Table of Contents

Overview

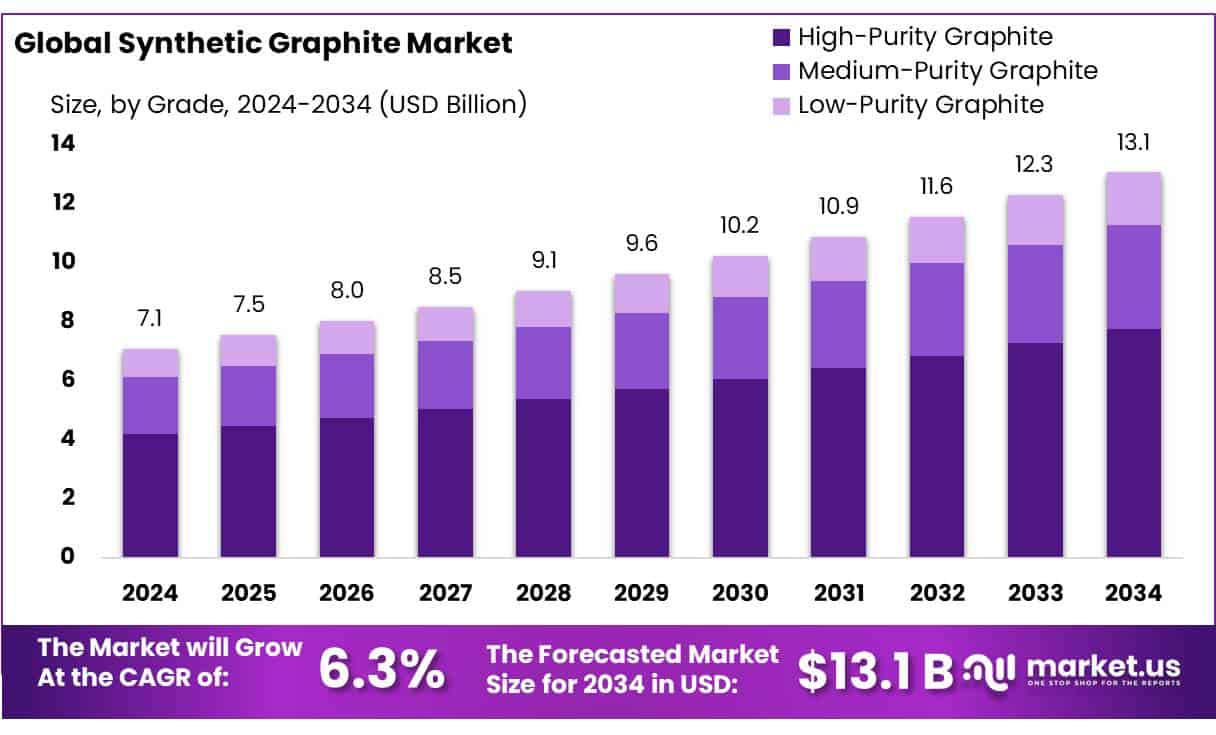

New York, NY – June 23, 2025 – The global synthetic graphite market is set to grow from approximately USD 7.1 billion in 2024 to around USD 13.1 billion by 2034, reflecting a compound annual growth rate (CAGR) of 6.3% from 2025 to 2034. This growth is being driven by rising demand for high-purity and high-performance graphite in applications such as electric vehicle (EV) batteries, electronics, metallurgy, and lubricants. Synthetic graphite is gaining popularity due to its consistent quality, excellent electrical conductivity, and resistance to high temperatures.

Key growth factors include increasing EV adoption, advances in lithium-ion battery technologies, and the trend toward high-efficiency industrial processes. Market opportunities are emerging in lightweight composite materials, expandable graphite for flame retardants, and sensor applications in emerging smart devices.

Expansion is being supported by new production facilities in Asia-Pacific, Europe, and North America, designed to meet clean energy transition needs. As manufacturers invest in eco-friendly production techniques—including hydroelectric-powered plants and recycled petroleum coke feedstocks—the market is expected to become more sustainable while continuing to expand across industries.

In 2024, the synthetic graphite market was led by high-purity graphite, which accounted for 59.3% of the market by grade due to its essential role in lithium-ion batteries, semiconductors, aerospace, and high-temperature furnaces. By application, rechargeable batteries dominated with a 39.1% share, driven by increasing demand from electric vehicles, energy storage systems, and portable electronics.

Synthetic graphite’s high conductivity and cycle life make it the preferred material for battery anodes. In terms of end use, consumer electronics held the largest share at 34.9%, supported by its critical function in battery performance and thermal management in smartphones, laptops, and wearable devices.

How Growth is Impacting the Economy

The expansion of the synthetic graphite market is positively influencing several high-value sectors, including automotive, electronics, energy storage, and advanced manufacturing. As electric vehicles and grid-scale energy storage gain momentum, demand for lithium-ion batteries—and thereby synthetic graphite—continues to rise. This surge is fueling investments in battery production facilities, job creation in high-tech manufacturing, and raw material processing.

Countries with domestic graphite processing capabilities are gaining economic advantages by reducing reliance on imports and securing supply chains for clean energy technologies. The consumer electronics sector is also seeing increased production activity as compact, fast-charging devices become more common, driving material innovation and economic scale.

Moreover, the growth of synthetic graphite supports advancements in aerospace, metallurgy, and semiconductors—sectors that contribute significantly to GDP in developed and emerging economies. As synthetic graphite becomes a cornerstone of next-generation technologies, its economic contribution is expected to increase through industrial diversification and clean technology alignment.

To succeed in the evolving synthetic graphite market, businesses should focus on scaling high-purity graphite production and securing long-term supply agreements with battery and electronics manufacturers. Investing in green manufacturing processes—such as low-emission furnaces and recycled petroleum coke inputs—will enhance sustainability credentials. Firms should also prioritize R&D in advanced graphite grades for next-gen batteries, semiconductors, and heat management applications.

Forming strategic partnerships with EV manufacturers, gigafactories, and electronics OEMs will strengthen market positioning. Additionally, expanding operations in high-growth regions like Asia-Pacific and North America and establishing localized supply chains will help meet rising demand and navigate regulatory or logistical challenges.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-synthetic-graphite-market/free-sample/

Key Takeaways

- Synthetic Graphite Market size is expected to be worth around USD 13.1 Billion by 2034, from USD 7.1 Billion in 2024, growing at a CAGR of 6.3%.

- High-Purity Graphite held a dominant market position, capturing more than a 59.3% share in the global synthetic graphite market.

- Rechargeable Batteries held a dominant market position, capturing more than a 39.1% share of the global synthetic graphite market.

- Consumer Electronics held a dominant market position, capturing more than a 34.9% share of the global synthetic graphite market.

- Asia-Pacific (APAC) held a dominant position in the global synthetic graphite market, capturing approximately 42.9% of the total market share, valued at around USD 3.0 billion.

Experts Review

The current synthetic graphite market is showing steady growth, underpinned by strong demand from electric mobility, renewable energy, and digital devices. Analysts observe that high-purity graphite will remain essential as battery quality and safety standards become stricter. In the near future, increased investment in battery manufacturing across North America and Europe will amplify synthetic graphite consumption.

The market’s versatility across sectors—from energy storage to semiconductors—adds resilience and long-term value. With ongoing innovation in material performance and production efficiency, synthetic graphite is positioned as a key enabler of low-carbon technologies, making its future outlook both promising and strategically important.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=151083

Key Market Segments

By Grade

- High-Purity Graphite

- Medium-Purity Graphite

- Low-Purity Graphite

By Application

- Rechargeable Batteries

- Fire Retardants

- Coatings

- High-Temperature Resistant Crucibles

- Lubricants

- Others

By End-Use

- Consumer Electronics

- Automotive

- Industrial Machinery

- Aerospace Defense

- Construction

- Others

Regional Analysis

In 2024, Asia-Pacific (APAC) led the global synthetic graphite market with a 42.9% share, valued at approximately USD 3.0 billion. This regional dominance is primarily driven by China, which contributes over 65% of global synthetic graphite production, backed by abundant raw materials, mature processing infrastructure, and government incentives for battery manufacturing.

Additionally, China produces more than 60% of the world’s EV batteries, reinforcing its role in the global battery supply chain. South Korea and Japan also significantly support regional demand through their leadership in advanced lithium-ion battery technologies, making APAC the key hub for synthetic graphite consumption.

Top Use Cases

Lithium-Ion Battery Anodes: Synthetic graphite is widely used as the anode material in lithium-ion batteries due to its high purity, long cycle life, and excellent conductivity. It ensures stable charging and discharging performance, making it essential for electric vehicles, smartphones, and energy storage systems.

Metallurgical Applications: In the steel industry, synthetic graphite is used as a carbon raiser and for lining furnaces. Its thermal stability and resistance to corrosion make it suitable for high-temperature processes such as electric arc furnaces, where it helps improve efficiency and product quality.

Semiconductors and Electronics: Synthetic graphite is used in the production of semiconductors and heat spreaders due to its superior thermal conductivity. It helps manage heat in compact electronic devices like smartphones, laptops, and LED systems, ensuring longer device life and performance stability.

Solar and Photovoltaic Systems: Synthetic graphite is applied in solar panel production, especially in the manufacture of crucibles and heating elements used to grow silicon crystals. Its thermal durability and chemical resistance are essential for maintaining purity during high-temperature processes in photovoltaic manufacturing.

Nuclear Energy Systems: In nuclear reactors, synthetic graphite acts as a moderator and structural component due to its low neutron absorption and high-temperature tolerance. It plays a role in both conventional and next-generation reactor designs, supporting safe and stable operations.

Recent Developments

In early 2024, Asbury Carbons was acquired by private equity firm Mill Rock Capital, marking a strategic investment to expand its engineered graphite and carbon solutions portfolio. This acquisition underlines Asbury’s commitment to scaling operations, accelerating innovation in synthetic graphite, and improving technical capabilities across various applications, including batteries, electrodes, and specialty carbon materials.

In late 2023, Mason Graphite rebranded as Mason Resources Inc. to reflect an expanded strategic focus on sustainable graphite materials. Alongside its rebranding, the company became a cornerstone investor in Canada’s Nouveau Monde Graphite, securing binding offtake agreements with Panasonic Energy and General Motors—positioning itself within the North American battery materials supply chain transformation.

Imerys has continued to expand its synthetic graphite offerings through product development focused on battery-grade purity. The company is investing in scaling its new graphite material production in Europe and North America to serve growing demand from electric vehicle battery manufacturers pursuing decarbonization and local sourcing strategies.

Nippon Kokuen has advanced its synthetic graphite production with upgrades to furnace capacity and automation. These enhancements aim to increase yields, reduce energy consumption, and meet rising demand from EV battery, electronics, and industrial customers, reinforcing its position as a key Japanese graphite supplier.

In early 2025, Graphit Kropfmühl launched a high-purity synthetic graphite product tailored for lithium-ion battery anodes. This specialization integrates advanced purification technologies and precision processing to meet strict European battery industry standards, reinforcing its presence within the region’s emerging EV supply chain.

Conclusion

The synthetic graphite market is expanding steadily, driven by accelerating demand from EVs, energy storage, and consumer electronics. High-purity graphite continues to lead due to its essential role in battery technologies. As industries prioritize cleaner energy and digital innovation, synthetic graphite is becoming a foundational material.

Businesses that invest in sustainable production and strategic partnerships will be best positioned for long-term growth. With rising regional investment and technological advancements, the market outlook remains strong and vital to the future of clean energy and mobility.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)