Table of Contents

Overview

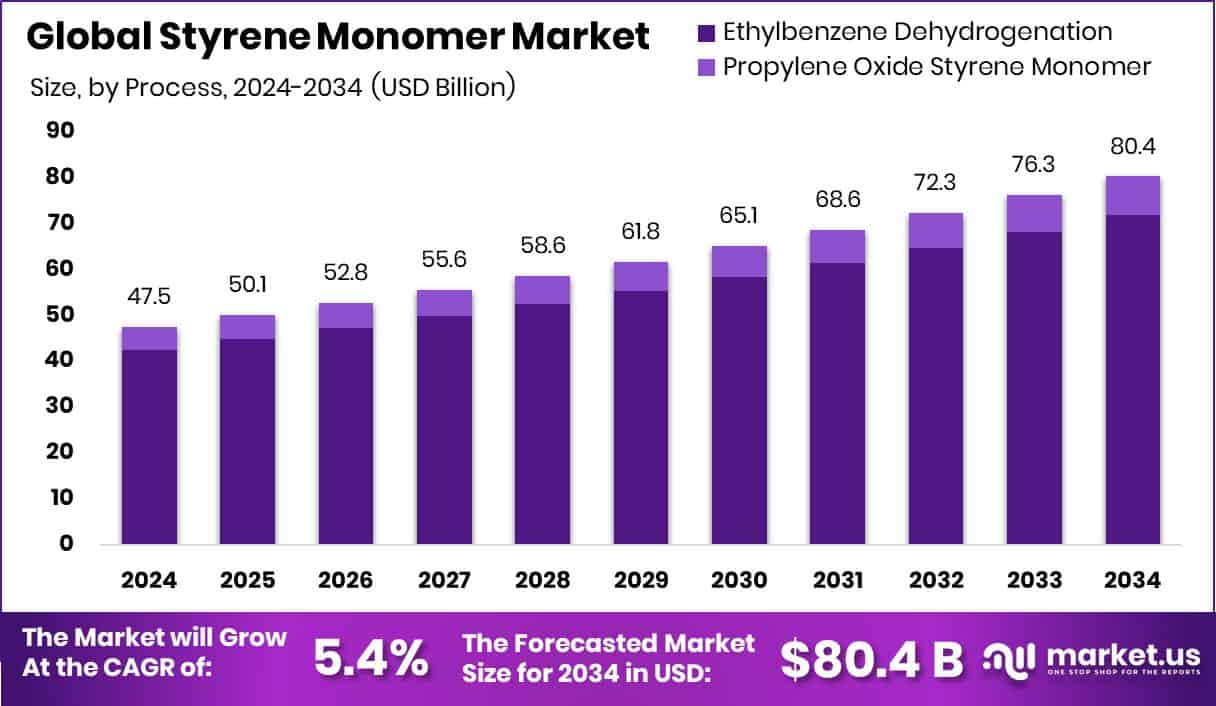

New York, NY – August 08, 2025 – The global Styrene Monomer market is poised for strong growth, projected to reach approximately USD 80.4 billion by 2034, up from USD 47.5 billion in 2024, growing at a CAGR of 5.4% from 2025 to 2034. Asia-Pacific leads the market with a 47.5% share, driven by increasing manufacturing and packaging demand.

Styrene monomer, a colorless and oily liquid primarily derived from petroleum, serves as a key raw material for producing various plastics and rubber compounds. It is widely used in manufacturing polystyrene and copolymers, which are essential for packaging, insulation, automotive parts, electronics, and construction materials.

The market’s growth is closely linked to trends in end-use industries such as automotive, electronics, packaging, and construction. With rising urbanization and infrastructure expansion, demand for styrene-based insulation and construction products is growing. Moreover, increased consumer demand for household appliances and electronics has strengthened the use of styrene polymers. Technological advancements and innovations in polymer blends have further diversified the applications of styrene in engineered plastics and durable goods.

In India, the styrene monomer market is undergoing significant expansion. Indian Oil Corporation Limited (IOCL) is setting up the country’s first domestic styrene monomer production facility at its Panipat refinery, with a capacity of 387 thousand tonnes. Scheduled for completion by 2026–27, this initiative supports the government’s “Atmanirbhar Bharat” push for self-reliance. Demand in India is mainly fueled by the packaging industry, along with the automotive and construction sectors that rely on ABS and SBR. According to the Chemicals and Petrochemicals Association of India (CPAI), domestic styrene demand is expected to grow by 15% in FY2025–26, reaching approximately 1.40 million tonnes.

Key Takeaways

- The global styrene monomer market is projected to reach approximately USD 80.4 billion by 2034, rising from USD 47.5 billion in 2024, with a compound annual growth rate (CAGR) of 5.4% between 2025 and 2034.

- Ethylbenzene dehydrogenation remains the dominant production method, accounting for 89.6% of global styrene monomer output.

- Polystyrene is the leading application segment, representing 42.9% of total styrene monomer usage worldwide.

- The packaging industry is the largest end-user, consuming 27.1% of global styrene monomer demand.

- In 2024, the Asia-Pacific region led the market with a valuation of USD 22.5 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-styrene-monomer-market/free-sample/

Report Scope

| Market Value (2024) | USD 47.5 Billion |

| Forecast Revenue (2034) | USD 80.4 Billion |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Process (Ethylbenzene Dehydrogenation, Propylene Oxide Styrene Monomer), By Application (Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), Acrylonitrile Styrene Acrylate (ASA), Styrene-acrylonitrile (SAN), Styrene Butadiene Rubber (SBR), Others), By End-use (Packaging, Electronics, Healthcare, Household, Automotive, Construction , Others) |

| Competitive Landscape | SABIC, INEOS, Shell plc, KR Chemicals, Qingdao Haiwan Group Co.,Ltd, Denka Company Limited, Chevron Phillips Chemical Company LLC, KH Chemicals, LOTTE Chemical CORPORATION, Repsol, Hanwha TotalEnergies Petrochemical Co Ltd, Americas Styrenics LLC, Westlake Corporation, Equate Petrochemical Company, The Kuwait Styrene Company, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146594

Key Market Segments

1. By Process Analysis (Rephrased):

- In 2024, Ethylbenzene Dehydrogenation accounted for 89.6% of global styrene monomer production, maintaining its dominance due to its cost-effectiveness, scalability, and integration with existing petrochemical infrastructure. This traditional method remains the industry’s preferred choice thanks to its high output efficiency, compatibility with ethylbenzene feedstock, and the ability to meet large-scale production demands. Continued process improvements and catalyst advancements further strengthen its position, even as alternative, low-emission technologies emerge.

2. By Application Analysis (Rephrased):

- Polystyrene led the styrene monomer market by application in 2024, representing 42.9% of total consumption. Its widespread use in packaging, electronics, consumer goods, and insulation is driven by its lightweight, affordable, and durable nature. The material’s popularity in high-demand sectors like food packaging and construction, along with ease of processing and recyclability, makes it a key driver of market growth, particularly in developing economies.

3. By End-use Analysis (Rephrased):

- In 2024, the packaging sector held the largest end-use share in the styrene monomer market at 27.1%. The demand is fueled by the global need for cost-efficient, protective, and lightweight packaging, especially in the food, beverage, and e-commerce sectors. Styrene-based materials like polystyrene and EPS are widely used for foam trays, containers, and insulation packaging, with continued interest from medical and pharma industries despite rising environmental concerns.

Regional Analysis

- In 2024, Asia-Pacific led the global styrene monomer market, capturing 47.5% of the total market share, valued at USD 22.5 billion. This regional dominance was driven by strong demand across packaging, automotive, and construction sectors, particularly in rapidly developing countries such as China and India. Ongoing industrialization and the expansion of downstream applications have significantly contributed to the region’s high styrene consumption.

- North America and Europe also played vital roles in the market, supported by mature end-use industries and consistent use of styrene-based polymers. In contrast, the Middle East & Africa and Latin America recorded more moderate growth, fueled by infrastructure development and increasing demand for consumer goods, though their overall market share remains lower compared to Asia-Pacific.

- While demand across all regions continues to grow, the scale and pace of expansion are most pronounced in Asia-Pacific. The region’s rising production capacity and industrial momentum position it as the key engine of global styrene monomer market growth.

Top Use Cases

- Packaging Applications: Styrene monomer is essential in producing polystyrene foam and clear plastic film used for food containers, trays, and protective packaging. These materials offer excellent lightweight properties, insulation, and shock resistance making them ideal for consumer goods, food service, and e-commerce applications where product protection and cost-efficiency matter most.

- Automotive Components: In the automotive sector, styrene monomer is processed into ABS and SBR plastics used for bumper covers, interior trims, and dashboards. These materials provide impact resistance, aesthetic finish, and lightweight advantages, helping manufacturers meet design flexibility and regulatory standards for fuel economy and safety in modern vehicles.

- Construction & Insulation Materials: Styrene-based foams like EPS and XPS are widely used in building insulation panels, structural forms, and pipes. These products deliver thermal efficiency, moisture resistance, and structural support in walls, foundations, and roof systems. Their cost-effectiveness and performance in energy-efficient construction make them attractive in both residential and commercial projects.

- Consumer & Household Goods: Styrene-derived polymers are integral in household items such as appliance housings, toys, disposable tableware, and consumer electronics enclosures. The material’s ease of molding, glossy finish, and affordability make it popular for everyday products combining practicality with decorative appeal and usability.

- Electronics & Electrical Applications: Styrene monomer is used to create rigid plastic components in electronics, including casings, connectors, and light switch housing. Its insulating properties, dimensional stability, and ability to be injection-molded precisely support reliable performance in electrical devices. Manufacturers value the balance of durability, cost-efficiency, and design flexibility in such components.

Recent Developments

1. SABIC:

- In 2024, SABIC’s Cos‑Mar styrene monomer unit in Louisiana achieved ISCC PLUS certification, becoming the first site in the Americas able to commercialize circular‑or bio‑renewable styrene monomer, supporting sustainable downstream production. This aligns with SABIC’s broader low‑carbon product portfolio and carbon neutrality commitments. The move positions SABIC at the forefront of eco‑friendly styrene in packaging and specialty applications.

2. INEOS Styrolution (INEOS):

- In June 2024, INEOS Styrolution announced it will permanently close its styrene monomer plant in Sarnia, Ontario by June 2026, citing regulatory constraints and economic non‑viability. The site has been under temporary shutdown since April 2024 following benzene emission concerns. INEOS will conduct an orderly wind‑down and support affected employees. Concurrently, they agreed to sell their ABS/SAN plant in Map Ta Phut, Thailand, with transaction closure expected in early 2025.

3. Shell plc:

- Shell is currently conducting a strategic review of its chemicals division, which includes its styrene monomer operations. This assessment reflects broader efforts to improve operational efficiency and profitability amid weaker performance in its diversified petrochemical portfolio. The review may result in portfolio restructuring, refocused investments in lower‑carbon solutions, or capacity adjustments, as Shell seeks to align its chemical operations including styrene production with sustainable and leaner business objectives.

4. Westlake Corporation:

- In 2025, Westlake successfully restarted its styrene monomer unit in Louisiana after a prior shutdown, restoring production capability. The company also joined an anti‑dumping complaint with other epoxy resin producers, targeting imports into the EU from Asia. These actions reflect Westlake’s commitment to defending market position and ensuring stable supply in the styrene and resin sectors, while navigating global trade pressures.

Conclusion

The styrene monomer market is experiencing steady growth, supported by increasing demand from sectors like packaging, automotive, construction, and electronics. The material’s versatility, cost-effectiveness, and compatibility with various polymer applications make it essential in modern manufacturing. Regions with strong industrial development, especially in Asia, continue to drive market expansion. While environmental concerns and regulatory pressures are shaping industry dynamics, efforts toward more sustainable production and recyclable materials are creating new growth opportunities. Moving forward, the market is expected to remain resilient, balancing traditional applications with innovation and sustainability trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)