Table of Contents

Overview

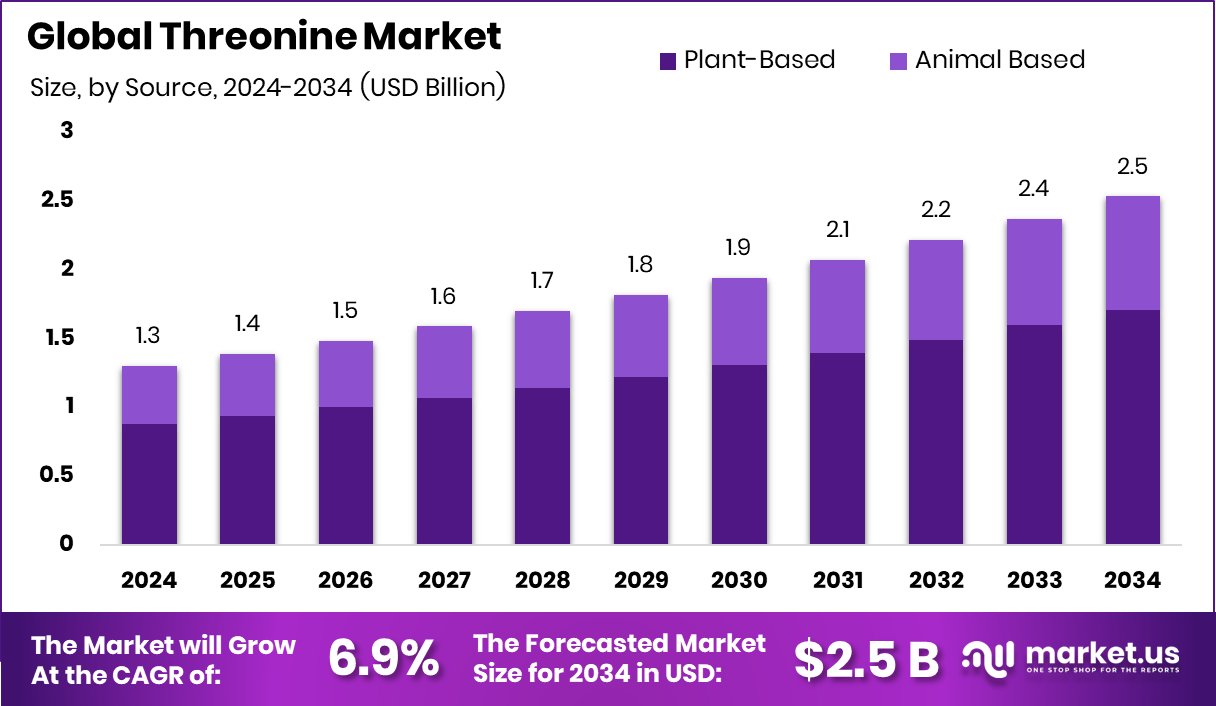

New York, NY – September 23, 2025 – The Global Threonine Market is projected to reach approximately USD 2.5 billion by 2034, rising from USD 1.3 billion in 2024, and is expected to grow at a CAGR of 6.9% between 2025 and 2034. The Asia-Pacific region dominates the market, accounting for 45.8% share, valued at around USD 0.5 billion, driven by the rapid expansion of the feed and animal nutrition sectors.

Threonine is an essential amino acid crucial for protein synthesis, maintaining digestive health, and supporting the immune system. Since it cannot be synthesized by the human body, it must be obtained through diet or supplementation. In animal nutrition, threonine is particularly important for optimizing growth and metabolic efficiency in poultry, swine, and aquaculture species.

The threonine market encompasses the global production and trade of this amino acid, with its primary applications in animal feed, pharmaceuticals, and dietary supplements. As the livestock sector grows to meet rising global protein demand, threonine has become a key feed additive, improving feed efficiency, reducing nitrogen excretion, and promoting sustainable farming practices. For instance, Wastelink recently secured USD 3 million to enhance its animal feed supply chain.

Market growth is largely driven by the increasing demand for high-quality animal protein. As meat consumption rises globally, feed additives like threonine are critical for ensuring healthy growth rates and better overall animal performance. Additionally, the expanding interest in functional foods and dietary supplements is boosting threonine demand in human nutrition, with consumers seeking improved digestive health, stronger immunity, and balanced nutrition.

Key Takeaways

- The Global Threonine Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In 2024, plant-based sources held a 67.3% share, showing the Threonine Market’s growing reliance on sustainable feedstock.

- Powder form dominated the Threonine Market with a 78.4% share, reflecting convenience and efficiency in feed applications.

- The animal feed sector captured 57.2% of the threonine market, underlining its critical role in livestock productivity.

- Rising livestock production across the Asia-Pacific 45.8% region strongly drives threonine demand, supporting USD 0.5 Bn growth.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-threonine-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.5 Billion |

| CAGR (2025-2034) | 6.9% |

| Segments Covered | By Source (Plant-Based, Animal-Based), By Form (Powder, Liquid), By End-Users (Animal Feed, Pharmaceuticals, Food and Beverages, Others) |

| Competitive Landscape | Evonik Industries AG, CJ CheilJedang Corporation, Ajinomoto Co., Inc., Archer Daniels Midland Company, Meihua Holdings Group Co., Ltd., Bio-Chem Technology Group Company Limited, NB Group Co., Ltd., Prinova Group LLC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157024

Key Market Segments

By Source Analysis

Plant-based production leads the threonine market, commanding a 67.3% share in 2024. This dominance stems from the growing adoption of sustainable, cost-effective fermentation technologies for amino acid production. The shift toward eco-friendly solutions, driven by global sustainability trends, has boosted the preference for plant-derived threonine, particularly in animal feed, where it enhances protein efficiency and livestock growth.

Regulatory support for sustainable raw materials and rising consumer demand for clean-label, natural ingredients further strengthen this segment. Plant-based threonine’s wide application in feed, nutraceuticals, and food industries underscores its market leadership.

By Form Analysis

In 2024, the powder form dominates the threonine market with a 78.4% share, favored for its ease of blending, storage stability, and cost-effectiveness. Powdered threonine is the top choice in animal feed due to its uniform mixing and precise dosing, which optimize feed efficiency and animal growth.

The pharmaceutical and nutraceutical sectors also prefer powder for its versatility in formulating tablets, capsules, and supplements with extended shelf life. Advances in fermentation and processing technologies enable scalable production of high-quality threonine powder, while its logistical advantages in transport and storage solidify its market dominance.

By End-Users Analysis

The animal feed sector leads the threonine market in 2024, holding a 57.2% share globally. Threonine’s critical role in poultry, swine, and aquaculture nutrition drives its demand, as it supports growth, feed efficiency, and productivity amid rising global protein needs.

By reducing excess crude protein in diets, threonine lowers feed costs and nitrogen emissions, aligning with environmental sustainability goals. Regulatory guidelines promoting balanced feed formulations further boost its use. With increasing consumer demand for high-quality meat and dairy, threonine remains essential for optimizing animal diets across Asia-Pacific, Europe, and North America.

Regional Analysis

Asia-Pacific dominates the threonine market in 2024, capturing a 45.8% share valued at USD 0.5 billion. The region’s leadership is fueled by its expansive livestock industry, particularly in China and India, where growing populations and urbanization drive demand for poultry, swine, and aquaculture products.

Supportive government policies promoting sustainable farming and feed efficiency enhance threonine adoption. Asia-Pacific’s robust manufacturing base enables cost-effective, large-scale production for domestic and global markets. While North America and Europe show steady demand due to advanced feed practices, Asia-Pacific’s scale and consumption trends make it the primary driver of the threonine market’s growth.

Top Use Cases

- Animal Feed Enhancement: Threonine is widely used in animal feed, especially for poultry and swine. It helps animals grow faster and use protein better, reducing feed costs. Farmers add it to diets to improve livestock health and productivity, meeting the growing demand for meat and dairy in a sustainable way.

- Nutraceutical Supplements: Threonine is added to dietary supplements to support human health. It aids in protein synthesis, immune function, and gut health. As consumers focus on wellness and natural ingredients, threonine’s role in clean-label nutraceuticals grows, making it popular in capsules and powders for fitness and health markets.

- Pharmaceutical Applications: Threonine is used in medicines to support tissue repair and immune health. It’s included in formulations for wound healing and recovery products. Its role in protein production makes it valuable for pharmaceutical companies developing treatments for muscle-related conditions, driving demand in the healthcare sector.

- Food Industry Fortification: Threonine is added to food products like protein bars and beverages to boost nutritional value. It appeals to consumers seeking fortified, clean-label foods. As plant-based diets grow, threonine from sustainable sources enhances food products, meeting the demand for healthier, eco-friendly options in the global food market.

- Aquaculture Nutrition: In fish farming, threonine is added to feed to improve fish growth and health. It supports efficient protein use, reducing environmental impact from excess feed. With aquaculture expanding to meet seafood demand, threonine’s role in sustainable fish feed formulations is increasingly vital for the industry.

Recent Developments

1. Evonik Industries AG

Evonik continues to advance its sustainable animal nutrition solutions, with Threonine being a key component. Their focus is on precision livestock farming, promoting efficient and resource-friendly meat production through optimal amino acid ratios. Recent developments include lifecycle assessments highlighting the environmental benefits of their Biolys (source for L-Lysine) and Threonine products in reducing the carbon footprint of animal feed.

2. CJ CheilJedang Corporation

CJ CheilJedang is aggressively expanding its global bio-portfolio, including Threonine production. A key recent development is the operationalization of its new, large-scale fermentation facility in Indonesia, significantly boosting the output of amino acids. This strategic expansion strengthens its supply chain resilience and competitive position to meet growing global demand, ensuring a stable supply of products like Threonine for the feed market.

3. Ajinomoto Co., Inc.

Ajinomoto Animal Nutrition Group (AANG) is leveraging its AminoScience expertise to promote ideal amino acid profiles, including Threonine, for sustainable aquaculture. Recent initiatives focus on reducing fishmeal dependency in shrimp and fish feed. They provide technical expertise on how supplemental Threonine improves growth performance and supports gut health in aquatic species, which is critical for the expanding aquaculture industry.

4. Archer Daniels Midland Company (ADM)

ADM is integrating its Threonine production into broader, holistic animal nutrition solutions. A key development is their focus on gut health management programs, where Threonine plays a vital role in supporting intestinal integrity and immune function. This aligns with the industry trend of reducing antibiotic use. Their recent research emphasizes optimal Threonine levels in swine diets to improve overall health and productivity.

5. Meihua Holdings Group Co., Ltd.

Meihua, a major global amino acid producer, has been focusing on technological innovation to maintain its cost leadership in Threonine. Recent developments include optimizing fermentation strains and processes to enhance yield and efficiency. They are also expanding their production capacity to solidify their market share, catering strongly to the domestic Chinese and Asian feed markets, which are experiencing steady growth in demand for premium additives.

Conclusion

Threonine is a key player in multiple industries, driven by its role in animal nutrition, human health, and sustainable practices. Its demand is fueled by growing protein needs, eco-conscious trends, and advancements in feed and food production. As consumers prioritize health and sustainability, threonine’s versatility ensures its strong market growth across animal feed, nutraceuticals, pharmaceuticals, and food sectors.