Table of Contents

Overview

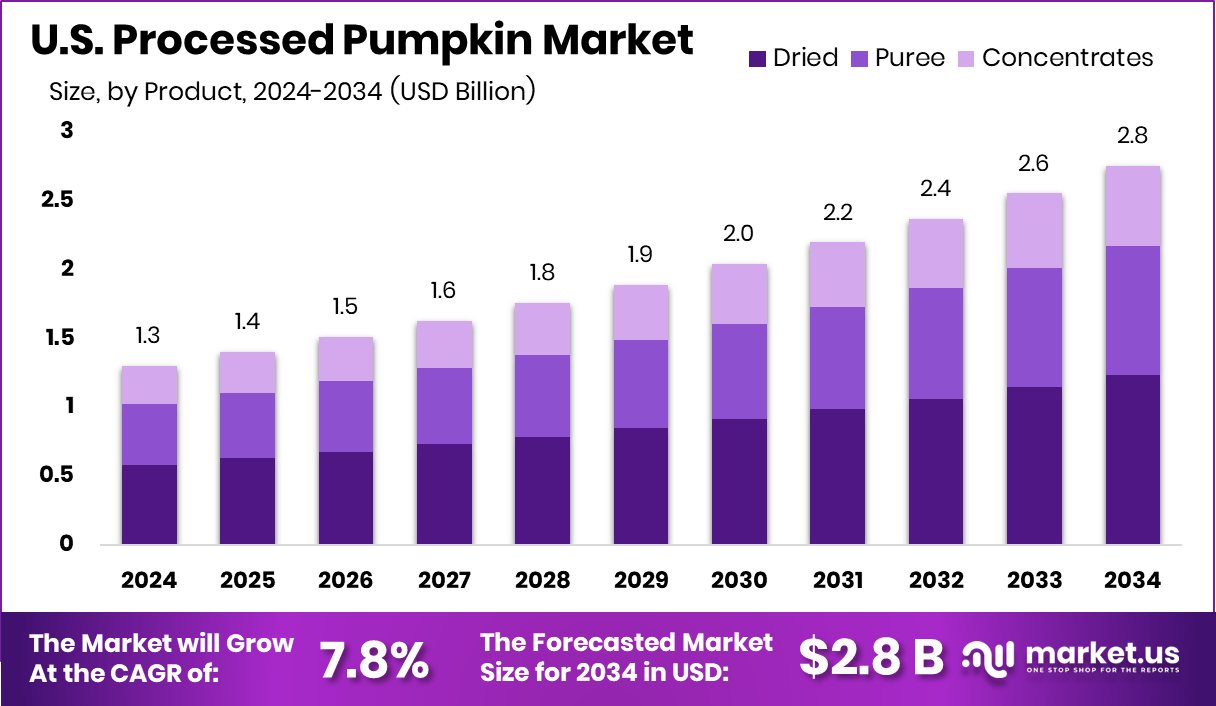

New York, NY – October 03, 2025 – The U.S. Processed Pumpkin Market is projected to reach USD 2.8 billion by 2034, rising from USD 1.3 billion in 2024, at a CAGR of 7.8% from 2025 to 2034. Processed pumpkin in the U.S. refers to pumpkin transformed into value-added forms such as canned pumpkin, puree, concentrates, powders, and dried pieces. Unlike fresh pumpkins, these products are preserved through canning, freezing, or drying, offering longer shelf life, consistency, and convenience for both consumers and food manufacturers.

They are widely used in bakery goods, soups, snacks, beverages, and baby food. The U.S. processed pumpkin industry focuses on producing and distributing pumpkin-based ingredients for domestic use and exports. Its growth is strongly linked to consumer demand for nutritious, seasonal, and natural foods, given pumpkin’s richness in fiber, vitamins, and antioxidants. Advancements in processing technologies, along with rising interest in plant-based and functional ingredients, continue to support market expansion.

Additionally, government-backed dietary initiatives that encourage fruit and vegetable consumption further reinforce demand. Pumpkin’s versatility as a creamy, nutrient-rich ingredient makes it suitable for both sweet and savory applications, fueling widespread adoption. Convenience and shelf stability enhance its value proposition in modern food systems. Opportunities exist in expanding organic and specialty lines, including pumpkin powders, functional snack formulations, baby food, and artisan purees.

Varietal innovations—focused on flavor, color, and processing efficiency also offer growth potential. U.S. government programs play a significant role in market development. The USDA has allocated over USD 82.3 million through its Specialty Crops Block Grant Program and Multi-State Grant Program to strengthen competitiveness in specialty crops, including pumpkin.

The USDA’s Value-Added Producer Grant (VAPG) provides up to USD 250,000 in working capital funding to support the processing and marketing of innovative value-added pumpkin products. Illinois remains the leading state for processing varieties, with nearly 70% of its pumpkin acreage dedicated to this purpose. Improved cultivation practices and stable yields contribute to a steady supply, helping achieve economies of scale and ensuring consistent availability for processors.

Key Takeaways

- The Global U.S. Processed Pumpkin Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

- By Product, dried pumpkin holds 44.8% in the U.S. Processed Pumpkin Market, showing rising shelf-stable demand.

- By Application, bakery dominates with a 34.7% share in the U.S. Processed Pumpkin Market, driven by seasonal use.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/u-s-processed-pumpkin-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.8 Billion |

| CAGR (2025-2034) | 7.8% |

| Segments Covered | By Product (Dried, Puree, Concentrates), By Application (Bakery, Beverages, Desserts, Baby Food, Snacks, Others) |

| Competitive Landscape | Libby’s Brand Holding, Del Monte Foods, Seneca Foods, Kraft Heinz, Inc., Pinnacle Foods Co., Woodland Gourmet, Döhler Group, Seawind Foods, Great American Spice Company, Kerr by Ingredion |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157932

Key Market Segments

By Product Analysis

In 2024, the Dried segment led the U.S. Processed Pumpkin Market’s By Product category, commanding a 44.8% share. Its dominance stems from its extended shelf life, lightweight properties, and ease of transport compared to fresh or canned options. Dried pumpkin is a popular choice for soups, bakery mixes, snacks, and powdered nutritional supplements.

The segment’s growth is fueled by rising consumer demand for natural and functional ingredients in packaged foods. Its availability in powder and flake forms enhances its appeal to food manufacturers seeking cost-effective, nutrient-rich formulations. With health-conscious trends and growing incorporation of dried fruits and vegetables in diets, the dried pumpkin segment is poised for continued expansion.

By Application Analysis

In 2024, the Bakery segment dominated the U.S. Processed Pumpkin Market’s By Application category, holding a 34.7% share. This leadership is driven by the extensive use of pumpkin puree and dried forms in pies, muffins, breads, and seasonal desserts, particularly during festive periods when pumpkin-flavored baked goods are in high demand.

The segment benefits from increasing health awareness, as pumpkin’s high fiber, vitamin content, and low-calorie profile align with consumer preferences for nutritious baked goods. Innovations such as gluten-free and organic pumpkin-based products further broaden the segment’s appeal. With growing demand for convenient, ready-to-eat pumpkin bakery items, this application is expected to sustain strong market performance year-round.

Top Use Cases

- Baking Delights: Processed pumpkin puree adds creamy moisture and mild sweetness to baked goods like pies, muffins, breads, and seasonal pastries in the U.S. food industry. Bakers use it for its nutritional boost, making treats healthier while keeping them tender and flavorful. This versatile ingredient shines in home kitchens and commercial bakeries, especially during holidays when demand peaks for cozy, fall-inspired recipes.

- Soup and Sauce Creations: In American cooking, processed pumpkin forms the base for hearty soups, creamy sauces, and stews, blending smoothly with spices for savory depth. Food manufacturers incorporate it into ready-to-eat products for convenience, appealing to busy families seeking nutritious, warming meals year-round. Its thick texture enhances dishes without overpowering other flavors.

- Beverage Innovations: U.S. brands mix processed pumpkin into smoothies, lattes, juices, and specialty drinks for a natural, earthy taste and vibrant color. This appeals to health-focused consumers wanting plant-based options with vitamins and fiber. Seasonal flavors like pumpkin spice drive popularity in cafes and homes, turning simple beverages into indulgent treats.

- Snack and Baby Food Options: Processed pumpkin goes into healthy snacks such as bars, chips, and granola, plus gentle baby foods for its fiber and vitamins. Parents and snack makers value it for clean-label appeal and natural sweetness, supporting growing trends in wholesome, kid-friendly products that fit busy lifestyles without added sugars.

- Dessert and Dairy Blends: American dessert makers blend processed pumpkin into cheesecakes, ice creams, and frozen treats for richness and subtle nuttiness. In dairy items like yogurts, it provides a creamy base while boosting nutrition. This use caters to those craving indulgent yet lighter options during festive seasons.

Recent Developments

1. Libby’s Brand Holding

Libby’s, a dominant force, continues to focus on supply chain resilience and sustainability. Recent efforts include promoting its use of 100% pumpkin without additives and educating consumers on its deep-rooted farmer partnerships to ensure consistent quality. The brand leverages its heritage and trusted name to maintain market leadership, especially during the key seasonal demand period, while highlighting the simplicity and purity of its core canned pumpkin product.

2. Del Monte Foods

Del Monte has been innovating within its pantry portfolio, including its canned pumpkin line. The company emphasizes the versatility of its pumpkin beyond pies, suggesting uses in soups, smoothies, and dog treats. Recent strategic focus has been on optimizing its supply chain and manufacturing efficiency to offer a competitively priced, high-quality product, ensuring broad distribution and availability in mainstream grocery channels.

3. Seneca Foods

As a major private label and food service supplier, Seneca Foods’ development is tied to the broader private label growth trend. The company has invested in agricultural efficiency and processing capacity to support its contracted growers. Its recent role involves helping retailers expand their store-brand canned pumpkin offerings, capitalizing on consumer shift to value brands while ensuring a stable supply from its large-scale processing operations.

4. Kraft Heinz, Inc.

Kraft Heinz leverages its massive distribution network for its canned pumpkin. Recent developments are part of its broader “Agile & Agile” strategy, focusing on operational efficiency and cost management within its portfolio. While not launching significant pumpkin-specific innovations, the company ensures its product is a reliable, widely available option, supported by the strength of its retail relationships and supply chain logistics rather than product-line marketing.

5. Pinnacle Foods Co

Following its acquisition by Conagra Brands, the former Pinnacle Foods’ operations, including its store-brand and food service pumpkin contracts, have been integrated into Conagra’s supply chain. Recent developments are now under Conagra’s strategic focus on margin growth and supply chain optimization. This has led to a more streamlined and efficient operation for its private label pumpkin products, benefiting from Conagra’s scaled resources.

Conclusion

The U.S. Processed Pumpkin sector thrives on its role as a flexible, health-promoting ingredient in diverse food applications, fueled by cultural traditions and rising interest in natural, convenient eats. As preferences shift toward wholesome choices, opportunities abound for innovation in forms like purees and powders, ensuring steady expansion amid seasonal peaks and broader wellness trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)