Table of Contents

Overview

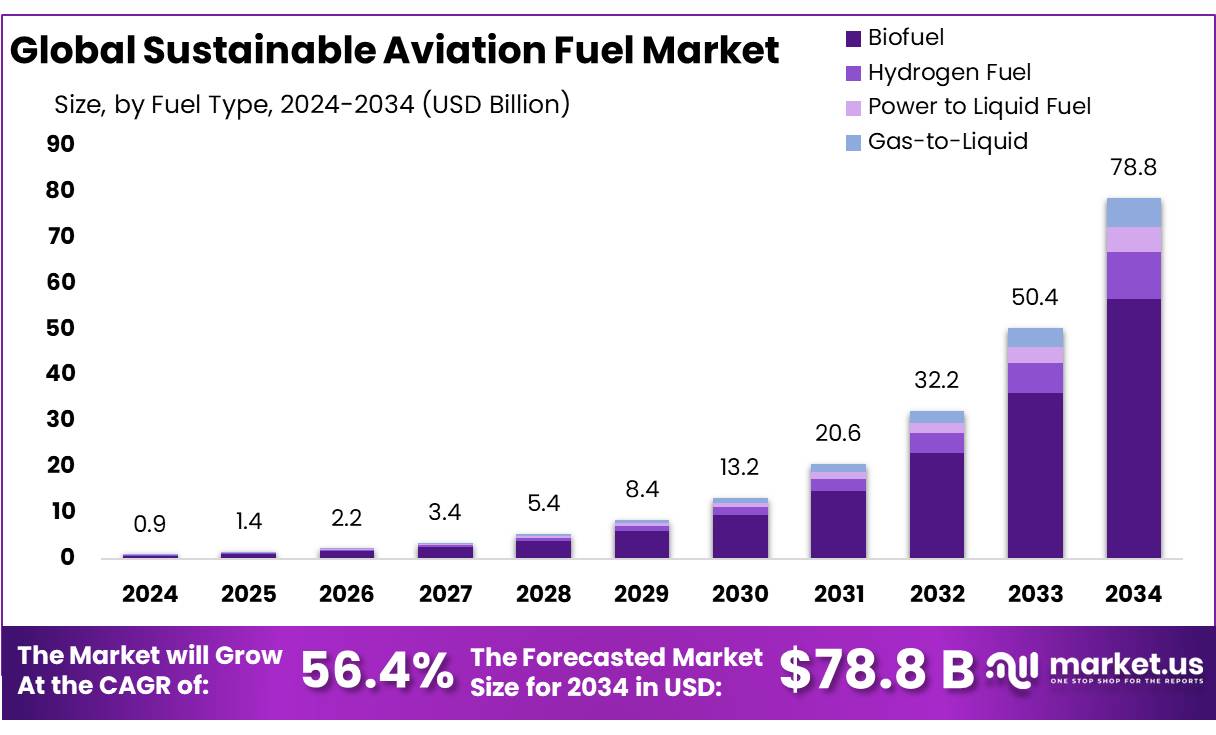

New York, NY – August 05, 2025 – The Global Sustainable Aviation Fuel (SAF) Market, valued at USD 0.9 billion in 2024, is projected to reach USD 78.8 billion by 2034, growing at a CAGR of 56.4% from 2025 to 2034. In 2024, the North America region led the market, holding a 38.2% share with USD 0.4 billion in revenue.

SAF, derived from renewable or waste-based feedstocks, is critical to the aviation industry’s goal of achieving net-zero carbon emissions. It significantly reduces lifecycle greenhouse gas emissions compared to conventional jet fuel. According to the International Air Transport Association (IATA), SAF could account for approximately 65% of the emissions reductions needed to meet this target.

The SAF market is undergoing rapid transformation, fueled by technological advancements and supportive policies. In the U.S., the Sustainable Aviation Fuel Grand Challenge, led by the Department of Energy (DOE), Department of Transportation (DOT), and Department of Agriculture (USDA), targets producing 3 billion gallons of SAF annually, aiming to meet 100% of domestic commercial jet fuel demand.

Global SAF production doubled from 300 million liters in 2022 to 600 million liters in 2023, driven by expanded U.S. production facilities. In 2024, production reached 1 million tonnes (1.3 billion liters), up from 0.5 million tonnes (600 million liters) in 2023, representing 0.3% of global jet fuel and 11% of renewable fuel production.

Government incentives are accelerating SAF adoption. The U.S. Inflation Reduction Act of 2022 offers tax credits of $1.25 to $1.75 per gallon for SAF producers, based on emissions reductions, to enhance competitiveness with conventional fuels and boost infrastructure investment. In the EU, the ReFuelEU Aviation initiative mandates SAF blending, starting at 2% in 2025 and increasing to 70%, aligning with the EU’s ‘Fit for 55’ goal of cutting greenhouse gas emissions by 55%.

Key Takeaways

- The Sustainable Aviation Fuel (SAF) Market is projected to grow significantly from USD 0.9 billion in 2024 to approximately USD 78.8 billion by 2034, registering a robust CAGR of 56.4% over the forecast period.

- Biofuel emerged as the leading fuel type, accounting for over 71.9% of the total SAF market share.

- Among the production technologies, HEFA-SPK (Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene) held the dominant position, contributing more than 61.8% to the SAF market.

- The Fixed Wings aircraft category led the platform segment, capturing a substantial 87.3% share in the SAF market.

- In terms of end use, the Commercial aviation sector dominated the market, representing over 68.4% of total SAF consumption.

- North America emerged as the key regional market, holding a 45.9% share, valued at approximately USD 0.4 billion in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/sustainable-aviation-fuel-market/request-sample/

Report Scope

| Market Value (2024) | USD 0.9 Billion |

| Forecast Revenue (2034) | USD 78.8 Billion |

| CAGR (2025-2034) | 56.4% |

| Segments Covered | By Fuel Type (Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas-to-Liquid), By Technology (HEFA-SPK, FT-SPK, HFS-SIP, ATJ-SPK), By Aircraft Type (Fixed Wings, Rotorcraft, Others), By Platform (Commercial, Regional Transport Aircraft, Military Aviation, Business and General Aviation, Unmanned Aerial Vehicles) |

| Competitive Landscape | Aemetis Inc., Avfuel Corporation, Ballard Power Systems, Eni SPA, Fulcrum BioEnergy, Inc., Gevo Inc., LanzaTech, Neste Oyj, Northwest Advanced Biofuels, LLC., OMV Aktiengesellschaft, Preem AB, Sasol Limited, SkyNRG B.V., TotalEnergies SE, Velocys |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153290

Key Market Segments

By Fuel Type Analysis

Biofuel led the Sustainable Aviation Fuel (SAF) Market in 2024, commanding a 71.9% share due to its renewable sourcing and substantial environmental benefits. Its ability to significantly cut greenhouse gas emissions compared to traditional jet fuels, combined with supportive government policies and mandates, has driven its dominance. Biofuel’s sustainability and proven impact make it the preferred choice for SAF production.

In 2025, biofuels are projected to expand their market share as new production facilities enhance SAF availability. Technological advancements, including improved feedstock processing and efficient conversion methods, are expected to boost biofuel competitiveness. With growing global pressure to meet emission reduction goals, airlines and producers are likely to continue prioritizing biofuels as a sustainable alternative to conventional aviation fuels.

By Technology Analysis

In 2024, HEFA-SPK (Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene) dominated the SAF market with a 61.8% share, driven by its efficiency and scalability in converting renewable feedstocks like used cooking oils into high-quality aviation fuel. Its ability to meet rising SAF demand makes it the preferred technology for airlines aiming to comply with sustainability regulations.

HEFA-SPK is expected to retain its leading position, with investments in refining technologies likely to enhance fuel yields and lower costs. Supported by global policies like the EU’s ReFuelEU initiative, HEFA-SPK will remain central to scaling SAF production while ensuring affordability and alignment with environmental goals.

By Aircraft Type Analysis

Fixed-wing aircraft dominated the SAF market in 2024, capturing an 87.3% share due to their extensive use in commercial aviation, particularly passenger planes with high fuel consumption. Their critical role in global air travel makes them prime candidates for SAF adoption as airlines work to meet sustainability targets.

In 2025, fixed-wing aircraft are expected to maintain their dominance, driven by the focus on reducing emissions from long-haul and intercontinental flights. Advances in SAF production and fuel efficiency will likely accelerate adoption in this segment, supporting the aviation industry’s environmental objectives.

By Platform Analysis

The commercial aviation segment led the SAF market in 2024, holding a 68.4% share due to its high fuel consumption and focus on sustainability. Regulatory pressures and consumer demand for eco-friendly travel have spurred major airlines to integrate SAF into their operations, supported by growing SAF availability.

In 2025, the commercial sector is expected to continue driving SAF adoption, with expanded production capacity and improved distribution infrastructure. As airlines align with global carbon reduction goals, the commercial platform will remain a key force in advancing SAF use and the aviation industry’s sustainability efforts.

Regional Analysis

In 2024, North America led the global Sustainable Aviation Fuel (SAF) market, securing a 45.9% share with a market value of approximately USD 0.4 billion. This leadership is driven by the region’s advanced aviation infrastructure, significant investments in sustainable technologies, and proactive government policies focused on reducing aviation-related carbon emissions.

The United States is the primary force behind North America’s dominance, supported by its robust aviation industry, including major airlines and airports committed to sustainable fuel adoption. Policies such as the Blended Fuel Tax Credit and SAF incentives under the Inflation Reduction Act (IRA) have spurred production and use of SAF. Leading airlines like United Airlines and Delta Air Lines are partnering with fuel producers to increase SAF blending in their operations, further driving market growth.

North America’s position is strengthened by substantial investments in SAF production facilities, with notable examples like World Energy’s California refinery, a pioneer in large-scale commercial SAF production. The region’s focus on clean energy technologies and supportive energy transition policies in the U.S. and Canada ensures a strong growth outlook for SAF.

Top Use Cases

- Commercial Airlines: Sustainable Aviation Fuel (SAF) is used by commercial airlines to reduce carbon emissions compared to traditional jet fuel. It’s a drop-in fuel, meaning no changes to aircraft or infrastructure are needed. Airlines blend SAF with conventional fuel to meet sustainability goals and comply with global emission regulations, enhancing eco-friendly operations.

- Military Aviation: Military aircraft use SAF to lower their environmental impact while maintaining performance. It supports national defense sustainability goals, reducing greenhouse gas emissions. SAF’s compatibility with existing engines ensures seamless integration. Military adoption also drives innovation in fuel production, encouraging scalable solutions for broader aviation use.

- Private Aviation: Private jet operators adopt SAF to appeal to eco-conscious clients and meet corporate sustainability targets. Using SAF reduces emissions significantly, aligning with environmental commitments. It’s blended with traditional fuel, requiring no engine modifications. This helps private aviation maintain luxury while supporting greener travel options.

- Cargo Airlines: Cargo airlines use SAF to reduce emissions during freight transport, addressing the growing demand for sustainable logistics. SAF helps lower the carbon footprint of global supply chains. Its drop-in nature ensures compatibility with existing fleets, making it a practical choice for cargo operators aiming for net-zero goals.

- Airport Operations: Airports use SAF in ground support vehicles and auxiliary power units to cut emissions. This supports cleaner airport operations and aligns with sustainability mandates. SAF’s use in ground equipment reduces the overall carbon footprint, helping airports meet environmental standards while maintaining efficient operations.

Recent Developments

1. Aemetis Inc.

- Aemetis is advancing its Carbon Zero 1 plant in California to produce SAF from renewable oils and agricultural waste. The company signed offtake agreements with major airlines and received USDA funding for its low-carbon ethanol-to-jet fuel technology. Aemetis also focuses on carbon sequestration to enhance SAF sustainability.

2. Avfuel Corporation

- Avfuel expanded its SAF supply agreements with fixed-base operators (FBOs) and corporate flight departments. The company provides Neste MY Sustainable Aviation Fuel and is working to increase SAF availability at U.S. airports, supporting aviation’s net-zero goals.

3. Ballard Power Systems

- While Ballard is known for hydrogen fuel cells, it collaborates on hydrogen-powered aviation as a complement to SAF. Its fuel cells are being tested for auxiliary power units (APUs) in aircraft, supporting decarbonization alongside bio-based SAF solutions.

4. Eni SPA

- Eni produces SAF from biomass and waste feedstocks at its Venice and Gela biorefineries. The company aims to supply SAF blends to airlines and recently partnered with Aeroporti di Roma to decarbonize airport operations. Eni is also investing in advanced biofuels for aviation.

5. Fulcrum BioEnergy, Inc.

- Fulcrum is developing waste-to-SAF plants, including its Sierra BioFuels Plant, converting municipal solid waste into low-carbon jet fuel. The company secured partnerships with United Airlines and Marathon Petroleum to scale SAF production using gasification and Fischer-Tropsch synthesis.

Conclusion

The Sustainable Aviation Fuel Market is growing rapidly due to rising environmental concerns and strict global regulations. SAF’s ability to cut emissions makes it vital for decarbonizing aviation. Its use in commercial, military, and private sectors, along with innovations in production, drives demand. Despite high costs, investments, and policies are making SAF more accessible, ensuring a greener future for aviation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)