Table of Contents

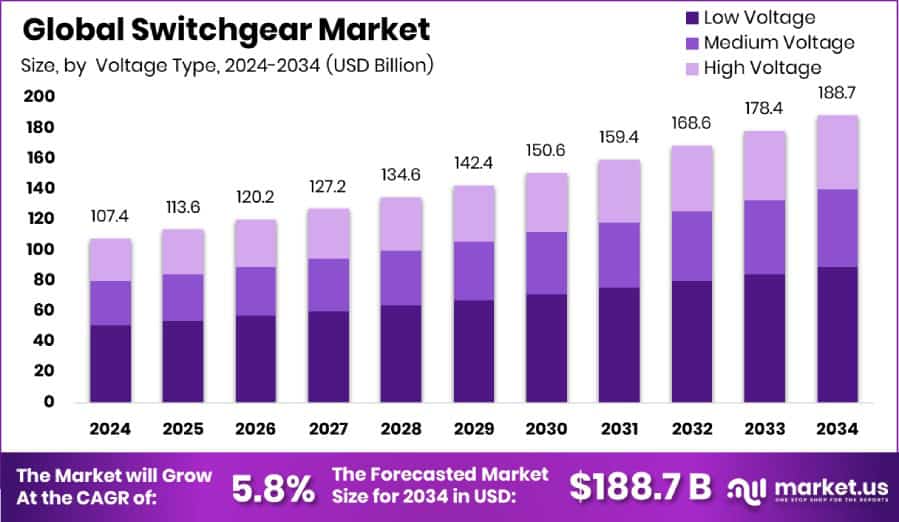

New York, NY – August 29, 2025 – The global switchgear market, valued at USD 107.4 billion in 2024, is projected to reach approximately USD 188.7 billion by 2034, growing at a CAGR of 5.8% from 2025 to 2034. North America alone accounted for USD 46.3 billion in 2024, driven by strong utility investments. Switchgear—comprising disconnect switches, fuses, and circuit breakers—plays a critical role in controlling, protecting, and isolating electrical systems, ensuring safety and preventing equipment damage during faults.

The market spans low, medium, and high-voltage applications, serving industries, utilities, and residential/commercial sectors. Growth is propelled by expanding power infrastructure, particularly in developing and urbanizing regions, alongside rural electrification projects demanding compact, reliable solutions. Rising renewable energy adoption, such as solar and wind projects, is also a key driver, as these require advanced switchgear for grid integration and operational safety.

Technological advancements, including digital and SF6-free switchgear, are gaining traction due to growing concerns over energy efficiency, reliability, and environmental impact. Notable developments include an $86 million facility in Pennsylvania and Berlin-based Nuventura securing €25 million to advance eco-friendly designs. With ongoing investments and innovation, the switchgear industry is positioned for sustained, robust growth over the next decade.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-switchgear-market/request-sample/

Key Takeaways

- The Global Switchgear Market is expected to be worth around USD 188.7 billion by 2034, up from USD 107.4 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the switchgear market, the low-voltage segment holds the largest share at 47.3% in 2024.

- Air insulation dominates among insulation types, accounting for 33.8% of the switchgear market’s total share.

- AC current type leads significantly in the market, representing around 87.2% of switchgear usage.

- Indoor installation is preferred by end-users, making up 57.4% of the global switchgear market share.

- Transmission and distribution utilities contribute the highest, capturing 58.9% of the total market demand.

- The North American switchgear market reached a valuation of USD 46.3 billion in 2024.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 107.4 Billion |

| Forecast Revenue (2034) | USD 188.7 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Voltage Type (Low Voltage, Medium Voltage, High Voltage), By Insulation (Air, Gas, Oil, Vacuum, Others), By Current (AC, DC), By Installation (Indoor, Outdoor), By End Use (T and D Utilities, Commercial and Residential, Industrial) |

| Competitive Landscape | ABB Ltd., Eaton Corporation, General Electric, Hitachi Limited, Bharat Heavy Electricals Limited (BHEL), Crompton Greaves, Powell Industries, Legrand, Atlas Electric, Inc., Siemens AG |

➤ Directly purchase a copy of the report— https://market.us/purchase-report/?report_id=154618

Key Market Segments

By Voltage Type Analysis

In 2024, low voltage switchgear led the market’s By Voltage Type segment with a 47.3% share, driven by its widespread use in residential, commercial, and industrial distribution networks. Its dominance stems from the growing need for safe, reliable power distribution amid rapid urbanization and infrastructure development across both advanced and emerging economies.

Low voltage systems are crucial for protecting circuits and managing energy in low-load settings such as buildings, factories, and public infrastructure. The rise of smart city projects and digital infrastructure has further fueled demand for compact, intelligent low-voltage equipment, essential for precise energy control and quick fault isolation.

Increasing safety regulations and the push to reduce outages are encouraging upgrades to existing systems, especially in densely populated urban centers. The segment also benefits from its cost-effectiveness, ease of installation, and adaptability, making it suitable for a variety of applications.

Its strong market position underscores its pivotal role in modern power management, particularly in decentralized grids and localized distribution networks. As energy systems evolve toward greater efficiency and resilience, low-voltage switchgear remains a key enabler, offering scalable solutions that meet the demands of both traditional and next-generation power infrastructures.

By Insulation Analysis

In 2024, air insulation dominated the Switchgear Market’s By Insulation segment with a 33.8% share, driven by the cost-effectiveness and widespread use of air-insulated switchgear (AIS) in diverse power distribution applications. Air, as an insulating medium, is safe, eco-friendly, and widely accepted, offering a simpler design and lower operational costs compared to alternative insulation types.

AIS is particularly favored in medium- and low-voltage networks for indoor installations across industrial facilities, commercial buildings, and utility substations. Its popularity is further boosted by grid modernization initiatives, where reliability, easy maintenance, and proven performance are crucial. With minimal risk of leakage, long service life, and reduced downtime, air-insulated systems present a dependable solution for a range of operational environments.

Ongoing infrastructure upgrades and the push for sustainable, scalable electrical systems continue to strengthen the demand for AIS. Its versatility for both indoor and outdoor applications adds to its market appeal, making it suitable for varied installation conditions. The segment’s substantial 2024 share reflects strong industry confidence in air insulation technology, particularly for projects prioritizing efficiency, operational safety, and long-term cost management, solidifying its role as a preferred choice in the evolving power distribution landscape.

By Current Analysis

In 2024, AC switchgear dominated the By Current segment of the Switchgear Market with an 87.2% share, reflecting the global reliance on alternating current for power transmission and distribution. Its widespread adoption is rooted in the efficiency of AC systems for voltage regulation, fault protection, and load control across public utilities, industrial facilities, and infrastructure projects.

The entrenched use of AC power in both urban and rural networks strengthens its role in system planning and upgrades. AC switchgear’s seamless compatibility with existing grid infrastructure and conventional generation sources ensures its continued preference, from power plants to end-user distribution points. Its capability to support long-distance transmission and efficient integration with transformers is critical for maintaining grid stability and operational reliability.

As the demand for resilient, efficient energy systems grows, utilities and industries increasingly rely on AC switchgear’s proven performance and cost-effectiveness. This technology remains indispensable for managing large-scale power delivery while enabling expansion in transmission and distribution networks. The segment’s commanding market share in 2024 underscores the enduring importance of AC systems as the backbone of modern electricity supply, playing a pivotal role in supporting economic growth and the evolution of global energy infrastructure.

By Installation Analysis

In 2024, indoor switchgear led the By Installation segment of the Switchgear Market with a 57.4% share, driven by its extensive use in enclosed facilities such as commercial complexes, manufacturing plants, data centers, and utility substations. Its popularity stems from a compact, space-saving design, enhanced safety features, and protection from environmental factors, all of which extend service life and lower maintenance requirements.

The strong market share reflects rising demand for secure, efficient power control solutions in densely populated urban areas where space optimization is essential. Indoor switchgear is also a preferred choice in infrastructure modernization projects, offering advanced protection, automation compatibility, and reliable fault-handling capabilities.

Its role is further reinforced by growing adoption in smart buildings and industrial automation systems, where integration with digital monitoring and control platforms supports operational efficiency. As global power distribution networks adapt to higher energy demands, stricter safety regulations, and the need for reliable performance, indoor switchgear provides a scalable and adaptable solution. The segment’s dominance in 2024 highlights its critical role in modernizing electrical systems while ensuring safety, efficiency, and long-term operational value in both industrial and commercial settings.

By End Use Analysis

In 2024, transmission and distribution (T&D) utilities dominated the Switchgear Market’s By End Use segment with a 58.9% share, underscoring the sector’s reliance on switchgear for grid reliability, load management, and safety. Switchgear is essential for controlling, protecting, and isolating electrical circuits, enabling stable electricity delivery across vast distances and intricate network structures.

This leadership is fueled by ongoing investments to expand and modernize national grids in response to rising power consumption. Utilities are prioritizing grid resilience, aiming to reduce outages and enhance real-time monitoring capabilities within substations and along transmission lines. The replacement of aging infrastructure further boosts demand for robust, efficient switchgear systems.

The shift toward decentralized generation and greater regional grid interconnection also drives the adoption of advanced switchgear capable of managing fluctuating loads and ensuring uninterrupted power flow. With electrification and large-scale infrastructure upgrades underway in many regions, T&D utilities continue to be the primary drivers of market growth. Their dominant share in 2024 reflects their pivotal role in shaping switchgear demand, as they implement technologies that enhance operational efficiency, system stability, and the ability to meet evolving energy needs in a rapidly transforming power landscape.

Regional Analysis

In 2024, North America led the global switchgear market with a 43.20% share, valued at USD 46.3 billion, driven by major investments in grid modernization, replacement of outdated infrastructure, and expanding renewable energy projects in the U.S. and Canada. The region’s emphasis on strengthening transmission and distribution networks has fueled demand for both low- and high-voltage switchgear systems.

Europe maintained steady growth, supported by clean energy transition goals and smart grid initiatives in markets like Germany and France. In Asia Pacific, adoption is accelerating due to rapid industrialization and urban growth in emerging economies, positioning the region for future expansion despite a smaller current share.

The Middle East & Africa are experiencing increased demand through infrastructure development and electrification in underserved areas, while Latin America shows moderate growth, driven by utility upgrades and rising energy consumption.

North America’s commanding market share underscores its pivotal role in shaping global switchgear demand, while other regions contribute through targeted infrastructure projects, policy support, and modernization efforts. Together, these dynamics reflect a diverse and expanding global market, with each region’s growth influenced by unique economic, industrial, and energy sector developments.

Top Use Cases

Industrial and Utility Safety: In factories, refineries, and power plants, medium- and high-voltage switchgear controls the large amounts of electricity needed for heavy machinery. It helps in isolating faults without shutting down the whole system, which avoids costly production stoppages. For example, in a steel manufacturing plant, switchgear controls massive rolling mills while protecting them from sudden voltage spikes or short circuits.

Power Grid Reliability: Utilities use switchgear extensively in substations and across power grids to isolate faulty sections while the rest of the network stays energized. This ensures continuous service and supports load management across large networks.

Renewable Energy Integration: In solar and wind farms, switchgear ensures stable voltage, manages variable generation, and protects equipment against faults. Gas‑insulated types are preferred in space‑constrained or harsh environments, enhancing reliability and longevity.

Upgrading Legacy Systems: Many facilities with aging switchgear can benefit from component upgrades—switchgear conversions—rather than full replacements. These upgrades improve safety, meet regulatory standards, and extend equipment life at a lower cost and reduced downtime.

Recent Developments

- In February 2025, at ELECRAMA 2025, ABB India launched the ‘LIORA’ range of modular switches. Designed for smart residential, commercial, and hospitality spaces, these switches integrate modern technology with superior safety and aesthetics.

- In January 2025, GE Vernova outlined plans to invest nearly $600 million to expand operations at two U.S. locations: the switchgear plant in Charleroi, Pennsylvania, and another facility in Clearwater, Florida. These expansions are expected to create over 260 new jobs.

Conclusion

Switchgear plays a vital role in ensuring safe, reliable, and efficient power distribution across industries, utilities, and infrastructure. With advancements in technology, growing renewable integration, and ongoing grid upgrades, demand continues to rise. Its adaptability across voltage levels and installation types ensures it remains a cornerstone of modern energy systems and future electrification efforts worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)