74.2% share of the global vitamin C ingredients market. This reflects its widespread use across pharmaceuticals, food and beverage, personal care, and animal nutrition. Vitamin C’s health benefits and antioxidant properties make it essential for product quality and shelf-life preservation.

Pharmaceutical companies heavily utilize vitamin C in tablets, powders, and immune-support products, while food and beverage manufacturers incorporate it as a preservative and nutrient enhancer in juices, snacks, and baked goods. Cosmetic brands also leveraged vitamin C for skin-brightening and anti-aging formulations.

Distribution Channel Analysis

Offline Channels Hold 69.7% Share in 2024

Offline distribution channels led the vitamin C ingredients market in 2024 with a 69.7% share, driven by their accessibility through pharmacies, supermarkets, health stores, and wholesale distributors. Consumers favor offline purchases for immediate access, in-person interaction, and the ability to review product details, particularly for health-related items. Offline channels also dominate B2B transactions, supplying bulk vitamin C to manufacturers in food, pharmaceutical, and cosmetic industries through established vendor relationships and specialized ingredient distributors.

Regional Analysis

North America Dominates with 42.7% Share, Valued at USD 1 Billion in 2024

North America led the global vitamin C ingredients market in 2024, capturing a 42.7% share, equivalent to USD 1 billion. This reflects the region’s robust health infrastructure, rising demand for immunity-supporting nutrients, and widespread use in fortified foods, supplements, and pharmaceuticals.

The U.S. drives this growth with mature distribution networks, a strong e-commerce ecosystem, and a focus on preventive healthcare. Vitamin C is integral to functional and lifestyle products, from fortified beverages to vitamin-enriched skincare and over-the-counter supplements. Clear regulations on ingredient safety and labeling further support steady demand and price stability in the region.

Top Use Cases

- Dietary Supplements: Vitamin C ingredients shine in everyday supplements like tablets and gummies, helping people stay healthy by supporting the body’s natural defenses. As a market analyst, I see this use case thriving because busy folks grab these easy boosts for energy and wellness, fitting perfectly into routines without hassle. Makers love adding it for its simple mix into flavors, keeping products fresh and appealing to all ages.

- Food and Beverage Fortification: In juices, cereals, and snacks, vitamin C ingredients add a tangy kick while packing in health perks like better iron uptake and freshness. From my analyst’s view, this is huge as shoppers hunt for smarter eats that taste great and fight spoilage. It’s a win for brands fortifying everyday grub to meet rising calls for wholesome bites.

- Pharmaceutical Formulations: Vitamin C ingredients power up meds and ointments for wound care and fatigue relief, speeding tissue repair and easing inflammation. As an analyst, I note its role in quick-recovery formulas that doctors trust, especially for immune tweaks in daily pills. This keeps it a staple in health kits worldwide, blending science with simple use.

- Cosmetics and Skincare: Brightening and Protecting Glow Top serums and creams use vitamin C ingredients to fade spots, smooth lines, and shield skin from daily harms like sun rays. In my market watch, this explodes with beauty fans craving radiant looks from natural-feel actives. Brands mix it into lightweight drops for easy glow-ups, riding the wave of self-care trends.

- Animal Feed Additives: Farmers blend vitamin C ingredients into pet chow and stock feed to build strong bones and fight stress in animals. Analysts’ eyes spot its growth in eco-friendly farms, pushing healthier herds for better yields. It’s a smart, affordable tweak that boosts vitality without fuss, aligning with sustainable ag shifts.

Recent Developments

1. DSM

DSM offers Quali-C, a traceable and sustainable vitamin C. A key development is their focus on supply chain transparency and carbon-neutral production, responding to consumer demand for environmentally responsible ingredients. They emphasize Quali-C’s consistent quality and reliability in the global market, backed by full traceability from their Scottish manufacturing site.

2. Mason Vitamins

Mason Vitamins provides a wide range of private-label and contract-manufactured supplements. Their recent developments focus on expanding finished product formulations that incorporate various forms of vitamin C (like Ester-C or ascorbic acid) into multi-vitamin packs, gummies, and effervescent tablets tailored for specific health demographics, such as immune or skin support, for their retail partners.

3. Sabinsa

Sabinsa is innovating with its branded, patented ingredient Lacto-C (Calcium Ascorbate), a non-acidic, stomach-friendly form of vitamin C. Recent developments highlight its high bioavailability and stability. They focus on scientific substantiation and promoting Lacto-C as a superior alternative to standard ascorbic acid for mineral fortification and dietary supplements, supported by clinical research.

4. Now Foods

NOW has expanded its vitamin C product line with innovative delivery formats. A key development is their Buffered C Capsules, which use calcium ascorbate to minimize gastric discomfort. They also emphasize their wide selection, including powdered Pure Ascorbic Acid and liquid C with rose hips, focusing on affordability, quality testing (like identity and potency verification), and non-GMO verification.

5. Roquette

Roquette, a global leader in plant-based ingredients, is developing novel excipients and delivery solutions that enhance vitamin C formulations. Their recent work involves using pea starch and other natural carriers to improve the stability, flowability, and compression of sensitive active ingredients like vitamin C in tableting, and creating taste-masking solutions for chewable applications.

Conclusion

Vitamin C ingredients keep evolving as a go-to powerhouse across wellness and beauty worlds. They effortlessly weave into daily lives, from quick health picks to glowing skin saviors, meeting folks’ hunger for simple, effective boosts. With smarter ways to stabilize and source them naturally, these ingredients promise even wider appeal, fueling fresh innovations that blend fun flavors, easy care, and real vitality. The path ahead looks bright, as growing love for balanced living cements their spot in hearts and routines everywhere.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)