Table of Contents

Overview

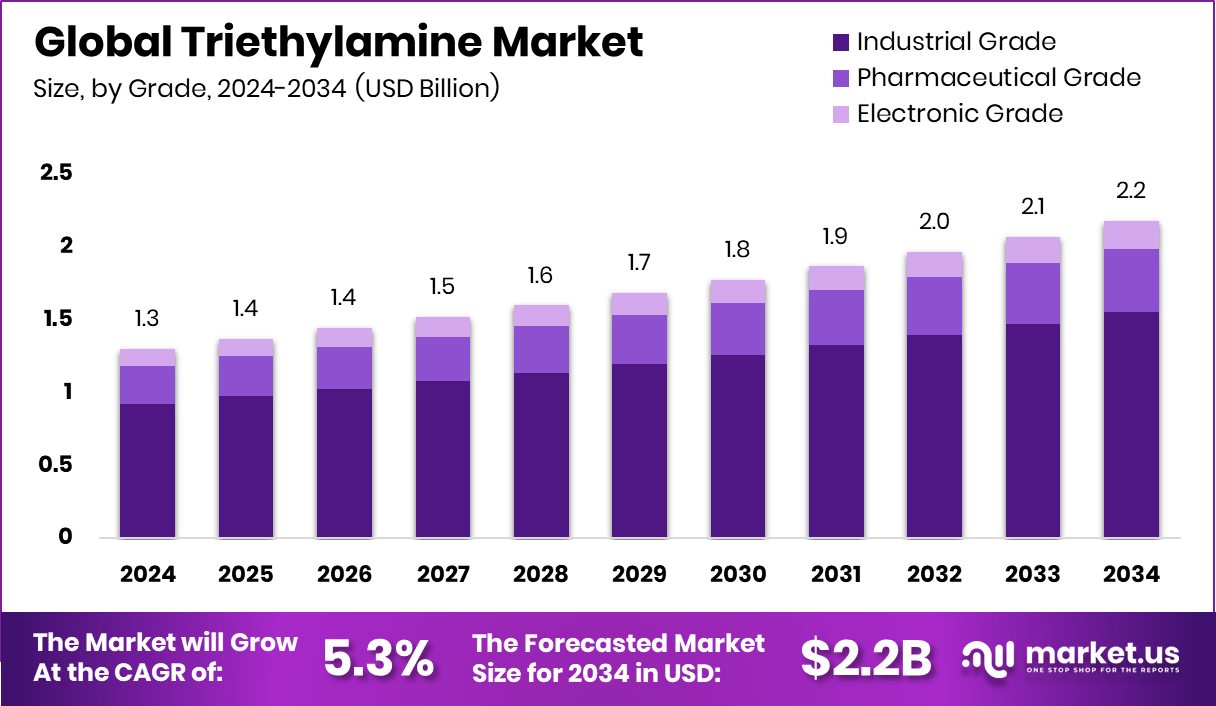

New York, NY – Nov 10, 2025 – The Global Triethylamine Market is projected to reach USD 2.2 billion by 2034, rising from USD 1.3 billion in 2024 at a 5.3% CAGR. The Asia-Pacific region, holding a 43.3% share (USD 0.5 billion), leads due to expanding chemical and manufacturing investments.

Triethylamine, a colorless, flammable liquid with a pungent ammonia-like odor, functions as a catalyst and neutralizing agent in producing pharmaceuticals, agrochemicals, resins, and rubber additives. Its versatility and role in cleaner synthesis make it vital to industrial processes. Market growth is driven by rising agrochemical and pharmaceutical output, supported by funding initiatives such as Arbuda Agrochemicals’ ₹120 crore NSE Emerge IPO and Kotak’s ₹375 crore investment in Cropnosys, which strengthens the agricultural chemical infrastructure.

Further, Bhaskar Agrochemicals’ redemption of preference shares and Scimplify’s $9.5 million funding for specialty chemical innovation reflect robust sector confidence. The shift toward sustainable and bio-based chemicals presents a significant opportunity, with VitalFluid’s €5 million AgTech funding marking a move toward green chemistry. Overall, triethylamine demand continues to grow as industries focus on eco-friendly manufacturing, cleaner reactions, and scalable production efficiency across emerging markets.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-triethylamine-market/request-sample/

Key Takeaways

- The Global Triethylamine Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In 2024, industrial-grade triethylamine dominated the Triethylamine Market, capturing 71.2% share due to extensive industrial applications.

- The agrochemical segment led the Triethylamine Market by application, accounting for a 32.8% share in 2024.

- The chemical sector emerged as the leading end-user, capturing 38.5% share of the Triethylamine Market.

- Strong manufacturing growth and rising agrochemical production boosted the Asia Pacific’s dominance, valued at USD 0.5 billion.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164113

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.2 Billion |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Grade (Industrial Grade, Pharmaceutical Grade, Electronic Grade), By Application (Agrochemicals, Pharmaceuticals, Textiles, Paints and Coatings, Rubber Processing, Others), By End-User (Chemical, Pharmaceutical, Agriculture, Textile, Others) |

| Competitive Landscape | BASF SE, Dow Chemical Company, Eastman Chemical Company, INEOS Group Holdings S.A., Huntsman Corporation, SABIC, Mitsubishi Gas Chemical Company, Inc., Linde plc, Alkyl Amines Chemicals Ltd., Balaji Amines Ltd., Daicel Corporation |

Key Market Segments

By Grade Analysis

In 2024, Industrial Grade dominated the Triethylamine Market by Grade, accounting for a 71.2% share. Its leadership stems from broad utilization in agrochemicals, pharmaceuticals, and chemical processing, where it acts as a catalyst, neutralizing agent, and intermediate. Favored for its cost efficiency, high purity, and formulation compatibility, industrial-grade triethylamine is essential for large-scale manufacturing. Demand has surged in producing pesticides, resins, and coatings, driven by global agricultural expansion and industrialization.

Additionally, rising investments in chemical and agrochemical infrastructure continue to boost adoption, particularly in developing regions. These factors collectively reinforce industrial grade’s dominance, solidifying its position as the core product category supporting the market’s sustained growth across diverse industrial applications.

By Application Analysis

In 2024, the Agrochemicals segment led the Triethylamine Market by Application, capturing a 32.8% share. This dominance is attributed to triethylamine’s essential role as an intermediate and catalyst in manufacturing herbicides, fungicides, and insecticides that underpin modern farming systems. Its ability to enhance chemical stability and reaction efficiency makes it indispensable for agrochemical synthesis. The segment’s growth is fueled by rising global food demand and the push for higher agricultural yields to support population expansion.

Additionally, increased investments in agrochemical manufacturing and the shift toward sustainable and precision agriculture technologies have amplified its use. These trends firmly establish agrochemicals as the largest and most influential application segment, strengthening triethylamine’s market presence across the global agricultural value chain.

By End-User Analysis

In 2024, the Chemical segment dominated the Triethylamine Market by End-User, holding a 38.5% share. This strong position stems from triethylamine’s wide application in chemical manufacturing as an essential intermediate, catalyst, and pH regulator. It plays a crucial role in producing resins, coatings, and specialty intermediates that serve multiple industrial sectors. The segment’s growth is supported by the expansion of global chemical production and continuous advancements in synthesis technologies that enhance efficiency and output quality.

Additionally, growing demand for high-performance materials and cost-effective production methods has further increased triethylamine usage. Together, these factors reinforce the chemical sector’s dominance, positioning it as a core driver of market growth and innovation in 2024.

Regional Analysis

In 2024, the Asia Pacific region led the Triethylamine Market, commanding a 43.3% share valued at USD 0.5 billion. This dominance is driven by rapid industrialization, expansion of agrochemical production, and a growing pharmaceutical base in key countries like China, India, and Japan. The region’s strong demand for triethylamine as a catalyst and neutralizing agent in large-scale chemical synthesis further strengthens its leadership.

North America and Europe follow with steady growth, supported by advanced R&D initiatives and a focus on sustainable chemical manufacturing. In contrast, Latin America benefits from increasing agricultural chemical demand, while the Middle East & Africa see progress through industrial diversification and enhanced manufacturing capacity.

Overall, Asia Pacific maintains its lead through a robust manufacturing network, cost-effective production, and high consumption in the agrochemical and pharmaceutical industries, solidifying its position as the global hub for triethylamine production and application.

Top Use Cases

- Organic synthesis base: TEA is frequently used as a base in chemical reactions that form esters and amides from acyl chlorides. It neutralizes the hydrochloric acid produced and helps drive the reaction forward.

- Pharmaceutical reagent and solvent: In drug manufacturing, TEA serves both as a reaction medium (solvent) and as a base to optimise yields and simplify purification, thanks to its volatility and miscibility with other solvents.

- Agrochemical intermediate: TEA is used in the synthesis of active ingredients for herbicides, fungicides and insecticides. It often functions as a neutralizing agent or forms salt versions of agrochemicals to improve their formulation.

- Catalyst in polyurethane production: TEA acts as a tertiary-amine catalyst in the production of polyurethane foams and coatings, accelerating the reaction between isocyanate groups and hydroxyl or water groups for foaming/curing.

- Resins and coatings applications: TEA is used to help resins and coatings cure, adjust pH, or crosslink, improving adhesion and durability in industrial paints, protective coatings, and automotive finishes.

- Textile and dye manufacturing: TEA is employed as an intermediate and acid-neutraliser in the production of quaternary ammonium compounds used for textile auxiliaries and dyes. It aids in the manufacture of colorants and treatment agents.

Recent Developments

- In December 2024, Dow finalised the sale of its flexible packaging laminating adhesives business to Arkema Group. The divested business generated about US$250 million in annual sales and supplied adhesives for food, medical, and industrial lamination applications.

- In May 2024, BASF entered into an agreement with IPP to market its ammonia, methanol and melamine plants at its Ludwigshafen Verbund site in Germany.

- In April 2024, INEOS completed the acquisition of its joint-venture partner TotalEnergies SE’s 50 % share in several petrochemical businesses at Lavéra (Naphtachimie, Gexaro aromatics, Appryl polypropylene) in southern France. This move expanded INEOS’s feedstock and production footprint in Olefins & Polymers.

Conclusion

The Triethylamine market is evolving steadily, supported by its wide industrial applications in pharmaceuticals, agrochemicals, and chemical synthesis. Its role as a key catalyst, neutralizing agent, and intermediate ensures consistent demand across manufacturing sectors. Growing interest in sustainable and bio-based chemical production is further shaping the market’s direction.

With continuous industrial expansion, technological advancements, and cleaner production practices, triethylamine remains vital to multiple value chains. Companies focusing on efficiency, safety, and eco-friendly innovations are expected to strengthen their market presence, making triethylamine an essential component in the shift toward more sustainable and performance-oriented chemical manufacturing worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)