Table of Contents

Overview

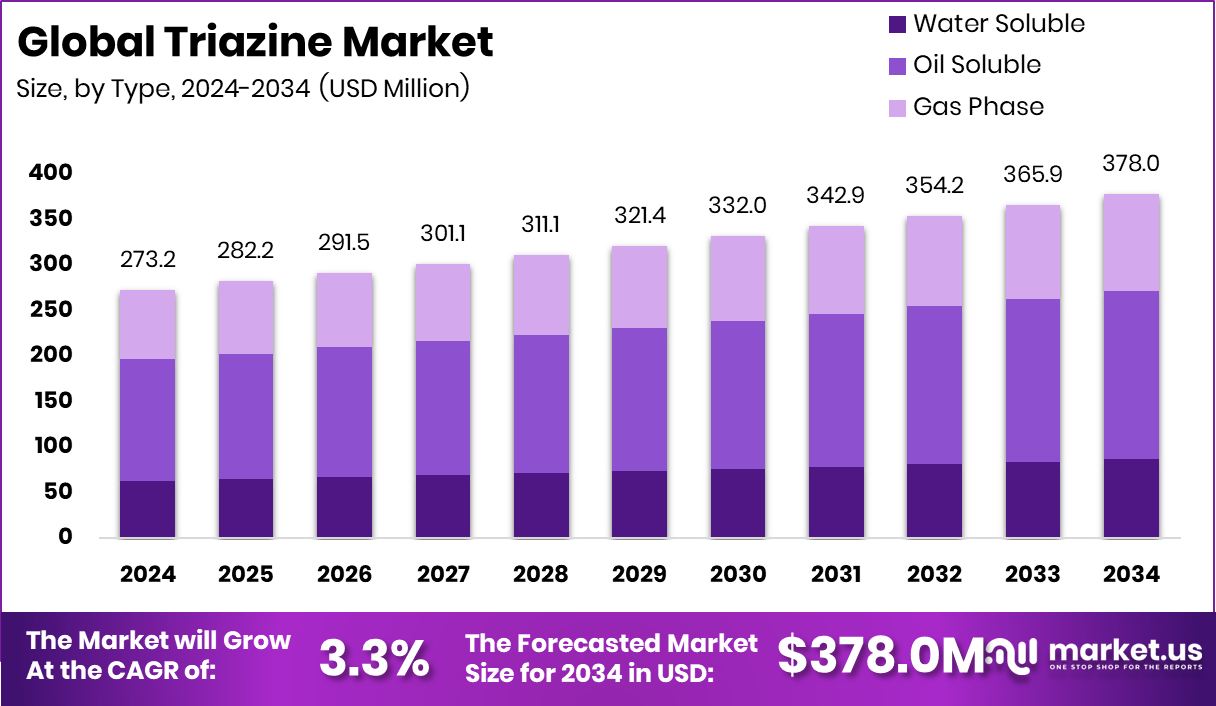

New York, NY – Nov 10, 2025 – The global triazine market is projected to reach USD 378.0 million by 2034, up from USD 273.2 million in 2024, growing at a 3.3% CAGR, with North America maintaining a 37.40% share due to robust energy investments and gas-processing expansion.

Triazine, a six-membered nitrogen-carbon compound, is vital in herbicides, resins, coatings, and gas-treatment applications because of its high thermal stability and reactivity. Its demand is rising with industrial gas production and cleaner-energy initiatives. Major funding highlights include CPV’s USD 1.1 billion gas-fired power plant in Texas, Ohio’s USD 100 million initiative for gas and nuclear production, and Texas’s USD 7.2 billion gas plant fund.

Additionally, the U.S. Department of Energy’s USD 625 million program for advanced gas and coal projects and the UK’s £6.5 million Europa and Egdon gas plans underline policy support for industrial adoption.

A USD 250,000 grant for gas-well emergency preparedness furthers safety initiatives. Growing use in agriculture, resin production, and specialty polymers continues to expand triazine’s industrial footprint, while its role in environmental remediation strengthens sustainable growth prospects across energy and chemical sectors.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-triazine-market/request-sample/

Key Takeaways

- The Global Triazine Market is expected to be worth around USD 378.0 million by 2034, up from USD 273.2 million in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034.

- In 2024, the oil-soluble segment dominated the Triazine Market, capturing 48.9% of the overall share.

- The MEA Triazine product type led the Triazine Market in 2024, holding a 73.3% share.

- The crude oil segment accounted for a 56.6% share in the global Triazine Market.

- The North American market value reached approximately USD 102.1 million, showing strong industrial demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164233

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 378.0 Million |

| Forecast Revenue (2034) | USD 273.2 Million |

| CAGR (2025-2034) | 3.3% |

| Segments Covered | By Type (Water Soluble, Oil Soluble, Gas Phase), By Product (MEA Triazine, MMA Triazine), By End-use (Crude Oil, Natural Gas, Geothermal Energy, Others) |

| Competitive Landscape | Dow, Baker Hughes Company, Halliburton, Clariant, Ashland, BASF SE, Eastman Chemical Company, Evonik Industries AG, Haihang Industry Co., Ltd, Hexion |

Key Market Segments

By Type Analysis

In 2024, the Oil-Soluble segment dominated the Triazine Market by type, accounting for 48.9% of the total share. Its leadership stems from extensive use in the oil and gas sector for hydrogen sulfide (H₂S) scavenging during gas sweetening and crude oil treatment. The oil-soluble form’s superior compatibility with hydrocarbons ensures efficient sulfur removal and corrosion control.

Its ability to perform under high temperature and pressure conditions further enhances its appeal in refineries and gas-processing facilities. Strong infrastructure investments and energy expansion in regions such as Texas and Ohio continue to drive demand, reinforcing the oil-soluble triazine segment’s commanding position within the overall market landscape.

By Product Analysis

In 2024, MEA Triazine dominated the Triazine Market’s product segment with a commanding 73.3% share. Its prominence stems from extensive application as a hydrogen sulfide (H₂S) scavenger in the oil and gas industry. Renowned for its high reactivity, chemical stability, and strong compatibility with hydrocarbon streams, MEA Triazine is widely used in gas sweetening and crude oil treatment operations. Its excellent solubility and consistent performance across varying temperatures and pressures enhance its industrial reliability.

Ongoing investments in gas-fired power plants and expanded natural gas production facilities continue to boost its demand. These developments have reinforced MEA Triazine’s critical role in global gas purification and processing, ensuring its sustained leadership within the overall triazine product landscape.

By End-use Analysis

In 2024, the Crude Oil segment led the Triazine Market by end use, accounting for 56.6% of total share. This dominance reflects triazine’s essential role in crude oil treatment, where it efficiently removes hydrogen sulfide (H₂S) and prevents corrosion during extraction and refining.

Its strong compatibility with hydrocarbons ensures cleaner processing and improved operational reliability. The compound’s effectiveness in maintaining crude quality and safety has made it a key additive across refineries.

Rising investments in oil and gas infrastructure, including new gas-fired power facilities and natural gas expansion projects, have further strengthened demand. This leadership underscores triazine’s importance in supporting stable, cleaner, and more efficient fuel production throughout the global energy chain.

Regional Analysis

In 2024, North America dominated the global Triazine Market, securing a 37.40% share valued at USD 102.1 million. This leadership stems from its advanced oil and gas infrastructure, increasing energy investments, and strong presence in industrial chemical manufacturing.

Expanding gas-fired power projects and refinery upgrades across the U.S. and Canada sustain high triazine demand for hydrogen sulfide (H₂S) removal and corrosion control. Europe’s market benefits from specialty chemical innovation and a shift toward cleaner energy, while Asia Pacific is growing rapidly due to industrialization and rising energy needs.

The Middle East & Africa region sees steady adoption through gas and petrochemical expansion, and Latin America gains momentum from increasing oil output. Overall, North America continues to shape global triazine trends, supported by robust energy sector activity and consistent demand from chemical industries.

Top Use Cases

- H₂S Scavenging in Oil & Gas Streams: Triazine is widely used in the oil and gas industry to remove toxic hydrogen sulfide (H₂S) from natural gas or crude oil streams. It reacts with H₂S in a non-reversible way, enabling safer processing and reduced corrosion of equipment.

- Herbicides for Agriculture: Certain triazine derivatives serve as broad-spectrum herbicides, used to control weeds in crops like corn and sorghum. Their chemical structure allows them to interfere with weed growth while being compatible with particular crops.

- Corrosion Inhibition for Metal Surfaces: Triazine-based compounds can act as inhibitors that protect metal surfaces (such as steel in oilfield water or pipelines) from corrosion. They form a thin protective layer and reduce the rate of metal degradation.

- Flame-Retardant Resins and Polymers: In polymer and resin manufacturing, triazine ring structures are incorporated to enhance thermal stability and flame retardancy of materials like epoxy coatings and thermosets. They help materials resist ignition and char formation under fire.

- Resin/Curing Agent in High-Performance Coatings: Triazine derivatives are used in advanced coating systems: by modifying polymer networks (for example, grafting triazine groups into chitosan or epoxy systems), they improve durability, adhesion, and corrosion protection of the coating.

- Environmental Remediation for Herbicide Pollution: Triazine herbicides themselves, when they persist in soil or water, are subject to microbial and nano-material remediation efforts. The triazine structure is targeted by enzymes or engineered microbes to break it down into less toxic components.

Recent Developments

- In June 2025, Clariant introduced SCAVTREAT 1173, described as a low-molecular-weight triazine developed for the rapid removal of hydrogen sulfide (H₂S) in gas-phase applications. This puts Clariant directly into the triazine chemistry space for H₂S scavenging.

- In April 2024, Baker Hughes signed an MoU with Iraq-based Halfaya Gas Company to collaborate on a gas-flaring reduction project at the Bin Umar gas-processing plant in southeastern Iraq. The collaboration covers supplying process equipment and evaluating modular gas-processing skids to convert flared associated gas into treated dry gas, LPG, and condensate.

Conclusion

The triazine market continues to grow steadily, driven by rising energy demand and its essential role in gas treatment, corrosion prevention, and agricultural applications. Its versatility and chemical stability make it vital in oil and gas processing, specialty coatings, and polymer production. Increasing focus on cleaner fuels and sustainable industrial operations further enhances its demand.

Ongoing innovation in triazine-based formulations is expanding their use in environmental protection and advanced material applications. Supported by industrial modernization and energy infrastructure expansion, the market is expected to witness consistent growth, reflecting triazine’s importance in enabling efficient and safer chemical and energy processes worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)