Table of Contents

Introduction

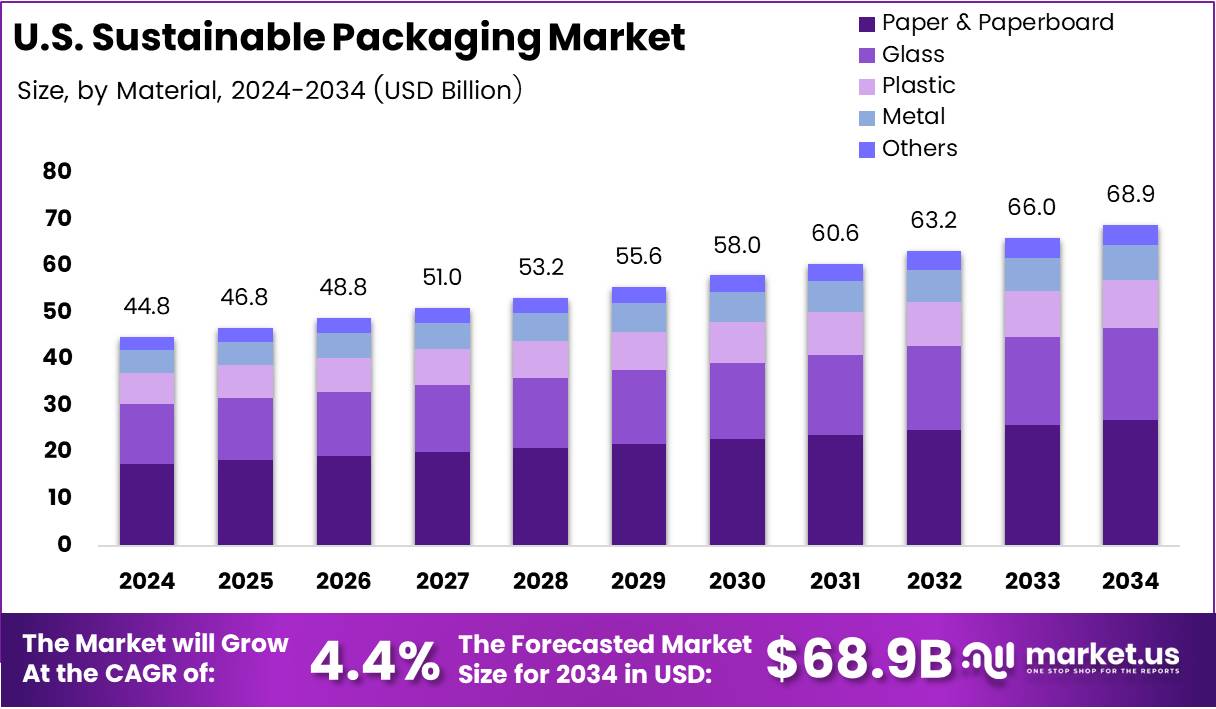

The U.S. sustainable packaging market is entering a transformative decade, projected to grow from USD 44.8 billion in 2024 to USD 68.9 billion by 2034, reflecting a steady CAGR of 4.4%. This growth highlights the country’s decisive shift toward eco-friendly materials and waste-reduction solutions across industries.

As regulatory frameworks tighten and consumer demand accelerates, businesses are embedding sustainability into packaging design, manufacturing, and distribution. From plant-based alternatives to reusable systems, innovation is reshaping how companies deliver products while aligning with national climate objectives.

Moreover, rising e-commerce volumes, stringent plastic bans, and corporate ESG commitments are pushing sustainable packaging beyond compliance. It is becoming a strategic tool for enhancing brand reputation, supply chain efficiency, and long-term competitiveness in the U.S. economy.

Key Takeaways

- The U.S. Sustainable Packaging Market is projected to reach USD 68.9 Billion by 2034, up from USD 44.8 Billion in 2024, at a CAGR of 4.4%.

- In 2024, Paper & Paperboard dominated the material segment with a 39.3% share, driven by recyclability and broad adoption across industries.

- Boxes & Cartons led the product type segment with a 28.6% share, supported by high use in e-commerce and retail.

- Recycled Packaging accounted for a 48.2% share in the process segment, reflecting rising investments in recycling and EPR initiatives.

- Food & Beverages emerged as the leading application segment with a 41.4% share, owing to strong eco-friendly packaging demand.

Market Segmentation Overview

By Material, Paper & Paperboard held a 39.3% share in 2024, driven by its wide recyclability and growing use in food service, retail, and online commerce. This segment benefits from government policies promoting circular models and consumer preference for biodegradable options.

By Product Type, Boxes & Cartons led with a 28.6% share. Their recyclability, cost efficiency, and widespread application in e-commerce logistics positioned them as the most sought-after sustainable packaging category across industries.

By Process, Recycled Packaging dominated with a 48.2% share. The segment thrived on investments in recycling infrastructure, consumer awareness, and EPR compliance, making it central to the U.S. sustainability landscape.

By Application, Food & Beverages captured a 41.4% share, reflecting high consumption patterns and strict sustainability compliance. Companies in this sector are prioritizing eco-friendly solutions to align with consumer expectations and regulatory mandates.

Drivers

A surge in consumer preference for recyclable and compostable packaging is accelerating adoption. According to EPA data, 33 million tons of cardboard were recycled in 2024, reinforcing consumer trust in paper-based solutions. Shoppers increasingly demand eco-friendly formats, compelling brands to strengthen their sustainability agendas.

Extended Producer Responsibility (EPR) policies are also reshaping the market. These frameworks make producers accountable for post-consumer packaging waste, encouraging recycling and compostable innovations. With more states rolling out EPR, packaging companies are adapting quickly to remain competitive.

Use Cases

In the food industry, sustainable packaging is being applied to reduce waste and enhance consumer appeal. Compostable trays, recyclable cartons, and refillable beverage containers are ensuring both regulatory compliance and strong brand loyalty among eco-conscious buyers.

E-commerce is another major use case, where recyclable mailers and biodegradable wraps are increasingly adopted. As online shopping expands, companies are prioritizing eco-friendly packaging to balance sustainability with logistics efficiency.

Major Challenges

A critical challenge lies in the limited recycling infrastructure for advanced bioplastics and composites. While innovation is rapid, U.S. facilities often lack the capacity to process these materials effectively, creating a disconnect between product design and waste management outcomes.

Another challenge is regulatory inconsistency. With states setting varying sustainability rules, packaging manufacturers face operational complexity and higher costs. This fragmented regulatory environment slows nationwide adoption of unified sustainable practices.

Business Opportunities

The expansion of bio-based polymers and biodegradable films presents significant growth opportunities. Food packaging manufacturers are increasingly investing in plant-derived solutions that meet consumer demand while addressing plastic bans.

Smart packaging innovations combining eco-friendly materials with features like freshness monitoring are also emerging. These technologies extend shelf life, reduce waste, and create value for businesses seeking both sustainability and operational efficiency.

Recent Developments

- June 2025 – A total of USD 1.9 billion in sustainable packaging investments was reported as inefficiently allocated, raising concerns about strategic alignment.

- April 2025 – Pack2Zero secured USD 5.7 million in funding to scale eco-friendly packaging innovations for mainstream adoption.

- July 2025 – Bambrew raised USD 10.3 million to expand sustainable packaging solutions globally, boosting its U.S. footprint.

- November 2024 – Ukhi landed USD 1.2 million in pre-seed funding to accelerate bio-packaging innovations and eco-conscious product development.

Conclusion

The U.S. sustainable packaging market is moving from regulatory compliance to strategic transformation. With projections reaching USD 68.9 billion by 2034, the sector is set to redefine how businesses approach packaging, balancing innovation, circularity, and consumer trust. Companies investing in bio-based solutions, recycling infrastructure, and reusable systems are positioned to lead the next phase of sustainable growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)