Table of Contents

Overview

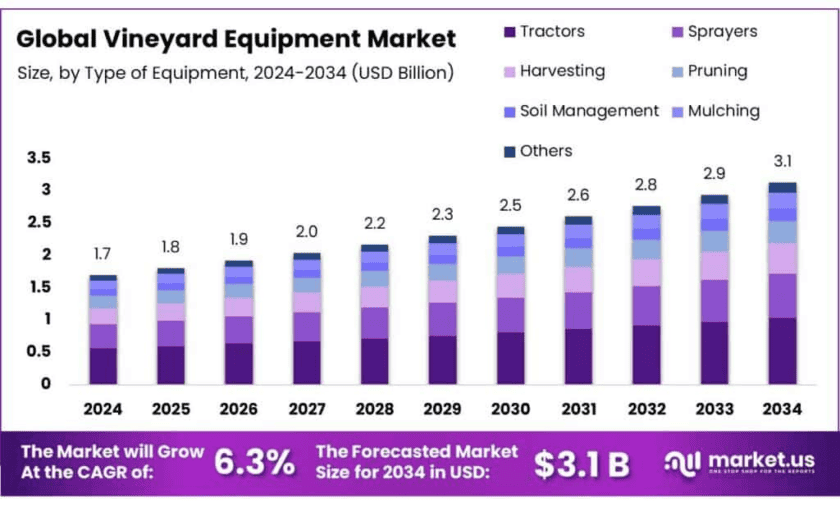

New York, NY – Oct 31, 2025 – The global vineyard equipment market is projected to reach USD 3.1 billion by 2034, rising from USD 1.7 billion in 2024, at a CAGR of 6.3% from 2025 to 2034. In 2024, North America dominated the market, accounting for 43.8% share and generating USD 0.7 billion in revenue. Vineyard equipment plays a vital role in modern agriculture, enhancing the efficiency and productivity of grape cultivation. It includes machinery and tools for planting, irrigation, pruning, pest management, harvesting, and vineyard maintenance. Given the specific climate and soil needs of vineyards, the demand for specialized and technologically advanced equipment continues to grow globally.

Industrial activity in this sector is heavily concentrated in the European Union, the United States, South America, and Oceania. The United States, particularly California, reported about 590,000 acres of grape cultivation in 2024. This highlights the significant presence of vineyard machinery and the ongoing need for equipment upgrades as acreage shifts between wine, table, and raisin grape uses. Data from the Food and Agriculture Organization (FAO) indicates that grapes remain one of the largest fruit crops worldwide, ensuring consistent demand for vineyard equipment even as regional production fluctuates.

Several factors are driving the growth of the vineyard equipment market. Climate change adaptation, the rising shift toward organic farming, and the focus on sustainable agriculture are among the primary catalysts. As changing weather patterns affect traditional grape-growing regions, vineyard operators are increasingly turning to advanced and resilient equipment solutions. According to the International Organisation of Vine and Wine, global organic vineyard areas expanded by 20% between 2018 and 2022, creating strong momentum for equipment designed for organic and eco-friendly practices.

- Government programs are also supporting this growth trend. In Europe, the Common Agricultural Policy (CAP) has allocated €1.6 billion (2021–2027) to encourage sustainability and modernization within the agricultural sector, including the wine industry. These funds promote rural development initiatives and the adoption of environmentally friendly vineyard machinery, reinforcing the sector’s transition toward sustainable and efficient viticulture.

Key Takeaways

- Vineyard Equipment Market size is expected to be worth around USD 3.1 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 6.3%.

- Tractors held a dominant position in the vineyard equipment market, capturing more than 44.9% of the total market share.

- Large Vineyards held a dominant position in the vineyard equipment market, capturing more than 67.2% of the total market share.

- North America held a dominant position in the vineyard equipment market, capturing a substantial 43.8% share, valued at approximately USD 0.7 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/vineyard-equipment-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.7 Bn |

| Forecast Revenue (2034) | USD 3.1 Bn |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Type of Equipment (Tractors, Sprayers, Harvesting, Pruning, Soil Management, Mulching, Others), By Application (Large Vineyard, Small Vineyard, Medium Vineyard) |

| Competitive Landscape | Yanmar Holdings Co., Ltd, Pellenc, CNH Industrial N.V., John Deere, SAGCO, Maschio Gaspardo S.p.A., GRIMME Landmaschinenfabrik GmbH & Co., Blueline Manufacturing Co |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159686

Key Market Segments

By Type of Equipment Analysis: In 2024, tractors held a dominant 44.9% share of the global vineyard equipment market, underscoring their indispensable role in vineyard operations. Tractors serve as the core machinery for crucial activities such as planting, plowing, and harvesting, making them the backbone of vineyard mechanization. Their versatility and ability to perform multiple functions efficiently have positioned them as an essential investment for vineyard owners worldwide.

The market for vineyard tractors has experienced steady expansion, with 2024 marking a notable surge driven by technological upgrades such as GPS navigation, precision steering, and automated control systems. These innovations have enhanced accuracy, minimized human error, and improved efficiency across varying vineyard terrains, resulting in significant labor cost reductions and improved productivity.

By Application Analysis: In 2024, large vineyards dominated the global vineyard equipment market, accounting for 67.2% of total market share. This leadership stems from their extensive operational scale, which demands high-capacity, durable, and technologically advanced equipment for effective cultivation and maintenance. Large vineyard operators, particularly in California, France, and Australia, continue to invest heavily in mechanization to enhance efficiency and crop quality.

Capital-intensive by nature, these enterprises have accelerated the adoption of automated harvesters, pruning systems, and self-propelled sprayers to counter rising labor costs and ensure consistent output. The growing emphasis on operational efficiency, coupled with advancements in automation, is expected to sustain the dominance of large vineyards in global equipment demand over the coming decade.

List of Segments

By Type of Equipment

- Tractors

- Sprayers

- Harvesting

- Pruning

- Soil Management

- Mulching

- Others

By Application

- Large Vineyard

- Small Vineyard

- Medium Vineyard

Regional Analysis

In 2024, North America emerged as the leading region in the global vineyard equipment market, capturing a significant 43.8% share, valued at around USD 0.7 billion. This dominance is supported by the region’s highly developed wine production industry, led by the United States, which ranks as the fourth-largest wine producer in the world. Within the U.S., California remains the epicenter of vineyard activity, contributing nearly 90% of total national wine output and driving substantial demand for advanced vineyard machinery and tools.

The region’s leadership is further strengthened by its growing shift toward mechanized and precision-based viticulture. Rising labor costs and the ongoing need to enhance operational efficiency have prompted vineyard operators to invest in modern technologies. Over recent years, North American vineyards have increasingly adopted GPS-enabled tractors, automated harvesters, and smart irrigation systems, enabling higher productivity and more accurate vineyard management.

Top Use Cases

Mechanical harvesting to cut labor hours and cost: Self-propelled and trailed harvesters replace hand crews that typically need ~5.3 labor-hours/ton; mechanized systems have demonstrated ~2.9 labor-hours/ton, a ~45% reduction. Using the 2024 U.S. field-worker wage of USD 18.42/hour, labor savings per 1,000 tons harvested can approach ~USD 44,000 before fuel and maintenance. UC studies also note rules-of-thumb like “5–6 workers needed to pick ~1 ton/hour” for hand harvest—underscoring the scale advantage of machines.

Variable-rate sprayers to slash pesticide use and drift: Laser/LiDAR or canopy-sensing sprayers adjust dose to vine size and phenology. Documented results include 46% pesticide savings vs. fixed-rate, and vineyard trials showing ~61–80% volume reductions at key growth stages; separate studies report up to 33–40% lower off-target losses. These systems also cut fuel and operator time per hectare while maintaining coverage.

Drip irrigation and scheduling to conserve water: Drip is now standard in many regions (e.g., 91% of surveyed Sacramento Valley winegrape area under drip). Targeted innovations from Washington State University have shown ~35% water savings in vineyards with optimized hardware/control. With irrigated farms generating >50% of U.S. crop sales on <17% of harvested cropland, precision irrigation and hardware pay back quickly in water-scarce zones.

Frost protection with wind machines and sprinkling: Cold-air mixing fans typically operate ~30–50 hours/season in frost-prone North Coast sites; extension guidance suggests 7–10 acres as a practical minimum block size for a wind machine. Where feasible, over-vine sprinkling can cost ~12% of wind-machine hourly operating cost and ~4% of oil-heater cost, offering a lower-OPEX alternative when water is available.

Canopy and disease monitoring via remote/precision viticulture: Multispectral satellites, UAVs, and proximal sensors enable early disease mapping and vigor zoning, supporting variable-rate fungicide and nutrient applications. Reviews of 92 papers (2024) highlight consistent gains in water-use efficiency and chemical load reduction; field studies in perennial crops show 32%+ spray-flow reductions with sensor-driven profiles—principles increasingly applied to vineyards.

Mechanical under-vine weeding to reduce herbicide dependency: Camera-guided hoes and in-row cultivators attain ~72–96% inter-row and ~21–91% intra-row weed-control efficacy, while recent trials identify combinations of tools achieving ~78.5% weed-control efficacy. Beyond chemical savings, studies caution that repeated herbicide use can reduce grapevine root mycorrhization by ~53%, bolstering the case for mechanical options.

Fleet planning and renewal based on acreage & terrain: Procurement of narrow tractors, mowers, and sprayers scales with planted area and row spacing. In California, 2024 grape acreage totaled ~590,000 acres (550,000 bearing; 40,000 non-bearing), implying large replacement cycles for key machines as blocks are replanted or repurposed (wine/table/raisin). Global fleet needs remain underpinned by ~7.2 million ha of vineyards worldwide.

Recent Developments

Yanmar Holdings Co., Ltd.: In April 2024, Yanmar’s viticulture-specialist subsidiary, Yanmar Vineyard Solutions, entered a strategic partnership with Maison Moët & Chandon to develop the “YV01” autonomous vineyard robot, reinforcing Yanmar’s move into high-tech vineyard machinery and targeting improved efficiency and safety in vineyard operations.

Pellenc Group: In the vineyard equipment sector, Pellenc continues to provide a broad range of vineyard-specific machinery from pruning tools to harvesting units, as indicated by its 2022 consolidated revenue of €346 million and global dealer network across 60 countries, reaffirming its leadership in viticulture equipment.

CNH Industrial N.V.: In the vineyard-equipment segment, CNH Industrial’s brand New Holland Agriculture continues to lead with self-propelled grape harvesters (the Braud range) and specialised straddle tractors for narrow-row vineyards. In 2023, CNH announced an investment of €21.4 million over two years in its Coëx (Vendée, France) facility to enhance manufacturing and R&D for vineyard/olive harvesting machines.

John Deere & Company: In the vineyard domain, John Deere has partnered with the Sonoma County Winegrowers in California launching the “Farm of the Future” initiative in 2024, deploying its Smart Apply® LIDAR-spray system which reportedly reduced spray volume by nearly 30% across 2,700 acres in the pilot.

SAGCO: Despite references in aggregate reports suggesting SAGCO’s vineyard-machinery share could rise by about 3.5% in 2024, there is no publicly verifiable breakdown of its specific vineyard-equipment revenue or year-by-year figures available through reliable sources.

Maschio Gaspardo S.p.A.: In 2024 the group posted consolidated revenues of €349.9 million, EBITDA of €41.32 million, and net profit of €12.29 million, while investing about €11 million into production efficiency and new product development, including vineyard-relevant tools.

GRIMME Landmaschinenfabrik GmbH & Co.: While primarily recognised for potato and beet harvesting technology, GRIMME is increasingly leveraging its carrier-vehicle and separator experience for vineyard applications, especially in Europe. For instance, the group achieved revenue of €814 million in 2024, up from €721 million in 2023, signalling broad investment capacity in adjacent segments.

Blueline Manufacturing Co.: Based in Yakima, Washington, Blueline specializes in vineyard-specific tractor platforms, sprayers, gondolas and custom equipment for growers. In a recent estimate the company reported annual revenue of approximately USD 11.3 million, underscoring its role as a niche specialist in the vineyard equipment space.

Conclusion

In conclusion, the global vineyard equipment market is clearly advancing into a new era of mechanisation and technological sophistication. Key drivers include rising labour costs, expanded organic and premium grape acreage, and growing adoption of precision-agriculture tools which are helping winemakers boost efficiency and minimise waste. Despite regional acreage fluctuations and climate pressures, the demand for specialised vineyard machinery remains strong, especially in leading markets such as North America.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)