Table of Contents

Overview

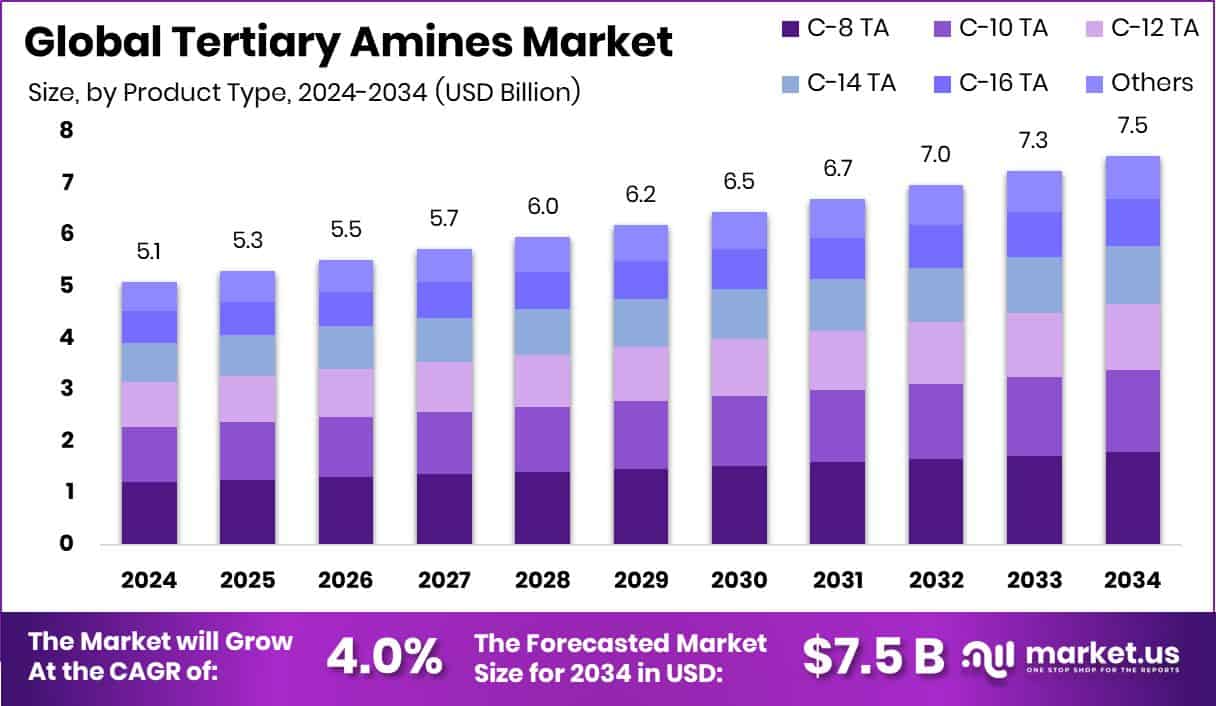

New York, NY – August 25, 2025 – The global tertiary amines market is set for steady growth, projected to rise from USD 5.1 billion in 2024 to USD 7.5 billion by 2034, at a CAGR of 4.0%. These compounds, defined by a nitrogen atom bonded to three carbon atoms, are less reactive than primary or secondary amines but highly valuable as intermediates. Their versatility makes them essential in surfactants, pharmaceuticals, agrochemicals, water treatment, and oil & gas applications.

A key growth driver is the personal care sector, where tertiary amines are used in emulsifiers, fabric softeners, and specialty chemicals. Asia Pacific leads this segment, expected to reach USD 2.4 billion, supported by rising demand for personal care products and expanding manufacturing capacity. The pharmaceutical industry is another strong contributor, with tertiary amines being integral in drug formulation and intermediates. Additionally, agriculture is boosting demand as these compounds are widely used in herbicides and pesticides to enhance crop yields.

Innovation in bio-based surfactants and specialty derivatives further supports growth. For instance, AmphiStar received €12.5 million in EIC funding to commercialize bio-based surfactants, while Dispersa secured $5.8 million to expand biosurfactant production from food waste. These initiatives highlight a broader trend toward sustainable solutions, positioning tertiary amines as critical to both industrial and eco-friendly applications.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-tertiary-amines-market/request-sample/

Key Takeaways

- The Global Tertiary Amines Market is expected to be worth around USD 7.5 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- C-8 TA holds a 23.8% share in the Tertiary Amines Market, driven by diverse industrial applications.

- The ammonolysis process leads with a 49.2% share in the tertiary amines market, ensuring high production efficiency.

- Surfactants dominate the tertiary amines market with a 59.4% share, supported by rising cleaning and personal care demand.

- Cosmetics and personal care account for 31.7% of the tertiary amines market, fueled by beauty product growth.

- Strong industrial growth in the Asia Pacific, 48.90% drives Tertiary Amines demand significantly upward.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155517

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.1 Billion |

| Forecast Revenue (2034) | USD 7.5 Billion |

| CAGR (2025-2034) | 4.0% |

| Segments Covered | By Product Type (C-8 TA, C-10 TA, C-12 TA, C-14 TA, C-16 TA, Others), By Production Process (Ammonolysis, Reductive Amination, Alkylation), By Application (Surfactants, Biocides, Others), By End Use (Cosmetics and Personal Care, Water Treatment, Pharmaceuticals, Cleaning Products and Disinfectants, Others) |

| Competitive Landscape | Albemarle Corporation, Alkyl Amines Chemicals Limited, Arkema, Balaji Amines, BASF SE, Dow Chemical, Eastman Chemical Company, Hexion Inc., Huntsman International LLC, Indo Amines Ltd. |

Key Market Segments

By Product Type Analysis

In 2024, C-8 TA emerged as the leading product type in the Tertiary Amines Market, capturing 23.8% share. Its dominance comes from its extensive application in producing surfactants, emulsifiers, and intermediates used across personal care, household cleaning, and agrochemicals.

Known for its solubility, stability, and formulation compatibility, C-8 TA is widely used in shampoos, detergents, and fabric softeners. Its role extends to corrosion inhibitors, flotation agents, and herbicide formulations, strengthening demand in water treatment, mining, and agriculture.

With industries in emerging economies expanding and the consumption of specialty chemicals rising, manufacturers are increasingly relying on C-8 TA for its versatility and cost efficiency. Backed by traditional uses and growing high-performance applications, the product is expected to retain its leadership position through 2025.

By Production Process Analysis

In 2024, ammonolysis dominated the production process segment of the Tertiary Amines Market, accounting for a 49.2% share. Its strong position stems from being the most efficient, scalable, and cost-effective method for producing a wide variety of tertiary amines.

This process, which catalytically reacts alcohols with ammonia, delivers high yields and consistent product quality. Its ability to handle diverse feedstocks makes it ideal for producing customized amine grades used in surfactants, emulsifiers, and corrosion inhibitors. The adaptability of ammonolysis to large-scale industrial operations ensures it meets rising demand from personal care, cleaning, and agrochemical sectors.

Advancements in catalyst design and process optimization have further improved its energy efficiency and environmental profile, reinforcing its preference among manufacturers. The process also delivers high-purity outputs with minimal by-products, enhancing competitiveness in specialty chemical markets.

By Application Analysis

In 2024, surfactants led the application segment of the Tertiary Amines Market, capturing a 59.4% share. This dominance is fueled by the critical role of tertiary amines as intermediates in producing cationic, non-ionic, and amphoteric surfactants used across personal care, household cleaning, and industrial products.

They are essential for formulating fabric softeners, shampoos, conditioners, dishwashing liquids, and surface cleaners, with demand further strengthened by rising hygiene awareness and expanding consumption of home and personal care goods globally. Their strong emulsifying, foaming, and wetting properties enhance product stability and performance, making them equally valuable in oilfield chemicals, agriculture, and textile processing.

The surge in FMCG sales through e-commerce and the shift toward high-performance, multifunctional formulations have reinforced their market strength. Moreover, the growing push for eco-friendly and biodegradable surfactants is encouraging innovation. Supported by industrial expansion and evolving consumer preferences, tertiary amines in surfactant applications are expected to retain their leadership into 2025, maintaining a commanding market presence.

By End Use Analysis

In 2024, cosmetics and personal care emerged as the leading end-use segment in the Tertiary Amines Market, accounting for a 31.7% share. This dominance reflects their extensive use in producing conditioning agents, emulsifiers, and surfactants, which improve the texture, stability, and performance of a wide range of personal care items.

Tertiary amines are integral in formulations for shampoos, conditioners, lotions, skin creams, deodorants, and hair dyes, ensuring smoother application, enhanced spreadability, and longer-lasting effects. Rising consumer interest in premium grooming and hygiene products, along with higher spending capacity, has significantly boosted demand in this segment.

Their ability to support mild, skin-friendly formulations suited for sensitive skin further adds to their value, while compatibility with both oil- and water-based systems ensures widespread application. Growth is also fueled by urbanization, lifestyle shifts, and rising disposable incomes, particularly in emerging markets.

Looking ahead, the push for sustainable, eco-friendly formulations and the rising preference for high-performance personal care products will continue to drive strong growth. As a result, tertiary amines in cosmetics and personal care are expected to retain their leadership position through 2025.

Regional Analysis

In 2024, the Asia Pacific led the Tertiary Amines Market with a commanding 48.9% share, valued at USD 2.4 billion. This leadership is fueled by rapid industrial expansion, rising manufacturing capacity, and strong demand from personal care, household cleaning, and agrochemicals.

Countries such as China, India, and Southeast Asian nations are key growth engines, driven by urbanization, higher disposable incomes, and an expanding middle class that is increasing consumption of grooming, cleaning, and agricultural products. The region also benefits from low-cost raw materials, skilled labor, and large-scale chemical production facilities, enabling competitive and high-volume output.

Agriculture remains a major contributor, as tertiary amines are vital in herbicide and agrochemical production. Ongoing investments in chemical infrastructure and the shift toward eco-friendly formulations further strengthen Asia Pacific’s position. Supported by government-backed industrial initiatives and export growth, the region is expected to retain its dominance in 2025 and beyond, catering to both domestic markets and rising global demand.

Top Use Cases

- Catalyst in Polymerization Reactions: Tertiary amines act as effective catalysts in polymer chemistry, helping monomers link together to form plastics and resins more quickly and efficiently. Their basic nature and nucleophilicity make them well-suited for initiating or speeding up reactions, improving production speed and quality in polymer manufacturing.

- Corrosion Inhibitors in Water Systems: Some tertiary amines form protective films on metal surfaces, such as in boilers or steam systems. These films shield the metal from water-induced corrosion, extending equipment life and reducing maintenance.

- Flocculants in Water Treatment: Tertiary amines help in water purification by acting as flocculants—attracted to tiny particles in water, they help clump them together. These clumps can be easily filtered out, resulting in clearer, cleaner water.

- Making Mild Shampoos & Soaps: Tertiary amines—especially DMAPA—are used to make gentle surfactants called amphoteric surfactants found in shampoos, liquid soaps, and body washes. These help create foam, moisturize the skin, and make shampoos milder and more user-friendly.

- Water Treatment Helpers: Some tertiary amines are key ingredients in water treatment chemicals like corrosion inhibitors and flocculants. They help prevent rust and clogs in industrial water systems—particularly in boilers and cooling towers.

Recent Developments

- In June 2025, AACL completed its ₹400 crore investment at the Kurkumbh site, bringing a new plant online to boost Ethyl Amines capacity—key members of the tertiary amines family. The facility strengthens its ability to meet growing demand.

- In December 2024, Arkema completed the purchase of Dow’s flexible packaging laminating adhesives business. This strengthens their offering in adhesive technologies, which often use specialty amines for bonding and formulation needs.

- In September 2024, Albemarle submitted state and federal permit applications to begin redeveloping the Kings Mountain Mine. This move supports their broader chemical operations, which include producing tertiary amines—used in things like surfactants and cleaning agents.

- In February 2024, BASF strengthened its collaboration with OQEMA to distribute its standard amines (not including ethanolamines) across the UK and Ireland. This move improves the regional supply of high-quality amines used in coatings, plastics, detergents, and crop protection.

- In January 2024, Balaji Amines completed construction of a new n‑Butylamine plant at Unit IV, boosting capacity by 15,000 tonnes per annum (TPA). This chemical finds uses in pharmaceuticals, agrochemicals, and emulsifiers, and the expansion strengthens its supply to these industries.

Conclusion

The tertiary amines market is poised for steady expansion, supported by their wide use in personal care, cleaning, pharmaceuticals, and agrochemicals. Their versatility as surfactant intermediates, corrosion inhibitors, and emulsifiers ensures continued relevance across industries. With rising hygiene awareness, growing agricultural needs, and innovations in eco-friendly formulations, demand is set to strengthen.

Expanding production capacity in Asia-Pacific, alongside sustainable manufacturing initiatives in Europe and North America, further reinforces global growth. As industries shift toward greener chemistry and high-performance products, tertiary amines will remain a key building block, driving both traditional and next-generation chemical solutions well into the future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)