Table of Contents

Overview

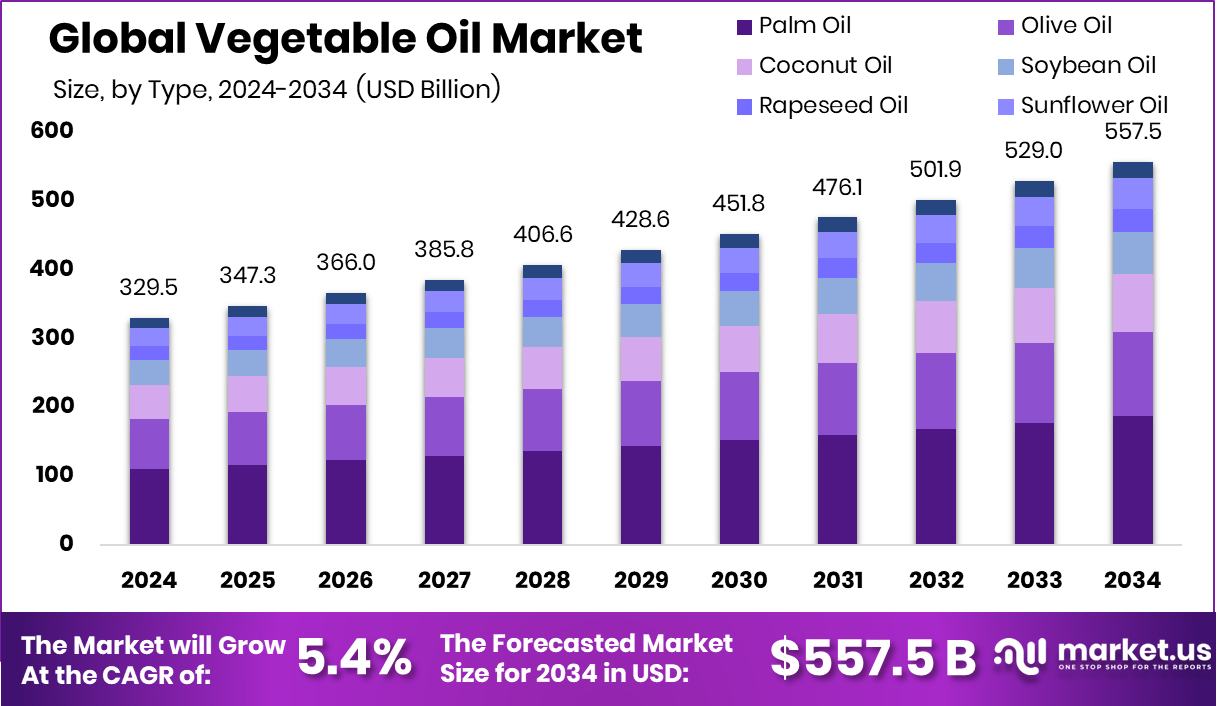

New York, NY – August 01, 2025 – The Global Vegetable Oil Market is projected to reach USD 557.5 billion by 2034, growing from USD 329.5 billion in 2024 at a CAGR of 5.4% from 2025 to 2034. Asia-Pacific holds a dominant 47.90% market share, driven by strong demand from the food and industrial sectors.

Vegetable oils, extracted from seeds or plant parts, include soybean, sunflower, palm, canola, and olive oils. Valued for their unsaturated fats, neutral flavor, and high smoke points, these oils are widely used in cooking, baking, and food processing. A 21% decline in edible oil imports since November suggests a move toward self-reliance, potentially through increased domestic production or alternative sourcing.

The vegetable oil market encompasses global production, trade, processing, and consumption of plant-based oils, serving industries like food and beverage, biofuels, animal feed, and personal care. Market dynamics are influenced by crop yields, weather, government policies, and evolving dietary preferences.

Growth is fueled by population growth, urbanization, and rising health awareness, particularly in developing economies with shifting consumption patterns. For instance, Cano-ela secured €1.6 million to advance seed-based ingredient innovation, highlighting interest in sustainable oilseed solutions.

Rising global food consumption and a preference for plant-based products drive market expansion. The food processing sector’s growth in emerging markets and health trends favoring unsaturated fats over animal fats further boost demand. Holiferm’s US$23.36 million funding to scale fermentation-derived vegetable oil production aligns with these trends. Urbanization, higher disposable incomes, and a trend toward home cooking have increased vegetable oil use, especially in urban areas.

Demand for oils in packaged and convenience foods is also rising, catering to busy consumers seeking shelf-stable cooking solutions. Romania’s EUR 70 million in grants to replace shuttered sunflower oil facilities strengthens the processed oil supply chain. Additionally, Sunflower Capital, founded by a Sequoia alum, raised USD 150 million, signaling strong investor confidence in oilseed and plant-based ingredient markets.

Key Takeaways

- The Global Vegetable Oil Market is expected to be worth around USD 557.5 billion by 2034, up from USD 329.5 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034

- In the vegetable oil market, palm oil held the largest share at 33.6% by type.

- Conventional vegetable oils dominated the market by nature, accounting for 89.1% of total consumption.

- The food industry led application-wise, utilizing 78.9% of the total vegetable oil market volume.

- HoReCa and foodservice channels contributed a 36.2% share in the vegetable oil market distribution.

- The Asia-Pacific market value reached USD 157.8 billion due to high consumption levels.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-vegetable-oil-market/request-sample/

Report Scope

| Market Value (2024) | USD 329.5 Billion |

| Forecast Revenue (2034) | USD 557.5 Billion |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Type (Palm Oil, Olive Oil, Coconut Oil, Soybean Oil, Rapeseed Oil, Sunflower Oil, Others), By Nature (Conventional, Organic), By Application (Food Industry, Biofuels, Others), By Distribution Channel (HoReCa/Foodservice, Supermarkets/Hypermarkets, Convenience Stores/Grocery Stores, Online Retail Stores, Others) |

| Competitive Landscape | Agro Tech Foods Limited, Archer Daniels Midland Company, Avril Group, Bhushan Oils & Fats Pvt. Ltd., Bunge Limited, Cargill Incorporated, Fuji Oil Holding Inc., Golden Agri-Resources, IFFCO Group, KTC, Kuala Lumpur Kepong Berhad, Louis Dreyfus Company B.V., Marico Ltd., Olam International Limited, Ottogi Co., Ltd., Patanjali Ayurveda Limited, Pompeian |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152867

Key Market Segments

By Type Analysis

Palm oil commands a 33.6% share of the vegetable oil market in 2024, driven by its cost-effectiveness, wide availability, and versatile applications. Its neutral flavor, long shelf life, and high yield per hectare make it a staple in food manufacturing, particularly for deep-frying and packaged foods.

Palm oil’s stability at high temperatures further boosts its demand. Beyond food, its use in personal care, cleaning products, and biofuels strengthens its market position. Population growth and urbanization in emerging economies fuel demand for affordable edible oils, with palm oil maintaining dominance despite sustainability concerns.

By Nature Analysis

Conventional vegetable oils hold an 89.1% market share in 2024, reflecting their affordability and widespread use in cooking, food preparation, and large-scale processing. Produced through traditional refining, these oils are accessible for household and commercial applications, especially in developing economies.

Their versatility, neutral taste, and familiarity drive high consumption in institutional and foodservice channels. Well-established supply chains and refining infrastructure further support their dominance, making conventional oils the preferred choice globally despite growing interest in alternative oil types.

By Application Analysis

The food industry accounts for 78.9% of vegetable oil demand in 2024, underscoring its essential role in cooking, frying, baking, and manufacturing processed foods like margarine and dressings. Rising global food consumption, urbanization, and demand for convenience foods propel this segment’s growth.

Vegetable oils provide the texture, stability, and performance needed for high-volume production, meeting both functional and nutritional demands. Their extensive use in restaurants, institutional kitchens, and packaged food facilities cements their critical position in the food industry’s supply chain.

By Distribution Channel Analysis

The HoReCa (hotels, restaurants, cafés, and catering) segment captures a 36.2% share of vegetable oil distribution in 2024, driven by high-volume usage in commercial food preparation. Vegetable oils are favored for their consistency, high-temperature stability, and cost-effectiveness in deep-frying, sautéing, and baking.

The global expansion of foodservice, particularly in urban areas with growing dining-out and delivery trends, fuels demand. Bulk purchasing by quick-service restaurants and casual dining outlets further supports this segment’s leadership in the vegetable oil market.

Regional Analysis

Asia-Pacific leads the vegetable oil market with a 47.9% share in 2024, equating to USD 157.8 billion in market value. High consumption in densely populated countries, coupled with robust food processing industries, drives this dominance. Urbanization and a shift toward packaged and convenience foods amplify demand.

North America shows steady growth, supported by a mature food industry and health-conscious oil preferences. Europe maintains a stable position, driven by demand for sustainable and clean-label oils. The Middle East & Africa and Latin America exhibit moderate growth, fueled by rising food demand and domestic production, but Asia-Pacific remains the market’s powerhouse due to its scale and industrial strength.

Top Use Cases

- Cooking and Food Preparation: Vegetable oils like palm, soybean, and canola are widely used for cooking, frying, and baking due to their high smoke points and neutral flavors. They enhance texture in dishes, extend shelf life in processed foods, and meet the growing demand for convenient, affordable cooking solutions in households and restaurants.

- Biofuel Production: Vegetable oils, especially palm and soybean, are key feedstocks for biodiesel, driven by global demand for renewable energy. Their use in biofuels supports sustainability goals, reduces greenhouse gas emissions, and aligns with government policies promoting eco-friendly alternatives, particularly in North America and Europe.

- Personal Care Products: Oils like coconut and olive are popular in cosmetics, used in soaps, lotions, and haircare for their moisturizing properties. Their natural, plant-based appeal caters to consumer demand for organic and sustainable products, boosting their use in the growing beauty and personal care industry.

- Animal Feed: Vegetable oils are added to animal feed to enhance nutritional value and energy content. Soybean and canola oils are commonly used to improve livestock health and growth, supporting the expanding animal feed industry, especially in regions with rising meat consumption.

- Industrial Applications: Vegetable oils serve as lubricants, hydraulic fluids, and bio-based solvents in industries. Their versatility and eco-friendly nature make them alternatives to synthetic chemicals, with growing use in manufacturing processes, driven by demand for sustainable industrial solutions.

Recent Developments

1. Agro Tech Foods Limited

- Agro Tech Foods Limited, a major player in India’s edible oil market, has been focusing on expanding its healthy oil portfolio, including sunflower and canola oils. Recently, the company emphasized sustainable sourcing and launched campaigns promoting heart-healthy oils. They are also investing in digital marketing to boost brand visibility.

2. Archer Daniels Midland Company (ADM)

- ADM has been advancing in sustainable vegetable oil production, partnering with farms to reduce deforestation-linked palm oil. They recently expanded their European non-GMO soybean oil capacity to meet rising demand for plant-based foods. ADM also invested in regenerative agriculture to improve oilseed sustainability.

3. Avril Group

- Avril Group, a key player in European vegetable oils, has been innovating in bio-based oils for food and industrial uses. Their recent developments include launching a new line of high-oleic sunflower oil and expanding biodiesel production from rapeseed oil. They are also focusing on traceability and eco-friendly processing.

4. Bhushan Oils & Fats Pvt. Ltd.

- Bhushan Oils & Fats has been strengthening its position in India’s specialty fats and edible oils market. The company recently upgraded its refining capacity and introduced fortified oils with vitamins. They are also exploring sustainable palm oil sourcing to align with global environmental standards.

5. Bunge Limited

- Bunge has been actively expanding its non-GMO and sustainable vegetable oil offerings. They recently partnered with a Brazilian firm to enhance traceability in soybean oil supply chains. Additionally, Bunge is investing in renewable diesel production from vegetable oils to support clean energy initiatives.

Conclusion

The Vegetable Oil Market in 2025 is thriving due to its diverse applications in cooking, biofuels, cosmetics, and more. Growing health awareness, urbanization, and demand for sustainable products drive its expansion, with palm oil leading due to cost-effectiveness. Innovations like fortified oils and eco-friendly sourcing further boost growth, making vegetable oils a vital component across global industries.