Table of Contents

Market Overview

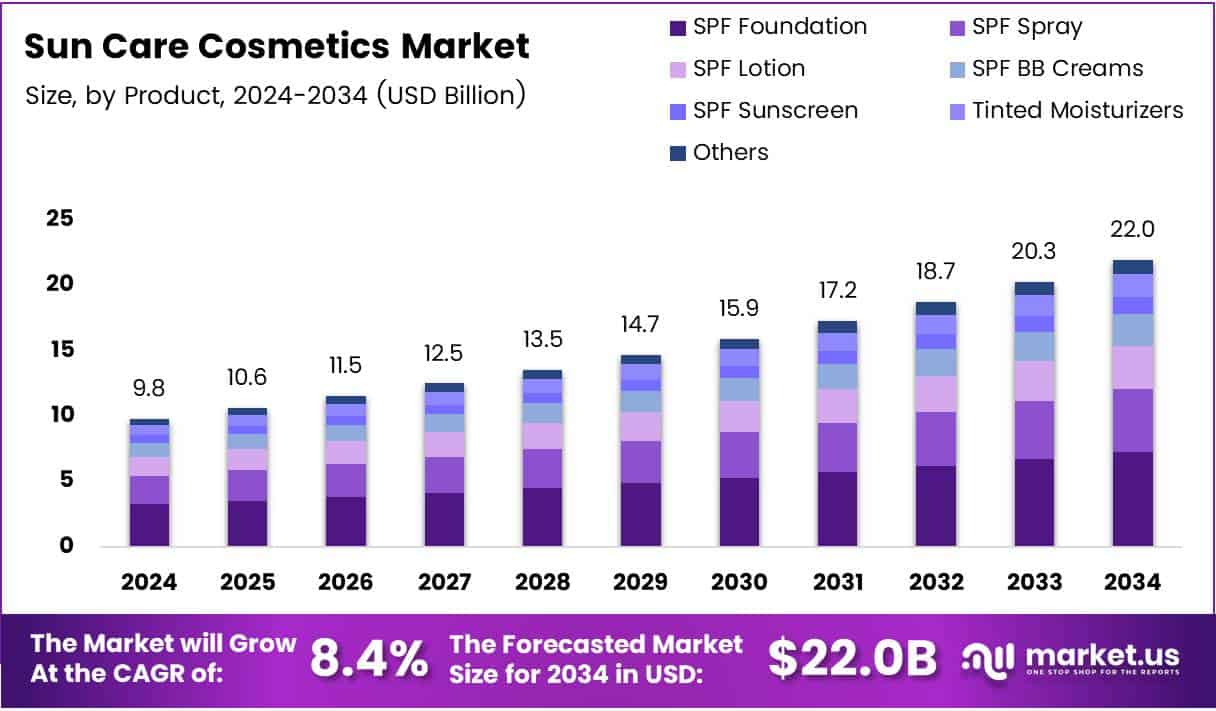

The Global Sun Care Cosmetics Market is poised for substantial growth, with its value expected to increase from USD 9.8 billion in 2024 to USD 22.0 billion by 2034, reflecting a compound annual growth rate (CAGR) of 8.4% during the forecast period from 2025 to 2034.

The Sun Care Cosmetics Market has witnessed significant expansion due to the rising awareness of skin protection. Consumers are more educated about the risks associated with UV radiation, such as skin cancer, sunburn, and premature aging.

As a result, demand for sunscreens and other protective skincare products has surged, with a growing interest in sunscreens that offer dual benefits, such as anti-aging and moisturizing effects. Furthermore, consumers are opting for multifunctional sun care products, which combine skincare benefits with sun protection, fueling market growth.

Technological advancements in product formulations, including mineral-based and organic sunscreens, have also contributed to this expansion. Moreover, product innovation and the introduction of high-performance sunscreens with higher SPF ratings are shaping product development trends. Regulatory bodies, particularly the U.S. FDA, ensure sunscreen efficacy, bolstering consumer confidence in these products.

Key Market Segments

By Product

In 2024, SPF Foundation was the dominant product segment, commanding a 24.1% share of the market. Its dual functionality as both a cosmetic and a protective skincare product makes it particularly appealing to consumers seeking convenience.

Other notable products include SPF Spray, popular for its ease of application; SPF Lotion, which remains a traditional favorite for its moisturizing and protective qualities; and SPF BB Creams, which are becoming more popular due to their light texture and skin-tone matching properties.

Although SPF Sunscreen remains an essential product, it faces increasing competition from multifunctional products. Other emerging formats, such as SPF Primers and Tinted Moisturizers, have also gained traction, offering subtle coverage along with sun protection.

By Type

The market’s preference for Conventional products remains strong, with conventional sunscreens holding an 83.7% market share in 2024. This preference is driven by affordability, availability, and the trust consumers place in well-established brands. In contrast, Organic sun care products, while growing, face challenges such as higher costs and limited availability, which restrict their broader appeal. Nevertheless, there is a growing segment of consumers seeking environmentally friendly, sustainable, and transparent products.

By Distribution Channel

Supermarkets and hypermarkets lead the distribution channel segment, holding a 34.2% share in 2024. These retail formats are favored for their wide assortment of products, promotional offerings, and the convenience they provide. Specialty Stores also play a significant role, particularly for informed buyers seeking expert recommendations or premium products. Online channels continue to rise in prominence, driven by the convenience of home delivery and a growing number of digital-first beauty brands.

Other distribution channels such as pharmacies and convenience stores continue to serve niche markets, with some consumers using them for emergency purchases.

Market Drivers and Restraints

Drivers

- Increased Skin Health Awareness: Growing knowledge of the risks associated with UV radiation, such as skin cancer and premature aging, is propelling consumers toward protective skincare solutions.

- Anti-aging Products: Consumers are increasingly seeking sunscreens that offer additional skin benefits, such as antioxidants, moisturization, and anti-aging properties.

- Emerging Markets: In regions like Asia, Latin America, and Africa, the expanding middle class and rising disposable income are fostering the demand for premium skincare products, including sunscreens.

Restraints

- Rising Production Costs: The cost of high-quality ingredients necessary for effective UV protection and skincare benefits is rising, which can put pressure on manufacturers to maintain competitive pricing.

- Regulatory Challenges: Stringent safety and efficacy regulations, particularly in markets like the U.S., increase compliance costs and may delay product launches.

- Environmental Impact: Some sun care ingredients, such as oxybenzone and octinoxate, harm marine life and coral reefs. This has led to growing restrictions, limiting the use of certain formulations.

- Competition from Alternatives: Other skincare solutions like moisturizers with SPF, BB creams, and natural oils present strong competition to traditional sunscreens.

Growth Factors

The demand for natural and organic sun care products is rising as consumers become more conscious of the ingredients in their skincare. Brands are also expanding their offerings to cater to a wider range of skin types and tones, making the market more inclusive. Additionally, multifunctional sun care products, which combine sun protection with skincare benefits, are gaining traction.

Emerging markets with increasing disposable income, particularly in Asia and Africa, present significant growth opportunities for sun care brands, allowing them to expand their presence in these regions.

Emerging Trends

There is a growing consumer focus on eco-friendly and sustainable packaging. As sustainability becomes a more important consideration for consumers, brands are increasingly shifting toward recyclable and minimalistic packaging to reduce their environmental footprint.

Reef-safe sunscreens, which avoid harmful chemicals that damage marine ecosystems, are becoming a major trend, supported by both consumer demand and regulatory measures in places like Hawaii and Palau. Furthermore, the demand for cruelty-free sun care products is rising as more consumers prioritize ethical considerations.

The use of wearable technology to monitor UV exposure is another emerging trend. Devices that track sun exposure in real-time help consumers make more informed decisions about their sun care routine, promoting better use of sun protection products.

Regional Analysis

Asia Pacific holds the dominant share of the global sun care cosmetics market, valued at USD 3.8 billion in 2024. The demand for sun care products in this region is driven by increasing awareness of skin health, particularly in countries like Japan, China, and India.

North America and Europe also have significant shares of the market, fueled by high consumer awareness and strict regulatory frameworks. Latin America and the Middle East and Africa are emerging markets, with growing interest in sun protection products.

Key Players

Key players in the sun care cosmetics market include Coty Inc., Johnson & Johnson Services, Inc., The Clorox Company, Beiersdorf AG, Shiseido Company Ltd., and Unilever, among others. These companies continue to drive market growth through product innovation, sustainability initiatives, and meeting the evolving needs of consumers.

Conclusion

The global sun care cosmetics market is experiencing rapid growth, driven by increasing awareness about skin health, rising demand for anti-aging products, and the preference for multifunctional formulations. As consumer preferences shift toward natural, organic, and sustainable products, brands are innovating to meet these needs. Emerging markets, especially in Asia, present new growth opportunities, and advancements in wearable technology further enhance the sun care experience. Despite challenges such as rising ingredient costs and environmental concerns, the market is set to expand significantly in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)