Table of Contents

Overview

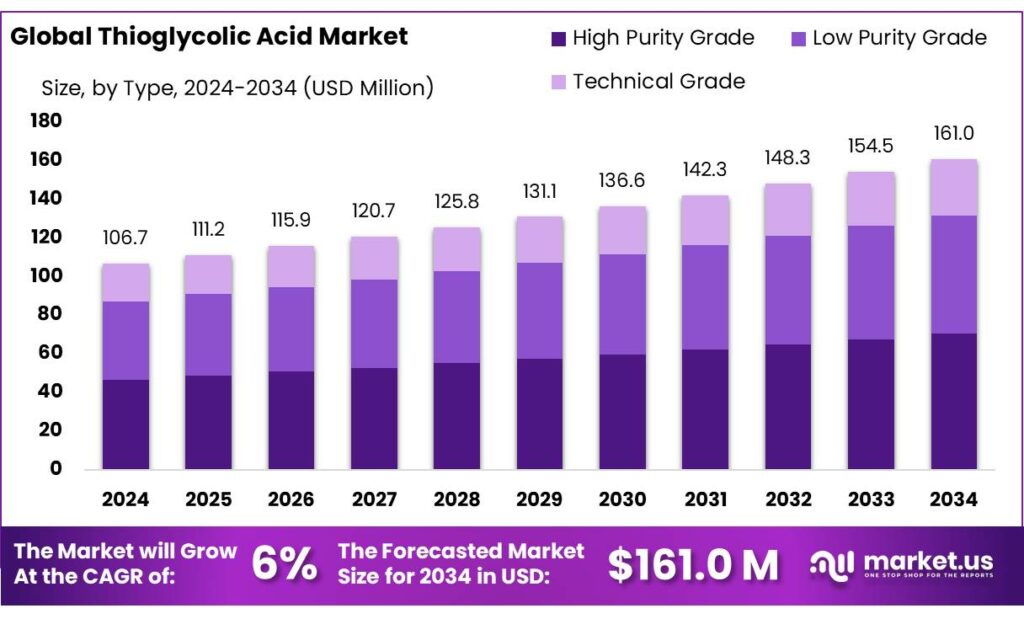

New York, NY – September 30, 2025 – The Global Thioglycolic Acid Market is projected to reach USD 161.0 million by 2034, rising from USD 106.7 million in 2024, at a CAGR of 6.0% between 2025 and 2034. In 2024, North America emerged as the leading region, securing a 42.9% market share valued at USD 45.7 million.

Thioglycolic acid (TGA), or mercaptoacetic acid, is a sulfur-based organic compound with the formula C₂H₄O₂S. Its versatile applications span across cosmetics, pharmaceuticals, leather processing, and as a chemical intermediate in thioglycolate production. The chemical industry in India plays a major role in shaping demand, contributing about 7% to the national GDP in 2022, producing over 80,000 chemical products, and employing nearly five million people.

Government-driven programs like Make in India, Aatmanirbhar Bharat, and the Production-Linked Incentive (PLI) Scheme are fostering growth in the domestic chemical sector. These initiatives encourage reduced import dependency, enhance manufacturing capacity, and strengthen innovation, thereby supporting the thioglycolic acid market.

In terms of industrial applications, TGA is increasingly valued as a corrosion inhibitor in oil and gas, a stabilizer in textile treatment chemicals, and a component in pesticide formulations. It also plays a role as a chain transfer agent in polymerization, further diversifying its industrial utility and strengthening long-term demand.

Key Takeaways

- The Global Thioglycolic Acid Market size is expected to be worth around USD 161.0 Million by 2034, from USD 106.7 Million in 2024, growing at a CAGR of 6.0%.

- High Purity Grade held a dominant market position, capturing more than a 43.8% share in the global thioglycolic acid market.

- Liquid held a dominant market position, capturing more than a 67.9% share in the global thioglycolic acid market.

- Corrosion & Scale Inhibitors held a dominant market position, capturing more than a 25.1% share in the global thioglycolic acid market.

- Oil & Gas held a dominant market position, capturing more than a 31.2% share in the global thioglycolic acid market.

- North America held a dominant market position in the global thioglycolic acid market, capturing more than a 42.9% share, valued at USD 45.7 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-thioglycolic-acid-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 106.7 Million |

| Forecast Revenue (2034) | USD 161.0 Million |

| CAGR (2025-2034) | 6.0% |

| Segments Covered | By Type (High Purity Grade, Low Purity Grade, Technical Grade), By Form (Liquid, Solid), By Application (Corrosion and Scale Inhibitors, Flow Stimulator, Reducing Agent, Chemical Intermediate, Chain Transfer Agent, Catalyst Recovery Agent, Additives, Others), By End Use (Oil and Gas, Plastics and Polymers, Chemicals and Petrochemicals, Leather, Cosmetics, Metal and Metallurgy, Others) |

| Competitive Landscape | Arkema, Daicel Corporation, HiMedia Laboratories, Qingdao LNT Chemical Co., Ltd., Ruchang Mining, Sasaki Chemical, Tokyo Chemical Industry Co., Ltd |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157316

Key Market Segments

By Type Analysis

High Purity Grade Commands 43.8% Market Share in 2024

In 2024, High Purity Grade led the global thioglycolic acid market with a 43.8% share, driven by its critical role in industries with stringent quality requirements, such as cosmetics, pharmaceuticals, and specialty chemicals. High-purity thioglycolic acid is essential for hair care products, depilatory creams, and medical applications, where impurities can compromise safety and efficacy.

The surge in demand for safe personal care products in 2024, fueled by rising disposable incomes and heightened grooming and hygiene awareness in regions like Asia-Pacific and North America, has bolstered this segment. Stricter regulatory standards in both developed and emerging markets further reinforce the preference for high-purity thioglycolic acid, solidifying its market dominance.

By Form Analysis

Liquid Form Holds 67.9% Market Share in 2024

In 2024, the Liquid form dominated the global thioglycolic acid market, accounting for a 67.9% share. Its widespread use stems from its ease of handling, rapid solubility, and compatibility with industrial processes in cosmetics, leather processing, and chemical manufacturing.

Liquid thioglycolic acid is a key component in depilatory creams and hair treatments, offering convenience and consistent performance. Beyond personal care, its applications in industrial cleaning and metal treatment benefit from the liquid form’s uniform application and effectiveness. The growing demand for both consumer and industrial solutions in 2024 has cemented the liquid segment’s lead over other forms.

By Application Analysis

Corrosion & Scale Inhibitors Capture 25.1% Share in 2024

In 2024, Corrosion & Scale Inhibitors led the global thioglycolic acid market with a 25.1% share, driven by their extensive use in oil & gas, water treatment, and power generation. Thioglycolic acid’s chelating properties make it vital for preventing rust, scaling, and mineral deposits, enhancing equipment longevity and operational efficiency while reducing maintenance costs.

The increased emphasis on industrial safety and asset protection in 2024, particularly in oilfield operations where pipelines and equipment face harsh conditions, has boosted demand. In water treatment, the compound ensures effective scale control, supporting smoother operations and regulatory compliance, making this application a cornerstone of the market.

By End Use Analysis

Oil & Gas Sector Leads with 31.2% Share in 2024

In 2024, the Oil & Gas sector dominated the global thioglycolic acid market, holding a 31.2% share. Thioglycolic acid’s role as a corrosion and scale inhibitor is critical in oilfield operations, from drilling fluids to enhanced oil recovery and pipeline maintenance. Its chelating properties protect equipment in extreme conditions, ensuring operational efficiency and asset longevity.

Rising investments in upstream exploration and production in 2024, particularly in North America, the Middle East, and parts of Asia, have driven demand. With global energy needs growing, thioglycolic acid’s cost-effective solutions for corrosion and scale control in both onshore and offshore operations have made it indispensable to the industry.

Regional Analysis

North America Commands 42.9% Market Share Valued at USD 45.7 Million in 2024

North America led the global thioglycolic acid market with a 42.9% share, equivalent to USD 45.7 million. This dominance is driven by the region’s robust industrial infrastructure, significant demand from the oil & gas sector, and a flourishing cosmetics and personal care industry.

Thioglycolic acid’s critical role in corrosion and scale inhibitors supports its widespread use in oilfield operations, particularly in the United States, a major hub for oil and gas production and consumption. The compound’s applications in exploration, refining, and pipeline maintenance continue to fuel its strong market presence in the region.

Top Use Cases

- Hair Perming and Styling: Thioglycolic acid helps create curls or waves in hair by breaking down tough bonds inside the hair strands. This makes it a key ingredient in perm lotions used at salons. It allows for easy reshaping without heat, meeting the growing need for versatile hair care options that fit busy lifestyles and diverse styles.

- Depilatory Creams for Hair Removal: In creams that remove unwanted body hair, thioglycolic acid softens and dissolves hair at the skin level for smooth results. It’s gentle yet effective for legs, underarms, or bikini areas, appealing to consumers seeking quick, painless alternatives to shaving or waxing in daily grooming routines.

- Corrosion Protection in Oil and Gas: Thioglycolic acid acts as a shield against rust and buildup in pipelines and drilling tools. By grabbing onto metal ions, it prevents damage from harsh fluids, helping energy companies cut repair costs and keep operations running smoothly in tough environments.

- Leather Processing for Softer Hides: During tanning, thioglycolic acid removes hair and tightens skin layers to produce supple leather. This step ensures high-quality materials for bags, shoes, and furniture, supporting the fashion and automotive sectors with durable, eco-friendly hides that meet global quality standards.

- Cleaning Agents for Metal Surfaces: Thioglycolic acid powers wheel cleaners and rust removers by dissolving iron stains and grime without scratching. It’s ideal for auto care and industrial upkeep, offering a safe, efficient way to restore shine and protect metals in everyday and heavy-duty applications.

Recent Developments

1. Arkema

Arkema is focusing on sustainability and supply security for its thioglycolic acid derivatives, particularly in the polymer and PVC stabilizer markets. The recent strategy emphasizes low-carbon initiatives and strengthening its global production network. They are investing in operational excellence at their major sites to meet growing demand from the plastics and lubricant industries, positioning TGA as a key specialty chemical within their advanced materials segment.

2. Daicel Corporation

Daicel has been actively expanding its thioglycolic acid and ester production capacity to solidify its leading market position. Recent developments include capacity expansions to address robust demand from the cosmetics sector for thioglycolates used in permanent wave solutions and depilatories. Daicel is also enhancing its high-purity TGA offerings for the pharmaceuticals industry, focusing on stringent quality control to serve as a critical reagent in synthesis.

3. HiMedia Laboratories

HiMedia Laboratories, a key player in life science reagents, lists Thioglycolic Acid as a critical component for microbiology culture media. Their recent development focuses on ensuring a consistent supply and high purity for use in thioglycollate broth, which is essential for testing the oxygen requirements of microorganisms. They emphasize quality control and compliance with global pharmacopoeia standards to serve pharmaceutical, academic, and diagnostic testing laboratories worldwide.

4. Qingdao LNT Chemical Co., Ltd.

Qingdao LNT Chemical promotes itself as a specialized manufacturer and global supplier of Thioglycolic Acid. Their recent activities center on competitive pricing and expanding export volumes for various grades of TGA. The company highlights its production capabilities to serve diverse industries, including cosmetics (thioglycolates), PVC stabilizers, and mining (as a leaching agent), focusing on cost-effective production to capture market share in price-sensitive regions.

5. Ruchang Mining

Ruchang Mining utilizes Thioglycolic Acid primarily as a non-toxic gold leaching agent in its mining operations. Their recent development involves the application of TGA in environmentally friendly gold extraction processes as an alternative to cyanide. This aligns with a growing industry trend towards greener mining technologies. The focus is on optimizing leaching efficiency and cost-effectiveness of TGA in their specific ore processing workflows.

Conclusion

Thioglycolic Acid is a quiet powerhouse in everyday industries, blending smart chemistry with real-world needs. Its ability to transform hair, safeguard metals, and refine materials keeps it essential for personal care, energy, and manufacturing. With rising focus on sustainable practices and innovative formulations, this versatile compound promises steady growth, helping businesses meet consumer demands for safer, more effective solutions while navigating global shifts toward greener production.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)