Table of Contents

Overview

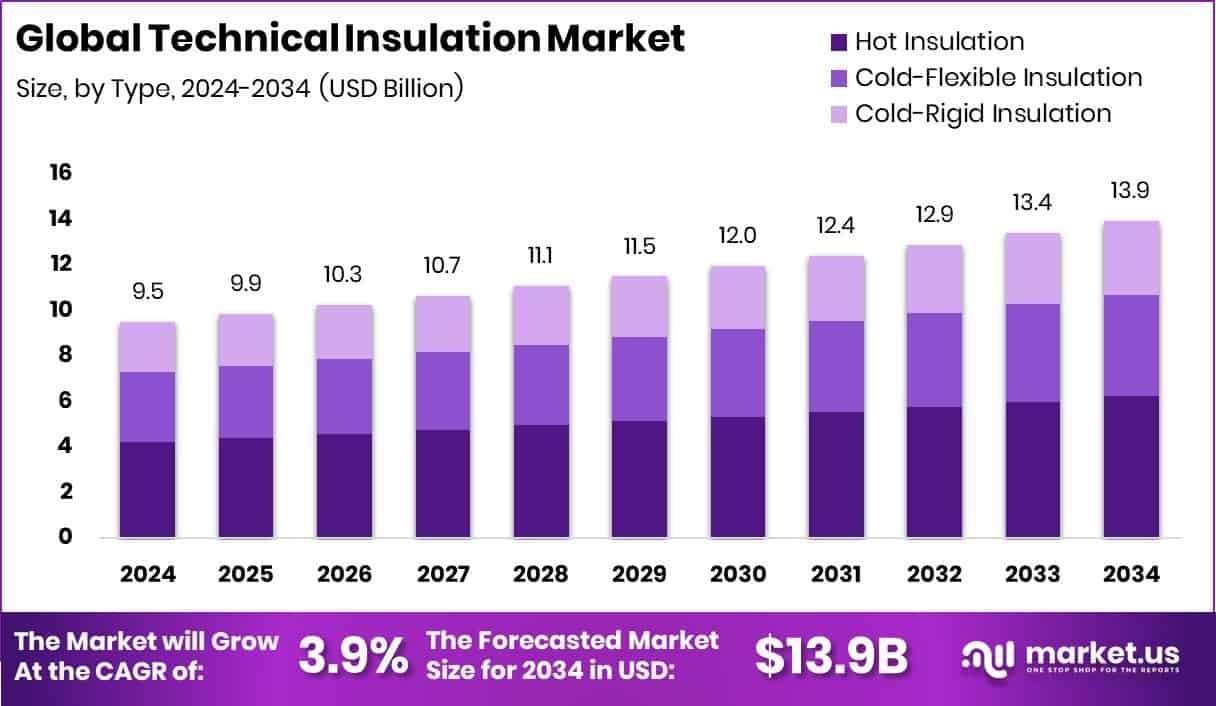

New York, NY – Nov 28, 2025 – The global technical insulation market is expanding steadily, supported by stricter energy-efficiency rules and infrastructure modernization. Market value is projected to increase from USD 9.5 billion in 2024 to nearly USD 13.9 billion by 2034, reflecting a 3.9% CAGR between 2025 and 2034. Asia Pacific, holding around 37.4% momentum, continues to lead growth due to rapid industrialization, large infrastructure upgrades, and aggressive energy-efficiency targets across utilities and process industries.

Technical insulation includes advanced materials applied to pipes, HVAC systems, boilers, turbines, vessels, and storage tanks to control heat loss, condensation, sound, and fire risks. Unlike basic building insulation, it is critical for protecting industrial equipment, ensuring worker safety, and maintaining operational efficiency in high-temperature or demanding environments. As industries focus more on decarbonization and heat-loss reduction, technical insulation has become a core component of energy management strategies across oil & gas, chemicals, power generation, district heating, food processing, cold storage, and large commercial buildings.

Market growth is reinforced by targeted public and private funding. Governments have committed £13.9 million to heat-network upgrades and are planning a £1 billion insulation scheme aimed at cutting household energy costs. In clean-energy infrastructure, Bedrock Energy raised USD 12 million to expand geothermal solutions linked to heat efficiency.

On the services and installation side, demand for better execution is increasing as correction cases reach £3,000 per site. Contractor digitalization is accelerating through Mura’s USD 4.5 million raise and Conry Tech’s USD 3 million funding, while shifting public budgets—such as USD 42 million withdrawn from Michigan school projects—continue to influence adoption timelines.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-technical-insulation-market/request-sample/

Key Takeaways

- The Global Technical Insulation Market is expected to be worth around USD 13.9 billion by 2034, up from USD 9.5 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- Hot insulation leads with a 44.8% share within the growing Technical Insulation Market globally in 2024.

- HVAC dominates applications at 37.9% inside the expanding technical insulation market across energy-heavy projects.

- Industrial and OEM hold a 49.7% share, powering the Technical Insulation Market for process efficiency improvements.

- The Asia Pacific records a USD 3.5 Bn market size across diverse users’ industrial expansion.

➤ Directly purchase a copy of the report –https://market.us/purchase-report/?report_id=166233

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 9.5 Billion |

| Forecast Revenue (2034) | USD 13.9 Billion |

| CAGR (2025-2034) | 3.9% |

| Segments Covered | By Type (Hot Insulation, Cold-Flexible Insulation, Cold-Rigid Insulation), By Application (Heating and Plumbing, HVAC, Acoustic, Refrigeration), By End-use (Industrial and OEM, Energy, Commercial Buildings) |

| Competitive Landscape | Zotefoams Plc, Owens Corning, Kingspan Group Plc, Rockwool International A/S, Recticel NV/SA, Morgan Advanced Materials plc, Armacell International S.A., Aspen Aerogels, Inc., Knauf Insulation, Saint-Gobain, Palziv Inc. |

Key Market Segments

By Type Analysis

In 2024, Hot Insulation dominated the By Type segment of the Technical Insulation Market, accounting for a 44.8% market share. This leadership position was driven by its essential role in high-temperature industrial applications, including process pipelines, boilers, heating units, and district heat-network systems. Industrial operators favored hot insulation to reduce thermal losses, protect equipment performance, and ensure safe working conditions under sustained heat exposure.

Hot insulation also gained preference among asset owners focused on maintaining stable operating temperatures while lowering energy waste across continuous operations. Its demand strengthened further as both industrial facilities and public infrastructure undertook upgrades aligned with energy-efficiency goals.

Government-backed insulation programs aimed at easing household and industrial energy cost pressures reinforced adoption across multiple end-use sectors. Due to its wide application range, proven performance in harsh environments, and consistency with long-term energy-efficiency strategies, hot insulation maintained a stable and leading market position throughout the year.

By Application Analysis

In 2024, HVAC applications led the By Application segment of the Technical Insulation Market with a 37.9% share, reflecting their widespread adoption across commercial buildings, industrial sites, transport terminals, and public infrastructure. This dominance stems from the critical need to maintain consistent indoor temperatures, meet air-quality standards, and comply with energy-efficiency regulations.

Demand was strongly supported by expanding HVAC retrofitting programs focused on lowering electricity consumption in heating and cooling systems. Facility owners increasingly prioritized insulated HVAC networks to achieve quieter operation, safer system performance, and reduced energy losses. The segment also benefited from higher awareness of long-term operating cost savings and improved moisture and condensation control.

By insulating ducts, chillers, air-handling units, and ventilation lines, HVAC systems maintained reliability while enhancing overall efficiency. As energy-efficient climate control remains a priority across buildings and infrastructure projects, HVAC continued to secure the largest application share in the market.

By End-use Analysis

In 2024, Industrial and OEM applications dominated the by-end-use segment of the Technical Insulation Market, capturing a 49.7% share. This leadership was driven by energy-intensive operations and continuous production processes that require precise and reliable temperature control across manufacturing plants, industrial machinery, and engineered assemblies.

Demand from this segment was reinforced by strict safety regulations and the need to minimize heat loss in high-performance operating environments. Industrial operators and OEMs increasingly relied on technical insulation to protect equipment, sustain productivity, and reduce unplanned downtime.

Widespread use in factories, machinery enclosures, and engineered components supported steady adoption, as insulation helps maintain thermal balance while preventing condensation and energy waste. With long-term efficiency, operational stability, and regulatory compliance remaining top priorities, Industrial and OEM end users continued to secure the largest share of the market in 2024.

Regional Analysis

The Asia Pacific region led the Technical Insulation Market with a 37.4% share, valued at approximately USD 3.5 billion, driven by extensive industrial usage across power generation, manufacturing plants, and commercial building systems. Strong installation activity across HVAC networks, process pipelines, and heat-managed industrial assets supported this leadership. Rapid urban expansion, ongoing infrastructure upgrades, and growing adoption of energy-efficiency practices across industrial hubs further reinforced the region’s dominant position.

North America recorded steady demand, supported by commercial building retrofits, routine industrial maintenance, and upgrades to heating and cooling systems to improve comfort and performance. Europe emphasized insulation in buildings, district energy systems, and regulated safety environments, where strict thermal control and compliance standards are critical.

In the Middle East & Africa, demand remained focused on energy-intensive industries and structures exposed to extreme heat, supporting consistent insulation use. Latin America witnessed gradual growth through industrial and commercial upgrades, driven by maintenance needs, cost efficiency, and long-term equipment protection.

Top Use Cases

- Reducing Energy Loss in Heating & Cooling Systems: Technical insulation helps keep heat (or cold) inside pipes, ducts, boilers, and tanks — so less energy is wasted. This means lower fuel or electricity costs for heating or cooling systems.

- Maintaining Stable Process Temperatures in Industry: In factories, refineries or power plants where precise temperature control matters (e.g. chemical reactions, steam distribution, metal processing), insulation ensures that process temperatures remain stable. This improves consistency, reduces energy waste, and helps maintain output quality.

- Protecting Personnel & Improving Workplace Safety: Insulation keeps the outside surfaces of hot pipes, boilers, or tanks cooler — reducing burn risk if workers touch them. It also prevents condensation or freezing on cold surfaces, which can cause slips or corrosion-related failures.

- Preventing Condensation, Corrosion & Moisture-Related Damage: When cold fluids flow in pipes, surfaces can get cold enough to cause condensation. Insulation (often with a vapor barrier) stops condensation from forming, thus preventing corrosion under insulation (CUI) and prolonging equipment life.

- Enhancing Fire Safety, Acoustic Control & Environmental Protection: Many technical insulation materials are non-combustible (e.g. mineral wool) and help dampen sound or vibration. This adds fire resistance and noise reduction — improving safety and comfort, especially in industrial or building-service environments.

- Minimizing Operating Costs & Supporting Sustainability Goals: By cutting energy losses, reducing fuel or power consumption, and lowering maintenance needs, technical insulation contributes to long-term cost savings. At the same time, reduced energy use means lower CO₂ emissions — helping meet environmental and sustainability targets

Recent Developments

- In November 2025, Zotefoams acquired Overseas Konstellation Company S.A. (OKC), a Spanish producer of technical foams. The deal is valued up to €36.0 million (an upfront payment of €27.6 million plus a possible deferred payment up to €8.4 million), and OKC brings complementary foam-production capabilities, including acoustic insulation, protective components and specialty packaging — expanding Zotefoams’ footprint and product range in Europe.

- In September 2024, Owens Corning presented new insulation innovations at the global energy-industry show Gastech 2024. They showcased their “FOAMGLAS” cellular-glass insulation systems — designed for demanding energy and cryogenic applications, including LNG (liquefied natural gas) or other extreme-temperature processes, where fire safety, thermal protection, and condensation prevention are critical.

Conclusion

The technical insulation market continues to play a vital role in improving energy efficiency, equipment protection, and operational safety across industrial, commercial, and infrastructure environments. Its importance is growing as industries focus more on reducing energy loss, maintaining stable operating conditions, and extending asset life.

Technical insulation supports safer workplaces, better system reliability, and long-term cost control without disrupting performance. Adoption is strongly linked to the modernization of heating, cooling, and process systems, along with stricter efficiency and safety expectations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)