Table of Contents

Overview

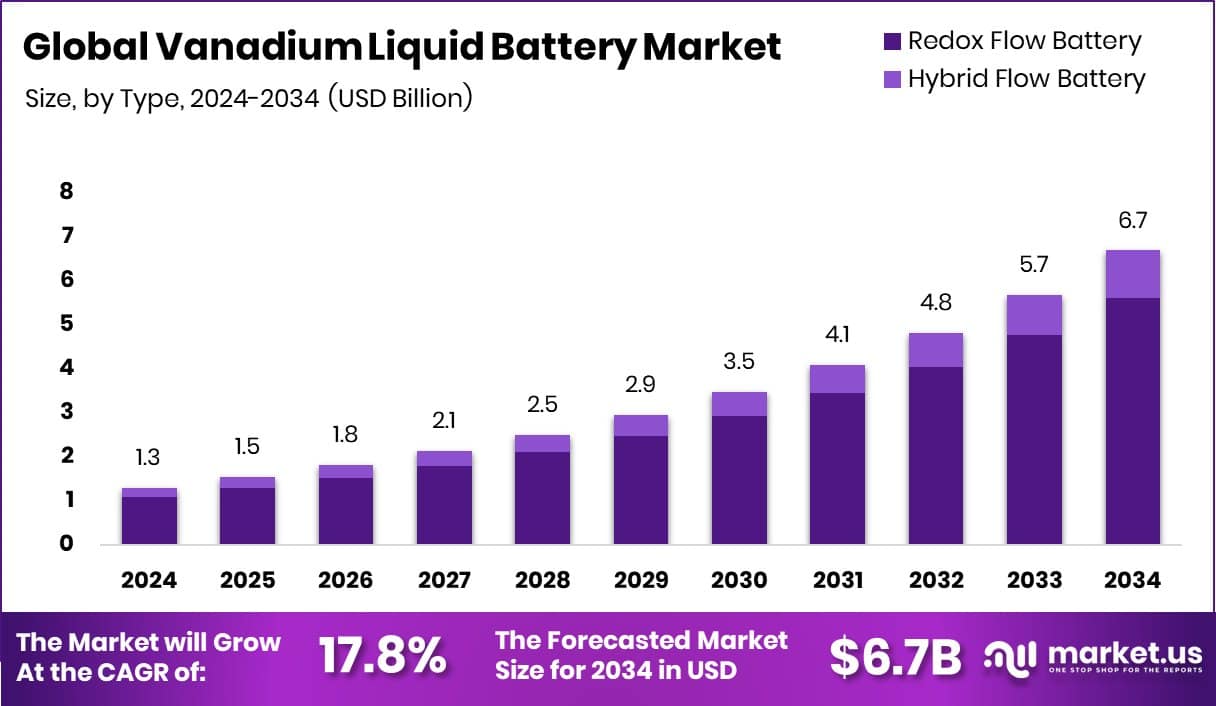

New York, NY – Nov 25, 2025 – The global Vanadium Liquid Battery Market is positioned for strong growth, expected to reach USD 6.7 billion by 2034, rising from USD 1.3 billion in 2024, supported by a projected 17.8% CAGR from 2025 to 2034. North America holds a 45.2% share, reflecting steady momentum as grid operators and renewable developers push for advanced long-duration storage.

Vanadium liquid batteries, also known as vanadium redox flow batteries, store energy using vanadium-ion liquid electrolytes in external tanks. Their long cycle life, deep discharge capability, and modular tank-based scalability make them suitable for solar and wind storage, microgrids, and backup systems.

Market expansion is strongly tied to renewable deployment and capital inflows. Key energy financing—such as ReNew’s funding for its 837 MW hybrid renewable project and Hero Future Energies raising ₹1,000 crore—continues driving large-scale storage demand. The supporting energy ecosystem is also evolving, backed by investments like ACS Energy’s ₹1.1 crore round for EV-charging networks and Oriana Power’s ₹212 crore BESS project in Karnataka.

Significant financial confidence is emerging, illustrated by Nuveen’s $1.3 billion fundraise and Core Energy Systems securing ₹200 crore. Together, these signals reinforce vanadium batteries’ growing role in future-ready, grid-stabilising storage infrastructure.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-vanadium-liquid-battery-market/request-sample/

Key Takeaways

- The Global Vanadium Liquid Battery Market is expected to be worth around USD 6.7 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 17.8% from 2025 to 2034.

- The Vanadium Liquid Battery Market is dominated by redox flow batteries, holding 84.6% share.

- Large-scale systems lead the Vanadium Liquid Battery Market with a 65.3% share worldwide.

- The energy and power sector drives the Vanadium Liquid Battery Market with a 72.1% share today.

- North America records a strong market valuation of USD 0.5 Bn today.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165728

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 6.7 Billion |

| CAGR (2025-2034) | 17.8% |

| Segments Covered | By Type (Redox Flow Battery, Hybrid Flow Battery), By Storage Capacity (Small Scale, Large Scale), By End-User (Energy and Power, Automotive, Others) |

| Competitive Landscape | Sumitomo Electric Industries Ltd., Dalian Rongke Power Co. Ltd., Invinity Energy Systems, Bushveld Energy Ltd., CellCube Energy Storage Systems Inc., VRB Energy Inc., Big Pawer Electrical Technology Xiangyang Inc. Co., Australian Vanadium Limited, StorEn Technologies Inc., Primus Power Corporation, Vanadis Power GmbH, Schmid Group |

Key Market Segments

By Type Analysis

In 2024, Redox Flow Battery led the By Type segment with an 84.6% share, demonstrating a strong preference for this technology in large-scale storage. Its dominance stems from its long cycle life, reliable operation, and the ability to scale system capacity simply by increasing electrolyte tank size. These features make it a top choice for utilities and long-duration storage needs.

Its capability to function safely under deep-discharge conditions further builds user trust, especially where uninterrupted renewable-energy support is required. As grids increasingly depend on solar and wind power, stable and expandable systems become essential.

This high share also reflects wider industry movement toward storage solutions that can balance fluctuating clean-energy supply without performance degradation. With flexible capacity growth and predictable output, Redox Flow Batteries continue to align well with modern energy-storage goals, reinforcing their leadership position in the market.

By Storage Capacity Analysis

In 2024, the Large-Scale segment held a leading 65.3% share in the By Storage Capacity category of the Vanadium Liquid Battery Market, showing strong preference for high-capacity storage solutions. This dominance is driven by demand from utilities, renewable-energy projects, and long-duration grid applications that require stable and scalable systems.

Large installations benefit from dependable performance, deep-discharge capability, and long operational lifespan, making them ideal for managing variable solar and wind output. The scalable tank-based architecture also allows capacity upgrades without redesigning the core system, which supports future expansion needs.

With growing focus on grid reliability, renewable integration, and long-term energy storage, the Large-Scale category continues to stand out as the main driver of adoption and market growth.

By End-User Analysis

In 2024, the Energy and Power segment led with a 72.1% share in the By End-User category of the Vanadium Liquid Battery Market, showing clear reliance from utilities and renewable developers. This dominance reflects the sector’s need for reliable long-duration storage to manage fluctuating solar and wind output while keeping the grid stable.

Vanadium systems’ long cycle life and consistent performance make them well-suited for large renewable portfolios, where balancing supply and demand is critical. Their durability and ability to handle repeated deep-discharge cycles further strengthen adoption.

The segment’s strong position also points to increasing investment in grid upgrades and transmission resilience. As more renewable power plants come online and energy storage becomes a required infrastructure component, the Energy and Power category continues to be the primary user group driving market expansion.

Regional Analysis

North America remains the leading region in the Vanadium Liquid Battery Market, holding a 45.2% share valued at USD 0.5 billion, driven by strong demand for long-duration storage and early adoption of flow battery systems. The region’s focus on reliable grid support and renewable expansion reinforces its position.

Europe follows with steady progress, supported by carbon-reduction policies and a shift toward safe, long-cycle storage to manage fluctuating solar and wind power.

The Asia Pacific region is accelerating adoption as renewable capacity expands and governments prioritise storage systems capable of long operating durations and scalability.

Meanwhile, the Middle East & Africa are building momentum through diversification strategies and large solar programs, creating meaningful opportunities for long-duration storage solutions.

Latin America continues gradual adoption, with interest rising as grids modernise and renewable infrastructure grows. Across all regions, durability, scalability, and long life remain central drivers of interest in vanadium-based storage systems.

Top Use Cases

- Renewable-energy integration: These batteries can store excess solar or wind power when generation is high (e.g., midday sun or strong wind) and then release it when needed (e.g., evening or calm periods). This helps match supply with demand and makes renewables more useful.

- Grid stability & frequency regulation: Because they can quickly absorb or provide energy, vanadium flow systems help keep the electricity grid stable — smoothing out fluctuations, maintaining proper voltage/frequency, and preventing blackouts.

- Large-scale, long-duration storage: Unlike batteries sized for minutes, vanadium flow systems are suited for many hours (or even days) of energy storage. Their design allows you to increase tank size (electrolyte volume) to raise capacity.

- Industrial & commercial peak-shaving: Factories, data centres or large buildings can use vanadium batteries to store power when tariffs are low (or renewable supply is high) and then use stored energy during peak-tariff hours, reducing energy cost and stress on utilities.

- Off-grid and remote site support: In locations where grid supply is weak, intermittent, or absent (islands, remote villages, disaster-prone zones), vanadium flow batteries can pair with renewables to provide a reliable backbone of power.

- Emergency backup and mission-critical power: Because these batteries can cycle many times without major degradation and can safely deep-discharge, they are good for backup power in hospitals, data centres, telecom sites, or during natural disasters where uninterrupted power is critical.

Recent Developments

- In December 2024, Rongke Power announced that it had completed a 175 MW / 700 MWh all-vanadium flow battery storage project in Wushi (Xinjiang region), China. This is described as the world’s largest vanadium flow battery installation at that time.

- In December 2024, Invinity launched its next‐generation VFB platform called Endurium, designed for large‐scale, long‐duration energy storage applications (4 to 18 hours for example). This platform is built to support grid‐scale wind and solar integration with vanadium flow battery technology.

Conclusion

The Vanadium Liquid Battery Market continues to gain attention as energy systems shift toward longer-duration, safer, and more flexible storage technologies. Its value lies in reliable cycle life, stable performance, and suitability for large renewable projects and grid applications. Growing investments in solar, wind, and microgrids are reinforcing demand for long-term storage that can operate without rapid degradation.

Increasing government support, industry partnerships, and pilot deployments are helping the technology move from niche adoption to broader commercial use. As more regions upgrade grid infrastructure and seek dependable storage, vanadium systems are becoming a strong option for future energy resilience and sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)