Table of Contents

Overview

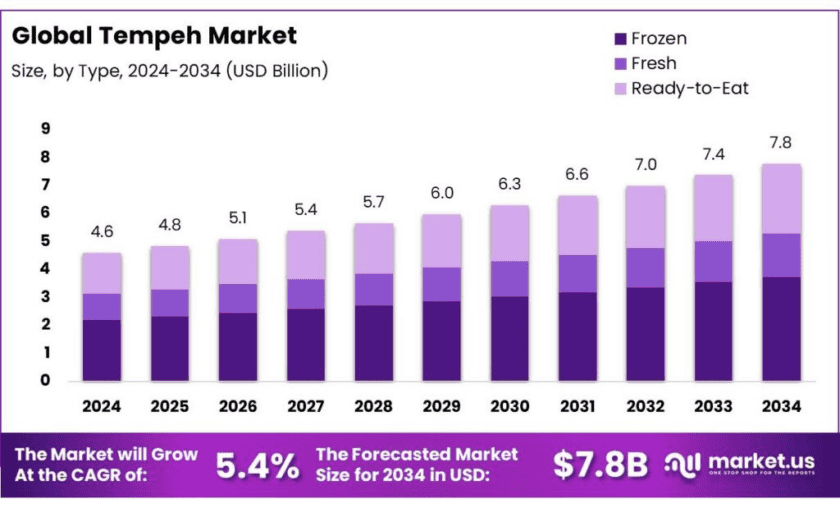

New York, NY – Nov 06, 2025 – The global tempeh market is projected to reach USD 7.8 billion by 2034, increasing from USD 4.6 billion in 2024 at a CAGR of 5.4% between 2025 and 2034. In 2024, Asia Pacific remained the leading regional market, capturing approximately 43.9% share and generating around USD 2 billion in revenue. Tempeh, a traditional Indonesian fermented soybean food originating from Central Java, is made by fermenting cooked soybeans with the fungus Rhizopus oligosporus, producing a firm, nutty-flavored, and highly nutritious cake.

Government policies have also strengthened the industry. The U.S. Department of Agriculture (USDA) has supported soybean exports to Indonesia, directly benefiting local tempeh and tofu manufacturers; in 2010, U.S. soybean exports to Indonesia reached USD 805 million, marking a 40% increase over six years. Growing demand for plant-based foods is another major driver. The Plant Based Foods Association reported that the U.S. plant-based food market expanded 27% in 2020, generating USD 7 billion in sales, underscoring consumers’ growing preference for sustainable and nutritious protein sources like tempeh.

According to the USDA, plant-based protein consumption is forecast to rise by 20% annually through 2025, signaling strong prospects for the tempeh segment. Furthermore, continuous innovations in fermentation technology, texture enhancement, and flavor diversification are expected to accelerate product development, ensuring the tempeh market sustains its robust global growth over the coming decade.

Key Takeaways

- Tempeh Market size is expected to be worth around USD 7.8 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 3.6%.

- Frozen tempeh held a dominant market position, capturing more than a 48.2% share of the global market.

- Soya Beans held a dominant market position, capturing more than a 72.4% share of the global tempeh market.

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 31.5% share of the global tempeh market.

- Asia Pacific dominated the global tempeh market, holding a significant share of 43.90%, valued at approximately USD 2 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/tempeh-market/free-sample/

Report Scope

| Market Value (2024) | USD 4.6 Bn |

| Forecast Revenue (2034) | USD 7.8 Bn |

| CAGR (2025-2034) | 3.6% |

| Segments Covered | By Type (Frozen, Fresh, Ready-to-Eat), By Source (Soya Beans, Multi-grain, Others), By Distribution Channel ( Hypermarkets and Supermarkets, Foodservice, Retail, Convenience Stores, Online, Others) |

| Competitive Landscape | HORIZON FOODS, Tootie’s Tempeh, Nutrisoy Pty Ltd, Maple Leaf Foods Inc., Primasoy, Lightlife Foods, Tofutti Brands, Eden Foods, Hain Celestial, Vitasoy, Wildwood |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159475

Key Market Segments

By Type Analysis – Frozen Tempeh Dominates with 48.2% Share in 2024

In 2024, frozen tempeh accounted for a commanding 48.2% share of the global market, driven by its exceptional convenience, shelf stability, and ease of distribution. Freezing allows tempeh to retain its flavor and nutritional integrity without preservatives, aligning perfectly with consumer preferences for clean-label and plant-based products. The segment’s expansion has been fueled by the busy lifestyles of urban consumers seeking ready-to-cook, nutrient-rich options. Retail penetration across supermarkets, hypermarkets, and e-commerce platforms has further boosted accessibility. As the global frozen food category grows rapidly, frozen tempeh benefits from being part of this expanding ecosystem.

By Nature Analysis – Soya Beans Lead with 72.4% Share in 2024

Soya beans dominated the tempeh market in 2024, holding an impressive 72.4% share due to their high protein, fiber, and amino acid content, along with their cost-effectiveness and widespread cultivation. Their rich nutritional composition and fermentation suitability make soybeans the preferred base for tempeh production globally. Regions such as Southeast Asia and North America continue to rely on soybeans as a stable, accessible raw material. The ongoing global shift toward plant-based diets and increased focus on sustainable protein production further reinforce soybean dominance.

By Distribution Channel Analysis – Hypermarkets & Supermarkets Capture 31.5% Share in 2024

In 2024, hypermarkets and supermarkets emerged as the primary distribution channels for tempeh, capturing 31.5% of global sales. Their extensive reach, organized retail infrastructure, and strong product visibility make them the preferred shopping points for consumers adopting plant-based eating habits. These outlets offer a wide variety of tempeh brands and formats, often coupled with promotional discounts and convenience in one-stop shopping experiences. As plant-based food demand accelerates, retailers are expanding shelf space and launching dedicated plant-protein sections, further boosting tempeh sales.

List of Segments

By Type

- Frozen

- Fresh

- Ready-to-Eat

By Source

- Soya Beans

- Multi-grain

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Foodservice

- Retail

- Convenience Stores

- Online

- Others

Regional Analysis

In 2024, the Asia Pacific region emerged as the dominant force in the global tempeh market, capturing a substantial 43.90% share, equivalent to approximately USD 2 billion in market value. This leadership is primarily attributed to the region’s strong cultural ties with tempeh, especially in Indonesia, where the product originated and remains an integral part of daily diets. Across Southeast Asia, tempeh’s deep-rooted role in traditional cuisine and its widespread consumption have fostered a well-established production ecosystem that supports consistent regional growth.

Additionally, rapid urbanization and rising health awareness have accelerated the shift toward plant-based diets in countries such as India, Japan, and South Korea. Consumers are increasingly choosing tempeh for its high protein content, digestibility, and environmental sustainability compared to animal-based proteins. The region’s favorable soybean cultivation conditions ensure reliable raw material availability, keeping production cost-effective and scalable. Together, these factors position Asia Pacific as the undisputed leader in the global tempeh industry, with sustained growth expected as plant-based nutrition continues to gain prominence across diverse consumer groups.

Top Use Cases

Plant-based protein replacement: Tempeh serves as a high-quality, plant-based protein alternative to meat and dairy. For example, one review notes that tempeh contains all nine essential amino acids and is described as a “complete protein” food. In practical terms, a 3-ounce (≈84 g) serving offers about 18 g of protein, which is more than many eggs contain. For consumers reducing animal-protein intake, this makes tempeh a compelling substitution. In commercial terms, as more flexitarians and vegetarians enter the food-market, tempeh’s role in formulations is expanding.

Health and wellness ingredient: Tempeh’s fermentation process gives it added health-value beyond simple nutrition. For instance, one study on soy-based tempeh identified ameliorative effects on oxidative stress, glycaemic control and blood lipid levels. Additionally, reviews comment on tempeh’s high micronutrient content — iron, manganese, magnesium, B-vitamins — as well as its dietary fibre and probiotic potential. From a product-development perspective, tempeh can appear in foods positioned for heart-health, digestive-health or weight-management: it is low in saturated fat, provides fibre and supports feelings of fullness.

Functional food & fermented-food segment: As a fermented soybean cake, tempeh fits into the growing “fermented / functional food” category. The fermentation boosts bioavailability of nutrients and introduces micro-organisms that may support gut-microbiota health. One experimental study found that consumption of a tempeh drink post-exercise lowered creatine‐kinase (CK) levels, improved muscle soreness and improved muscle strength more than a placebo. For food-brands and manufacturers, this means tempeh can be integrated into “functional” snacks or sports-nutrition formats.

Sustainability & supply-chain innovation: Tempeh originates from fermentation of cooked soybeans by the fungus Rhizopus oligosporus. Its production is relatively low-cost and can use legumes beyond soybeans. A recent initiative at the UMass research center is developing chick-pea and pea-based tempeh in order to extend the category and reduce reliance on soy. From a market-research perspective, tempeh appeals to sustainability conscious brands: plant-based, fermented, lower-resource than many animal-based proteins. This presents an opportunity for “next-gen” tempeh variants and premium positioning.

Culinary versatility & product diversification: Tempeh can be used in a wide range of product forms: from traditional Indonesian dishes to Western-style marinated strips, ready-to-cook cubes, frozen meal kits and snack bars. According to consumer-attitude data, only about 23% of Danish consumers had a positive attitude to tempeh in one survey — signalling room for awareness-raising and innovation in product design. Moreover, research highlights that processing methods—such as pre-marinating, smoking, flavouring, or combining with vegetables/legumes—can expand tempeh’s usage beyond its core fermentation form.

Recent Developments

In 2024, Horizon Foods (Australia) expanded its tempeh portfolio with artisan-style fresh tempeh under the “Byron Bay Tempeh” brand, using locally grown lupin beans and other legumes. For example, in April 2024 they announced that their “Bisque Tempeh” is made from Australian-grown lupin beans in Southern NSW. While explicit annual volume or revenue figures were not publicly disclosed, their positioning in 2023–24 emphasises small-batch, hand-crafted production appealing to health- and sustainability-oriented consumers.

In November 2022 the worker-owned cooperative Tootie’s Tempeh launched in Biddeford, Maine, producing approximately 232 pounds per week at start of 2023, with plans to scale ten-fold. The brand emphasises organic soybeans, plastic-bag free fermentation and sustainable packaging. By 2024 they had reportedly eliminated over 90,000 single-use plastic bags from their process. This strongly positions them in the premium, clean-label tempeh niche in the U.S. market.

In 2023–24, Nutrisoy Pty Ltd, an Australian family-owned business established in 1984, continued expanding its tempeh product range under the Nutrisoy, Soyco and TLY brands on the domestic market. Their range now includes certified organic plain tempeh, spiced tempeh, and pre-cooked tempeh burgers (300 g and 200 g packs) made from Australian-grown non-GMO soybeans. While public financials for tempeh only are not disclosed, the company’s investment in a new high-tech production facility at Banksmeadow, NSW signals a capacity uplift in 2024.

In 2024, Maple Leaf Foods Inc. deepened its tempeh footprint via its subsidiary brand Lightlife, launching “Tempeh Protein Crumbles” in March 2024 – a pre-seasoned, ground-tempeh format delivering 16 g protein and 6 g fibre per serving. Lightlife Tempeh claims to be the #1 tempeh brand in the U.S. and Canada under the Maple Leaf plant-based business unit.

In 2023–24, Primasoy, a family-owned organic tempeh producer based in Melbourne, continued to scale its operations, making tempeh from “Australian Certified Organic soybeans” and distributing across Australia. Their focus on traditional Indonesian fermentation methods and locally-sourced raw materials helped strengthen their positioning in the clean-label, health-food niche, with no major public revenue figures disclosed yet but clear investment in brand and production infrastructure.

In March 2024, Lightlife Foods, under its parent Maple Leaf Foods Inc., launched “Tempeh Protein Crumbles” in two flavours, expanding its tempeh range in the U.S. plant-based category. The innovation underscores Lightlife’s claim as the “#1 tempeh brand in the U.S. and Canada” and demonstrates its strategy of offering convenient, value-added formats to capture growing demand for plant-based proteins.

Although primarily known for soy-based cheeses and frozen desserts, Tofutti Brands has begun exploring broader soy food applications, yet there is no public record of a dedicated tempeh line in 2023–24. Their corporate focus remains on vegan and lactose-free alternatives, and despite tempeh being referenced in some analyst lists, the company’s 2024 annual report does not list tempeh revenues separately. This suggests that tempeh remains an emerging or minor part of their soy-foods portfolio at this stage.

Eden Foods, Inc. emphasizes fermented soybean foods including miso, natto and tempeh in its portfolio and culture of non-GMO and organic soy products. In 2023-24, the company highlighted tempeh as part of its “Fermented Food” platform and educational content on its website, indicating strategic interest though no discrete tempeh sales figures were published. Their broader soy-foods business continues to position tempeh as a nutrition and wellness vehicle in health-food channels.

Conclusion

In conclusion, Tempeh stands out as a compelling plant-based protein solution that aligns with rising consumer demand for nutritious, sustainable, and versatile foods. The product delivers impressive nutritional credentials — for example, a 3-ounce (~84 g) serving supplies around 18 g of complete protein, plus significant fiber, iron and minerals.

Moreover, the traditional heartland of tempeh, the Asia-Pacific region, provides both cultural familiarity and raw-material advantages, further anchoring its market leadership. Given its dual role as a protein alternative and a fermented functional food, tempeh offers food manufacturers, retailers and ingredient developers a strong platform for innovation—whether in frozen formats, ready-to-cook meals or multi-legume variants.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)