Table of Contents

Overview

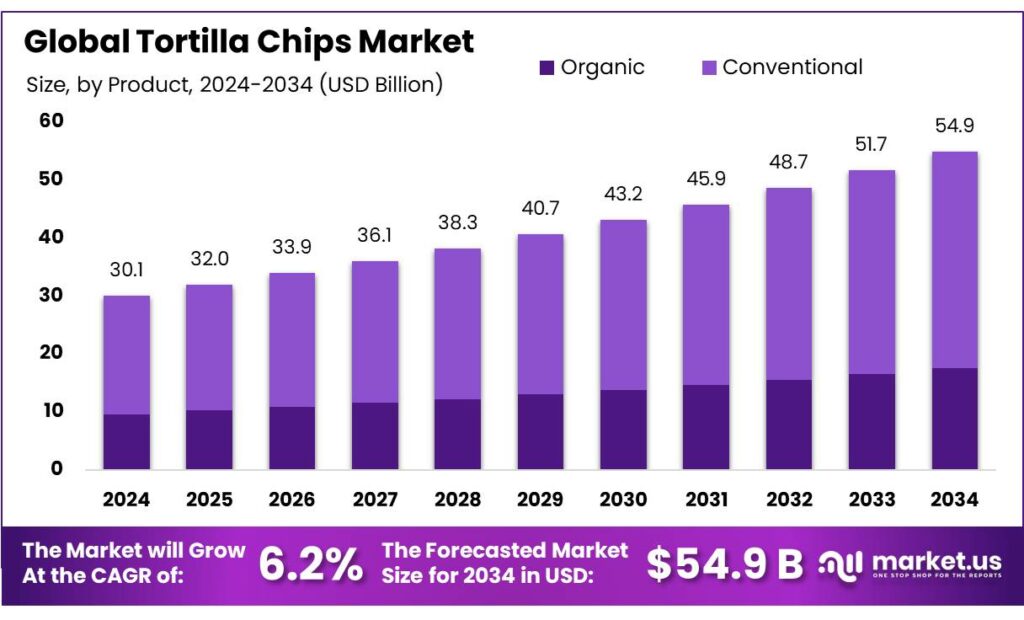

New York, NY – October 13, 2025 – The Global Tortilla Chips Market is projected to reach USD 54.9 billion by 2034, up from USD 30.1 billion in 2024, expanding at a CAGR of 6.2% from 2025 to 2034. In 2024, North America dominated the market, accounting for a 43.9% share and generating approximately USD 13.2 billion in revenue.

Tortilla chips are crunchy snacks made from corn tortillas that are cut into triangles and fried or baked. The dough, called masa, is prepared from treated corn and later shaped, cooked, and crisped to perfection. Their versatility and compatibility with various cuisines have made them a favorite worldwide.

Market growth is driven by rising demand for convenient and ready-to-eat snacks, especially among the urban youth. The spread of quick-service restaurants (QSRs) and the growing influence of Western food culture have further accelerated consumption in emerging markets such as India.

Government programs like the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI), with an outlay of ₹10,900 crore, are enhancing domestic manufacturing and export potential. Additionally, initiatives under the Pradhan Mantri Kisan SAMPADA Yojana (PMKSY), funded with ₹4,600 crore plus an extra ₹920 crore, support agri-infrastructure and processing.

Mexico’s Tortilla Price Stabilization Pact, established to curb price fluctuations, also aids market stability. Strategic partnerships continue to reshape the competitive landscape. PepsiCo’s 2024 acquisition of Siete Foods for USD 1.2 billion strengthened its presence in the ethnic and healthy snack category, highlighting growing global interest in diversified tortilla-based products.

Key Takeaways

- Tortilla Chips Market size is expected to be worth around USD 54.9 Billion by 2034, from USD 30.1 Billion in 2024, growing at a CAGR of 6.2%.

- Conventional tortilla chips maintained a dominant position in the Indian market, capturing more than a 67.5% share.

- Fried tortilla chips held a dominant position in the Indian market, capturing more than a 63.8% share.

- Supermarkets and hypermarkets held a dominant position in the Indian tortilla chips market, capturing more than a 54.2% share.

- North America emerged as the dominant region in the global tortilla chips market, capturing a substantial 43.9% share, translating to approximately USD 13.2 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-tortilla-chips-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 30.1 Billion |

| Forecast Revenue (2034) | USD 54.9 Billion |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Product (Organic, Conventional), By Type (Baked, Fried), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others) |

| Competitive Landscape | Grupo Bimbo, PepsiCo, Arca Continental S.A.B. de C.V., Fireworks Foods, Hain Celestial, Intersnack Group, Kellanova, GRUMA corporation, La Tortilla Factory, Tyson Foods Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158329

Key Market Segments

By Product Analysis

Conventional Tortilla Chips Hold Over 67.5% Market Share in 2024

In 2024, conventional tortilla chips dominated the Indian market, securing more than 67.5% of the market share. Their popularity stems from affordability, widespread availability, and familiar traditional flavors that resonate with consumers. The cost-effective production of conventional tortilla chips, driven by readily available raw materials, ensures accessibility to a wide audience. Their versatility in flavor profiles and seasonings further caters to diverse consumer preferences.

The segment’s growth is fueled by the rise of quick-service restaurants (QSRs) and the growing snacking trend. With increasing urbanization and fast-paced lifestyles, demand for convenient, ready-to-eat snacks has surged. Conventional tortilla chips, being easy to store and consume, align well with this trend, while their affordability appeals to price-conscious consumers.

By Type Analysis

Fried Tortilla Chips Lead with 63.8% Market Share in 2024

Fried tortilla chips captured a commanding 63.8% market share in India in 2024, driven by their authentic taste and crispy texture, which are highly favored by snack enthusiasts. The deep-frying process enhances their flavor and crunch, making them a top choice.

Their dominance is supported by widespread availability across retail channels, including supermarkets, convenience stores, and e-commerce platforms. Affordable pricing and product familiarity make fried tortilla chips accessible to a broad consumer base. Additionally, their adaptability to various flavor profiles and seasonings appeals to diverse taste preferences, further solidifying their market position.

By Distribution Channel Analysis

Supermarkets and Hypermarkets Account for 54.2% of the Tortilla Chips Market in 2024

In 2024, supermarkets and hypermarkets led the Indian tortilla chips market, holding over 54.2% of the market share. Their dominance is driven by their widespread presence in urban and semi-urban areas, offering a convenient one-stop shopping experience. These outlets provide extensive shelf space for snack products, including a wide variety of tortilla chip brands and flavors, catering to diverse consumer preferences.

The growth of this channel is propelled by rising disposable incomes and evolving consumer lifestyles, which drive demand for ready-to-eat snacks. Promotional offers and discounts in supermarkets and hypermarkets further boost tortilla chip sales, attracting a broad customer base.

Regional Analysis

North America Leads the Tortilla Chips Market with 43.9% Share in 2024

In 2024, North America held a commanding 43.9% share of the global tortilla chips market, valued at approximately USD 13.2 billion. The region’s dominance stems from the strong foothold of leading snack producers, well-established retail and distribution networks, and a longstanding consumer affinity for Mexican-inspired foods. Continuous product innovations, premium flavor introductions, and the expansion of convenience food channels further reinforce North America’s leading position in the global market.

Top Use Cases

- Everyday Snacking Delight: Tortilla chips make a perfect quick bite for busy days, offering a crunchy escape with their salty goodness. Pair them with fresh dips like salsa or guac for an easy flavor boost that fits right into lunch breaks or evening chills, keeping hunger at bay without much fuss.

- Nachos Party Essential: At gatherings, tortilla chips shine as the base for loaded nachos, topped with cheese, beans, and veggies for a crowd-pleasing shareable. Their sturdy shape holds up to melty toppings, turning simple get-togethers into fun, interactive feasts that spark joy and conversation.

- Creative Meal Topper: Crush tortilla chips to add a satisfying crunch to salads, soups, or casseroles, elevating everyday dishes with a Tex-Mex twist. They blend seamlessly into chili or scrambled eggs, providing texture that makes familiar meals feel fresh and exciting for the whole family.

- Versatile Home Cooking Hack: Use leftover tortilla chips as a smart breading for chicken tenders or fish, giving a crispy coat with bold seasoning. This thrifty trick transforms pantry staples into gourmet-like results, perfect for weeknight dinners that save time and reduce waste.

- Healthier Baked Treat: Bake fresh tortilla wedges with a dash of lime and spices for a guilt-free alternative to store-bought snacks. This simple method creates airy, flavorful chips ideal for mindful munching, aligning with wellness goals while delivering the same addictive crunch.

Recent Developments

1. Grupo Bimbo

Grupo Bimbo, through its brand Barcel, is heavily investing in the healthy snack segment. Their recent innovation includes the launch of “Totis Pop,” a puffed tortilla chip positioned as a baked, lower-fat alternative. This move directly targets health-conscious consumers seeking better-for-you options without sacrificing the traditional tortilla chip taste, expanding their portfolio beyond traditional fried snacks.

2. PepsiCo

PepsiCo continues to innovate under its flagship Doritos brand. A key recent development was the limited-time release of “Dinamita Stax,” a hollow, rolled tortilla chip designed to compete with Pringles’ format. Furthermore, they are aggressively marketing “Doritos Triangles,” a simpler, organic product line aimed at capturing the premium and clean-label segments, showing a strategic diversification within the tortilla chip category.

3. Arca Continental S.A.B. de C.V.

Arca Continental, a key PepsiCo bottler and snack distributor in Latin America, is focusing on market penetration and sustainability. Their recent developments include expanding the distribution of tortilla chip brands like Totis and integrating more recycled materials into their packaging. They are executing targeted marketing campaigns to drive growth in underpenetrated regions, leveraging their extensive distribution network to increase household reach for their snack products.

4. Fireworks Foods

Fireworks Foods, the maker of the Siete Family Foods brand, remains a major disruptor in the tortilla chip space with its grain-free offerings. Their primary recent development involves expanding their product lines, including new flavors for their popular almond flour and cassava & chia seed tortilla chips. They continue to champion the “free-from” attribute (gluten, grain, dairy), directly appealing to the health and wellness-driven consumer base.

5. The Hain Celestial Group

Hain Celestial, through its brand Garden of Eatin’, is emphasizing its core identity in the natural and organic sector. Their recent focus is on reinforcing their non-GMO and organic credentials, using simple, recognizable ingredients. While innovation has been slower, they are leveraging the consumer trend towards transparency and clean labels, positioning their tortilla chips as a trusted, health-conscious choice in the competitive market.

Conclusion

Tortilla Chips are evolving into a beloved staple that mirrors our fast-paced, flavor-hungry lives. Their rise stems from a clever mix of tradition and innovation, where classic crunch meets bold new tastes like spicy fusions and plant-powered options. Health-savvy eaters now embrace baked versions and clean ingredients, while busy folks grab them for on-the-go joy. From cozy home kitchens to lively social scenes, these chips bridge cultures and cravings, promising a vibrant future in the snack world.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)