Table of Contents

Introduction

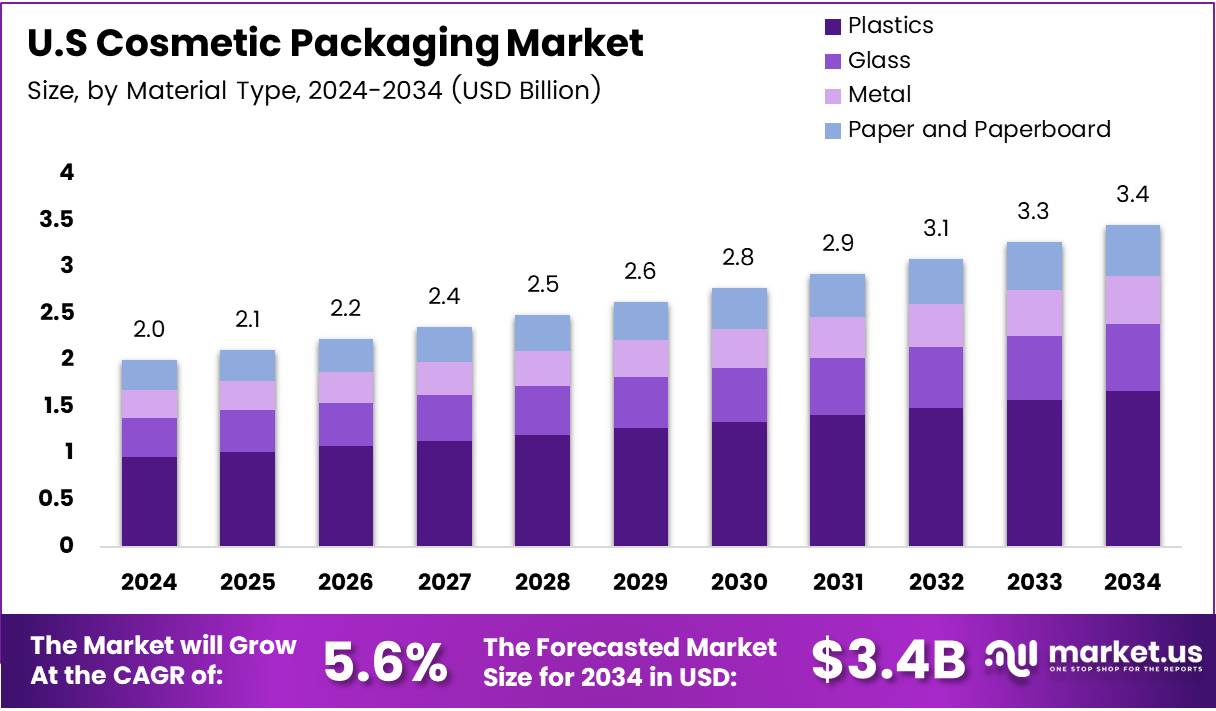

The U.S. cosmetic packaging market is set for a strong decade of growth, projected to reach USD 3.4 Billion by 2034 from USD 2.0 Billion in 2024, advancing at a CAGR of 5.6%. Packaging remains a vital enabler for the beauty and personal care industry, ensuring product protection, brand differentiation, and compliance with evolving regulations.

Transitioning into the next phase, the market is being reshaped by sustainability demands, design innovation, and the rapid rise of e-commerce. Packaging is no longer a functional necessity but a strategic tool that enhances consumer experience, aligns with eco-conscious values, and sustains competitive advantage in a crowded marketplace.

Key Takeaways

- The U.S. Cosmetic Packaging Market is projected to reach USD 3.4 Billion by 2034, up from USD 2.0 Billion in 2024, with a CAGR of 5.6%.

- In 2024, Plastics led with a 48.3% share, driven by versatility and cost-efficiency.

- Bottles and Jars dominated with a 38.1% share, reflecting wide use in skincare, haircare, and liquid cosmetics.

- Pump-based dispensing mechanisms held 42.9%, supported by demand for hygienic and precise application.

- Skin Care accounted for 44.4%, fueled by rising focus on anti-aging and preventive beauty care.

Market Segmentation Overview

Plastics maintained a dominant 48.3% share in 2024, offering lightweight, cost-effective, and versatile solutions. Glass held its ground as the premium choice for luxury packaging, while paper and paperboard gained momentum due to sustainability policies and consumer demand for recyclable materials.

Bottles and Jars secured 38.1% of the market, showcasing their role as the backbone of skincare, haircare, and liquid cosmetic categories. Tubes and sticks emerged as strong contenders in lip care and travel-friendly cosmetics, while folding cartons and pouches grew in supporting roles.

Pump-based mechanisms held the lead with 42.9%, reflecting consumer trust in precision and hygiene. Droppers and pipettes gained traction in premium skincare, while spray dispensers and twist-up formats served niche product needs with user-friendly solutions.

Skin Care packaging captured 44.4%, underscoring the U.S. consumer shift toward holistic routines, anti-aging, and wellness-focused regimens. Color cosmetics and fragrances continued to drive demand for aesthetic-driven and functional formats.

Drivers

One key driver is the rising demand for premium beauty products, which accelerates the adoption of elegant, durable, and eco-conscious packaging that mirrors brand quality. Luxury skincare and fragrance packaging, particularly glass and high-end plastics, benefit from this trend.

Another driver is the expansion of e-commerce beauty sales, requiring packaging that balances durability and aesthetic appeal. Ship-ready formats with leak-proof and lightweight features are pushing design innovation to meet logistics and sustainability expectations.

Use Cases

Cosmetic packaging safeguards formulations while enhancing consumer engagement. Protective e-commerce-ready solutions ensure that delicate creams, serums, and fragrances remain intact during shipping, reducing damage-related losses.

Customizable and refillable designs serve as a marketing tool, enabling brands to stand out in subscription boxes, influencer-driven sales, and retail promotions. Packaging thus evolves into both a protective function and a loyalty-building asset.

Major Challenges

The regulatory landscape poses challenges, as compliance with FDA labeling, safety, and recyclability standards requires significant investment. Smaller cosmetic players face higher barriers to entry due to complex compliance costs.

Another challenge is raw material price volatility, especially for plastics, glass, and paper. Fluctuating costs disrupt supply chains and margin stability, forcing companies to adopt flexible sourcing and pricing strategies.

Business Opportunities

The shift toward refillable and reusable systems provides brands with a unique opportunity to align with circular economy goals. This move not only reduces waste but also encourages repeat purchases through refill programs.

The rise of smart packaging technologies such as QR codes and AR-enabled designs offers anti-counterfeiting benefits, consumer engagement, and direct marketing opportunities. This tech-driven approach helps brands stand out in a competitive environment.

Regional Analysis

The U.S. remains the largest market in North America, backed by high consumer spending on personal care products, which reached USD 387.5 Billion in 2023 (BEA). This spending power ensures a strong base for both primary and secondary packaging growth.

State-level initiatives, particularly in California, are driving extended producer responsibility (EPR) policies. These regulations encourage brands to adopt recyclable, biodegradable, or refillable solutions, reshaping the competitive landscape of packaging suppliers.

Recent Developments

- Aug 2025 – Debut raised US$20 million to accelerate its AI-driven ingredient discovery platform for skin longevity, strengthening R&D collaborations.

- Oct 2024 – Earthodic secured funding to expand its bio-based coating technology in the U.S., boosting sustainable alternatives to petroleum-based coatings.

- May 2024 – Three Ships Beauty raised C$3.5 million to expand retail distribution and clean beauty manufacturing capabilities in the U.S.

- May 2025 – Wonderskin secured US$50 million to expand its retail footprint and develop high-performance beauty packaging innovations.

Conclusion

The U.S. cosmetic packaging market is entering a decade of transformative growth. With USD 3.4 Billion projected by 2034, sustainability, digital readiness, and consumer personalization will remain the guiding forces. Companies that embrace eco-conscious innovation, smart technologies, and premium aesthetics will not only achieve compliance but also secure competitive leadership in a highly dynamic beauty ecosystem.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)