Table of Contents

Overview

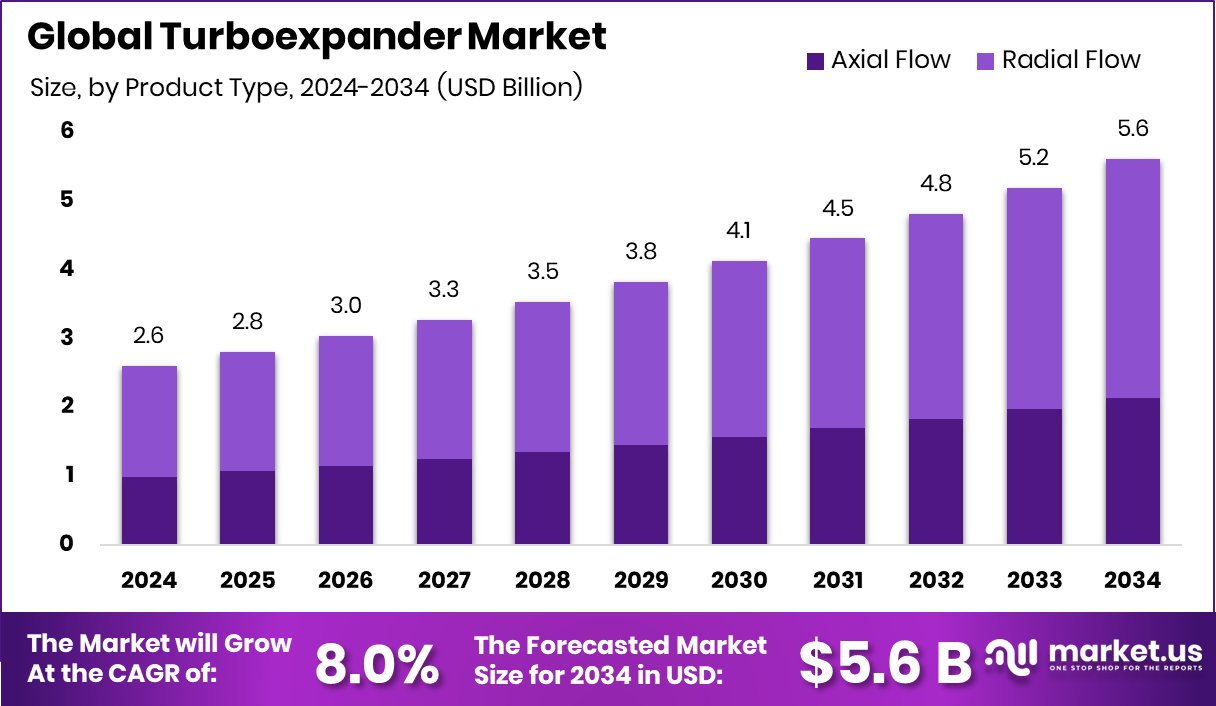

New York, NY – August 07, 2025 – The Global Turboexpander Market is projected to grow from USD 2.6 billion in 2024 to USD 5.6 billion by 2034, achieving a CAGR of 8.0% from 2025 to 2034. In 2024, the Asia-Pacific region led the market with a valuation of USD 1.1 billion.

A turboexpander is a high-speed rotating device that expands pressurized gas, converting thermal energy into mechanical energy. This process significantly reduces the gas’s temperature and pressure, making it essential for cryogenic applications like natural gas liquefaction, air separation, and helium recovery.

The turboexpander market encompasses the global production, installation, and maintenance of these devices across industries such as energy, petrochemicals, industrial gases, and renewables. Market growth is driven by increasing demand for energy-efficient gas processing, rising investments in LNG infrastructure, and expanding industrial gas applications.

A key driver is the growing use of turboexpanders in natural gas processing and LNG plants, where they enable low-temperature operations and enhance energy recovery while reducing carbon emissions. For instance, Cleantech startup Sapphire Technologies raised USD 10 million to accelerate the commercialization of its energy recovery systems for hydrogen and natural gas applications.

Additionally, the rising demand for industrial gas separation, particularly for oxygen, nitrogen, and argon production, fuels market growth. Turboexpanders support efficient cooling and expansion in air separation units, serving industries like metallurgy, healthcare, and electronics.

Key Takeaways

- The Global Turboexpander Market is expected to be worth around USD 5.6 billion by 2034, up from USD 2.6 billion in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034.

- Radial flow turboexpanders dominate the Turboexpander Market, holding a strong 62.8% share in 2024.

- Turboexpanders with less than 20 MW capacity captured 50.2% and were favored for compact and industrial uses.

- Hydrocarbon turboexpanders lead the application segment with 59.7%, mainly used in natural gas processing plants.

- The oil and gas sector remains the top end-user in the Turboexpander Market, accounting for 67.1% share.

- Rapid industrial growth in Asia-Pacific drives turboexpander demand, capturing 43.90% market share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/turboexpander-market/request-sample/

Report Scope

| Market Value (2024) | USD 2.6 Billion |

| Forecast Revenue (2034) | USD 5.6 Billion |

| CAGR (2025-2034) | 8.0% |

| Segments Covered | By Product Type (Axial Flow, Radial Flow), By Power Capacity (Less than 20 MW, 20 MW to 40 MW, Above 40 MW), By Application (Hydrocarbon Turboexpanders, Air Separation Turboexpanders, Others), By End-User (Oil and Gas, Power Generation, Others) |

| Competitive Landscape | Air Products and Chemicals Inc., Atlas Copco AB, Baker Hughes Company, Cryostar SAS, Chart Industries, Man Energy, Nikkiso ACD, PBS Group, a.s., R&D Dynamics Corporation, Siemens Energy (Siemens AG), Turbogaz |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153766

Key Market Segments

By Product Type Analysis

Radial Flow turboexpanders led the Turboexpander Market in 2024, capturing a 62.8% share. Their dominance stems from high efficiency in managing moderate-to-high flow rates and versatility across industrial applications. Ideal for cryogenic processes like gas processing and air separation, radial flow turboexpanders offer stable performance, compact design, and reliable energy recovery.

Their simple structure simplifies maintenance, boosting adoption in demanding sectors. The growing need for energy-efficient, reliable systems, coupled with their thermodynamic efficiency and durability under varying pressures, ensures radial flow turboexpanders maintain their market lead, especially as gas-based infrastructure and clean energy processes expand.

By Power Capacity Analysis

In 2024, turboexpanders with a capacity of less than 20 MW held a 50.2% market share, dominating the By Power Capacity segment. These compact, flexible systems are widely used in small- to mid-scale applications, such as decentralized gas processing, air separation, and energy recovery systems.

Their popularity reflects their ease of integration, quick commissioning, and suitability for both new and retrofit projects. Valued for energy efficiency and cost-effectiveness, these turboexpanders align with industries’ focus on reducing carbon emissions and improving process efficiency. The demand for scalable, modular systems further solidifies their position as a strategic choice.

By Application Analysis

Hydrocarbon Turboexpanders dominated the By Application segment in 2024 with a 59.7% share, driven by their critical role in natural gas processing and hydrocarbon recovery. Engineered for gases like methane, ethane, and propane, they are essential in gas plants, refineries, and petrochemical facilities.

Their ability to provide cryogenic cooling, lower energy costs, and increase throughput drives adoption in both new and existing plants. As global energy industries prioritize optimized gas processing, hydrocarbon turboexpanders remain vital for their reliability and efficiency in harsh environments, supporting sustainable and cost-effective operations.

By End-User Analysis

The Oil and Gas sector led the By End-User segment in 2024, accounting for 67.1% of turboexpander demand. Turboexpanders are integral to upstream, midstream, and downstream operations, including natural gas processing, pressure let-down stations, and LNG facilities, where they enable efficient gas expansion, energy recovery, and cooling.

Their dominance reflects their role in optimizing performance and reducing costs in oil and gas operations. With the industry’s focus on lowering carbon emissions and enhancing efficiency in refining and gas transport, turboexpanders’ durability and high thermal efficiency make them indispensable in demanding environments.

Regional Analysis

In 2024, the Asia-Pacific region held the largest share of the global turboexpander market at 43.9%, valued at USD 1.1 billion. Rapid industrialization, expanding natural gas infrastructure, and investments in energy-efficient technologies drive this dominance. Countries in the region, heavily engaged in petrochemicals, LNG processing, and industrial gas production, rely on turboexpanders for pressure management and energy recovery.

Government initiatives promoting cleaner energy and infrastructure modernization further boost demand. While North America and Europe remain significant due to established oil and gas sectors, and the Middle East & Africa and Latin America show steady growth, Asia-Pacific leads due to its extensive energy projects and industrial expansion.

Top Use Cases

- Natural Gas Liquefaction: Turboexpanders cool and expand high-pressure natural gas in LNG plants, enabling efficient liquefaction. They significantly lower the gas temperature, supporting energy recovery and reducing operational costs. Their role in modern gas processing facilities drives demand, especially as global LNG infrastructure expands to meet cleaner energy needs.

- Air Separation: Turboexpanders are vital in separating air into gases like nitrogen, oxygen, and argon for industries such as healthcare, metallurgy, and electronics. They cool the air to cryogenic levels, ensuring efficient gas production. Their reliability and energy efficiency make them essential for high-demand industrial gas applications.

- Energy Recovery in Pipelines: Turboexpanders capture energy from high-pressure gas streams in pipelines, converting it into electricity. Used in pressure let-down stations, they replace traditional valves, reducing energy waste. This supports cost savings and lower carbon emissions, making them ideal for sustainable gas distribution systems.

- Hydrocarbon Recovery: In gas processing plants, turboexpanders recover valuable liquids like ethane and propane from natural gas. They achieve cryogenic cooling, separating hydrocarbons efficiently. This enhances plant productivity and profitability, meeting the rising demand for natural gas liquids in the petrochemical and energy sectors.

- Geothermal Power Generation: Turboexpanders generate electricity in geothermal plants by expanding high-pressure gas or steam. They improve energy efficiency in low- to medium-power applications, supporting carbon-free power production. Their adoption is growing as industries prioritize renewable energy to meet sustainability goals.

Recent Developments

1. Air Products and Chemicals Inc.

- Air Products has advanced its turboexpander technology for hydrogen liquefaction, enhancing efficiency in large-scale LNG and clean energy projects. Their SMR-X expander boosts cryogenic processes, reducing energy consumption. The company is also integrating turboexpanders in blue and green hydrogen initiatives.

2. Atlas Copco AB

- Atlas Copco’s NGS Turboexpander series now features improved aerodynamics for higher efficiency in natural gas processing. The latest models offer better pressure control and reliability, targeting biogas and carbon capture applications. Their expanders are used in helium and nitrogen recovery systems.

3. Baker Hughes Company

- Baker Hughes introduced the NovaLT Turboexpander, optimized for LNG and industrial gas applications. It incorporates advanced bearing technology for lower maintenance and higher uptime. The company is also deploying turboexpanders in carbon capture and hydrogen projects.

4. Cryostar SAS

- Cryostar launched its H2 turboexpander for liquid hydrogen production, supporting the energy transition. Their expanders now feature magnetic bearings for oil-free operation, enhancing reliability in cryogenic applications. The company is expanding into helium and bio-LNG markets.

5. Chart Industries

- Chart Industries’ Turbonetics Turboexpanders have been upgraded for hydrogen and helium liquefaction. Their latest models improve efficiency in peak-shaving LNG plants and small-scale gas processing. Chart is also focusing on modular turboexpander solutions for decentralized energy projects.

Conclusion

The Turboexpander Market is poised for strong growth, driven by rising demand for energy-efficient and sustainable solutions across industries like LNG, hydrogen, and industrial gas processing. Their ability to recover energy, reduce emissions, and support cryogenic applications aligns with global decarbonization goals. As industries prioritize cost savings and environmental responsibility, turboexpanders will remain critical for optimizing processes and advancing clean energy initiatives.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)