Table of Contents

Overview

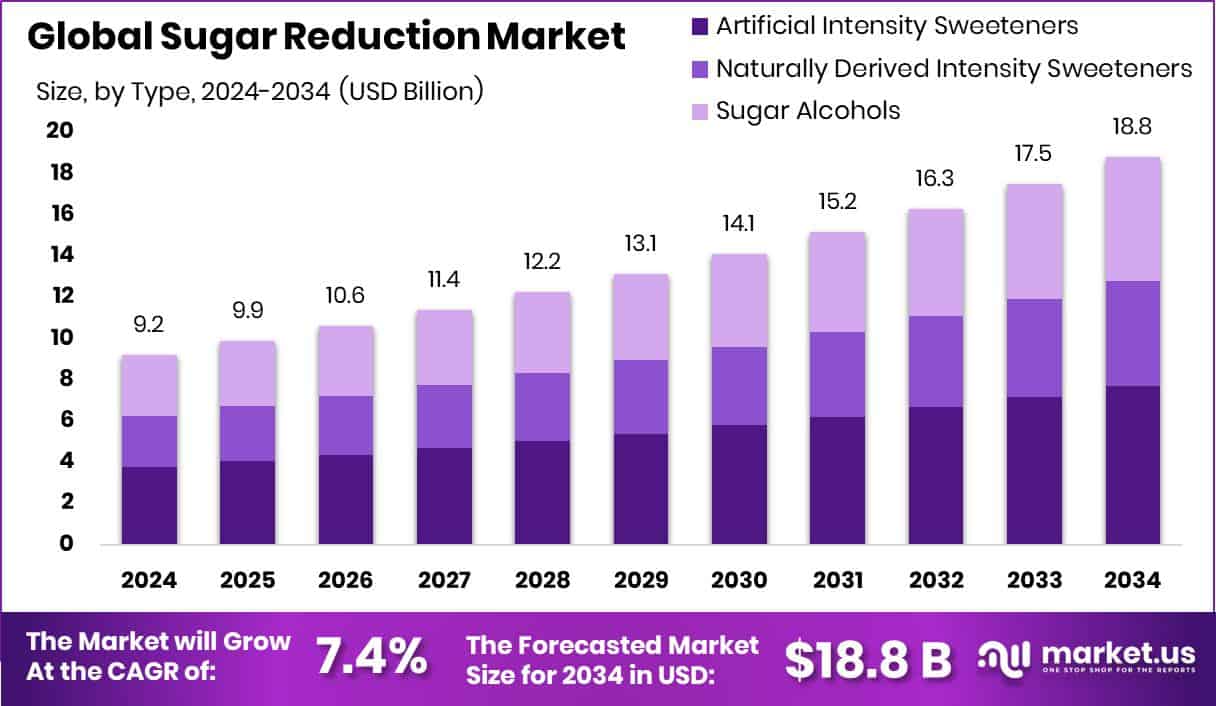

New York, NY – Aug 14, 2025 – The global sugar reduction market is anticipated to reach approximately USD 18.8 billion by 2034, growing from USD 9.2 billion in 2024, with a projected CAGR of 7.4% between 2025 and 2034. North America leads the market with a substantial 46.20% share, driven by increasing consumer preference for healthier, reduced-sugar food and beverage options.

Sugar reduction involves decreasing the amount of added sugars in food and beverage products. This can be achieved through reformulation, the use of natural or artificial sweeteners, or by enhancing flavor profiles to preserve taste while cutting sugar content. The primary objective is to promote healthier dietary habits, particularly in light of the growing link between high sugar intake and health issues such as obesity and diabetes.

The sugar reduction market encompasses a range of products, ingredients, and technologies designed to lower sugar content across various food and beverage segments. This includes alternative sweeteners, low-calorie formulations, and innovations in sugar-free products. The market is being shaped by rising health consciousness among consumers, evolving regulatory frameworks, and food industry efforts to meet demands for clean-label and reduced-sugar products.

One of the key drivers of market growth is increasing public concern over sugar-related health risks. Consumers are becoming more label-conscious, encouraging food and beverage companies to minimize sugar without compromising on taste. Regulatory actions and global public health campaigns are also prompting manufacturers to adopt sugar-reduction strategies.

The demand for low-sugar or sugar-free options is particularly high among health-conscious consumers, individuals managing diabetes, and parents seeking healthier food choices for their children especially in snack and beverage categories. These preferences are pushing reduced-sugar products into the mainstream.

There is significant market potential in developing natural sugar substitutes that closely mimic the taste of sugar. Advances in flavor masking and reformulation techniques are creating opportunities in categories like bakery, dairy, and beverages. Furthermore, emerging markets present growth opportunities as consumer awareness of sugar-related health issues continues to rise.

In terms of government initiatives, the U.S. Special Diabetes Program has invested approximately $3.55 billion over 27 years in research focused on type 1 diabetes. In India, the government allocated ₹2,500 crore to the sugar sector for FY 2024-25 under the National Cooperative Development Corporation (NCDC), which also reduced interest rates to 8.5% for term loans and 8% for working capital loans to cooperative sugar mills.

Key Takeaways

- The global sugar reduction market is projected to reach approximately USD 18.8 billion by 2034, rising from USD 9.2 billion in 2024, with a compound annual growth rate (CAGR) of 7.4% during the 2025-2034 forecast period.

- Artificial sweeteners lead the market by type, accounting for 41.30% of the total share in 2024.

- In terms of functional use, sweetening agents dominate, making up 63.30% of the market.

- Powdered forms are preferred due to their stability and ease of use in processing, representing 43.20% of the market.

- Bakery products are the primary application area, holding a 47.30% share in the sugar reduction segment.

- In 2024, the North American market achieved a value of USD 4.2 billion, highlighting the region’s strong demand for reduced-sugar solutions.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/sugar-reduction-market/free-sample/

Report Scope

| Market Value (2024) | USD 9.2 Billion |

| Forecast Revenue (2034) | USD 18.8 Billion |

| CAGR (2025-2034) | 7.4% |

| Segments Covered | By Type (Artificial Intensity Sweeteners, Naturally Derived Intensity Sweeteners, Sugar Alcohols), By Functionality (Sweetening Agents, Preservatives, Mouthfeel, Flavor Enhancers), By Formulation Type (Liquid, Powder, Granular, Tablets and Capsules), By Application (Bakery, Beverages, Confectionery, Dairy, Snacks, Others) |

| Competitive Landscape | Ajinomoto Co, Alchemy Foodtech Pte. Ltd., Amalgamated Sugar, Bayn Europe AB, Cargill Inc., Celanese Corporation, Danone S.A., Givaudan SA, Hain Celestial Group, Ingredion, JK Sucralose Inc, Mondelēz International, NOW Foods, PepsiCo, PureCircle Limited, Roquette Freres SA, Tate & Lyle, The Coca-Cola Company, Unilever plc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144536

Key Market Segments

By Type Analysis

Artificial Intensity Sweeteners accounted for 41.30% of the global sugar reduction market in 2024.

In 2024, artificial intensity sweeteners emerged as the leading type in the sugar reduction market, capturing a significant 41.30% share. This dominance reflects the growing consumer inclination toward low-calorie sugar alternatives that deliver sweetness without added calories. The rising prevalence of obesity, diabetes, and other health concerns has led consumers to seek healthier dietary choices, including sugar substitutes.

The strong performance of this segment indicates consumers’ confidence in artificial sweeteners to replicate the taste of sugar while supporting healthier lifestyles. Compared to natural sweeteners and sugar alcohols, artificial sweeteners are often favored for their effectiveness in reducing calorie intake without compromising flavor.

As health awareness continues to influence consumer behavior, the market is expected to see further innovation in artificial sweeteners. Companies are investing in R&D to enhance taste and health attributes, ensuring these products remain competitive in a rapidly evolving health-focused marketplace.

By Functionality Analysis

Sweetening Agents dominated functionality-based segments with a 63.30% market share in 2024.

In the functionality category, sweetening agents maintained a commanding 63.30% share of the sugar reduction market in 2024. This highlights their pivotal role in product reformulation strategies aimed at reducing sugar content while preserving taste integrity.

Manufacturers are increasingly relying on sweetening agents to meet consumer demand for low-sugar and sugar-free options, especially as global regulations tighten around sugar content. The widespread application of sweetening agents across food and beverage categories shows their importance in achieving taste consistency and consumer satisfaction.

Given their central role in developing reduced-sugar products, sweetening agents are expected to remain a critical component of innovation strategies. Future advancements may focus on improved sensory profiles and added health benefits, further reinforcing their dominance in this segment.

By Formulation Type Analysis

Powdered formulations led with a 43.20% market share in 2024.

In 2024, powder emerged as the leading formulation type in the sugar reduction market, capturing a 43.20% share. Its popularity stems from advantages such as long shelf life, ease of handling, and seamless incorporation into diverse product applications like beverages, dairy, and baked goods.

Powdered sweeteners are preferred by manufacturers for their accuracy in dosing, consistent sweetness levels, and cost-effectiveness in both production and distribution. These features make them especially suitable for mass-market food production and consumer product lines.

As manufacturers increasingly focus on scalable sugar-reduction solutions, powdered formulations are expected to remain in demand due to their flexibility, processing stability, and compatibility across multiple product categories.

By Application Analysis

Bakery applications dominated with a 47.30% market share in 2024.

In terms of application, bakery products led the sugar reduction market in 2024, accounting for a 47.30% share. The growing popularity of healthier baked goods such as low-sugar breads, pastries, cookies, and cakes has made this segment a primary driver of sugar reduction efforts.

Urban consumers, increasingly concerned with issues like diabetes and obesity, are driving demand for bakery items that offer indulgence with improved nutritional profiles. As sugar plays a functional role in texture, structure, and shelf life in baked goods, manufacturers are turning to innovative sweetener blends that maintain product quality while reducing sugar content.

The strong market share of bakery applications signals ongoing investment in this space, with companies likely to continue exploring advanced sweetening systems tailored to the specific needs of baked products.

Regional Analysis

North America led the global sugar reduction market in 2024, securing a dominant 46.20% market share and reaching a value of USD 4.2 billion. This leadership is driven by strong consumer awareness of sugar-related health risks, a high adoption rate of low-sugar and sugar-free products, and growing preference for natural sweeteners in both the U.S. and Canada.

Europe is witnessing steady growth, largely fueled by stringent regulations aimed at reducing sugar content in processed foods and the increasing demand for clean-label and healthier alternatives among health-conscious consumers.

Asia Pacific is rapidly emerging as a high-growth region, supported by urbanization, evolving dietary habits, and rising health awareness in countries such as China, Japan, and India. The growing middle class and increasing focus on lifestyle-related health issues are contributing to regional market expansion.

The Middle East & Africa region is experiencing moderate growth, with health and wellness trends beginning to influence purchasing decisions, particularly in Gulf Cooperation Council (GCC) countries.

Latin America also plays a role in the market’s global expansion. Countries like Brazil and Mexico are implementing sugar taxes and promoting low-sugar food choices as part of national health initiatives. However, North America continues to hold the largest market share and revenue leadership.

The region’s well-developed food industry and consumer demand for health-oriented innovation are driving the widespread integration of sugar-reduction strategies across key application areas such as beverages, bakery, and dairy products.

Top Use Cases

- Bakery Product Reformulation with Digital Tools : Bakers use innovative digital tools to lower sugar in breads, cakes, and pastries, while preserving texture and mouthfeel. By adjusting starches, fibers, and hydrocolloids, products maintain quality and stability even after sugar reduction. This helps launch clean‑label options and meet sugar-free or reduced‑sugar claims while retaining consumer appeal.

- Fiber‑based Substitution in Beverages : Beverage makers are replacing sugar with functional fibers like chicory inulin and resistant dextrin to reduce calories. These fibers mimic sugar’s volume and mouthfeel and improve nutritional value. This trend supports low‑sugar and no‑added‑sugar labeling while appealing to health-conscious consumers seeking gut‑friendly products.

- Using Sweetness Enhancers in Soft Drinks : Brands incorporate sweetness enhancers or molecules that amplify existing sweetness to maintain taste with less sugar. This technique allows up to 50% sugar reduction in beverages without changing the flavor profile significantly, supporting regulatory compliance and consumer taste expectations.

insights.figlobal.com - Gradual Sugar Reduction Strategy in Food Lines : Some manufacturers implement stepwise sugar reduction over time so consumers adjust gradually. This approach helps retain product acceptance while lowering sweetness intensity across categories like juices or snacks, and helps build trust among health‑focused shoppers.

- Reformulation of Soft Drinks as a Benchmark : Soft drink companies have successfully cut sugar concentrations via gradual reformulations, creating a model for other food sectors. By reducing sugar levels and compensating with alternative bulking or sweeteners, brands achieve lower calorie drinks without sacrificing consumer satisfaction.

Recent Developments

- Ajinomoto Co.

- Ajinomoto Health & Nutrition (AHN), a division of Ajinomoto, has launched partnerships and new product platforms focused on sugar reduction. In August 2024, AHN teamed with biotech company Shiru to develop and commercialize high-intensity sweet proteins that can replace up to 70-90% of sugar sweetness without impacting blood sugar. They also unveiled solution platforms such as Salt Answer and Palate Perfect for clean-label taste enhancement and sugar reduction in food and beverage formulations

2. Bayn Europe AB

- Bayn Europe has launched The Sugar Reduced Community, an open-forum platform aimed at uniting stakeholders including food companies, researchers, and NGOs to collaborate on reducing added sugar consumption. Its activities include a ‘Sugar Reduced Studio’ café in Sweden, where reduced-sugar menus and DIY classes are offered. Bayn hopes the community will spur corporate CSR initiatives and product innovation focused on sugar reduction

3. Cargill Inc.

- Cargill continues expanding its sugar reduction toolkit, offering label-friendly stevia sweeteners and complementary texturizers and bulking agents for beverages and foods. In 2025, they launched a Sugar Reduction Toolbox and a Score in Sugar Reduction report, providing consumer insights and formulation guidance. Their EverSweet® and related nature-derived sweetness platforms support brand reformulation efforts aimed at lowering sugar while maintaining taste and texture.

4.Danone S.A.

- Under its “Danone Impact Journey,” Danone reaffirmed its 2023-2030 roadmap with specific commitments to reduce added sugar in children’s products. They pledge that by 2030, more than 95% of products for children will contain less than 10 g total sugar per 100 g. By 2024, Danone had already reformulated its Danonino brand in Mexico to cut sugar content by 43.8%, while lowering sugar across its Aquadrinks portfolio by 32% since 2008. They also launched Too Good & Co. Zero Sugar in Q4 2024, expanding in 2025.

Conclusion

The sugar reduction market is undergoing rapid transformation driven by shifting consumer preferences, regulatory pressures, and innovation in sweetener technologies. Companies across the food and beverage industry are actively reformulating products to meet growing demand for healthier options, especially in categories like beverages, bakery, and dairy. Artificial sweeteners, sweetening agents, and powdered formulations are emerging as key components in product development strategies aimed at lowering sugar without compromising taste or functionality.

Major players are investing in R&D partnerships, launching new platforms, and expanding clean-label offerings to gain competitive advantage. Regions such as North America continue to lead the market, supported by advanced manufacturing infrastructure and health-conscious consumers, while emerging economies are presenting new growth opportunities. Strategic initiatives such as government programs, consumer education, and sugar taxes are also shaping market dynamics globally. As the market evolves, innovation and collaboration will remain central to enabling sustainable sugar reduction across the global food system.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)