Table of Contents

Introduction

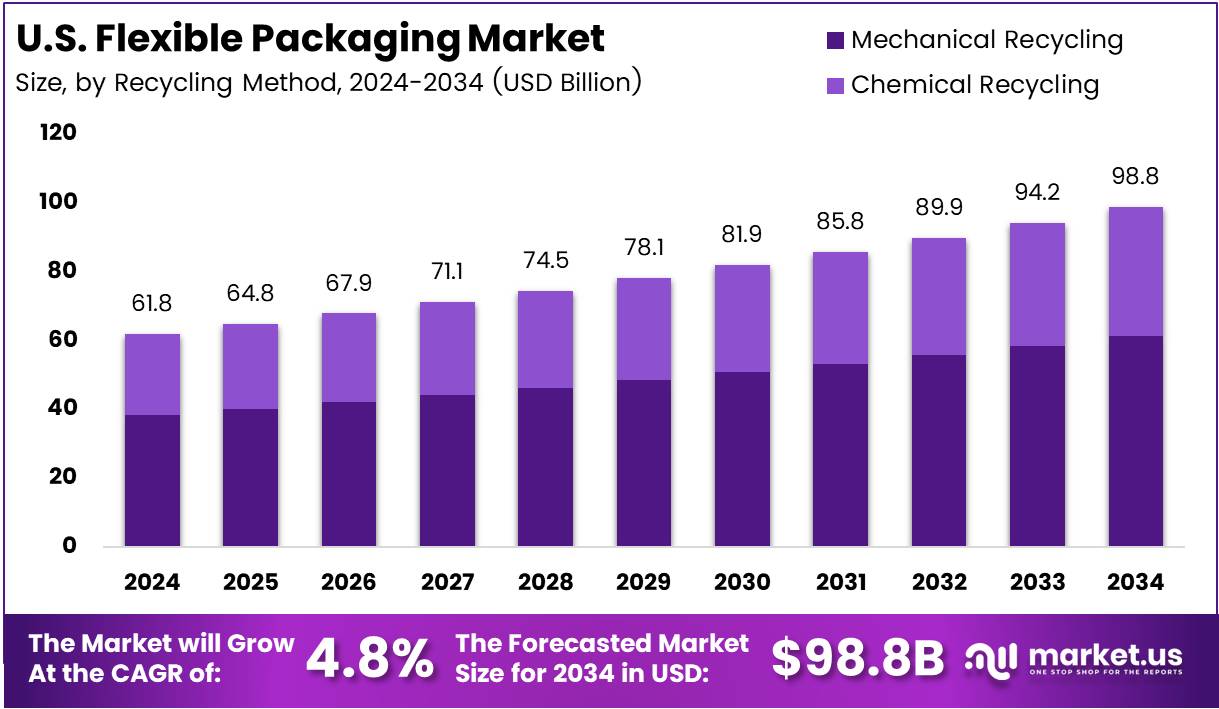

The U.S. Flexible Packaging Market is entering a transformative decade, projected to grow from USD 61.8 Billion in 2024 to USD 98.8 Billion by 2034, advancing at a CAGR of 4.8%. This growth reflects strong consumer demand for convenience, sustainability, and innovative packaging formats.

Moreover, shifting lifestyles, expanding e-commerce, and government-backed sustainability initiatives are fueling the adoption of lightweight, versatile, and eco-friendly packaging solutions. From resealable pouches to compostable laminates, the market is steadily adapting to evolving consumer expectations and regulatory standards.

Key Takeaways

- The U.S. Flexible Packaging Market is projected to reach USD 98.8 Billion by 2034, rising from USD 61.8 Billion in 2024, at a CAGR of 4.8%.

- In 2024, Mechanical Recycling dominated the recycling method segment with a 67.9% share, supported by mature infrastructure and cost efficiency.

- Pouches held the leading packaging type share in 2024 with 31.8%, reflecting consumer demand for lightweight and convenient formats.

- By material type, Plastic captured a 34.4% share in 2024, driven by versatility, affordability, and strong protective performance.

- The Food and Beverages sector led end-use in 2024 with a commanding 58.3% share, highlighting extensive packaging requirements across categories.

Market Segmentation Overview

Recycling Method

In 2024, Mechanical Recycling held a 67.9% share, cementing its dominance due to widespread adoption and cost efficiency. With established infrastructure and proven economic viability, it remains the most relied-upon recycling approach, while chemical recycling shows growth potential but faces higher costs and limited capacity.

Packaging Type

Pouches captured 31.8% in 2024, driven by their lightweight properties, versatility, and consumer-friendly design. Their ability to reduce material usage while ensuring product freshness has made them the top choice across food, personal care, and household categories, significantly reshaping packaging preferences.

Material Type

Plastic accounted for 34.4% in 2024, supported by its superior barrier qualities and affordability. Sub-segments like PE, PP, and PET dominate due to moisture resistance, heat stability, and durability. While paper, biopolymers, and aluminum foil are expanding, plastics remain central to industry supply chains.

End-Use

Food and Beverages led with 58.3% in 2024, reflecting extensive demand across packaged foods, drinks, and ready-to-consume products. Growing consumer demand for freshness, portion control, and convenience continues to sustain this dominance, while pharmaceuticals and cosmetics are expanding their packaging adoption.

Drivers

The first key driver is the consumer shift toward lightweight and convenient packaging solutions. Flexible packaging reduces transportation costs, provides resealable features, and adapts to diverse e-commerce requirements, making it a prime choice in modern retail.

The second driver is the growing focus on sustainability. Companies are innovating recyclable and bio-based formats to meet consumer preferences and regulatory frameworks. This dual focus on cost savings and environmental impact makes flexible packaging highly competitive.

Use Cases

One major use case is in the food industry, where stand-up pouches and films extend product shelf life while ensuring lightweight transport. They are widely adopted in fresh produce, frozen foods, and beverages, aligning with consumer demand for sustainable and portable formats.

Another use case lies in healthcare and pharmaceuticals, where sterile flexible packaging ensures safety, compliance, and easy handling. From medical devices to drug packaging, flexible formats support regulatory standards while maintaining product integrity.

Major Challenges

One significant challenge is regulatory compliance, as state-level restrictions on plastics require constant innovation. Companies face complex compliance requirements, adding costs and slowing product development.

Another challenge lies in limited recycling infrastructure, particularly for multilayer packaging. Difficulty in processing such materials raises environmental concerns, restricting adoption and requiring urgent investment in circular solutions.

Business Opportunities

The first major opportunity is the rise of bio-based and compostable packaging materials. Government incentives and consumer preference for eco-friendly products drive investment in biodegradable alternatives, creating long-term growth avenues.

The second lies in smart packaging technologies, which incorporate sensors for freshness, temperature, and tracking. These innovations enhance customer trust, reduce waste, and create new premium product segments.

Recent Developments

- Jul 2025: TedPack LLC acquired Fairview International LLC, expanding its footprint in North America and Europe, boosting capacity, and diversifying premium packaging solutions.

- Jun 2024: Eagle Flexible Packaging installed a SOMA Optima2 Wide Web Flexographic Printing Press, enhancing efficiency and sustainable high-quality printing capabilities.

- Apr 2025: TOPPAN Holdings acquired Sonoco’s TFP business, broadening its advanced materials portfolio with stronger capabilities in electronics, healthcare, and sustainable packaging.

Conclusion

The U.S. Flexible Packaging Market is undergoing a pivotal transformation, moving toward USD 98.8 Billion by 2034 at a CAGR of 4.8%. Anchored by sustainability trends, consumer convenience, and digital innovation, the market is expected to remain a critical pillar of the packaging industry.

While regulatory challenges and recycling limitations present barriers, opportunities in bio-based materials and smart packaging underscore a strong growth trajectory. Backed by government policies and rising eco-conscious consumer behavior, flexible packaging is positioned as a resilient and adaptive solution for the future.