Table of Contents

Overview

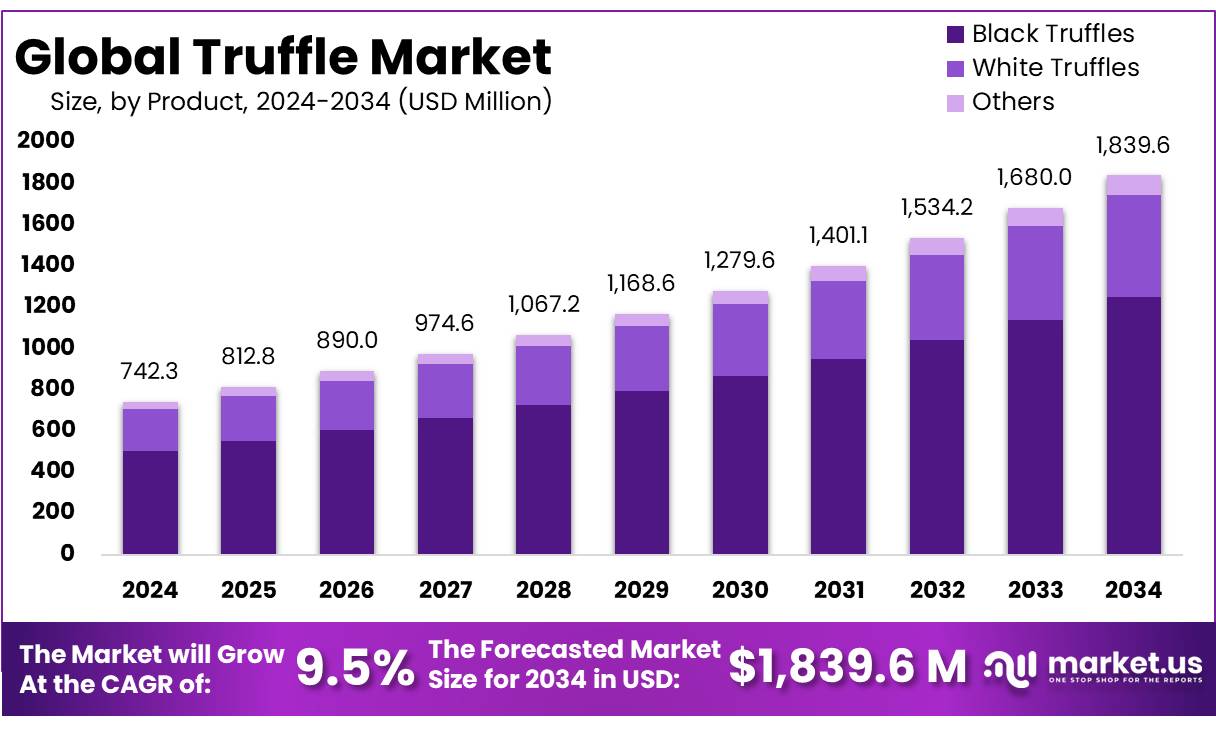

New York, NY – August 04, 2025 – The Global Truffle Market is projected to grow from USD 742.3 million in 2024 to USD 1,839.6 million by 2034, with a CAGR of 9.5% during the 2025–2034 forecast period. In 2024, North America led the market, holding a 56.2% share and generating USD 417.1 million in revenue.

Truffle concentrates, such as oils, pastes, powders, and salts, are specialty ingredients derived from gourmet truffles (primarily Tuber species like black melanosporum and white magnatum). This segment links primary truffle production to luxury culinary markets, serving food manufacturers, fine-dining restaurants, and retail consumers. Truffle concentrates offer a stable, scalable alternative to fresh truffles, providing consistent flavor, extended shelf life, and accessibility for gourmet cooking.

Key growth drivers include rising demand in premium culinary sectors, adoption by foodservice and retail channels, and increasing consumer interest in gourmet home cooking. Processed truffle products, including concentrates, accounted for ~45% of the 2024 market. These products appeal to both culinary enthusiasts and health-conscious consumers due to truffles’ antioxidant and bioactive properties.

Government initiatives, such as the EU’s Rural Development Programme, have supported truffle orchard expansion in regions like Aragón, Spain, through subsidies. Similarly, agricultural agencies like India’s APEDA are exploring trade frameworks to promote exotic products, though truffle-specific data is limited.

National forestry and agriculture ministries view truffle cultivation as a tool for rural diversification, boosting incomes and reversing depopulation. For instance, Teruel, Spain, reported a €17 million turnover and school enrollment growth from 72 to 153 children over 15 years, driven by truffle-related development.

Key Takeaways

- Truffle Market size is expected to be worth around USD 1839.6 Million by 2034, from USD 742.3 Million in 2024, growing at a CAGR of 9.5%.

- Black Truffles held a dominant market position, capturing more than a 67.9% share of the overall truffle market.

- Conventional held a dominant market position, capturing more than 79.4% share of the global truffle market.

- Fresh held a dominant market position, capturing more than a 59.6% share of the overall truffle market.

- B2B held a dominant market position, capturing more than a 69.4% share of the global truffle market.

- Food & Beverages held a dominant market position, capturing more than a 74.3% share of the global truffle market.

- Europe stands as the dominant region in the global truffle market, accounting for 56.2% of the total market share, with a valuation reaching approximately USD 417.1 million in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/truffle-market/request-sample/

Report Scope

| Market Value (2024) | USD 742.3 Million |

| Forecast Revenue (2034) | USD 1839.6 Million |

| CAGR (2025-2034) | 9.5% |

| Segments Covered | By Product (Black Truffles, White Truffles, Others), By Nature (Organic, Conventional), By Form (Fresh, Processed), By Distribution Channel (B2B, B2C), By End-use (Food and Beverages, Cosmetics and Personal Care Products, Pharmaceuticals, Others) |

| Competitive Landscape | Arotz, SA, Gazzarrini Tartufi, TruffleHunter, Inc., Urbani Truffles, SABATINO NA LLC, LES FRÈRES JAUMARD, The Welsh Truffle Co., PLANTIN Truffles, Truffle Hill, Tartufi Morra, Angellozzi Tartuficoltura, Great Southern Truffles, BLACK BOAR TRUFFLE, Trufo, OLD WORLD TRUFFLES |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152762

Key Market Segments

By Product Analysis

Black Truffles led the global truffle market in 2024, commanding a 67.9% share. Their dominance stems from high culinary demand, particularly in fine dining and premium food products across Europe and North America, where Tuber melanosporum’s intense aroma and versatility are prized.

Consistent cultivation in France, Spain, and Italy, supported by favorable climates and established harvesting methods, ensures a robust supply. The growing popularity of processed truffle products like oils, sauces, and concentrates, which predominantly use black truffles, further strengthens their market position.

By Nature Analysis

Conventional Truffles held a 79.4% share of the global truffle market in 2024, driven by their widespread availability and lower production costs. Well-established cultivation techniques in countries such as France, Spain, and China enable higher yields and efficient supply chains, making conventional truffles more accessible than organic varieties. Their versatility across foodservice and packaged products makes them the preferred choice for manufacturers and chefs.

By Form Analysis

Fresh Truffles dominated the market in 2024 with a 59.6% share, fueled by strong demand from luxury restaurants, hotels, and gourmet kitchens. Prized for their aroma, texture, and flavor, fresh truffles are a premium ingredient in European and North American cuisines. Their limited availability and short shelf life enhance their exclusivity, driving high prices during peak seasons and appealing to chefs and food enthusiasts.

By Distribution Channel Analysis

The B2B channel led the truffle market in 2024, capturing a 69.4% share. This is driven by consistent demand from restaurants, hotels, catering services, and food manufacturers seeking bulk supplies for quality control and freshness. B2B transactions, often involving long-term contracts and seasonal sourcing agreements, are critical in the truffle trade due to its limited harvest window, ensuring traceability and volume discounts.

By End-Use Analysis

The Food & Beverages sector held a 74.3% share of the truffle market in 2024, propelled by truffles’ widespread use in fine dining, specialty dishes, and premium packaged products. From truffle-infused oils, cheeses, and pasta to sauces and snacks, demand for truffle flavoring has surged in retail and foodservice. The growing trend of gourmet ingredients in everyday meals and the appeal of natural flavor enhancers further drive this segment’s growth.

Regional Analysis

Europe dominated the global truffle market in 2024, holding a 56.2% share valued at USD 417.1 million. Its leadership is rooted in a rich culinary heritage, favorable climates, and advanced cultivation techniques. France, Italy, and Spain are key producers, with France leading in black truffle (Tuber melanosporum) production, Italy excelling in white truffles (notably Alba varieties fetching over US$3,000/kg at auctions), and Spain expanding truffle farming with over 10,000 hectares supported by EU subsidies and reforestation initiatives.

Major truffle markets like Sarlat and Richerenches in France and events in Italy’s Umbria and Piedmont attract global buyers. The EU’s Common Agricultural Policy (CAP) funds truffle cultivation, promoting sustainable agroforestry and rural economic growth. Strong domestic demand for gourmet foods and favorable trade agreements bolster Europe’s exports to North America and the Asia-Pacific.

Top Use Cases

- Gourmet Cooking & Fine Dining: Truffles are a luxury ingredient in high-end restaurants, used in dishes like pasta, risotto, and sauces. Chefs prefer fresh black and white truffles for their intense aroma. Truffle oil and shavings enhance flavor in premium dishes, making them a staple in Michelin-starred kitchens.

- Retail Packaged Goods: Truffle-infused products like oils, salts, and honey are popular in supermarkets. Brands sell preserved truffles in jars or freeze-dried forms, allowing home cooks to enjoy gourmet flavors without fresh truffles.

- Health & Wellness Products: Truffles contain antioxidants and anti-inflammatory properties. Some companies extract truffle compounds for supplements and skincare, claiming benefits like improved immunity and anti-aging effects.

- Vegan & Plant-Based Alternatives: With rising vegan demand, truffle-flavored plant-based cheeses, butters, and sauces are gaining traction. These products mimic truffle taste using natural extracts, appealing to ethical consumers.

- Luxury Food Gifting: Truffle gift sets, including oils, spreads, and fresh truffles, are popular for corporate and festive gifting. High-end brands offer customized packaging for exclusive appeal.

Recent Developments

1. Arotz, SA

Arotz, a Spanish gourmet food specialist, has expanded its truffle product line with new vacuum-sealed fresh truffle options to enhance shelf life. The company introduced black truffle (Tuber melanosporum) tapenades and oils, targeting high-end restaurants and retailers. Arotz is also investing in sustainable truffle farming to meet rising global demand while minimizing environmental impact. Their D.O. (Designation of Origin) certified truffles continue to gain recognition in European markets.

2. Gazzarrini Tartufi

Gazzarrini Tartufi, an Italian truffle supplier, launched a new line of truffle-infused cheeses and butters, blending premium truffles with traditional dairy. The company has also introduced freeze-dried truffle shavings for longer preservation without losing aroma. Gazzarrini is expanding its e-commerce platform to reach global consumers, offering same-day shipping for fresh truffles in Europe. Their Tuber magnatum (white truffle) harvests remain a highlight, with increased exports to Asia and the U.S.

3. TruffleHunter, Inc.

TruffleHunter has introduced new truffle-based condiments, including truffle honey and mustard, catering to gourmet food enthusiasts. The company is leveraging blockchain technology to ensure traceability and authenticity of its truffles from forest to table. They’ve also expanded their U.S. distribution network, partnering with high-end grocery chains like Whole Foods. Additionally, TruffleHunter released a limited-edition white truffle oil made from this season’s finest harvests.

4. Urbani Truffles

Urbani Truffles, a global leader, has unveiled a new line of plant-based truffle products, including vegan truffle sauces and spreads. The company is enhancing AI-driven truffle hunting techniques to improve yield and sustainability. Urbani also launched a subscription service for fresh truffles, delivering seasonal varieties directly to consumers. Their collaboration with Michelin-starred chefs continues to drive innovation in truffle gastronomy.

5. SABATINO NA LLC

Sabatino has expanded its ready-to-use truffle products, including truffle-infused pasta sauces and risottos, for home cooks. The company introduced a new “Truffle of the Month” club, offering exclusive truffle varieties to subscribers. Sabatino is also focusing on sustainable packaging, using biodegradable materials for its truffle oils and preserves. Their Tuber borchii (bianchetto truffle) range has seen increased demand in North America.

Conclusion

The Truffle Market is expanding beyond traditional culinary uses into health, vegan alternatives, and luxury gifting. Rising demand in fine dining and retail packaged goods drives innovation, while sustainability and traceability gain importance. With growing interest in gourmet experiences and wellness, truffles remain a high-value niche in the global food industry, offering diverse opportunities for brands and investors.